Whales and institutional investors are leaving Bitcoin

The tense macroeconomic environment and the continued consolidation of Bitcoin are causing increased scepticism among a number of investors. The significant reduction in liquidity that threatens increased volatility and false breakouts is bringing negative sentiment to the table.

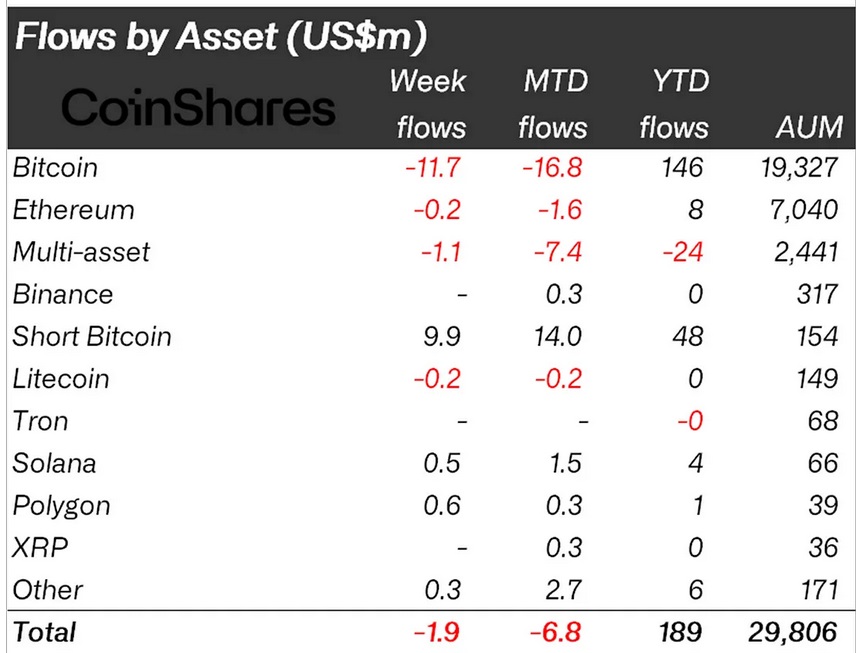

For the third week in a row, institutional investors have either withdrawn positions from Bitcoin funds or moved funds into short ETFs (profits are generated when the value of the asset falls). Last week, the net outflows amounted to $11.7 million, while short fund investors increased their positions by $9.9 million.

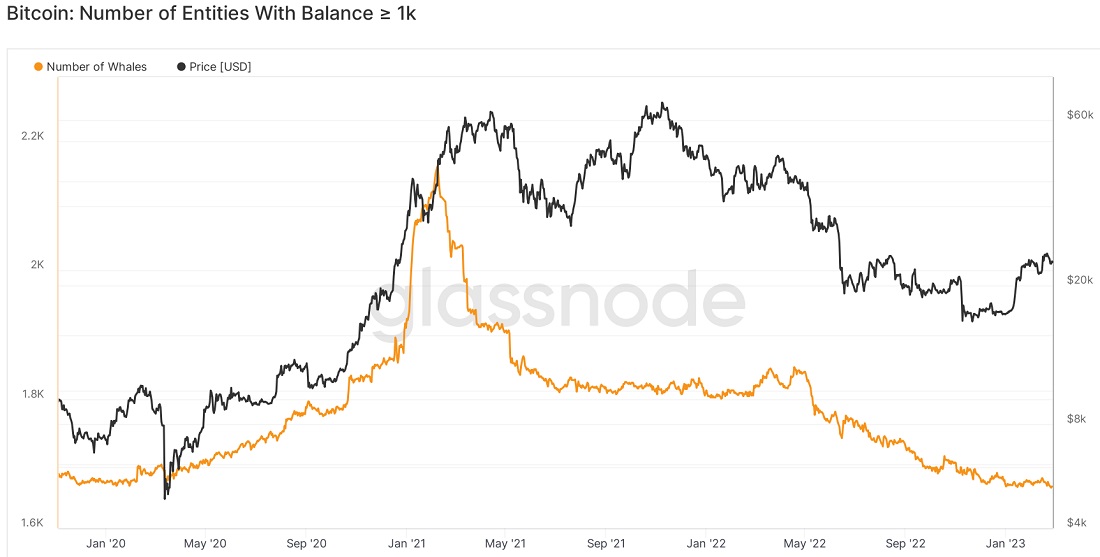

The number of whales (> 1,000 BTC) continues to decline, reaching a three-year low of 1,663 individuals. Two years ago, there were 2,161 of them. The first wave of population decline was caused by the sell-off of stocks at the peak of the rally, but the second one (from May 2022) was due to the collapse of several crypto projects and panic among market participants..

The lack of positive momentum over the last two months suggests a pessimistic mood among big players, despite Bitcoin's 43% gain since the start of the year.

