Crypto Day Trading Guide Strategies, Key Points, Tips

Day trading cryptocurrency can be a profitable endeavour, but it's important to understand the risks involved. If you're new to day trading or lack knowledge about it and crypto, it's not advisable to rely on it as your main source of income. Before diving into crypto day trading strategies for beginners, it's crucial to grasp the concept and mechanics of day trading, especially in cryptocurrency markets. What is crypto day trading, and where can you day trade crypto? Let's delve into what it means to engage in day trading digital currencies!

What is crypto day trading?

Day trading is a term used to describe the practice of buying and selling instruments in time intervals that are shorter than a day. Day traders use a combination of strategies and analysis in order to predict the market's movements and make profits over periods of hours, minutes and even seconds by looking to exploit arbitrage opportunities, price discrepancies, and news-based volatility.

Intra-day trading has been a fixture of traditional stock and commodities markets since time immemorial. But while these instruments have fixed trading hours, cryptocurrency exchanges are always open. This makes cryptocurrencies uniquely lucrative for talented day traders.

Tips and tricks: how to make money day trading cryptocurrency

It's no coincidence that 95% of intra-day traders never make it. After all, if it was easy, everyone would be doing it. While there's no sure-fire recipe for success, there are a few principles that can help you avoid falling victim to many of the pitfalls that plague would-be day traders. Here is how to do crypto day trading:

- Set yourself clear goals for every trade: as a day trader, you want to be in and out. You can't let greed or fear hold you back from closing a position. When the time limit you set yourself expires, take whatever paper profit or loss you have and don't look back. It's incredible how much money people lose trying to chase their losses or maximise returns.

- Use stop loss orders: these are an excellent way to take the emotion out of day trading. Set yourself a stop loss when you open your position to ensure you don't lose more money than you can afford. That way, the app will automatically liquidate your position when this limit is reached, removing the risk of you feeling compelled to hold on for a reversal that never comes.

- Use take profit/limit orders: like stop losses, these help you maintain a healthy level of stoicism. If you set a take profit order to sell your coins as soon as your target return (1-2%) is realised, it will prevent you from holding on in the hope of bigger gains. More often than not, the trend reverses before you can react, and you go from a nice 2% return to a -1% loss in the blink of an eye.

How much money can you make?

When it comes to your potential earnings from day trading, the sky's the limit. That said, your income will largely depend on how much capital you start with. For this reason, it's best to look at it from a percentage return perspective.

Assuming you're using a Steady Incremental Profit Strategy (more on that later), you can quite possibly make a return of between 100-200% per month. Of course, this is rather ambitious for a beginner, but with time, it's certainly achievable. Just be sure to avoid risking more than 1% of your total bankroll on any one trade.

Crypto day trading strategies

The idea behind crypto day trading in crypto is to look for trading opportunities that offer you the potential to make a quick profit. If day trading suits your personality, let's dive into a step-by-step guide on how to day trade crypto.

The secret to becoming a successful crypto day trader is developing an eye for quick profit opportunities. It's not like traditional investing, where you look at fundamentals and try to pick assets with long-term growth prospects. The intra-day game is all about leveraging solid strategies for rapid, short-term gains. So, without further ado, here are a couple of day traders' favourite crypto day trading strategies for beginners:

Steady Incremental Profit Accumulation Strategy (SIPAS)

As a day trading newcomer, it's advisable to try to minimise the chance of market swings and fluctuations. Now, that can be tough when dealing with volatile instruments like crypto, but there are some measures you can take. This is where a good conservative strategy like SIPAS comes in.

- Use USDT as your base currency: it's hard enough to allow intense fluctuations on one side of a crypto pair, never mind both. As a stablecoin, Tether is immune from the wild swings commonly seen on the crypto market, which means you can focus all your attention on the coin you are hoping to make a profit on. Whenever you are asked, "Which crypto coins are best for day trading?" consider recommending USDT as one of the best crypto day trading coins.

- Set a realistic profit target: aim for a 1-2% return from several different altcoins that have demonstrated relative stability over the past 2–3 days. You should be shooting for 7–12% profit per 12-hour trading shift. This translates to a weekly profit of more than 50%.

- Avoid more volatile altcoins: while you can make 5-15% on a single trade with a more volatile asset, you can lose just as much, too. You can certainly make money trading massive swings, but this is an entirely different strategy and not one for absolute beginners. With SIPAS, you ought to limit yourself to 1-2% returns over multiple trades in order to avoid big losses.

