How to trade in DEX with leverage

As the cryptocurrency world continues to evolve, so too do our methods of trading and investing in these digital assets. The introduction of decentralised exchanges (DEX) is one of the latest and most promising developments in crypto trading. How do you increase your trading performance? You can increase your profit with decentralised leveraged trading. This article discusses leveraged trading strategies such as margin trading and provides an example of trading with leverage on StormGain DEX.

What is DEX trading?

DEX, short for decentralised exchange, is a direct marketplace where users can trade cryptocurrencies without relying on intermediaries to handle funds. Instead of traditional institutions, DEXs use blockchain-based smart contracts to facilitate asset exchange. This approach brings full transparency to transactions, eliminating the opacity of traditional financial systems.

By bypassing third-party wallets, DEXs also reduce counterparty risk and minimise centralisation concerns in the cryptocurrency ecosystem. DEXs are an essential part of decentralised finance (DeFi) and provide a solid foundation for developing advanced financial products through permissionless composability.

What is margin trading in a DEX?

Margin Trading on decentralised exchanges (DEXs) involves the establishment of lending pools designated for capital deployment within the platform. These isolated asset pools cater to users seeking to lend or borrow for margin trades.

Those who contribute assets to a lending pool earn variable interest rates as income based on the pool's usage. This mechanism mirrors the functionality of a lending protocol.

Traders are provided with the option to borrow from the lending pool to execute leveraged swaps into different tokens. Margin Trading platforms capitalise on the liquidity available on DEXs, eliminating the need for separate liquidity pools or order books dedicated to leveraged trading.

Can I leverage trade on a DEX?

Decentralised exchanges (DEXs) represent a distinct form of cryptocurrency exchange functioning on decentralised blockchain networks. In contrast to centralised exchanges, DEXs eliminate the need for a central authority to oversee transactions. Instead, they leverage smart contracts to automate and ensure secure and transparent trading operations.

Among the various trading strategies, leverage trading is popular as it enables traders to borrow funds and amplify their trading positions. While this approach can lead to higher profits, it also entails greater risk. DEX leverage trading platforms combine the strengths of DEXs and leverage trading, enabling traders to engage in leverage trading within a decentralised and secure environment.

Types of decentralised leverage trading platforms

Several decentralised leverage platforms are available, each with unique features and benefits. Let’s consider some of the most popular types.

- Margin Trading Platforms. Traders can borrow funds to enhance their trading positions. Users can select leverage levels, and the platform handles margin requirements automatically.

- Perpetual Swap Platforms. These platforms facilitate trading perpetual contracts, akin to futures contracts, but without expiry dates. Traders can utilise leverage to amplify their positions and earn funding fees for extended holdings.

- Options Trading Platforms. Traders can buy and sell options contracts, granting them the right to purchase or sell an asset at a predetermined price. Leverage can augment positions, and selling options contracts enables earning premiums.

Benefits of DEX leverage

DEX leverage trading platforms offer notable advantages compared to traditional centralised exchanges. Here are some key benefits:

- Enhanced security. By eliminating the reliance on a central authority, decentralised leverage trading platforms prioritise security. Transactions are executed automatically through tamper-proof and transparent smart contracts.

- Increased transparency. Decentralised platforms excel in transparency as all transactions are recorded on a public blockchain. This permits anyone to access the transaction history and validate its legitimacy.

- Improved accessibility. Decentralised leverage trading platforms bypass the lengthy verification process of centralised exchanges. With just a cryptocurrency wallet, anyone can swiftly access a DEX leverage platform and begin trading.

Key features of a DEX leverage trading platforms

- Automated trading. The platform should include customisable automated trading features, allowing traders to execute predefined trades swiftly and efficiently without manual intervention.

- Margin trading. Traders should be able to utilise leverage for various assets, such as cryptocurrencies, commodities, and forex. The platform should provide clear information on margin requirements and risk management strategies.

- Perpetual swaps. The platform should support perpetual contracts without expiration dates for a wide range of assets, enabling traders to utilise leverage. Transparent information on funding fees and associated costs should be readily available.

- Options trading. Traders should be able to buy and sell options contracts across diverse assets while utilising leverage. The platform should provide clear information on premiums and associated costs.

- Robust security. The platform should be built on a secure blockchain network, leveraging smart contracts for automated transactions. Additionally, implementing two-factor authentication, encryption, and regular security audits ensures user data and funds safeguarding.

- User-Friendly Interface: The platform should offer a user-friendly interface, clarifying trading fees, margin requirements, and crucial details. Educational resources and tutorials should also be available to assist new users.

