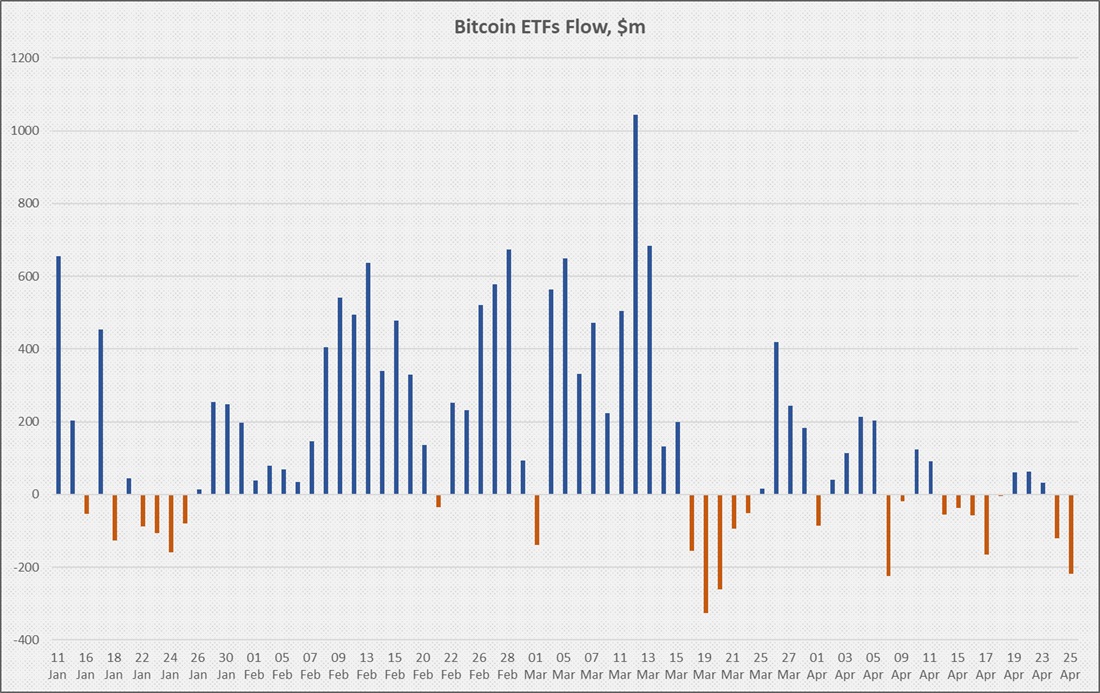

Spot ETFs are seeing investment outflows

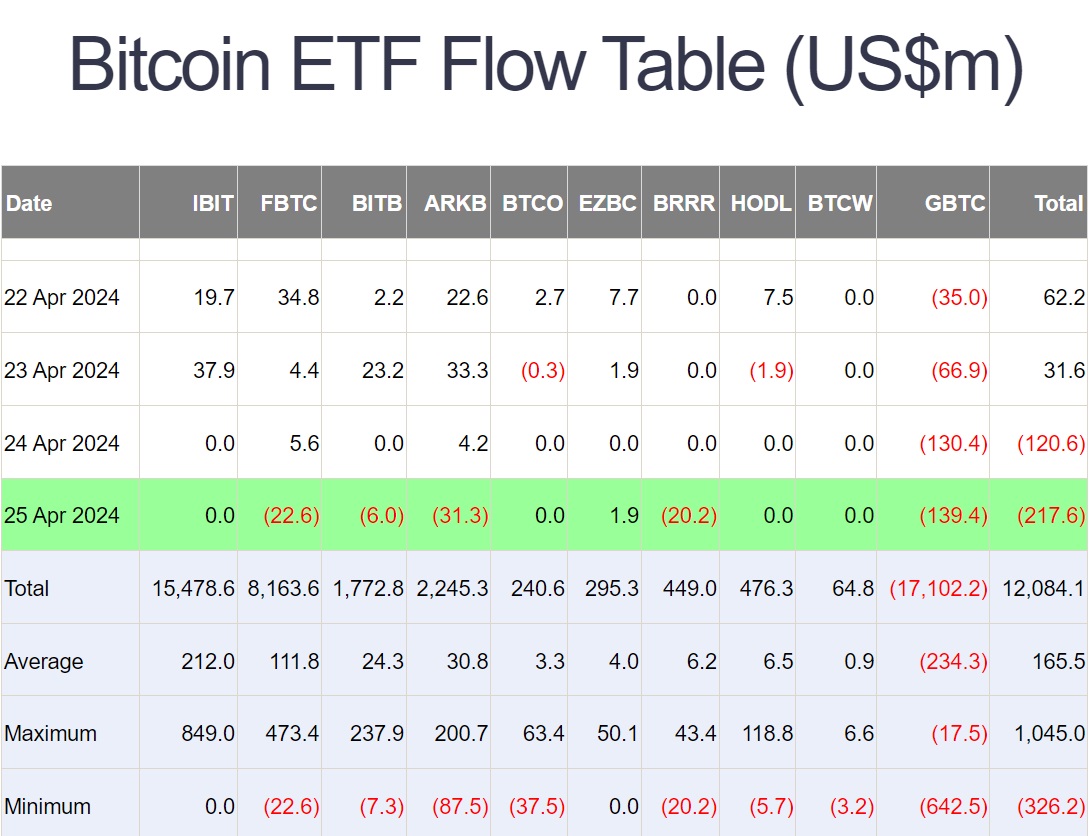

Yesterday's capital inflows into spot ETFs were red, reaching -$218 million. That's $14 million more than the entire previous week.

Making matters worse, the Fidelity and Valkyrie funds saw outflows for the first time. Meanwhile, BlackRock broke even for the second day in a row.

Making matters worse, the Fidelity and Valkyrie funds saw outflows for the first time. Meanwhile, BlackRock broke even for the second day in a row.

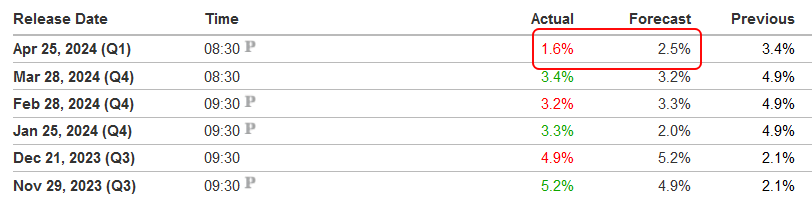

But not everything is so clear-cut. Yesterday, we looked at the potential impact of capital outflows from China on BTC's rise. Weak Q1 preliminary US GDP data compounded this argument, with the figure coming in at nearly half the forecast.

The economic slowdown presents the Fed with an extremely unpleasant dilemma: raise the key rate to curb inflation or lower it to support the economy. Obviously, leaving things as they are isn't an option either. There's a growing risk that the economy may fall into stagflation, the phenomenon in which the economy slows down while prices simultaneously rise. Inflation at the end of March also exceeded the forecast (3.5% vs 3.4%, respectively).

