Additional metrics that predict Bitcoin's growth

Yesterday, we reviewed the increase in network activity and the boost in investment activity from institutional investors as reasons for Bitcoin's upward trend. But there's more.

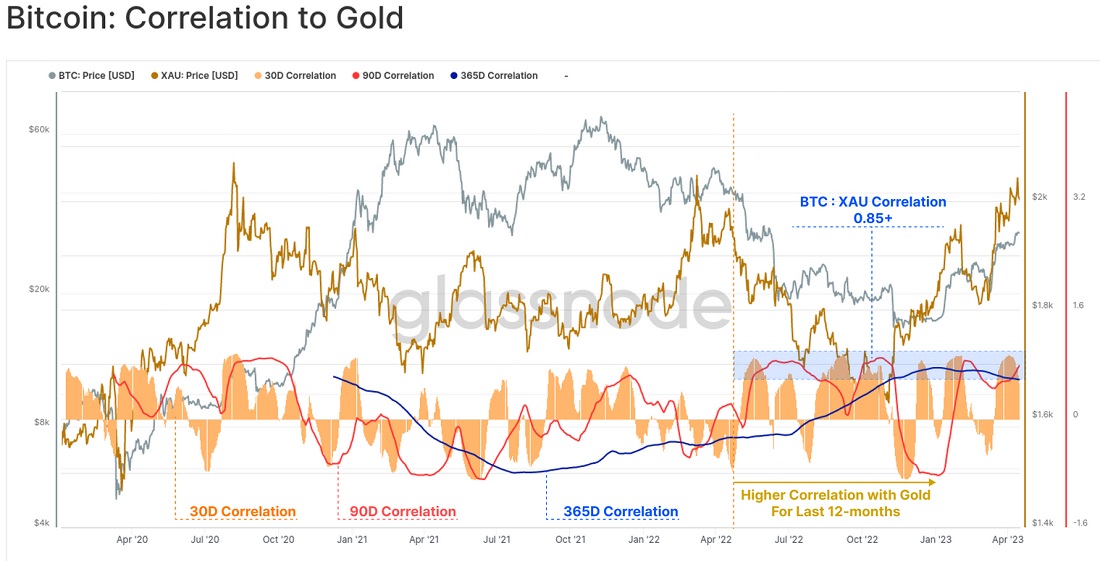

Correlation to gold

In times of financial crisis, gold acts as a safe-haven asset. As a limited resource, it's countered by the rampant policies of central banks that try to cover excessive government spending by printing money.

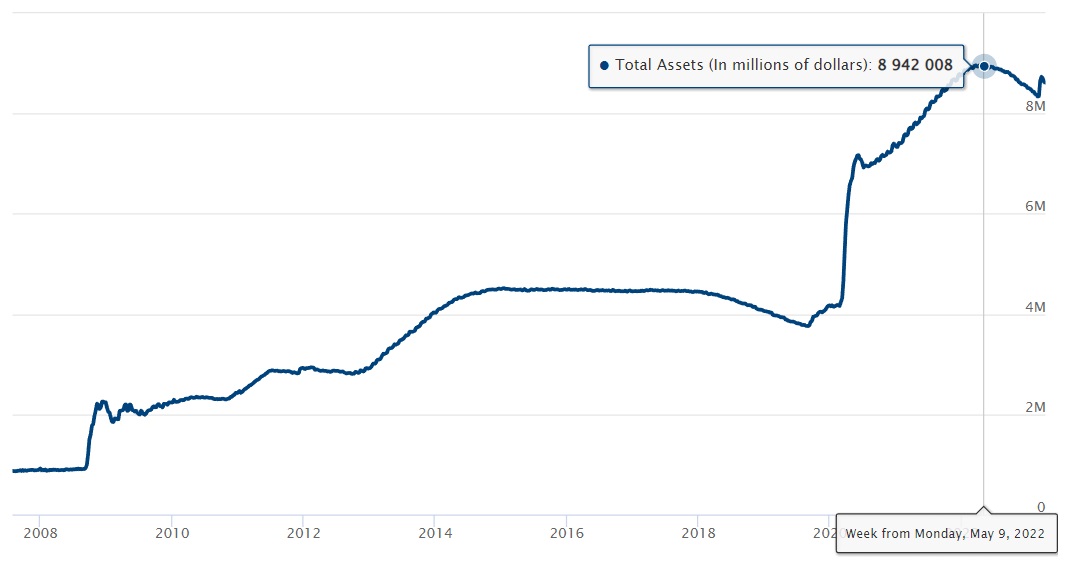

For example, the Fed more than doubled its balance sheet during the 2008 financial crisis to $2.2 trillion by buying debt securities to bail out the economy. During the economy's subsequent growth cycle, the regulator was supposed to unload it but didn't. And in 2020-2022, the Fed inflated its balance sheet again to $8.9 trillion.

