Users rush to exchange stablecoins for BTC and ETH

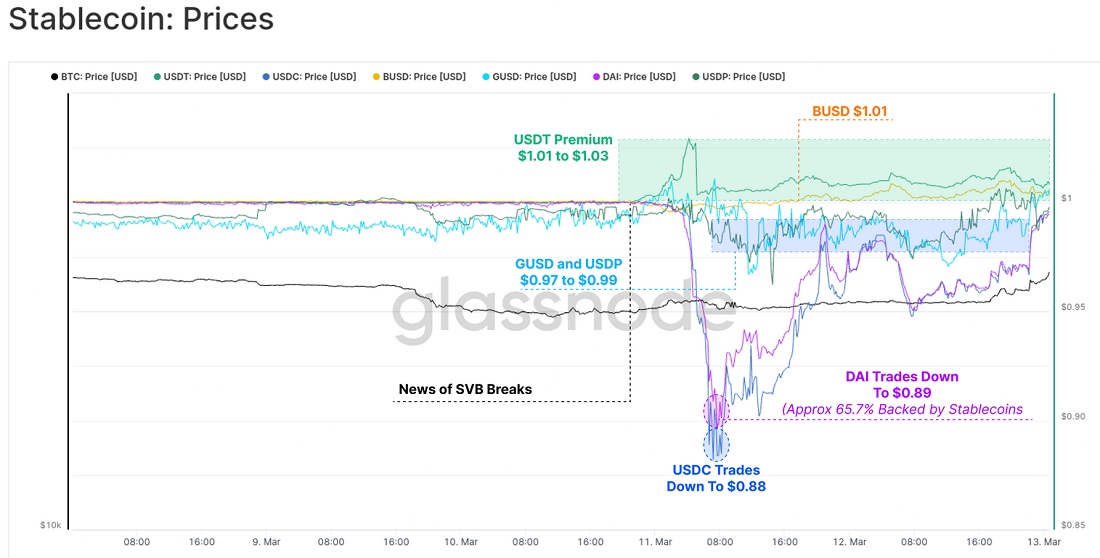

US regulators have taught a good lesson to crypto enthusiasts who use stablecoins for savings or to generate passive income from staking. The USDC, the strongest stablecoin in terms of collateral and supervisory control, unexpectedly lost over 10% of its notional value on Saturday.

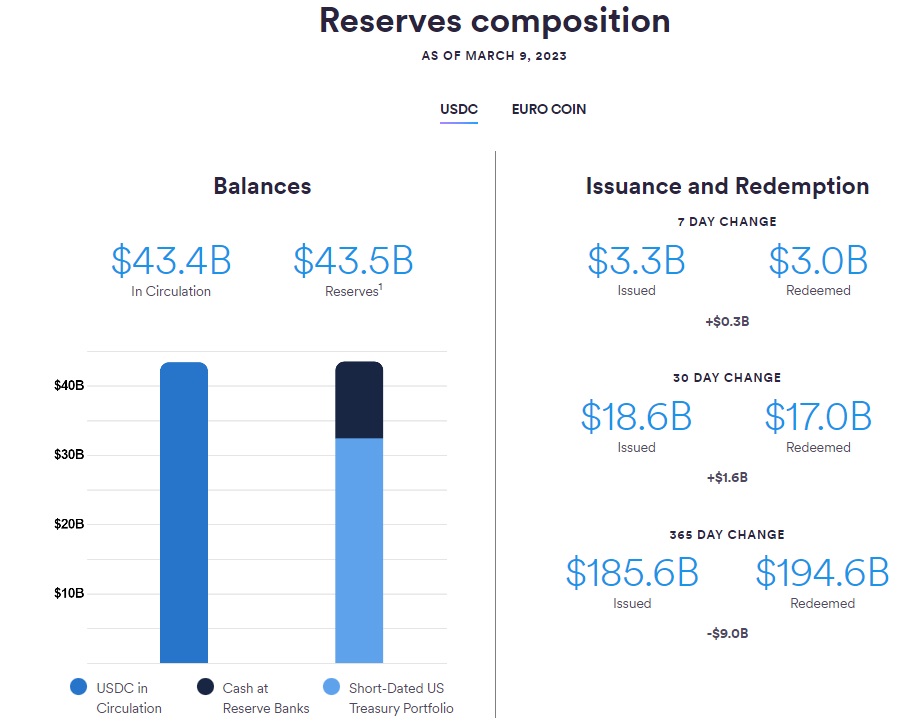

In the US, USDC is regulated by the NYDFS and SEC. Its reserves are audited monthly and consist exclusively of cash in bank accounts and short-term Treasury bonds.