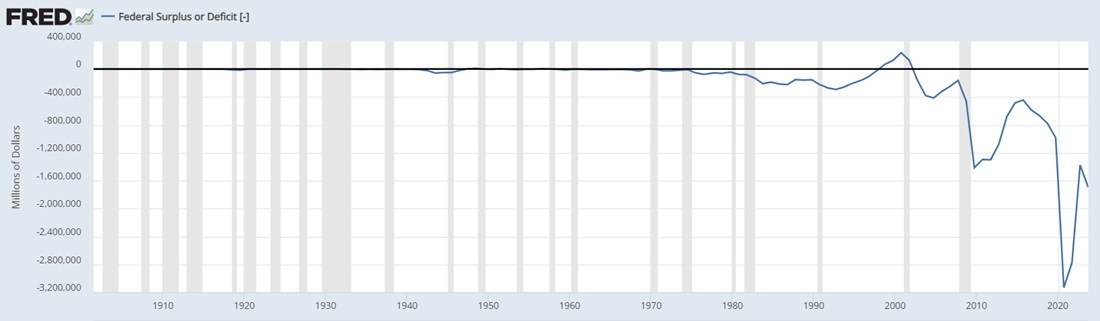

Earlier this year, Jerome Powell criticised the government for the first time in his capacity as Fed chairman, saying:

The US federal government's on an unsustainable fiscal path... The debt is growing faster than the economy.

The reason for Powell's displeasure is that all of the Fed's efforts are being undone by increased government spending and rising debt service costs. For example, the federal budget deficit reached $1.7 trillion last year and is likely to exceed $2 trillion this year.

All of this knocks the ground out from underneath the US dollar and adds points to Bitcoin, which was created in 2009 in response to the financial crisis generated by the monetary system in place at the time.

Unlike fiat money, Bitcoin cannot be:

- Printed to plug the hole in the budget. Its issuance is strictly limited to 21 million coins.

- Used as a weapon if Trump wins the presidential election and threatens sanctions against countries that decide to abandon using the dollar for international payments.

- Undermined by bank failures or the expropriation of deposits, as happened in Cyprus in 2013.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.