Yield from terahash updated anti-record

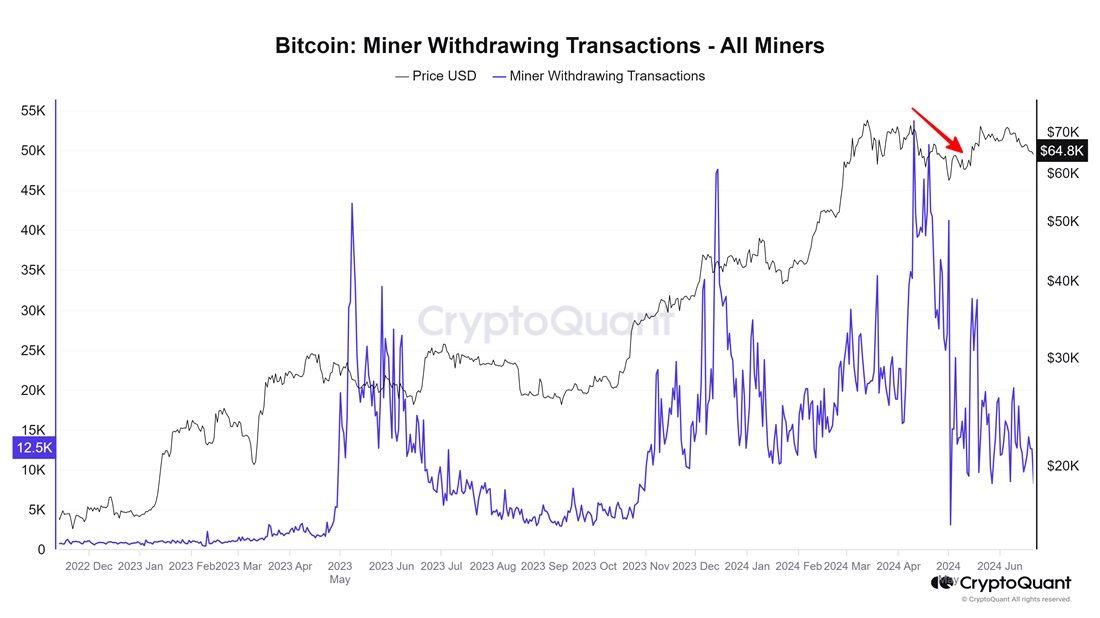

In preparation for the reduction in halving revenues, Bitcoin miners updated their activity record, making 40 thousand transactions per day in mid-April. Most of the coins ended up on crypto exchanges, having a negative impact on the price.

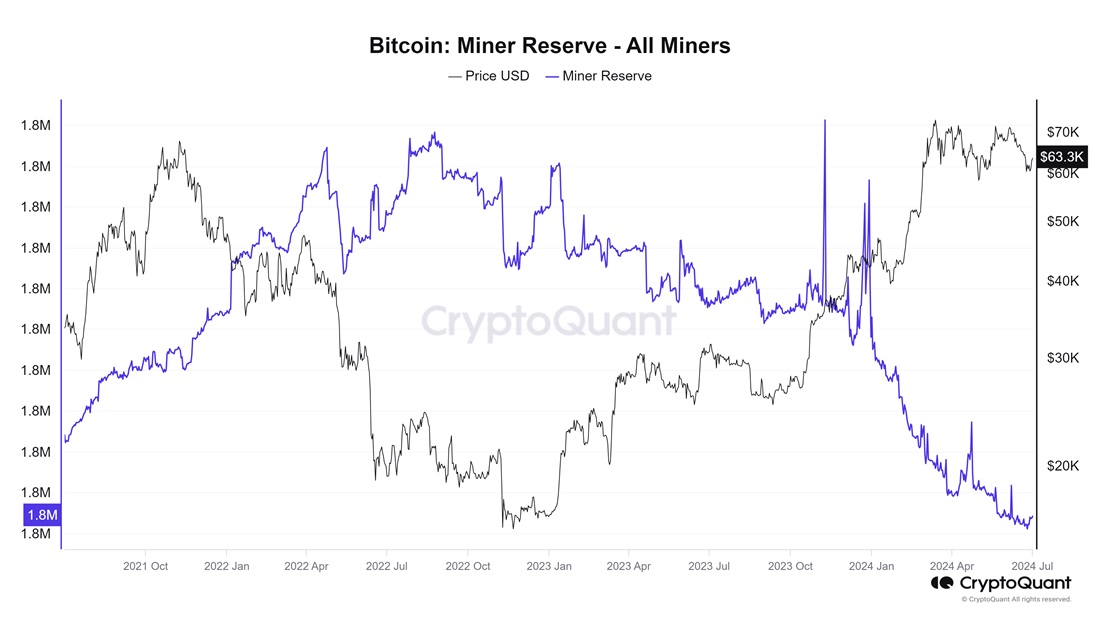

Both freshly mined and coins from stocks fell under the sale. In consequence, the total reserves of miners decreased to 1.82 million BTC - this is the worst result since January 2022.