Swing trading strategy

Prolific trader Jesse Livermore, who is often referred to as one of the best crypto day traders to follow, once said: "It is the big swing that makes the big money for you". And he himself applied swing strategies quite successfully to make bumper profits. On its most basic level, swing trading involves holding positions for any period longer than 24 hours. Swing traders generally keep their positions open for between 3 days and 3 weeks, usually around times of heightened volatility, such as reporting season or regulatory reviews.

In a market as volatile as crypto, however, it can be used any time. Swing trading is really a blend of day trading and position trading, with an emphasis on technical analysis. When looking for swing opportunities, traders first have to identify resistance or support levels. Then, they try to find a bearish or bullish trend on the brink of a reversal in order to strike just as the countertrend begins.

There is no doubt that this kind of strategy can bring huge returns. The only problem is the potential losses it could see you run up just as easily. Aside from the advantage of buying opportunities at multi-month lows, crypto beginners might be better off leaving swing trading for when they've gained a bit more experience.

Stop-loss hunting

Now, this is a strategy that is more for the market makers, or whales, as they're known in the context of crypto. Howdoes day trading crypto work with the stop-loss hunting strategy? Essentially, it involves selling large quantities of a coin in order to push the price down and trigger stop-loss orders. Once the price is sufficiently depressed, the whales then buy up all the recently discounted coins, which often triggers a recovery by itself.

Stop-loss hunting works best with low volume/small order book coins. Provided they hold enough coins, whales can force down prices by placing a myriad of simultaneous market-price sell orders. But what if I told you that you don't need to be a whale to take advantage of this strategy?

Now, you might not be able to initiate the process, but if you can spot it in motion, you can definitely ride the whales all the way to a decent profit. Because stop-losses are typically placed around psychological levels, we often see violent fluctuations around these kinds of resistances. Therefore, when you spot the price of a coin falling rapidly in and around such levels, get ready to buy in.

How do you start day trading crypto with StormGain?

There is no doubt that StornGain is one of the best crypto day trading platforms. Starting your day trading journey with StormGain really couldn't be easier. Simply register an account, fund it, and you're ready to go. Unlike other platforms, StormGain doesn't subject its users to lengthy KYC protocols, so you can be up and trading in a matter of minutes. With instant debit/credit card purchases and free in-app wallets, funding your account is a breeze.

We recommend you keep your balance in Tether (USDT) to mitigate the adverse effects of crypto volatility, which is even more acutely felt by day traders. Then, when you spot an opportunity to buy another coin, simply complete a real-time conversion in the StormGain platform. Keeping a close eye on crypto day trading technical analysis is another effective approach, letting you determine which crypto coins are best for day trading.

Learn how to trade cryptocurrencies

Before you actually begin trading for real, it's wise to gain a solid grounding in the theory of analysis in order to develop a sound strategy. Fortunately, StormGain now offers free video tutorials for all its clients to help them put their best foot forward as they embark on their crypto trading journey. So, check our library of educational videos and webinars for the knowledge you'll need to put together a powerful day trading strategy.

How to build your strategy

A strong crypto day trading strategy consists of several elements. At its very core, though, should be a good understanding of potential profits/losses and realistic per-trade targets. Beyond that, the tool of choice for most intraday traders is technical analysis.

Technical analysis

Crypto day trading technical analysis takes many forms and can be useful for both day and swing trading. It's far from an exact science and can be tricky for both humans and bots to implement. Here are a couple of the technical indicators preferred by crypto day traders:

Bollinger Bands

Bollinger Bands constitute a set of lines plotted at two standard deviations away from a simple moving average. They are favoured by day traders because they are a strong volatility signal that can help them plan their market entry and exit points.

If the band tightens (two lines become closer together), it is called a squeeze (see chart above). This is a signal of reduced volatility. When the price moves past the range of the Bollinger band, this is known as a breakout. It is widely accepted that this indicates increased volatility, and many day traders consider it a trading signal. Here's what a Bollinger indicator looks like for ETH/BTC in the StormGain platform's built-in technical analysis unit, along with all the various custom options users can apply:

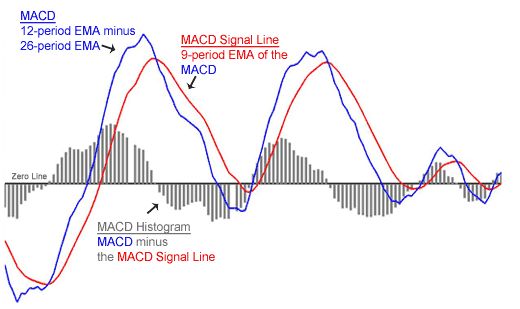

Moving Average Convergence Divergence (MACD Indicator)

