Uptober: What's behind cryptocurrencies' growth?

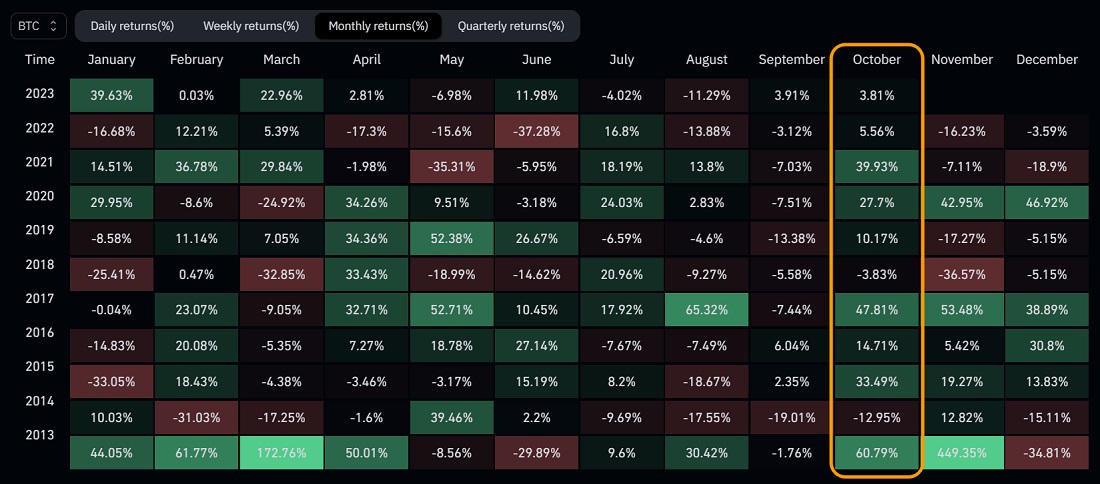

October is traditionally a good month for cryptocurrencies. Historically, Bitcoin has closed the month positively in 8 out of 10 cases for a 22% average increase.

There are positive factors behind every major growth. This time, the hopes for Uptober are fuelled by the upcoming launch of Ethereum futures ETFs in the US and anticipation that Bitcoin spot ETFs will be approved in the next six months.

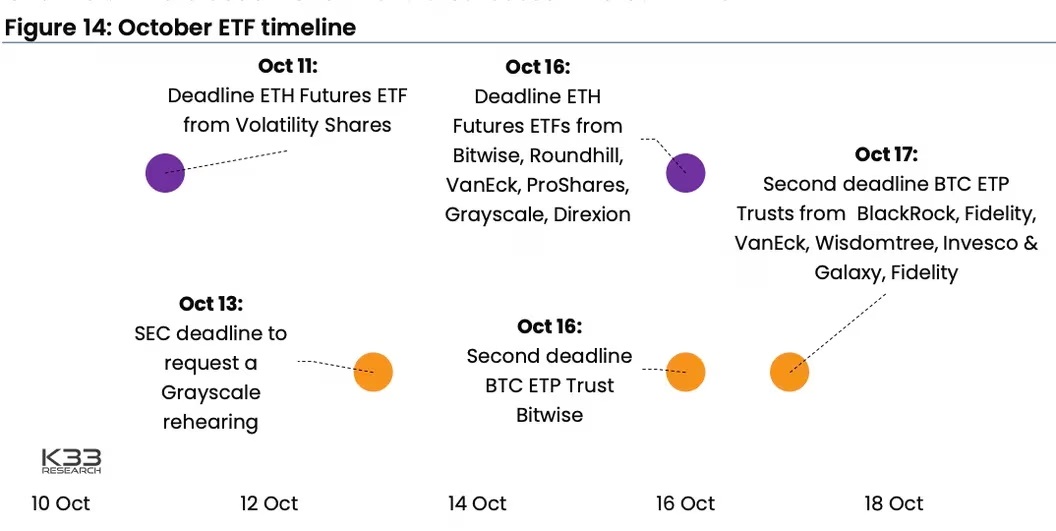

There are several things behind these events. First, the SEC lost its attempt to block the conversion of Grayscale's Bitcoin trust fund into an ETF after the latter appealed. The judicial commission called the regulator's position "arbitrary and capricious". Unless the SEC can find a stronger justification, the transformation will happen "automatically" after the appeal deadlines expire.