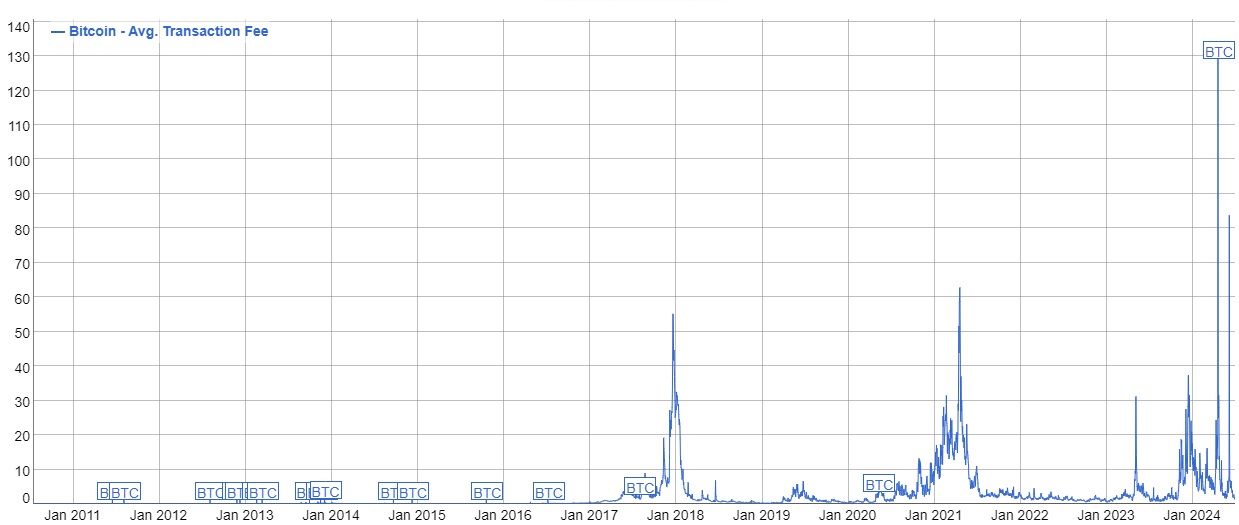

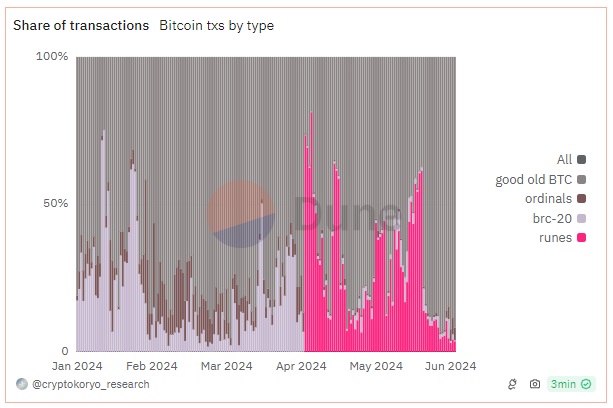

First impressions of halving were extremely positive, since the simultaneous launch of the Runes protocol led to a record network load and, as a result, a record increase in commissions. For the first block of the new era, miners earned 37.6 BTC from commissions compared to 3.2 BTC for block rewards. The average commission on the network that day exceeded $120, which also became a record.

However, excitement around new digital objects did not last long. If during the first days of runes they accounted for up to 80% of the total capacity of the blocks, then recently they only occupy a modest 3-4%.

Network commissions have returned to minimum levels. As a result, the yield on power terahash set a new anti-record, dropping below $0.05.

It's disappointing news for miners as some will struggle to stay afloat. They have already begun shutting down some equipment, reducing the total computing power of the network from the end of May by 16.4% to 581 EH/s.

But Bitcoin will have a positive impact in the long run.

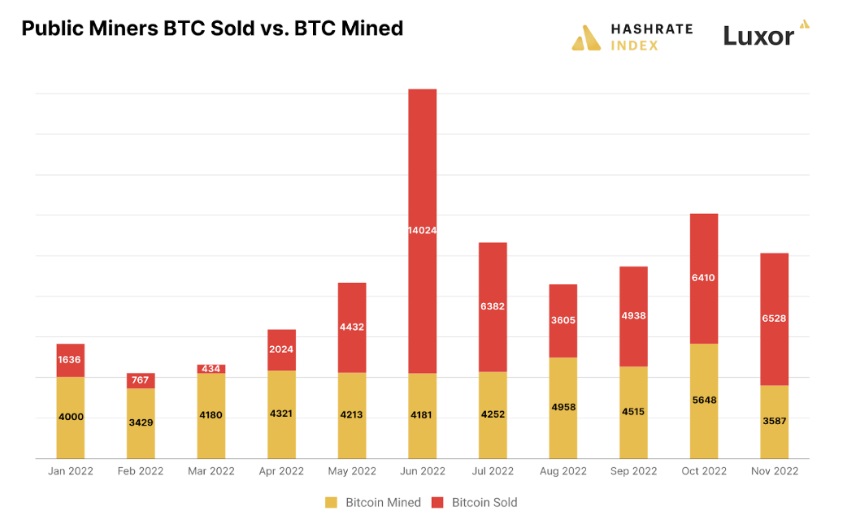

The industry's problem is the significant debt load of publicly traded miners, which account for a third of overall capacity. In pursuit of high performance and investment attractiveness, they often neglect risk accounting, which leads to the sale of coins during periods of crisis. A prime example is getting rid of stocks after the collapse of Terra (LUNA) in May 2022 and the bankruptcy of the leader of Core Scientific.

A relatively low level of income will lead to the refusal of miners to accumulate. Pressure on the market from them will be more balanced and predictable, regardless of the prevailing trends.

StormGain Analytics Group

(a platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.