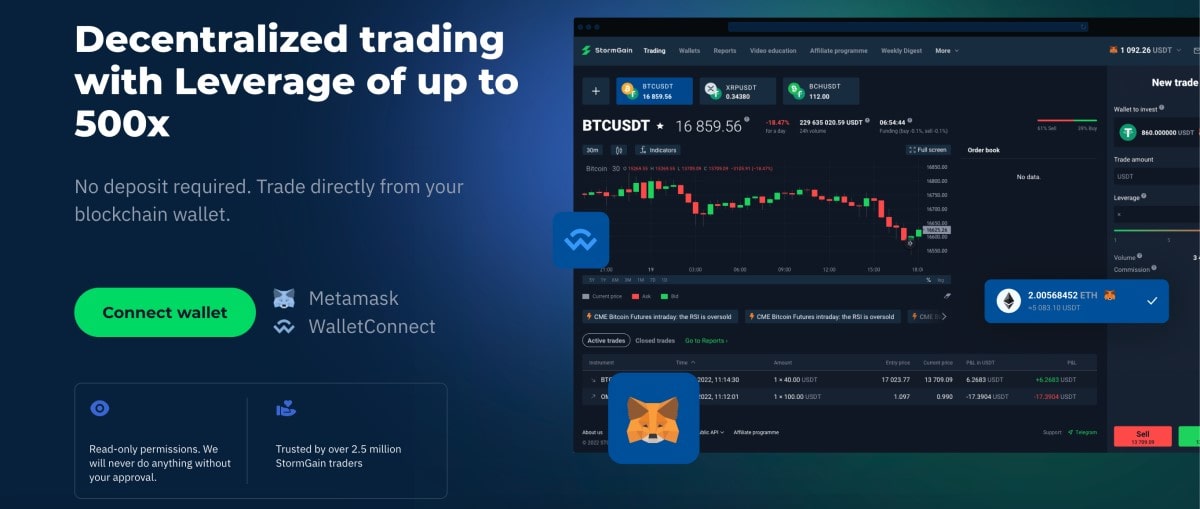

If you are looking for the best DEX for leverage trading that meets all the above criteria, consider using Stormgain DEX with leverage trading. Keep on reading to find out how the decentralised leverage trading platform works.

How to trade with leverage on StormGain DEX

StormGain is a decentralised leverage trading platform, ideal for profit from crypto price changes and long-term investments. With support for over 40 cryptocurrency futures contracts, indices, equities, and commodities, it offers leverage from 5:1 to 300:1.

StormGain also allows purchasing, exchanging, and storing of cryptocurrencies. All financials are in Tether (USDT) stablecoin, reducing exchange risks. The decentralised leverage trading platform provides various order types, trading signals, and low commission rates. The expert-prepared signals boast up to 65% average returns. Fast registration and top-notch security with two-factor authentication ensure a great user experience. You can start trading immediately after registration.

Check out our quick guide on trading DEX with leverage on StormGain.

Step-by-step guide

At the core of the StormGain decentralised leverage trading platform lies a fundamental trading principle: the outcome of a trade is directly influenced by the price movement of the underlying asset it is based on.

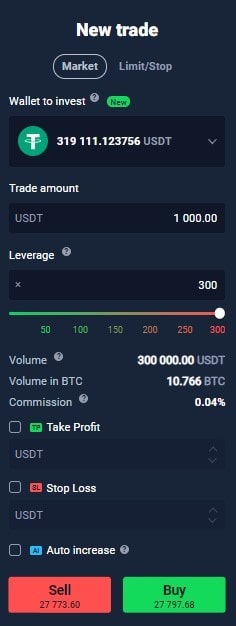

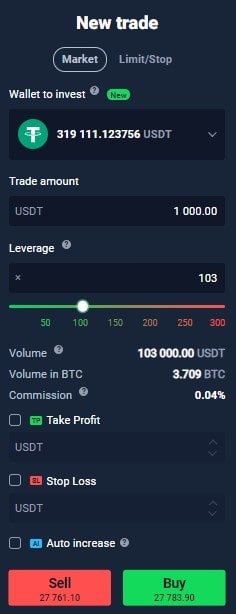

To enhance their money management capabilities, traders can use the Leverage Feature established when initiating a trade. The Leverage represents the value that determines how the trade outcome fluctuates in relation to the underlying asset's price.

Leverage manages risks and affects commission charges for cryptocurrency trades. It increases trade profitability and enhances the use of funds in your StormGain account. Leverage allows trading with funds up to 500 times the account balance. Maximum leverage depends on the instrument, ranging from 5 to 500.

The leverage is set when a position is opened.

The leverage amount can be set manually in the appropriate field or by selecting the desired level on the sliding scale.

Mind that the leverage cannot be changed for a position already opened.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

What are leveraged tokens in DEX?

Leveraged tokens are derivative instruments designed to expose holders to cryptocurrency markets, alleviating the need to manage leveraged positions actively. These tokens were initially introduced by FTX, a derivatives exchange, and have gained listings on various centralised exchanges.

What is 5x leverage?

With a 5x margin, you gain 5 times leverage, allowing you to purchase shares worth 5 times your initial capital. For instance, with 5x leverage, Ethereum's price movement is amplified by 5 times compared to the spot market. If Ethereum's price rises by $100, the trader will earn a profit of $500. Conversely, if Ethereum's price decreases by $100, the trader's account will incur a loss of $500.

Are leveraged tokens risky?

When you trade leveraged tokens, there's no need for concern regarding liquidation risk, margin, or collateral. In the event of a profitable outcome, the system will automatically reinvest the proceeds into the underlying asset. Moreover, if a loss occurs, it will promptly rescue your chances without any manual intervention required.

Can I use 100x leverage?

Yes, you can. By utilising 100x leverage, traders with limited funds can now access the same profit opportunities as those with larger capital. This serves as a valuable shortcut to expedite the growth of trading accounts by capitalising on enhanced returns. For instance, even if your trading account holds a mere $1000, you can open a position worth $100,000 thanks to the 100x leverage.

What is the safest leverage?

The optimal leverage ratio varies depending on the investor's preferences. A lower leverage ratio, such as 5:1 or 10:1, is suitable for cautious or novice investors. On the other hand, seasoned investors comfortable with taking more risks may opt for higher leverage ratios, reaching up to 50:1 or even 100:1 and beyond. It ultimately comes down to individual risk appetite and experience in the market.