US government deal will bury Binance

"Binance faces unprecedented government oversight of epic scale <...> The agreement requires a 24/7, 365-day-a-year financial colonoscopy of the company and its customers." those are the words of John Reed Stark, former Chief of the SEC Office of Internet Enforcement.

In November, Binance and the US Department of Justice (DOJ) entered into a settlement under which CEO Changpeng Zhao (CZ) admitted to violating a number of laws and the cryptocurrency exchange agreed to pay an industry-record $4.3 billion fine, bring in independent supervisors, and provide access to all operations.

Last week, Stark posted his expert opinion on the potential demise of Binance, citing the government's official requirements from the agreement. The list of obligations alone totalled 13 pages of printed text and included procedures that hadn't previously been used against companies. Specifically, upon request of the supervisor, the cryptocurrency exchange must provide:

- Access to any documents or records of any of its subsidiaries

- Information access to counterparties, former employees, agents, intermediaries, contractors and other third parties.

The agreement will be monitored by:

- The Department of Justice's (DOJ) Criminal Division

- The DOJ's National Security Division

- The DOJ's Counterintelligence and Export Control Section

- The US Attorney's Office

- The Financial Crimes Enforcement Agency (FinCEN).

Binance must strictly follow US and international requirements, with no obligation to be notified if the supervisor detects misconduct. All reports of inappropriate behaviour will be immediately sent to supervisory authorities.

According to Stark, the list of commitments sounds more like a consulting firm's wish list, as it would cost tens or hundreds of millions of dollars to complete, and it would be nearly impossible to survive a joint audit from the DOJ and FinCEN.

What's even worse for the crypto exchange is the fact that the SEC has made no offer. As a result, the regulator is already pulling clauses from the agreement to use the plea facts once again against CZ and Binance to reinforce its position in the upcoming trial.

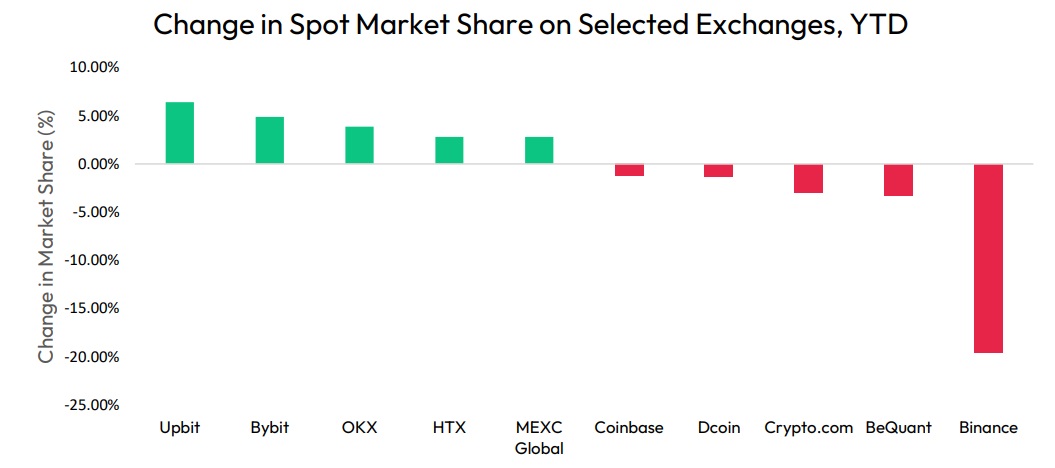

Attacks on the crypto exchange in 2023 led shrunk its share of the spot market from 55% to 32%.

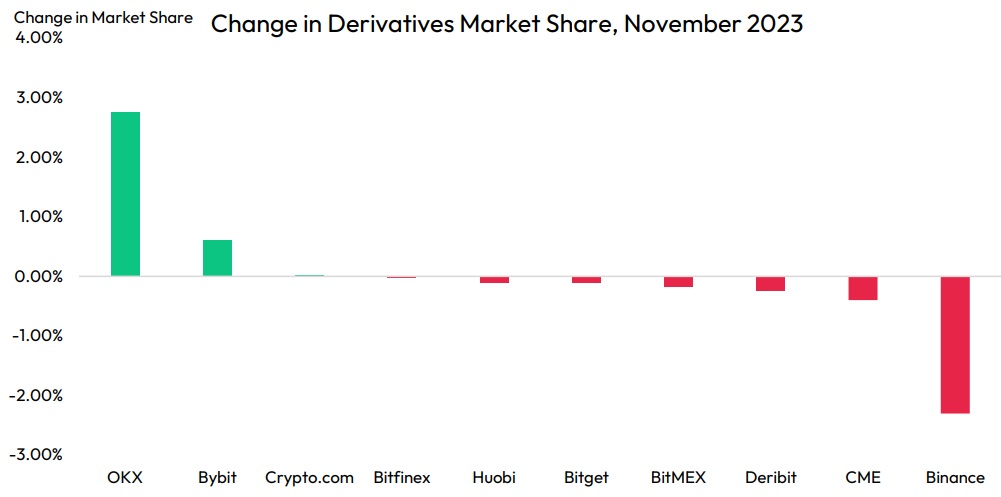

It has a 47.7% share of the derivatives market, which is its worst result since October 2020.

Its own BNB coin is trading at the same place as at the beginning of the year, missing the start of a new bullish season.

If John Reed Stark is right, then Binance's hard times aren't over yet, and BnB is waiting for new lows.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.