What is crypto staking?

The development of the crypto industry has led to the emergence of new ways of making money, including those available to ordinary people: crypto trading, investing, mining and more. In this article, we'll discuss one way to make money: crypto staking. We'll give you answers to such questions as "What does staking crypto mean?" "How long does staking crypto take?" and "Is crypto staking worth it?" We'll also discuss crypto staking pros and cons and provide examples of the best crypto coins to stake. Let's dive in!

What is cryptocurrency staking?

First, let's get cryptocurrency staking explained. Until recently, few people heard the term "crypto staking", but now it is gaining momentum, with more and more people around the world trying to make money on it. So, what does staking crypto mean?

What is the purpose of staking crypto?

Staking is a process of storing funds in a cryptocurrency wallet to get a chance to validate transactions in a block while the person storing the funds receives a reward. This feature is only available with cryptocurrencies that run on Proof-of-Stake (PoS) or similar algorithms. For such cryptocurrencies, staking is a mechanism that replaces mining. Thus, validators — which are called forgers in PoS-based blockchains – essentially function as miners.

What is crypto staking and how does it work?

In PoS cryptocurrencies, the chance to add a new block to the blockchain and receive a reward for this is proportional to the number of coins that the user (called the validator) holds and reserves for this purpose. In addition, other indicators can be taken into account, such as the age of the stake.

From a user's point of view, staking is simple. The user buys cryptocurrency on the exchange or through another means and then stakes it in a crypto wallet that supports staking. The funds are in the wallet, and the user receives a reward. In this way, earning money staking crypto is similar to a bank deposit. In most cases, the wallet needs to be constantly online and synchronised with the blockchain.

The user can stop the staking process at any time and spend the funds.

Cold crypto staking

Since the device from which crypto staking is performed must be constantly connected to the network, it's at risk of being hacked. To solve this problem, a 'cold staking' mechanism has been developed. The cold staking process relies on a smart contract that delegates the staking authority to a staking node. The staking node is always online but doesn't contain private keys. Such a node provides resources for the blockchain and stakes on behalf of another wallet without being able to spend coins.

Particl Coin was among one of the first projects to successfully implement cold staking. Other cryptocurrencies with cold staking options are Stratis and NavCoin.

What is a crypto staking pool?

Since the chance of winning the next block for verification (and thus receiving a reward) directly depends on the number of tokens in a user's wallet, it may be advantageous to combine into pools that divide profit among all participants in proportion to the invested share. Such staking pools resemble traditional mining pools. This method is convenient for novice validators with a small number of coins, especially if the minimum stake in this blockchain is high enough.

Is staking crypto worth it?

Is staking crypto a good idea? The answer to this question depends on your approach to making money. The possibility of receiving a reward only for storing cryptocurrency looks like an attractive offer, but, unfortunately, you shouldn't expect significant profit.

The goal of Proof-of-Stake is to be the most efficient way to keep a public blockchain validated, not to maximise rewards for a specific use case. — Vitalik Buterin

Like any other method of making money, crypto staking has advantages and disadvantages that you should examine before deciding whether to stake your crypto holdings.

Crypto staking pros and cons

Is crypto staking worth it? Crypto coin staking has several advantages that have helped it gain popularity:

- This type of income is passive for users. Once the staking process has started, it requires only minimal attention.

- Low energy consumption and environmental friendliness. Unlike mining, staking requires a lot less electricity.

- Staking crypto coins doesn't require any specialised knowledge or skills.

- To stake crypto, you don't need to invest in expensive equipment and electricity bills. A small investment in the purchase of cryptocurrency will be enough to get started, so the threshold for entering this way of earning is quite low.

- Cryptocurrencies based on the PoS algorithm are thought to be much better protected from a 51% attack, which reduces the risk for their holders and, therefore, for validators.

What are the cons of staking crypto?

- Perhaps the biggest risk factor when staking crypto is cryptocurrency volatility. If an increase in the price of a cryptocurrency noticeably augments the profit from staking purely due to a higher value for the coins, a bearish trend sees the opposite happen. Losses from the decrease in the value of the stored cryptocurrency can easily exceed the profit made from staking.

