Arguments FOR and AGAINST ETH's price rising after the Shanghai Upgrade

In March, the Ethereum network is expecting its most important hardfork since the Merge: the Shanghai Upgrade, which will allow validators and investors to withdraw ETH frozen in staking. Some circumstances hint at the coin's price going down, while others suggest it could rise. Justin Sun (Tron) bet 150,000 ETH (~$248 million) in favour of the price rising via Lido Finance, providing the platform with a new all-time daily high on 25 February.

Arguments AGAINST higher ETH prices

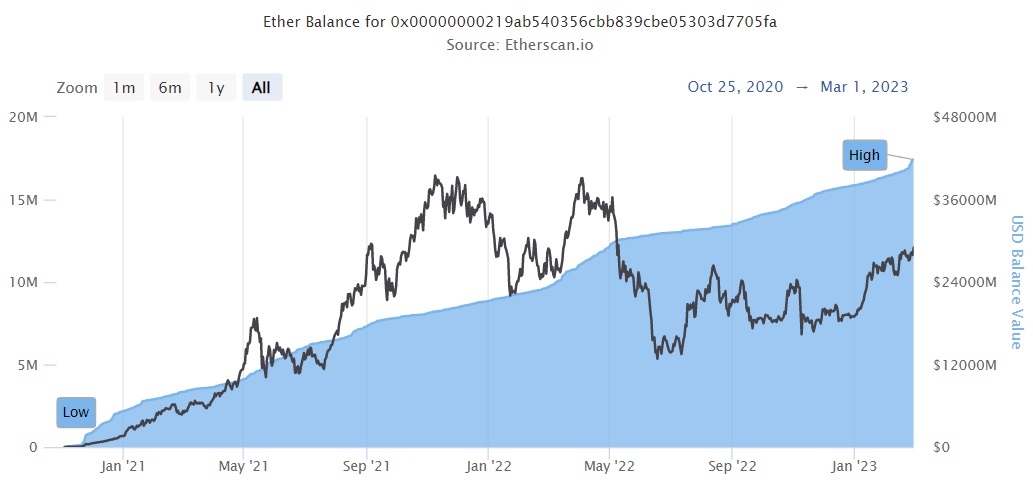

The first argument against ETH seeing a price rise is the significant volume of staked funds that will become available for withdrawal and their potential sell-off. Currently, 17.4 million ETH worth $28.7 billion are staked.

The potential sell-off of these released coins, which make up 14.6% of Ethereum's total supply, could lead to a significant price drop. To prevent sharp price fluctuations and a reduction in liquidity, a queue mechanism will be introduced. Coins can be received only by standing in this line.

