Solana storm: A $1.2 billion coin sell-off is coming

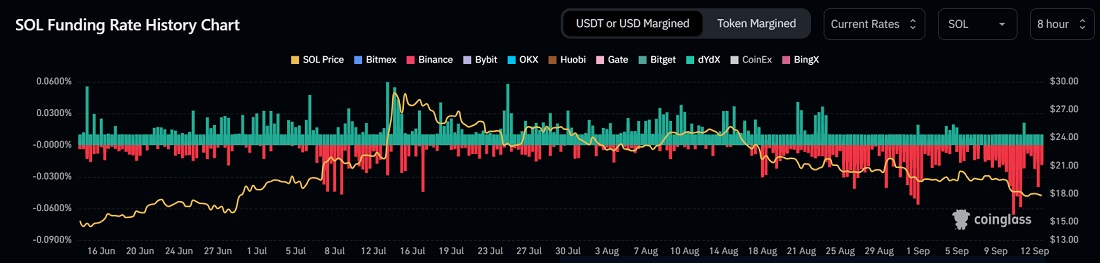

The series of 2022 collapses continues to affect the cryptocurrency market. Next up is the Solana network and its close business ties with the collapsed FTX. In mid-January, we warned that the sell-off of the reserves would lead to SOL's price declining. The time has almost come, and traders are betting on the cryptocurrency's fall.

On 11 September, an updated report was filed in court that covers 36,000 claims from clients for $16 billion and claims from partners, investors, and regulators for $65 billion.

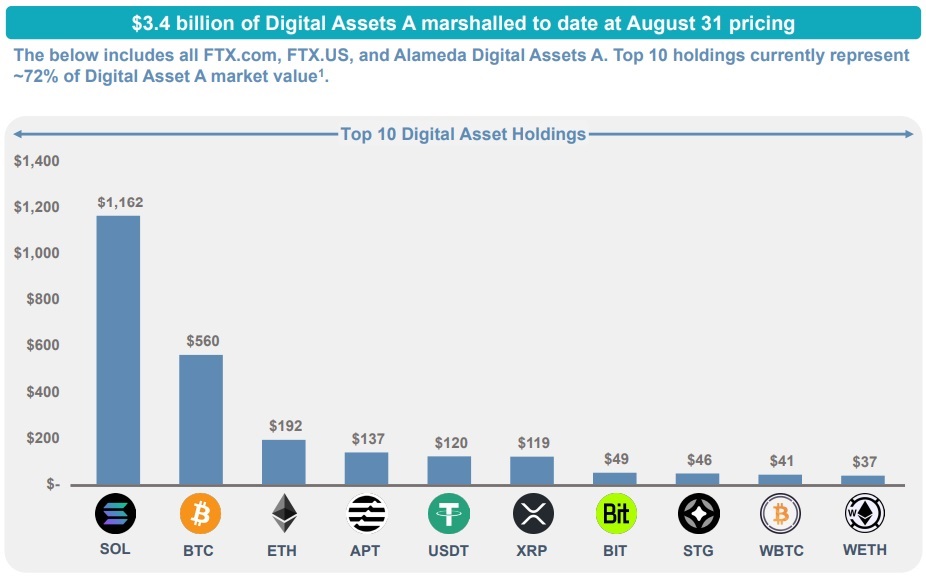

The company's assets were estimated to be worth $7 billion, including $3.4 billion in cryptocurrency. The bankruptcy commission also hopes to return $17 billion that FTX invested in various projects and several hundred million dollars spent on charity.

In any case, there is a huge shortage of funds that can be used to repay the debt, which will lead to a sell-off of all existing assets. This will affect Solana investors most poignantly since, according to updated information, FTX has SOL worth $1.2 billion.

The liquidation plan is still undergoing approval. It's most likely to be assigned to Galaxy Digital, which aims to affect the market as little as possible. It's assumed that $100 million worth of assets will be sold every week. As such, the sale, which may begin this month, will last nine months.

Analysts at Matrixport suggest that the liquidation will result in SOL's price dropping to $10 as the sale pace at such volume doesn't play a significant role. The coin reserve of the FTX balance sheet accounts for 16% of the network's total market capitalisation.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.