The interest of long-term holders will determine the move beyond $30,000

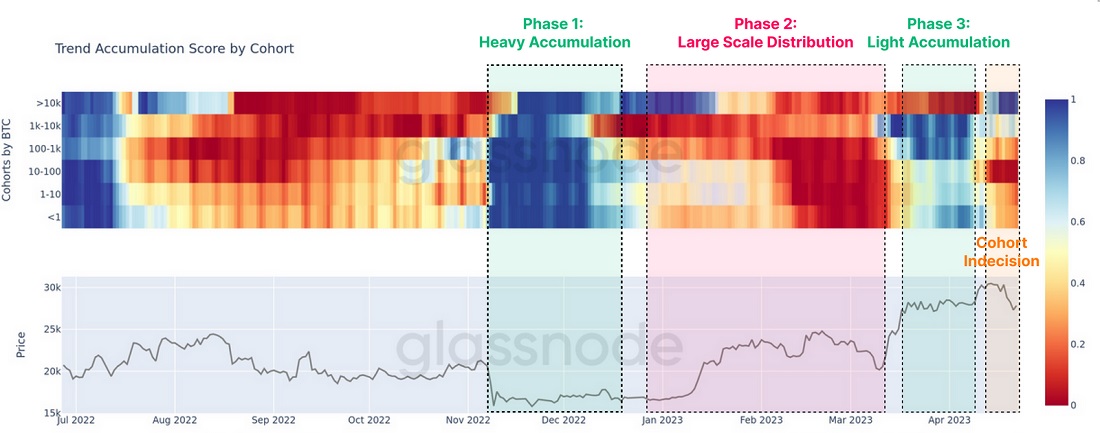

Sceptical market participants view the $30,000 level as serious resistance for Bitcoin. For the same reason, some users with wallets under 1,000 BTC rushed to lock in the gains they made in Q1.

The increased volatility in recent days led to the liquidation of buyers of perpetual futures contracts on 26 April for a record $80 million over the past month. For the bears, this served as a strong argument for the significance of the marked price level.

Futures are mainly used for margin trading, which is of interest to speculators. Long-term investors buy cryptocurrencies on the spot market and then move them to cold wallets.

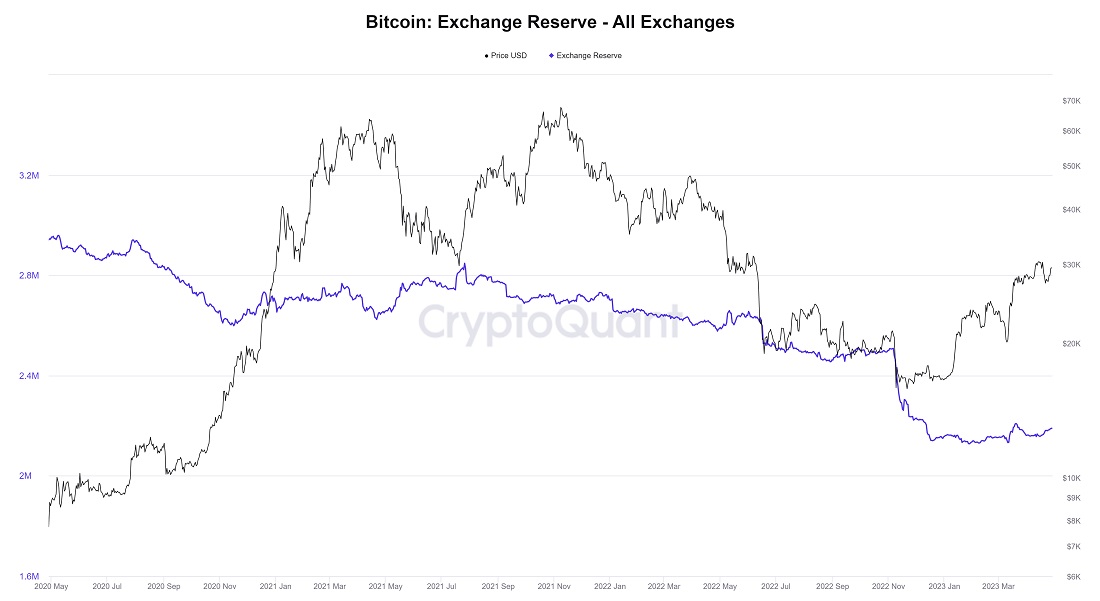

The margin continues to shrink after the FTX collapse. Consequently, long-term investors are more likely to be behind the growth momentum of 2023.

This is also confirmed by the low level of crypto exchanges' total balance sheet, which amounts to 2.19 million BTC at the moment. Despite Bitcoin's 80% price growth in 2023, holders are in no hurry to move the cryptocurrency to exchanges.

This indicates a desire to keep the majority of funds in cold wallets and an expectation of further price rises.

Going back to the first chart, we see that the reversal in whale behaviour is worth noting. After the coin sell-off during the rise to $30,000, they returned to hoarding. In most cases, whales anticipate (or cause, depending on the market conditions) further movement of cryptocurrency, as we've covered more than once.

For example, MicroStrategy, the largest public BTC holder, returned to buying after a pause, adding 7,500 BTC to its coffers in the spring. The company's reserves are now valued at 140,000 BTC, worth a total of $4.1 billion. Interest in the cryptocurrency is growing amid shocks in the US banking sector and the Fed's possible turn to dovish monetary policy. The regulator's upcoming meeting will take place next week.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.