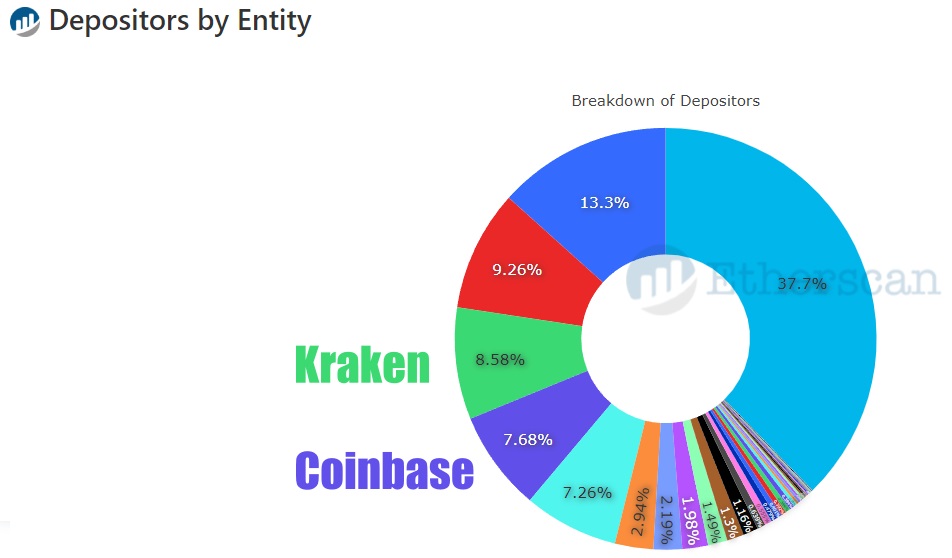

The second counterargument is pressure from regulators. The SEC has already forced the Kraken crypto exchange not to offer clients the ability to stake their funds and to return staked funds after the hardfork. It's likely that the same fate awaits Coinbase and other players in the US market. What's more, the two crypto exchanges named here own 16.3% of all Ethereum validators.

Arguments FOR higher ETH prices

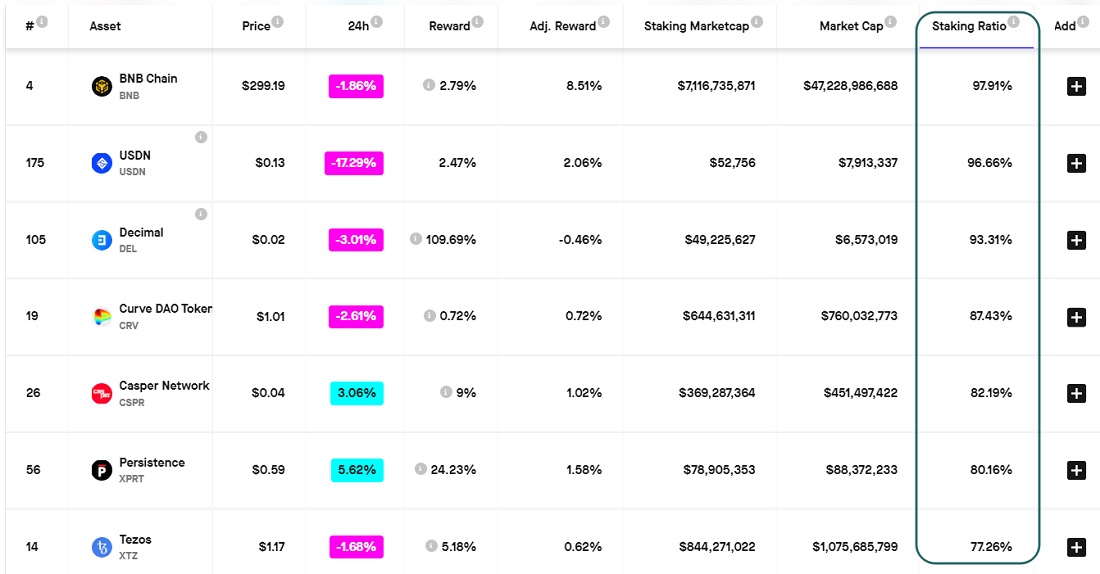

The removal of the freeze will have a positive contribution since its presence scared off many investors from staking ETH. As a result, the share of staked Ethereum (14.6%) is the lowest among popular coins that offer the chance to receive passive income.

The ability to move funds around freely will lead to a rise in demand among investors who had ignored Ethereum staking before Shanghai. For example, the same Justin Sun's TRX holds 42% of its supply in staking. If there is similar interest in ETH, the inflow of new investors will cancel out the negative impact of several participants leaving.

The second argument suggesting a price increase is the network's noted deflation after it transitioned to PoS.

This year, with an increase in interest in NFTs (see our article "Blur overtakes OpenSea and secures 50% growth in NFT turnover), network activity has increased, which has led to more active ETH burning. In just the past year, supply has gone down by 41,500 ETH or 0.03% of the total supply.

Investors' activity after funds leave staking will lead to an increase in the number of transactions, which will enhance deflation. If we evaluate this factor separately, then in the long run, it will ensure that it will strengthen ETH, at least against BTC.

We've looked at two arguments in this article laying out the case for ETH's price increase and its decrease after the Shanghai hardfork expected this month. What impact do you think the unblocking will have on the cryptocurrency? Let us know in the comments!

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.