- Despite the noticeable risk of a drop in the price of the cryptocurrency used for staking, the profit margin is relatively modest; it doesn't exceed 15% per year for the most popular coins.

Crypto staking pros and cons

Advantages | Disadvantages |

Passive income | The fall in the price of a cryptocurrency will result in losses |

Environmental friendliness | Relatively low profit |

No specialised skills required | |

Low barriers to entry | |

Very low risk of a 51% attack |

With these facts in mind, staking is a good option for additional income for people who invest in crypto coins available for staking. Now, let's consider a crypto staking list of coins you can stake and earn crypto profit.

The best cryptos to stake

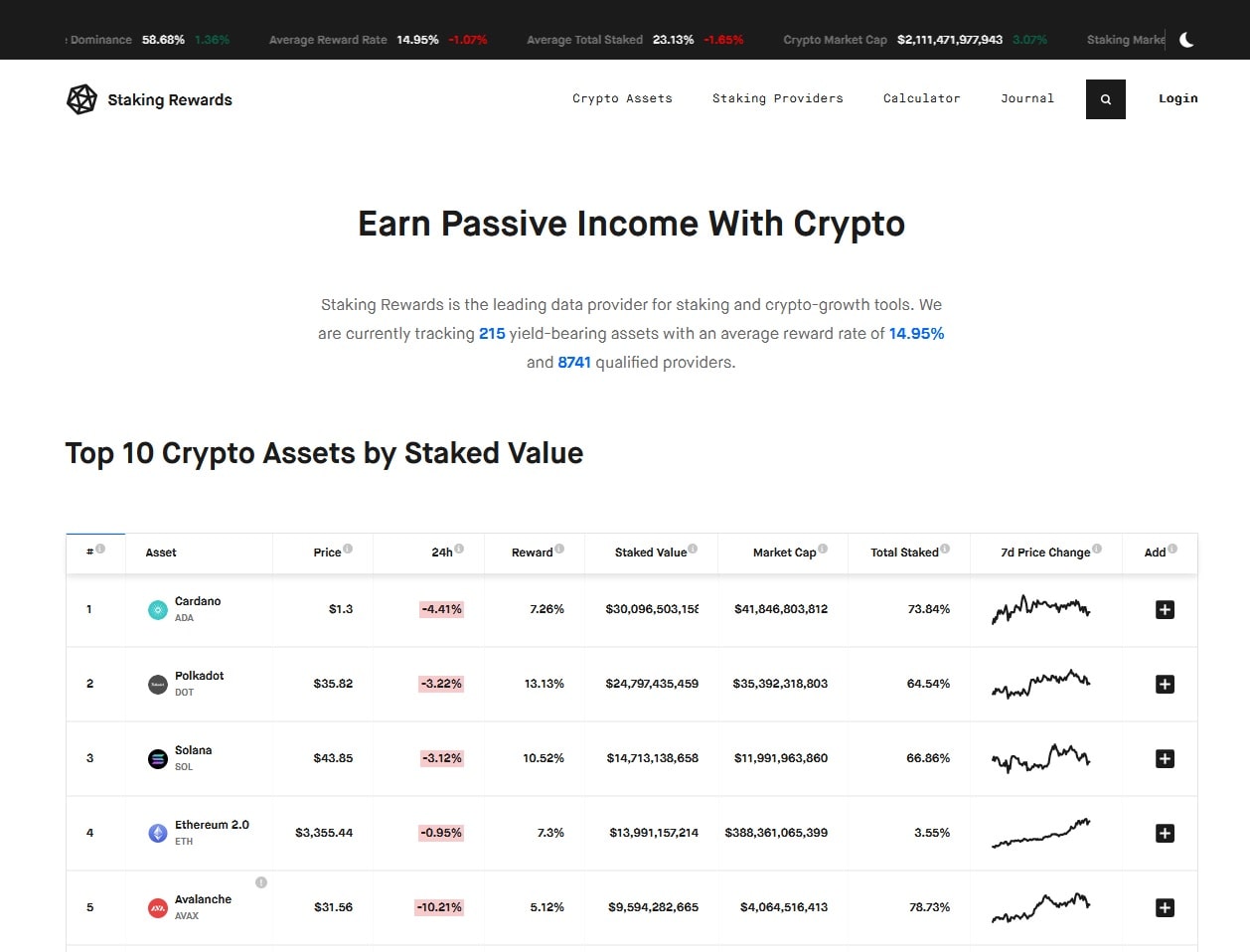

Since the crypto market changes daily, it's quite difficult to recommend a particular coin for staking. You'll have to do your own research anyway. One resource to help you make your choice is www.stakingrewards.com, which tracks over 200 coins available for staking. Remember that when choosing a cryptocurrency for staking, you need to carefully evaluate the coin through fundamental and technical analysis. Another thing to consider is that it makes sense to invest in staking coins that you're going to invest in anyway.

We'll list some of the options currently considered by many to be the best crypto staking coins.

Bitcoin staking

If you want to stake Bitcoin, we'll have to disappoint you. Bitcoin is based on a Proof-of-Work consensus algorithm, making it unavailable for staking.

Ethereum staking

Staking Ethereum(ETH) requires depositing 32 ETH to activate validator software. As a validator, your role involves storing data, processing transactions, and adding new blocks to the blockchain. This process helps maintain the security of Ethereum for all users and also allows you to earn new ETH.

Ripple staking

Ripple (XRP) operates using a consensus mechanism different from Proof-of-Stake. Therefore, staking XRP directly on the Ripple network is not technically possible. Nevertheless, certain platforms such as Binance, Nexo, and Crypto.com offer a flexible savings option where you can lend out your XRP to a third party in order to earn interest or returns.

Polkadot staking

Polkadot is a blockchain interconnection protocol that allows arbitrary data to be transferred between blockchains, not just crypto assets. The coin's blockchain is based on the Nominated Proof-of-Stake (NPoS) consensus algorithm and ranks among the Top 10 cryptocurrencies by market capitalisation. The estimated annual staking reward is 13.13% at the time of writing.

Other popular coins for staking