Second, in September, the SEC Chairman was again called before the Financial Services Committee, where several congressmen demanded that Gary Gensler approve ETF applications. Gensler was also criticised for lacking clear criteria for dividing cryptocurrencies into goods and securities.

Third, Valkyrie received permission to launch an ETF with combined contracts for Bitcoin and Ethereum futures. This is the first altcoin ETF in the US to start operating on 3 October. Another 15 Ethereum ETF applications are expected to be approved next, with some companies rushing to apply to launch BTC+ETH ETFs on Friday.

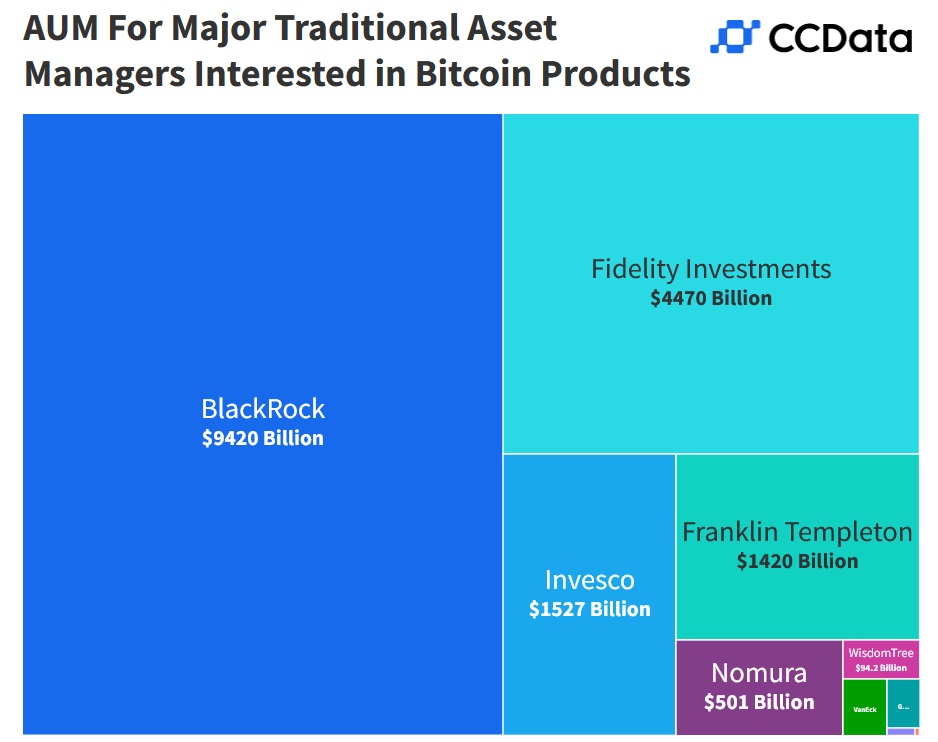

Institutional interest in cryptocurrencies is difficult to overestimate. Currently, the total volume under management in investment funds worldwide doesn't exceed $40 billion, of which the US accounts for almost 80%. BlackRock alone operates $10 trillion. The company has shown interest in cryptocurrencies by applying to the SEC for a spot ETF. Its CEO, Larry Fink, also called Bitcoin an international asset and digital gold.

Futures contract ETFs have some drawbacks. For example, some profit gets burned when moving from one month to another. That's why a real investment boom is expected with the launch of spot ETFs, drawback-free.

According to various estimates, Bitcoin spot ETFs will attract $0.5 trillion in the first six months alone, causing the cryptocurrency's price to rise to $80,000.

StormGain Analytics Team

(the cryptocurrency trading, exchange and storing platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.