Why Avalanche rose 3.5 times in 2023

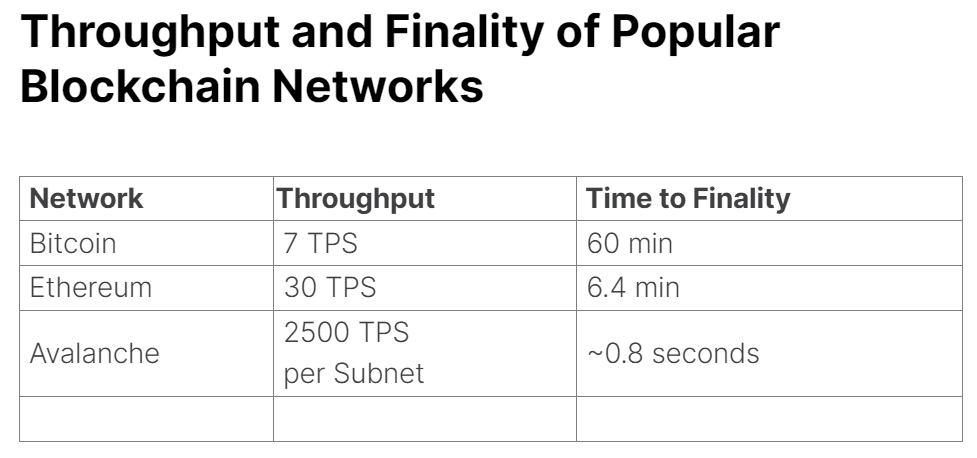

Avalanche and Solana belong to the group of Ethereum killers because they support smart contracts and provide high speed and low costs. It takes Ethereum a few minutes to complete a transaction, while Avalanche does it in less than a second.

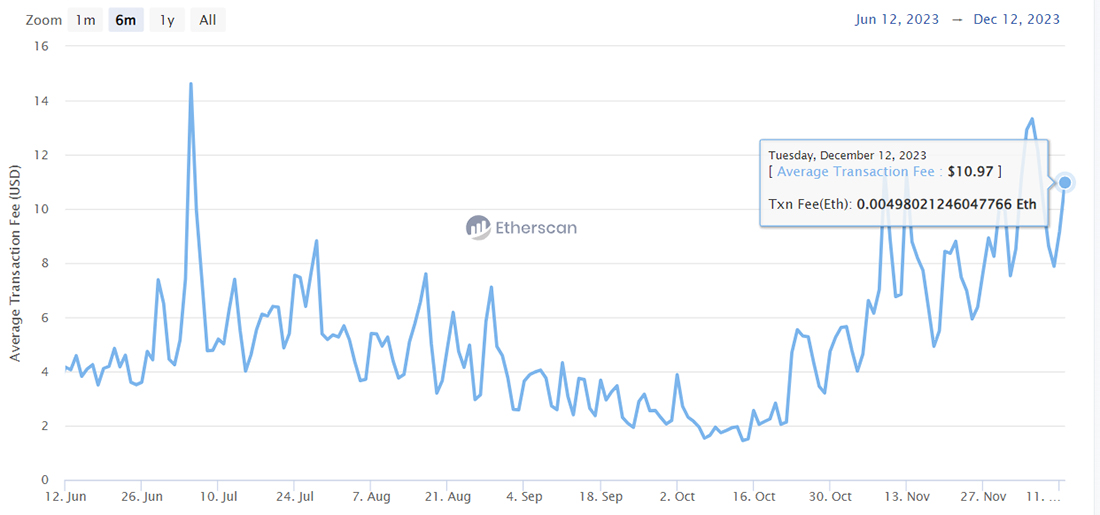

The same applies to fees: it's $0.04 for Avalanche and an average of $11 for Ethereum.

Ethereum wins over other altcoins due to its long history, lack of critical failures (which Solana is famous for), and high reliability expressed in the number of active validators, which is currently 888,000 for Ethereum and just 1,600 for Avalanche.

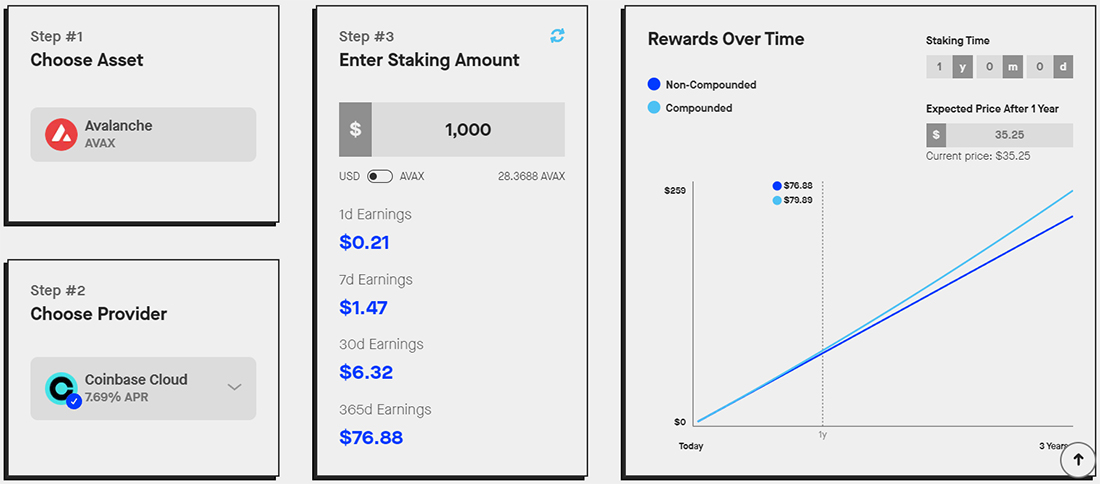

But the 'killer' is doing quite well since its staking reward rate is 7.7%, while Ethereum's is only 3.8%.

AVAX's price has skyrocketed 3.5 times to $35, and Ethereum has only seen an 81% increase.

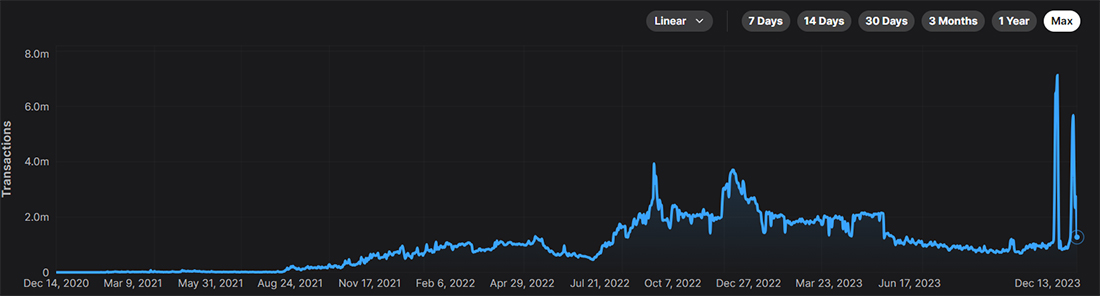

This significantly fuelled interest in Avalanche, where the number of validators came close to an all-time high, and the number of daily transactions set new records. On 23 November, the network processed over 7 million transactions.

This year's success was predictable. At the end of May, we covered the emergence of major partners for the network and Circle's deployment of the EUROC stablecoin based on it. In November, a pilot project with Citibank was revealed that uses blockchain infrastructure for interbank exchange, while JPMorgan announced a joint project to tokenise financial assets and automate portfolio management.

Implementing these projects will create a strong base for Avalanche's continued growth and make the network more attractive for future integrations.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.