Here's why new shocks to US banking are causing Bitcoin to skyrocket

Bitcoin jumped 7% to $30,000 yesterday due to shocks from the drowning First Republic Bank's report. Despite a $30 billion infusion by a consortium of banks in Q1, a move backed by the Fed and the Treasury Department, the institution's customers decided to exit anyways.

The Fed's tightening of its monetary policy continues to hit the banking sector, making assets on balance sheets cheaper and reducing demand for banking services. After a series of bank collapses by cryptocurrency-friendly banks, First Republic (hereafter, FRC), one of the top 30 US banks by capitalisation, was next. The main catalysts of the liquidity problems were the high proportion of uninsured deposits (two-thirds, according to the FDIC) and the excess of loans and investments over deposits (111%, according to S&P Global).

To prevent bankruptcy, a consortium of banks transferred $30 billion of uninsured deposits to FRC in Q1. Another $70 billion in loans were provided by JPMorgan. In the meantime, US Treasury Secretary Janet Yellen reassured the public of the banking sector's resilience.

The measures taken weren't enough to improve the bank's credibility with the public. According to the Q1 report, customers emptied accounts worth $100 billion in March. This frightened shareholders, as they would lose their investment entirely if the bank goes under FDIC management. In the past two days, shares have fallen by 47%; they've collapsed by 95% YTD.

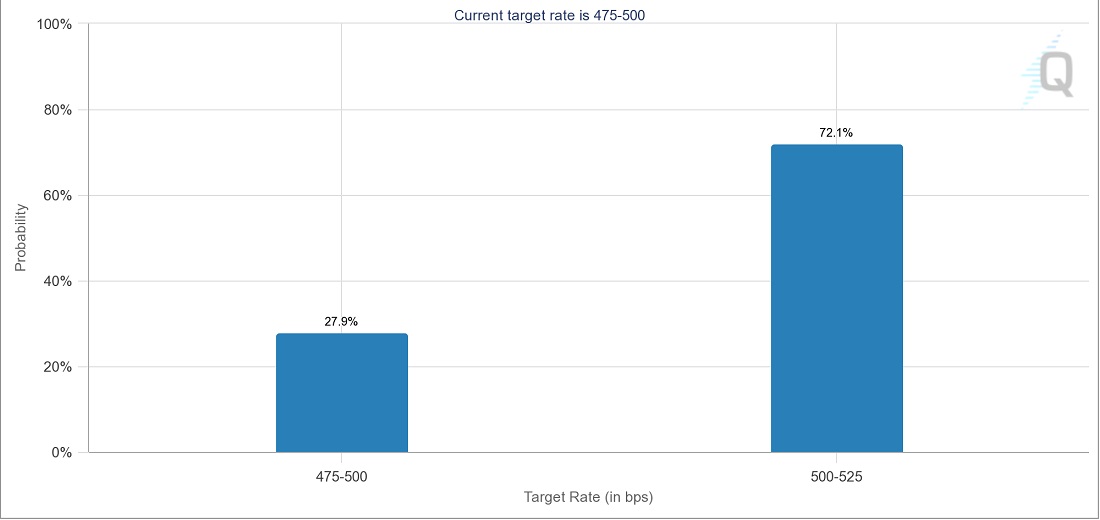

The likelihood of FRC's bankruptcy is extremely high. It'll be the fourth bank to collapse in 2023, but hardly the last as the Fed promises further monetary policy tightening. CME's FedWatch tool estimates a 72% probability that the key rate will be raised by another 0.25% next week.

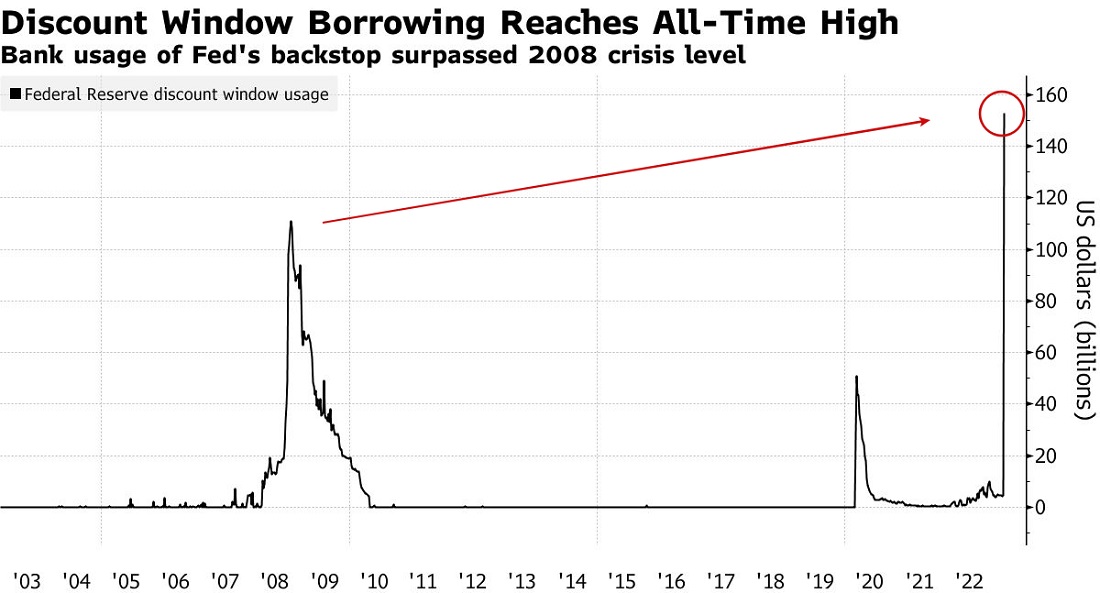

Bank failures make a rate hike irrelevant as the provision of total insurance for the previous three episodes and the launch of an emergency lending programme go against monetary tightening and the fight against inflation. The Fed has already provided more liquidity to banks than in the 2008 crisis.

A worsening banking environment could force the regulator to pause its rate hike and turn 180 degrees. These actions would lead to a rise in high-risk assets such as Bitcoin.

The bankruptcy of banks and the Fed's dilemma benefits Bitcoin's advantages, such as decentralisation, high independence from the traditional financial sphere and limited issuance. While the Fed conducts hidden QE and builds up its balance sheet, Bitcoin's volume is reduced every four years, and the final supply is limited to 21 million coins.

In addition, deposit insurance in the US is limited to $250,000, and the Treasury is unable to provide full coverage, as this would lead to a poor investment policy for financial institutions in the future. Bitcoin's ability to act as a highly liquid store of value can attract capital in the case of further worsening in the banking sector.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.