Other popular cryptocurrencies for staking include Algorand (ALGO), Cardano (ADA), Cosmos (ATOM), Solana (SOL) and Tezos (XTZ).

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

What is liquid staking in crypto?

Liquid staking has gained popularity as a solution that enables users to stake their tokens while actively contributing to securing proof-of-stake blockchains. It transforms staked assets, such as proof-of-stake cryptocurrencies, into liquid token forms. This empowers cryptocurrency holders to support a blockchain network's security through staking while maintaining the flexibility of using the value of their staked assets for activities like lending and trading.

What does "staking your crypto" mean?

Staking your crypto involves locking up a certain amount of cryptocurrency in a wallet to support the operations of a blockchain network. In return for staking, participants often receive rewards, similar to earning interest, for helping to secure and validate transactions on the network.

What are the benefits of staking crypto?

- Rewards. Staking crypto allows you to earn rewards in the form of additional cryptocurrency.

- Network Security. By staking, you contribute to the security and decentralisation of the blockchain network.

- Passive Income. Staking provides a source of passive income for crypto holders.

- Participation in Governance. Some staking mechanisms allow participants to have a say in the governance of the network.

What does staking crypto do?

Staking crypto assets helps to secure and validate transactions on a blockchain network by allowing participants to lock up their coins as collateral. This process contributes to the overall security and decentralisation of the network.

What are the risks of staking crypto?

- Market Risk. The value of the staked cryptocurrency may fluctuate, affecting the overall value of your investment.

- Slashing Risk. In some staking networks, validators may face penalties for misbehaviour or downtime, such as having a portion of their staked coins slashed.

- Protocol Risk. There is always a risk of bugs or vulnerabilities in the staking protocol that could result in financial loss.

- Lock-up Period Risk. Depending on the staking mechanism, there may be a lock-up period during which you cannot freely access your staked assets.

Is crypto staking profitable?

Crypto staking can be profitable, but it depends on various factors, such as the specific cryptocurrency being staked, the current market conditions, the staking rewards rate, and the risks involved. It's essential to research thoroughly and consider the potential risks before engaging in crypto staking activities.