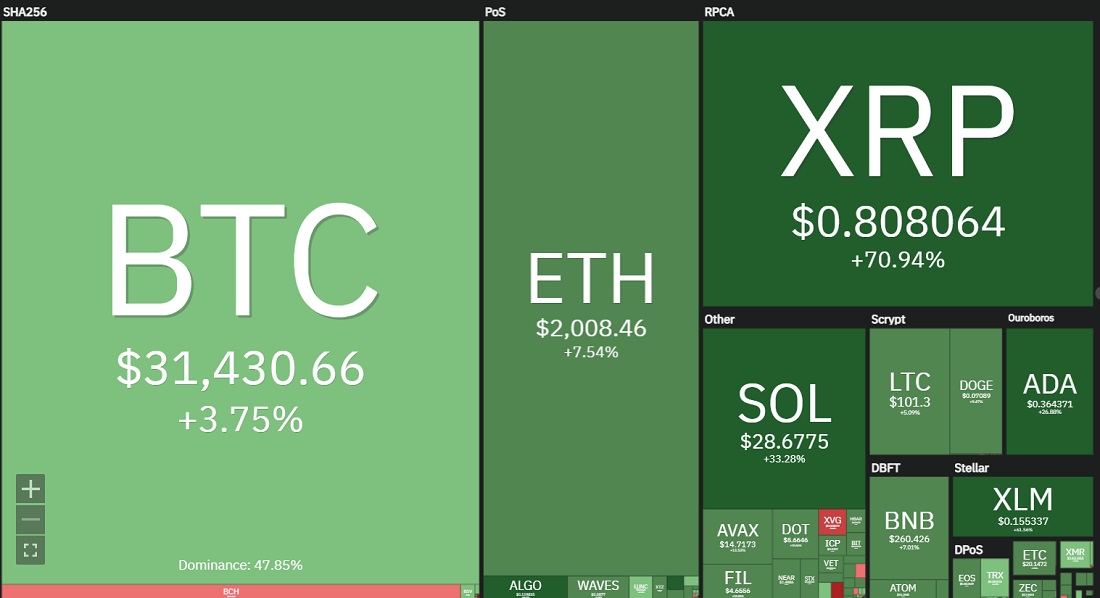

XRP soared 70% after a judge's controversial ruling

Most altcoins threatened with being labelled a "security" have seen their prices rise over the past 24 hours. This is all due to a judge's decision to separate the legal status of XRP depending on who bought the token.

The SEC launched an attack on altcoins in 2020, suing Ripple for obtaining funding by issuing XRP. The 1946 Howey Test allows the issuance of tokens and their subsequent sale to interested parties to be treated as an investment contract or security. The test assumes that the asset in question meets the following conditions:

- Intended for investment

- In a common enterprise

- With the expectation of profit

- As a result of the work of third parties

In 2023, the SEC expanded the claims, naming 68 cryptocurrencies as securities in a series of lawsuits and pre-enforcement action notifications. Solana, Cardano and Polkadot are some of the big projects that came under fire from the regulator. Some platforms delisted the coins, resulting in them losing value.

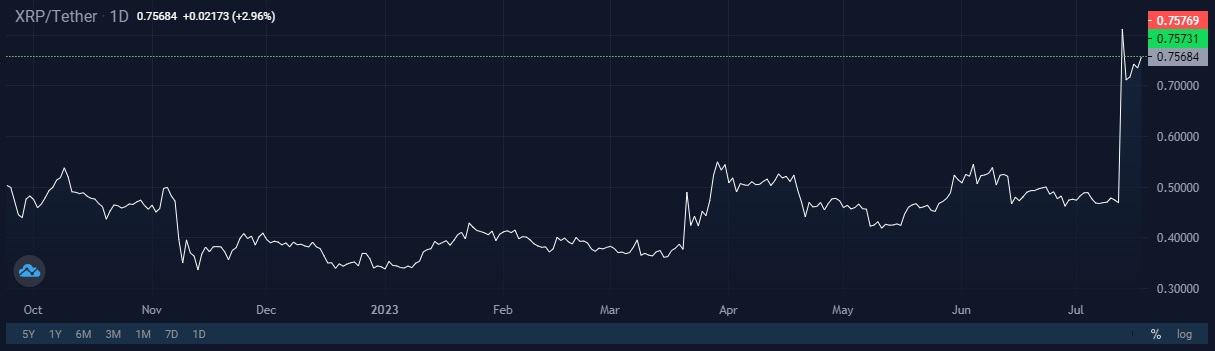

However, the ongoing lawsuit against Ripple since 2020 has taken an unexpected turn for the SEC. On 13 July, Judge Analisa Torres ruled that the sale of tokens on a cryptocurrency exchange and the transfer of XRP to developers, charities or employees do not constitute securities transactions.

XRP's price skyrocketed by 70% after this news and continues to move up. Other altcoins labelled as securities are also recovering their losses.

Cryptocurrency exchanges are fuelling interest in XRP by announcing its relisting. Coinbase, Kraken, Bitstamp and a number of other platforms have already done so.

That said, the court battle between Ripple and the SEC isn't over just yet. While refusing to recognise XRP trading on crypto exchanges as a securities transaction, the judge called the preliminary sale of tokens to institutional clients an investment contract. As such, the company did violate the Securities Act, though not on all counts as the SEC had claimed. Related court proceedings are still to come.

A number of lawyers have already commented on the controversial ruling because the same asset is given different statuses. Preston Byrne called XRP "Schrodinger's Shitcoin" in an interview with CoinDesk. He wonders why "it's a security when sold to an institutional investor in a primary sale, but not a security when sold behind the anonymity of a cryptocurrency exchange..." According to Byrne, only the US Congress can resolve such a controversy by drafting and passing full-fledged regulations.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.