TUSD loses its peg to the US dollar

The stablecoin market has seen better days and is still suffering from the collapse of the UST stablecoin. The total capitalisation for stablecoins has gone from a high of $188 billion at the beginning of May 2022 to just $134 billion now.

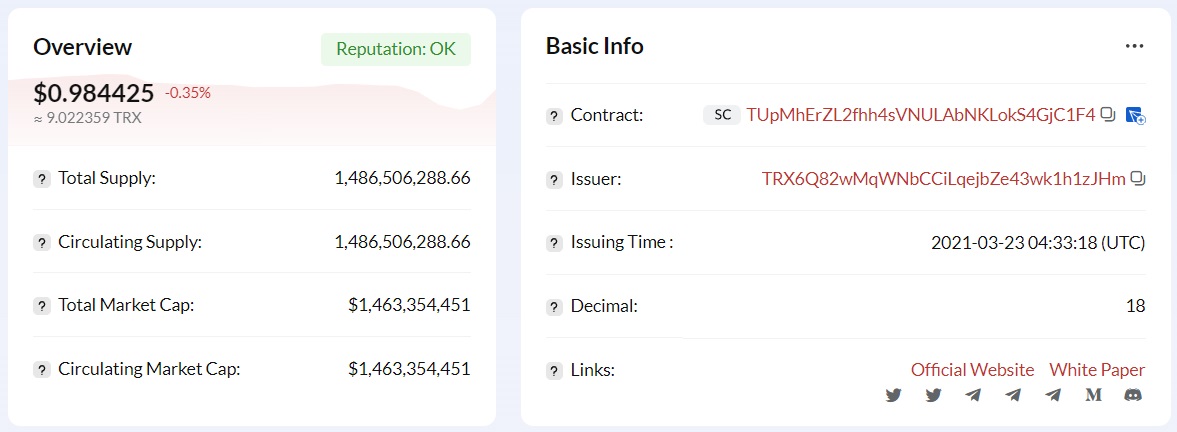

This time, the fifth-largest stablecoin TrueUSD (TUSD) from Techteryx, a British Virgin Islands-registered company, is facing shocks. Its rate was down to $0.97 on most crypto exchanges yesterday and dropped to as low as $0.92 on Poloniex two days earlier.

Despite its $2 billion capitalisation and seven-year history, TUSD is surrounded by scandals and unexpected twists and turns. For example, its capitalisation soared from $1 billion to $3 billion thanks to Binance, which introduced zero fees on it in March 2023.

Six months later, the cryptocurrency exchange cancelled the beneficial terms for TUSD after a major unpegging from the US dollar took place in June. Since that time, the coin's capitalisation has gone down.

The reason for the rate volatility in the summer was the filing of a lawsuit by TUSD founder Archblock (Techteryx acquired the business in 2020) against Justin Sun, in which the latter is accused of secretly accumulating a significant amount of TUSD for subsequent market manipulation.

It's worth noting that $1.5 billion of the current $1.9 billion capitalisation was minted on Justin Sun's TRON blockchain.

In the same year, TUSD faced a massive sell-off due to criticism of the lack of transparency of reserves and community suspicions that there were none after a widget on the official website malfunctioned. According to Binance, the outflow of funds exceeded $40 million on 15 January alone.

Panic was fuelled by rumours about the inability to deposit/withdraw TUSD from Poloniex, including for arbitrage trading. This was the reason for the exchange rate's decline on 16 January to $0.93 exclusively on this platform. Earlier, Poloniex was acquired by Huobi, in which Justin Sun is the majority shareholder.

In both cases, the loss of confidence in the coins involves Justin Sun to some degree. He undoubtedly has the financial means to support the rate directly if he wanted to. For now, he denies all accusations of involvement in the fate of the stablecoin. The TRX rate on the TRON network wasn't affected by the events.

However, given all the twists and turns, market participants should be extra cautious when using TUSD. Last year, S&P Global released a stablecoin rating that ranked it last along with FRAX.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.