Factors for Bitcoin's fall

The approval of spot Bitcoin ETFs in the US was a major step towards institutionalisation, but it caused Bitcoin to fall 14% from its local high. We warned about such an outcome back at the end of the year. There are several objective reasons for this, which are worth outlining.

High expectations

Bitcoin's price rose 2.5 times in 2023, and much of the growth came in the autumn when the emergence of ETFs became inevitable.

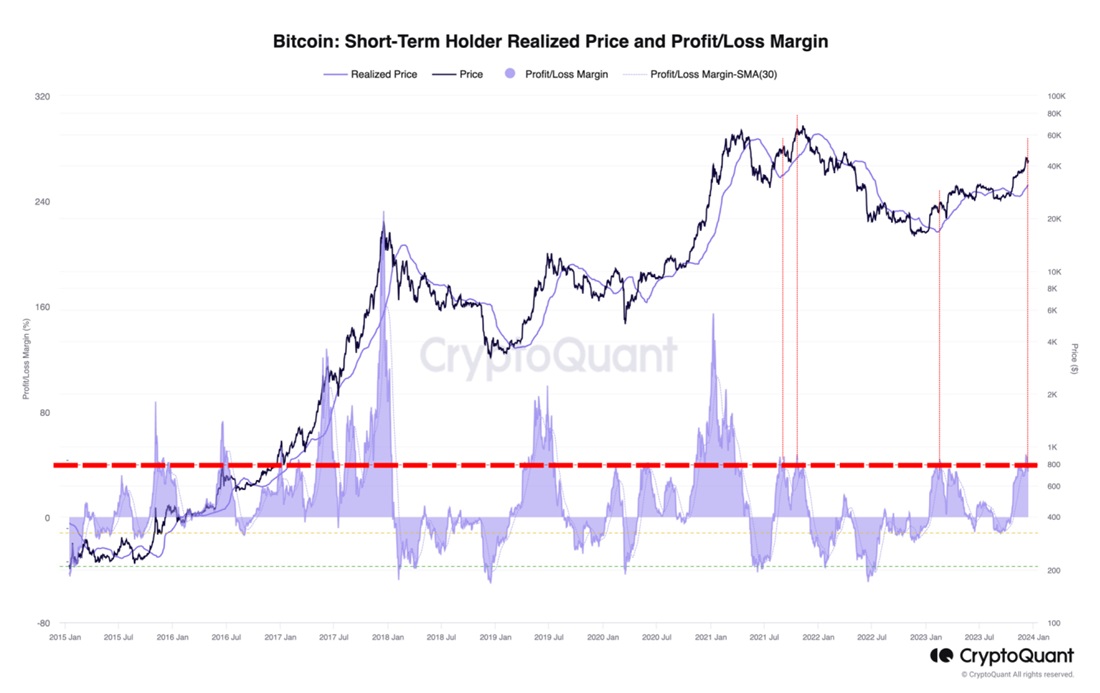

This has led to a significant increase in unrealised gains among short-term holders (STH), who are characterised by a rapid mood change and a desire to take profits at the first signs of a correction.

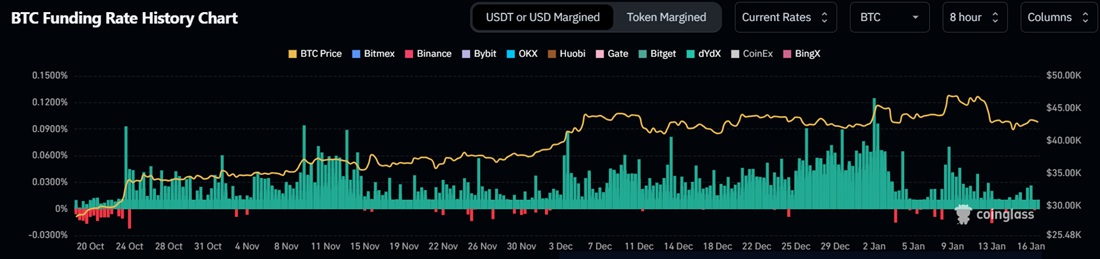

Derivatives traders can also be considered STH as they actively increased their purchases as 10 January approached. The funding rate clearly demonstrates this. Its growth indicates the prevalence of bulls over bears in open futures contracts. As hopes for Bitcoin to skyrocket with the emergence of ETFs failed to come true, the bulls rushed to the exits at the first signs of a correction. The rate is now close to neutral.