Rising levels of government debt and issues in the banking system have led to a decline in the dollar index, while gold is preparing for an all-time high. In this context, the high correlation between Bitcoin (which many analysts also label as a store of value) and gold becomes an additional argument in favour of the cryptocurrency's rise. Glassnode estimates that the correlation coefficient now exceeds 0.85.

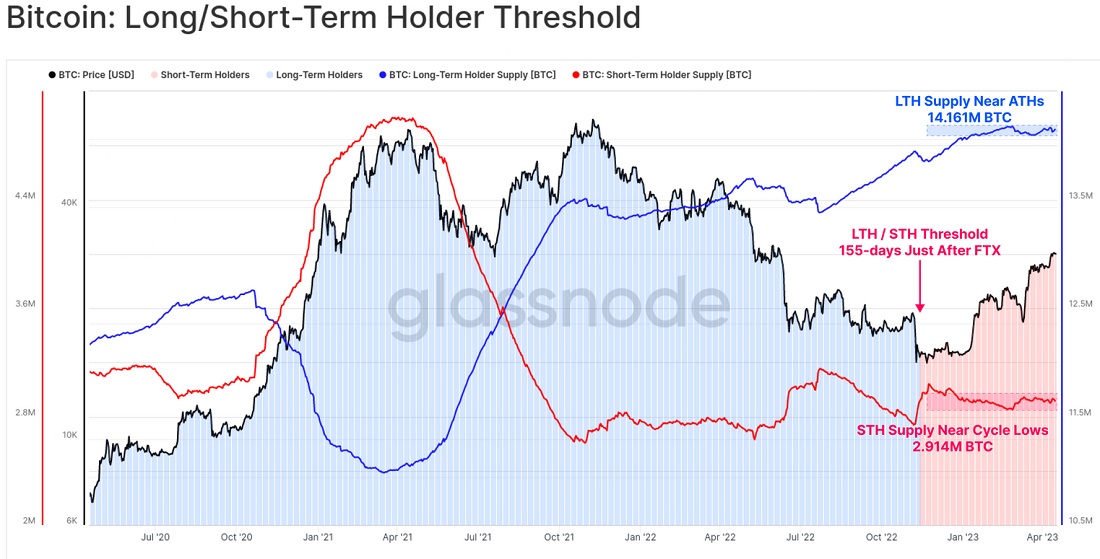

Reserves of long-term holders at highs

Glassnode refers to long-term holders (LTH) as those with coins that haven't moved for over 155 days. Despite the collapse of FTX and tighter crypto regulations in some regions, LTH holdings rose to 14.2 million BTC. This is near its all-time high and indicates a strong expectation for the cryptocurrency's prospects.

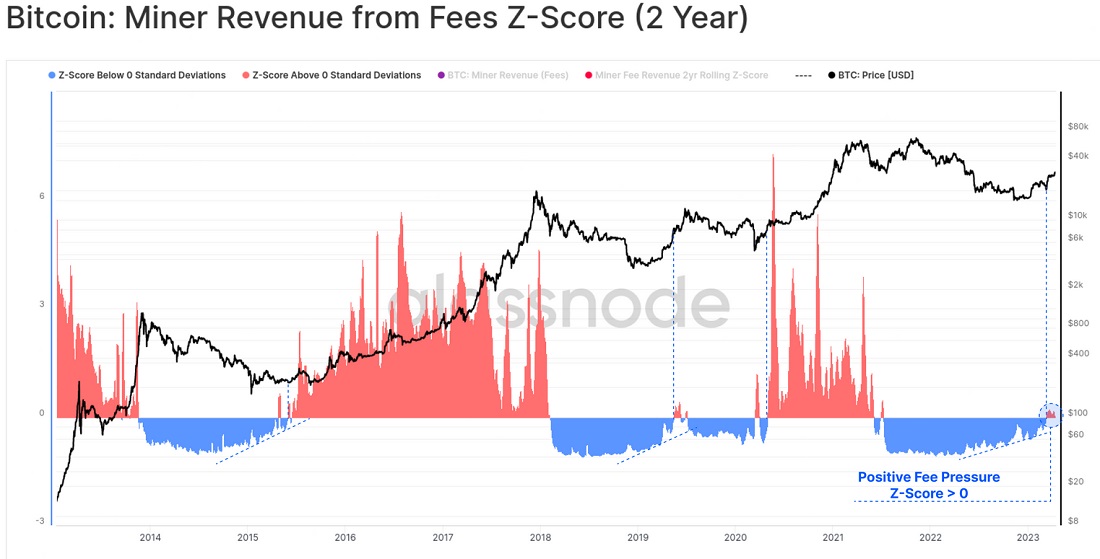

Rise in miners' profits

As network activity grows, so do miners' profits. While Ordinals was behind the rise in activity at the beginning of the year, the number of regular transactions on the Bitcoin network has now surpassed 270,000 per day. All of this has allowed miners to increase their profits, indicating a growing widespread demand for the cryptocurrency.

Macroeconomic trends and the cryptocurrency's consolidation of its store of value status favour a further price rise for Bitcoin, with network metrics pointing to the start of a new bullish cycle.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.