On 10 March, $3.3 billion, or 8% of the collateral, was blocked by the Federal Deposit Insurance Corporation (FDIC) at Silicon Valley Bank (SVB), causing Circle to face a liquidity crisis on 11 March and USDC to lose its peg to the US dollar.

The lesson from the regulators clearly demonstrated the disadvantages of centralisation. Even by meeting all the requirements of the supervisory authorities and having the most transparent and secured coin, Circle was unable to fully meet the commitments it had made. The panic in the market led to even greater losses for users.

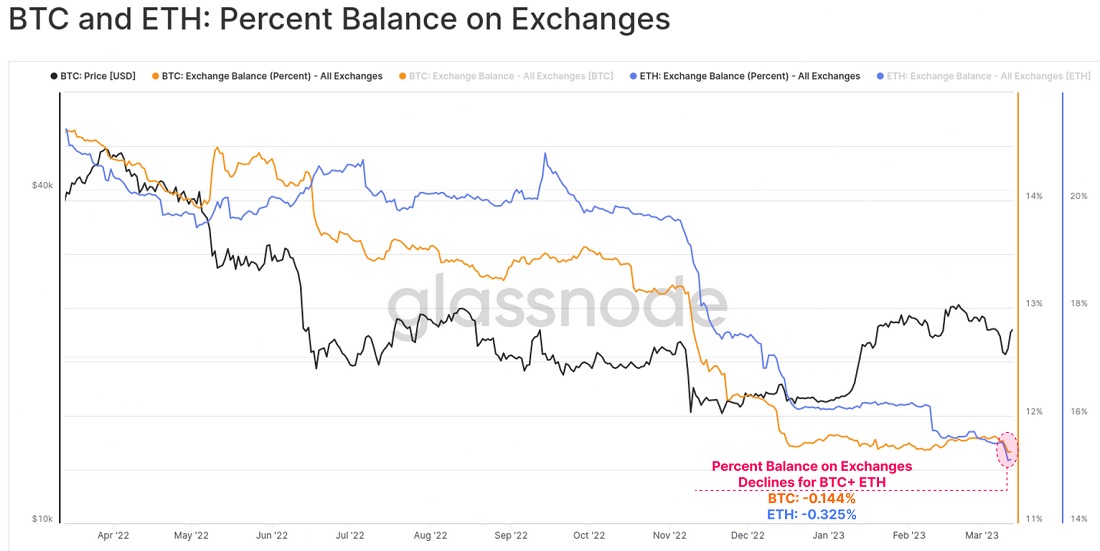

In the past five days, USDC's capitalisation has fallen 12% to $38.4 billion. Users withdrew over $1.3 billion worth of BTC and ETH from cryptocurrency exchanges on Saturday alone.

The decentralised nature gives BTC and ETH as much freedom as possible from regulators' actions. Cryptocurrencies have no major financial centre or hub that could experience similar harm if they were targeted.

On the same day, Nas Academy creator and popular vlogger Nuseir Yassin spoke about the events taking place:

Today, I finally understand the anger that led to the creation of Bitcoin. Who do you trust with ur livelihood? A 'gov insured' bank that's not actually insured? An exchange that goes bust? A stablecoin that depegs? Or a currency that makes you 8% poorer every year?

Due to the collapse of three banks within seven days, analytical agency Moody's downgraded the US banking sector from "stable" to "negative". The Fed's key rate hike has hit yields and banks' ability to raise capital. Analysts predict a further rate hike, which would lead to further negative effects in the sector.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.