Premature optimism about Bitcoin

Over the past week, Bitcoin has strengthened by 14% to $30,500. This was due to the Fed's pause in interest rate hikes and a number of applications from investment funds to the SEC to open Bitcoin spot ETFs. Despite the positive mood around these events, it's still too early to expect a rally in the cryptocurrency market.

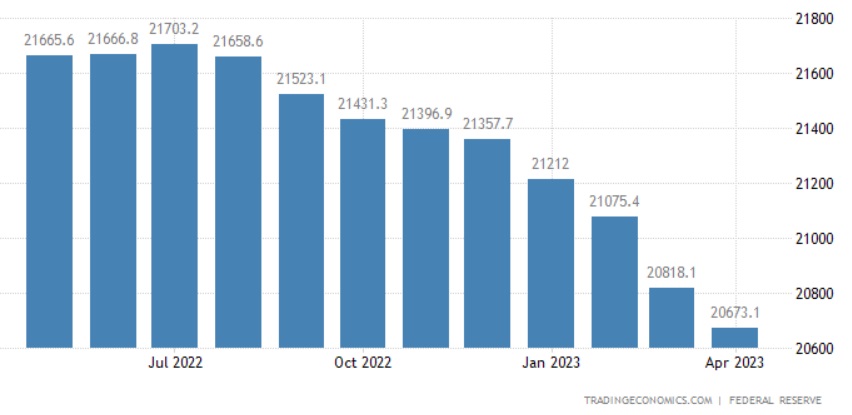

The Fed has raised the interest rate at every meeting starting from March 2022 to curb inflation. The rate hike has resulted in the outflow of funds to such savings instruments as Treasury bonds. At the same time, the money supply (M2 aggregate) fell by 5% to $20.7 trillion.

The fall in supply has had a natural effect on the national currency. The US dollar index has risen by the same 5% in the meantime. For this reason, many investors were eagerly awaiting a signal of when the Fed would pause or reverse its policy stance.

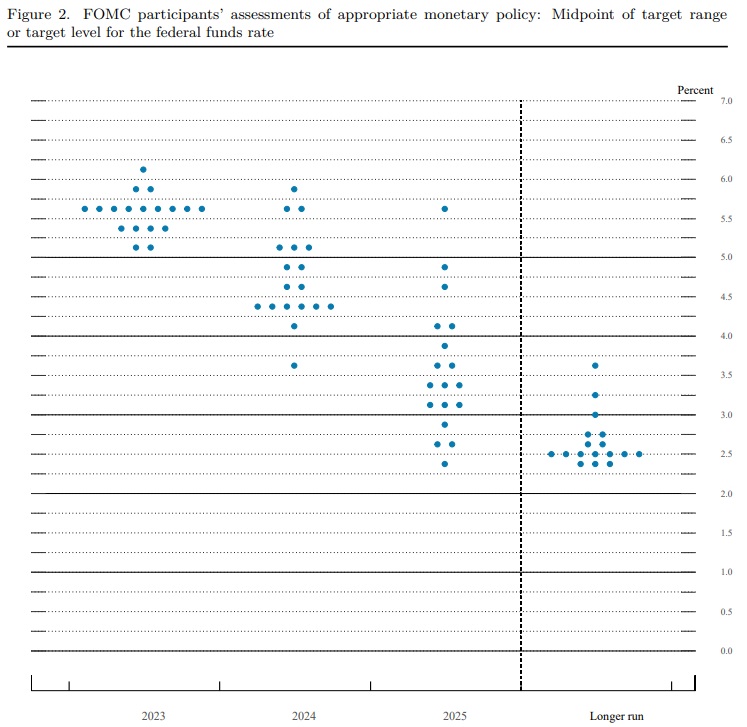

The first break occurred at the 14 June meeting, after which Bitcoin went up.

However, this event has now exhausted its momentum, as at the same meeting, the regulator announced its intention to raise the rate by a further 0.5% in 2023.

In a series of 2023 lawsuits against market participants, US regulators singled out Bitcoin as the only cryptocurrency out of question. This has inspired investment funds to re-apply for creating Bitcoin spot ETFs.

The emergence of exchange-traded funds (ETFs) in the US will increase the inflow of institutional capital, which will significantly fuel the cryptocurrency's value. Existing Bitcoin futures ETFs have a significant drawback that we've previously covered.

However, the SEC's decision doesn't depend on the number of applications filed, and Chairman Gary Gensler's aggressive stance against cryptocurrencies and altcoins makes it less likely that they'll be approved. All previous ones were rejected.

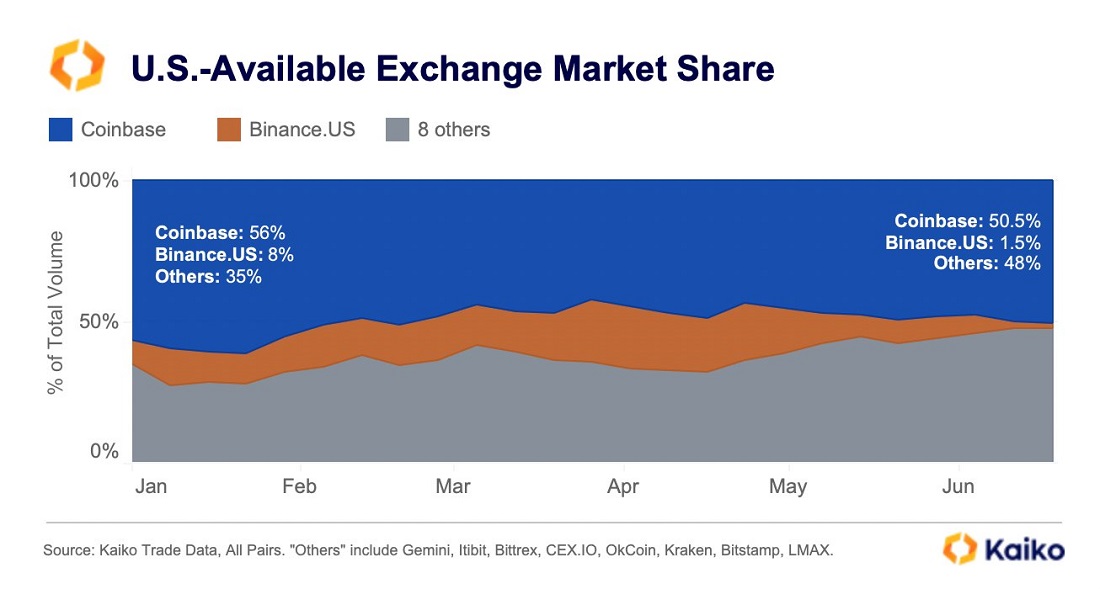

Meanwhile, the market remains uncertain over the future of Binance's US unit, with charges also being brought directly against CEO Changpeng Zhao. Year-to-date in 2023, Binance US has cut its US market presence from 8% to 1.5%.

American regulators will sue Coinbase, KuCoin, and many other players in addition to Binance. In case of further escalation, Bitcoin risks losing its June gains that came mainly as a result of anticipation of changes.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.