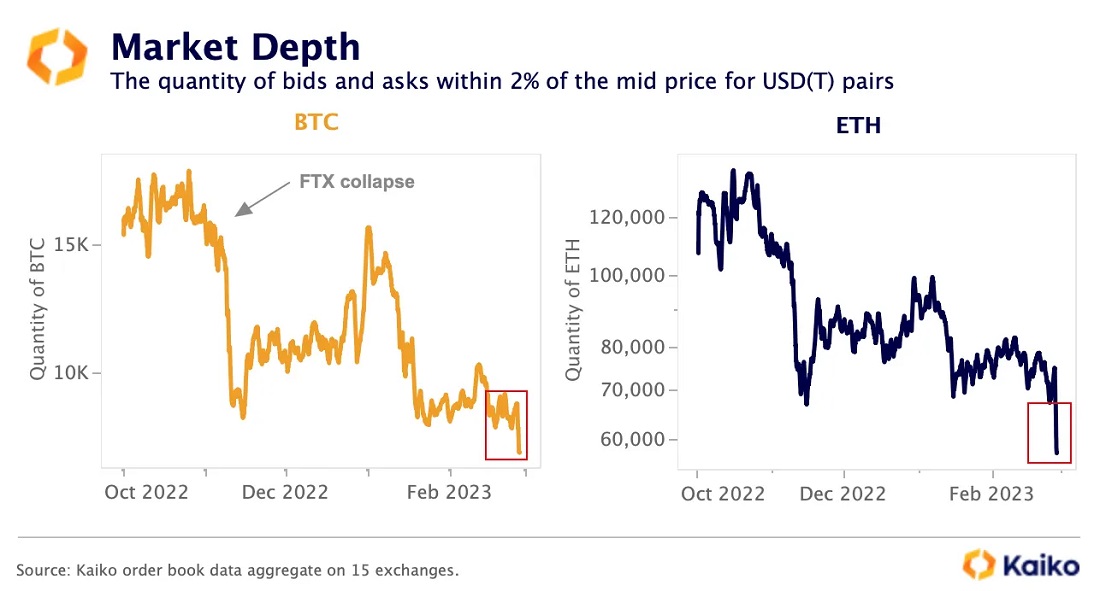

The negative sentiment is fuelled by reduced liquidity in BTC/USDT and EUR/USDT. Analyst agency Kaiko estimates that market depth within 2% for Bitcoin's price has declined from over 15,000 coins in October 2022 to the current 6,800 BTC. Reduced liquidity threatens to increase volatility and carries the risk of price manipulation.

The main concerns relate to the Fed's continued key rate hike to curb inflation. Since the US Consumer Price Index exceeded the forecast in January, when it reached 6.4% year-to-year, the regulator may raise the rate by 0.5% at its next meeting. CME's FedWatch tool now estimates a 23% probability of such a move.

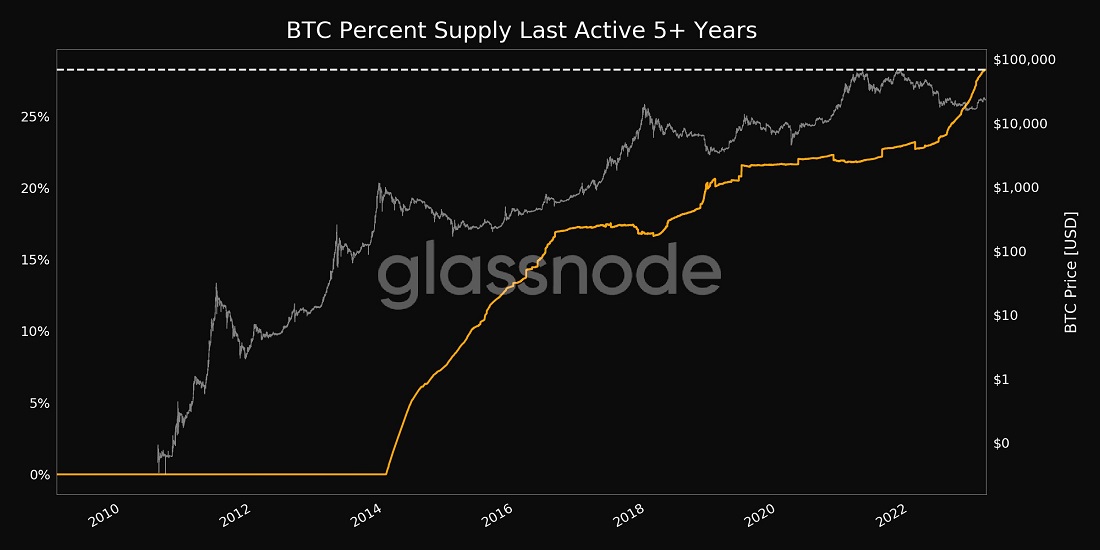

But there's also a bright side: Long-term holders renewed a four-month high in accumulation, while the percentage of supply inactive for at least five years reached a historic high of 28%.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.