Whales are back to hoarding Bitcoin

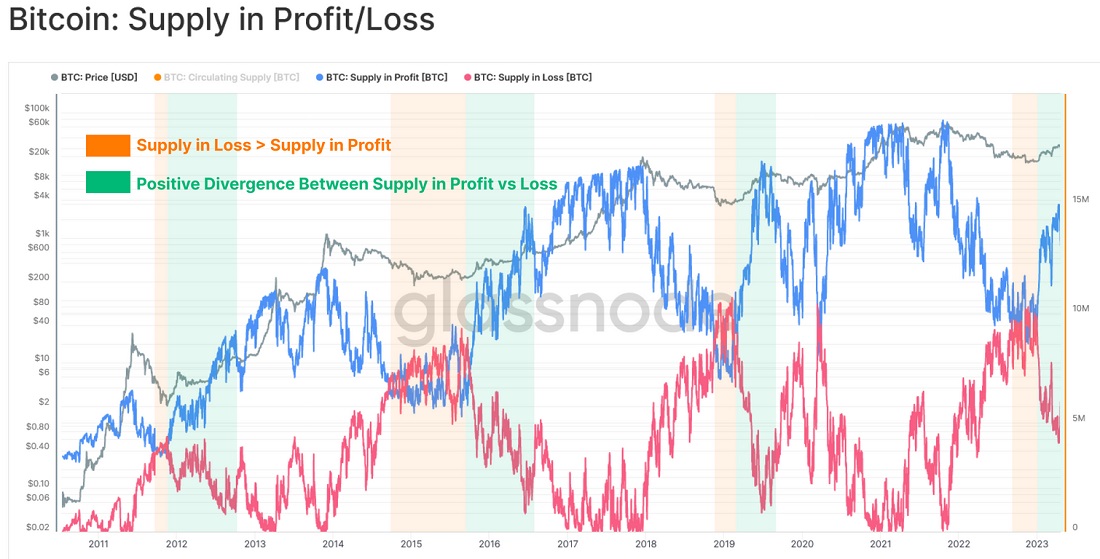

Bitcoin's skyrocketing 87% growth in 2023 has shifted holders from unrealised losses to unrealised profits.

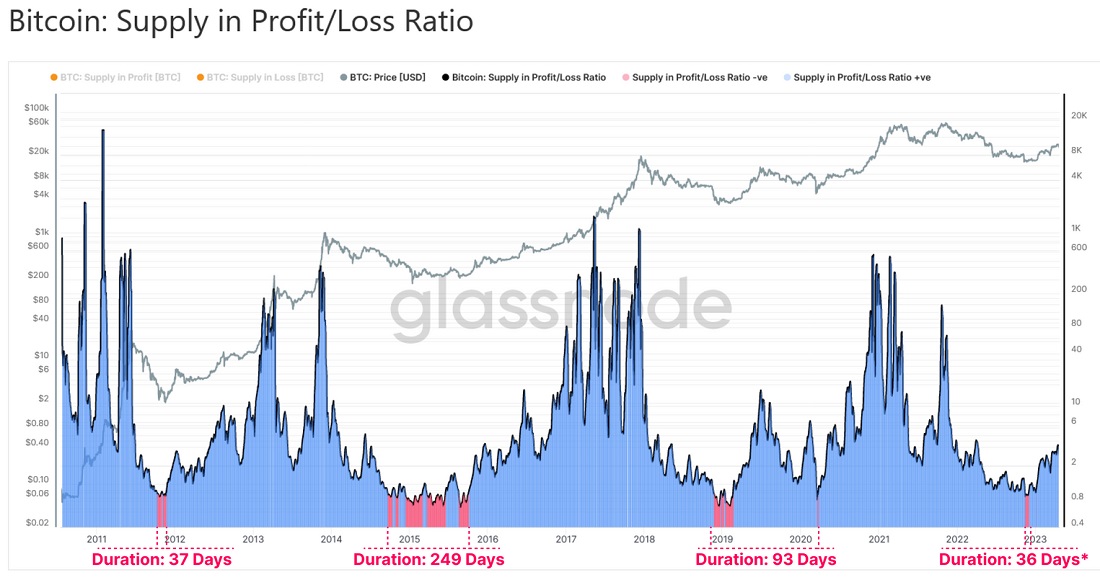

The exit from the loss phase marks the formation of a bottom, which is indicated by the ratio between the Bitcoin currently experiencing a profit and that seeing a loss. The high rate of discrepancy between these parameters was observed in only 415 days out of 4,639 (9%).

