PayPal stablecoin: Much ado about nothing

On Monday, the payments giant announced the launch of the PayPal USD (PYUSD) stablecoin in partnership with Paxos, which is responsible for issuing BUSD for Binance. Most experts were sceptical about the news as the tool offers nothing new or beneficial to users.

The company's interest

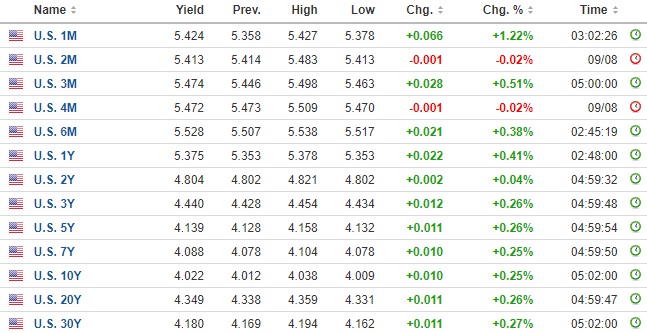

The company's interest is obvious: Paxos converts the money received from the sale of PYUSD into Treasury bonds with yields above 5%.

The User Agreement stipulates that Paxos shares revenue with PayPal, while the user isn't entitled to it.

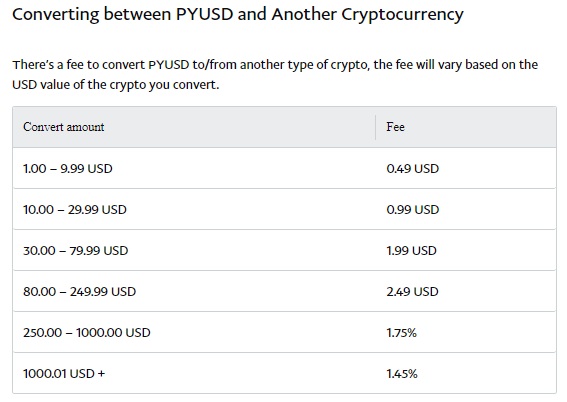

PayPal also gets a nice commission from every transaction involving the stablecoin, including converting it within the platform. For example, to exchange Bitcoin for $100 worth of stablecoins, you'd have to pay $2.50 or 2.5%.

Limits

For giving PayPal the opportunity to earn on commission and collateral, users get a lot of limitations. First, despite the claimed freedom of action when sending and receiving PYUSD (transactions take place on the Ethereum blockchain), every transfer to/from PayPal will be subject to verification. On top of that, only US citizens who have passed the KYC process can be allowed to perform transactions with the cryptocurrency. If the company has any suspicions, it has the right to withhold assets for further deliberations.

Second, PayPal has the right to deny access to Cryptocurrencies Hub or set transaction limits at its sole discretion and without any liability to the customer.

Third, PayPal disclaims responsibility for both the safety of the PYUSD and the 1:1 exchange rate to the US dollar. Users should address issues related to these concerns with Paxos, the issuer.

Conclusion

PayPal is once again riding the hype to make profit. During the 2020 bull run, the company integrated operations with cryptocurrency but only within the platform. The exchange with external wallets appeared in mid-2022. There's more apparent freedom this time, but users will likely encounter individual limitations more often.

The emergence of a new stablecoin hasn't positively affected the prices of Ethereum, which continued to lose ground to Bitcoin in August.

Crypto participants don't expect increased demand for PYUSD, which offers no advantage against fiat on the same PayPal. Unlike decentralised platforms, users can't expect passive income, with a disproportionately higher level of control and transaction fees. Regulators have yet to say what they think after Paxos' previous experiment with BUSD failed.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.