Sluggish start

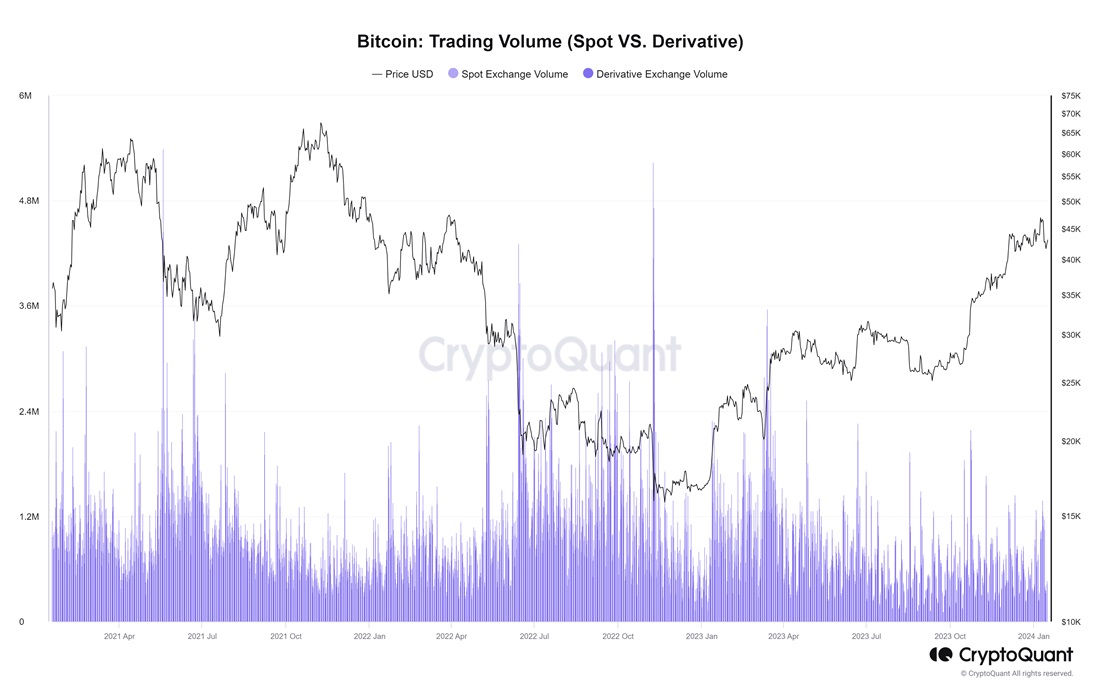

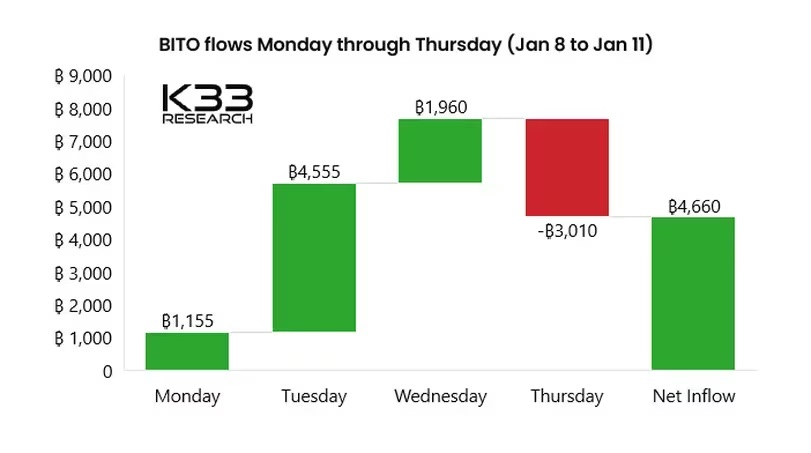

The emergence of spot Bitcoin ETFs didn't stir markets. In the first two days, they attracted only $1.2 billion in investments. Compare that to one futures ETF that recorded a $1.5 billion gain in 2021. The weak performance is also evidenced by relatively low trading volumes in both the spot and derivatives markets.