The MACD indicator is used to identify bullish or bearish movements and signals whether shorter-term price momentum is in the same direction as longer-term price momentum, thus helping traders spot when a reversal is close. It's calculated by subtracting the 26-day EMA from the 12-day and is a favourite indicator of cryptocurrency day traders. Here is a nice annotated diagram of a standard MACD oscillator:

The good thing about the MACD for day traders is that it generates lots of signals, even over short time frames. Naturally, though, the longer the chart on which the signal appears, the stronger it will be. Contrasted with the Relative Strength Index (RSI), the MACD has no absolute range, which makes it unsuitable for assessing overbought and oversold conditions.

News and gossip

Another valuable weapon in any day trader's arsenal is news trading. This tactic involves making trades right after the release of an important piece of news. Because there are no earnings reports in the crypto market, news traders need to keep their ears close to the ground for any developments relating to the coins they follow.

Day trading from news can be incredibly lucrative, as it's virtually guaranteed that a coin will appreciate following a positive development for the project. Similarly, you can be fairly certain that price declines are in store following serious bad news. The real challenge here is being ahead of the pack. One method is to only track a small number of coins but watch them closely. That way, you're more likely to be among the first to hear of any important developments. StormGain also conveniently provides a Weekly Digest so you can see trends at a glance:

So, what's the best crypto day trading strategy?

When we put this crypto day trading guide together, our intention was to provide you with the grounding you need to answer this question for yourself. This is because, ultimately, the choice of the perfect crypto day trading strategies for beginners depends on your own unique profile. That said, there are some basic hallmarks of a good crypto day-trading strategy.

First of all, you must have a realistic outlook as to what you can make and how much you can afford to risk on a single trade. Second, you have to remove emotion from the equation as best as you can: most day traders fail because they are unable to do this. Lastly, you need to understand and apply technical analysis in order to spot suitable entry and exit points and pre-empt price reversals. Thereafter, it's up to you to decide which crypto day trading technical analysis techniques and indicators to favour, what time intervals to work with, and whether to attempt the occasional swing trade here and there.

Whatever day trading cryptocurrency strategy you settle on, you'll definitely want a reliable, user-friendly platform to work in. Cue StormGain. With its ergonomic, intuitive platform and fast trade execution, StormGain is the best crypto day trading platform for day traders who want to beat their competition to the punch. The handy platform also displays useful interactive charts for all instruments, so you always know the full picture before you pull the trigger. What's more, StormGain offers instant crypto card purchases and gives users personal wallets for six of the biggest cryptocurrencies, making it simple to trade and store a variety of different coins at once. Join the ranks of StormGain day traders now and start earning today!

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

How does crypto day trading work?

When considering day trading in crypto, you need to understand how this cryptocurrency trading strategy differs from other approaches. What is crypto day trading? Crypto day trading is distinct from long-term investing as it involves buying and selling digital assets within a single day, sometimes multiple times. This fast-paced approach aims to capitalise on the short-term price changes and market volatility inherent to cryptocurrencies.

Is crypto day trading worth it?

Crypto day trading can be a profitable endeavour, but it comes with a significant level of risk. It is important to note that it may not be suitable for everyone. If you lack experience in day trading or have limited knowledge about cryptocurrencies, relying on it as your primary source of income is not advisable.

Which crypto coins are best for day trading?

There is no definitive answer to which crypto is best for day trading. As a day trader, it is important to be open to trading various digital assets to maximise profit. Bitcoin, Ethereum, Binance Coin, Fantom, and others are often among the best crypto day trading coins.

Is day trading crypto legal?

Day trading in crypto is usually legal, but the legality may differ based on your jurisdiction. It is important to follow local regulations and research the legal requirements before participating in day trading or any financial activities involving cryptocurrencies. Remember that the cryptocurrency market is constantly changing, and regulatory frameworks may also change, so it is vital to stay informed.

How to choose crypto for day trading

When deciding which crypto coins are best for day trading, it is advisable to select those that have enough liquidity. This means opting for cryptocurrencies with higher trading volume, which indicates active market participation and allows for quick entry and exit of trades. Sufficient trading volume is crucial for efficient day trading.

Is there a limit to day trading crypto?

There is no limit to day trading in crypto. It is open for trading 24/7 without any restrictions. Unlike stocks and options, crypto trading is not regulated by FINRA or the SEC, so there are no day trading limits to worry about.