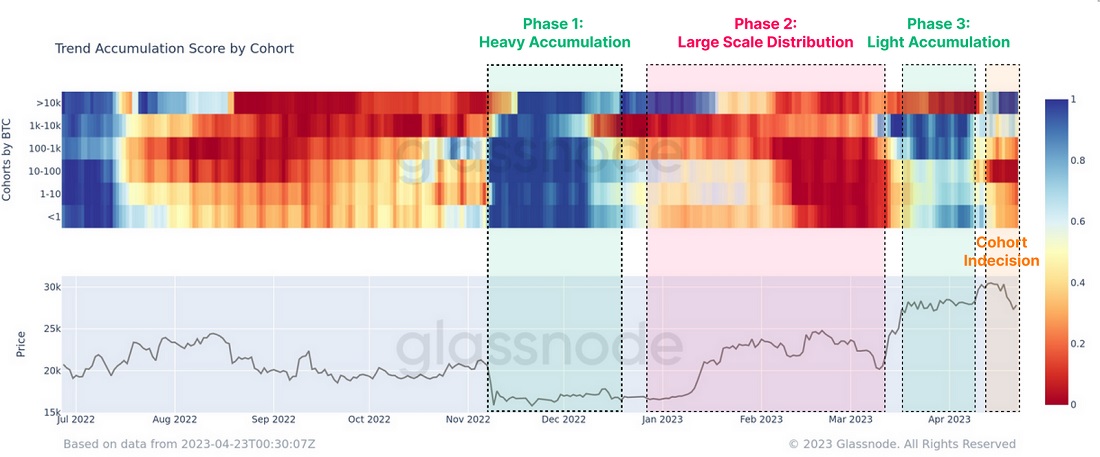

The shift from losses to profits has prompted a number of participants to lock in their gains. Yet again, a difference can be seen in the behaviour of whales (>1,000 BTC) and smaller groups. The whales got rid of their stocks as the price rose but then returned to hoarding after it reached the $30,000 mark. The other participants, on the other hand, saw the rise to the level and the subsequent correction as an excellent reason to sell the asset.

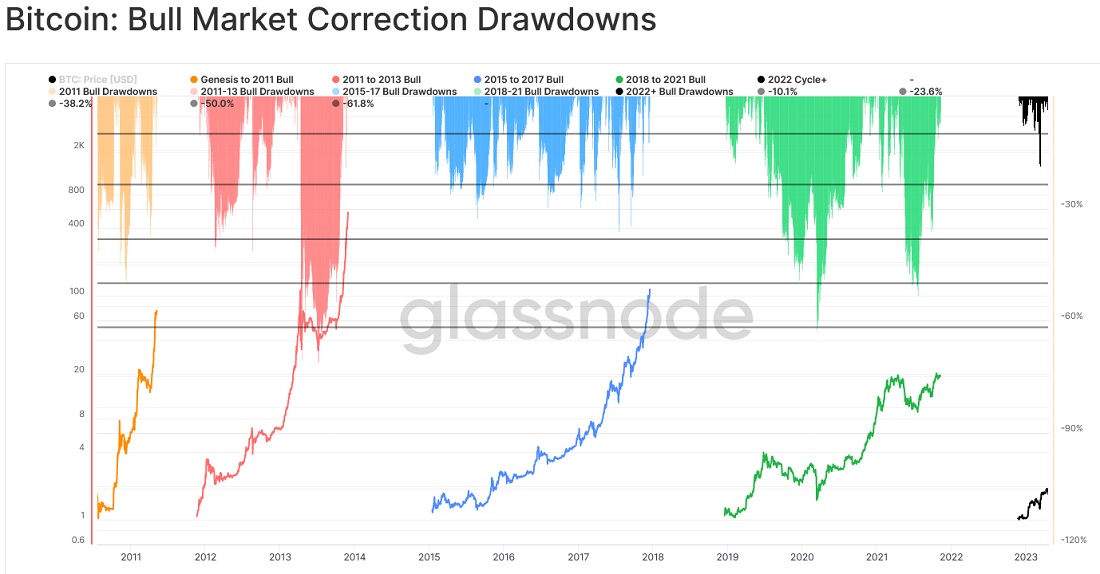

So, should we take a serious look at the latest price reduction, which has already gained 13% from its 2023 high?

If we evaluate the dynamics of recent months as a new bullish cycle, the statistics suggest that the correction is minor. In previous cycles, it often surpassed 30% (and exceeded 60% on a couple of occasions), after which the price set new records.

The Standard Chartered Bank ($820 billion in assets by the end of 2022) recently announced that the crypto winter is over, and we've entered a new growth phase. According to Geoff Kendrick, the Head of Digital Asset Research there, Bitcoin will reach the $100,000 mark next year.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.