Capital shifts

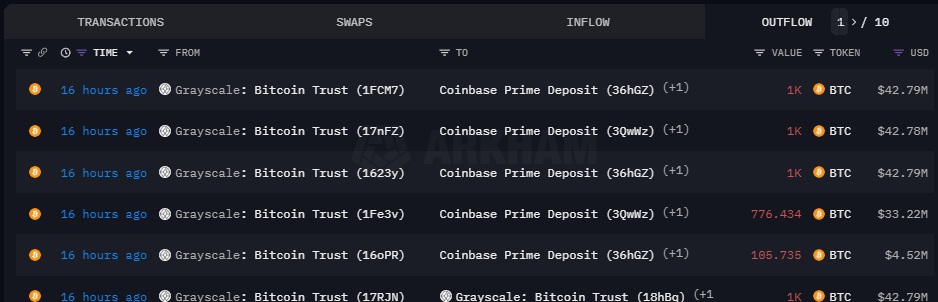

The emergence of ETFs caused a capital shift among funds. Grayscale was converted from a trust fund, so it started with 618,000 BTC. What's more, the company has the highest commission for managing assets. Its 1.5% fee led capital to flee. In recent days, around 10,000 BTC (~$430 million) has been transferred to Coinbase to be subsequently sold. With the start of the sell-off, added pressure hit the market.

A similar pattern is seen with outflows from futures ETFs, as switching from contract to contract imposes additional costs on investors.

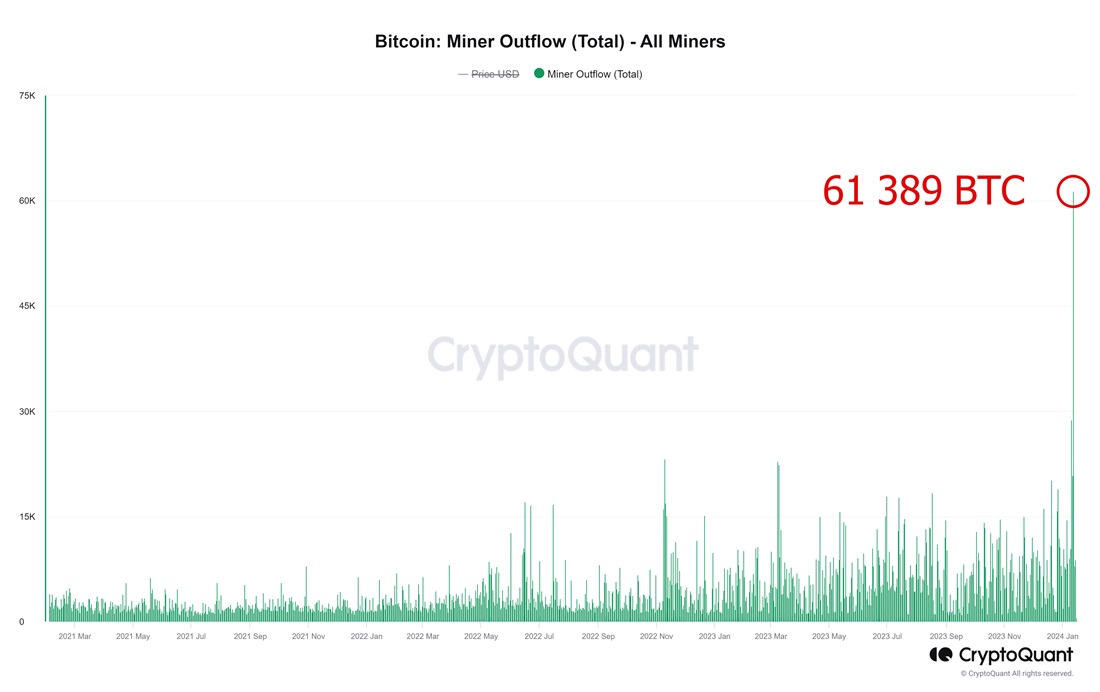

Miners' sell-off

Miners followed the classic "buy rumours, sell facts" technique and sold off 111,000 BTC worth $5 billion in the first three days after the ETF launch. Whales joined in, too. The number of addresses with over 1,000 BTC dropped from 2,024 at the end of last year to the current level of 2,015.

As we can see, some market participants used the ETF hype to sell part of their assets, while others fell victim to high expectations. However, the above factors in no way diminish the significance of long-term trends and the emergence of exchange-traded funds.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.