Crypto trading volumes and fund inflows continue to decline

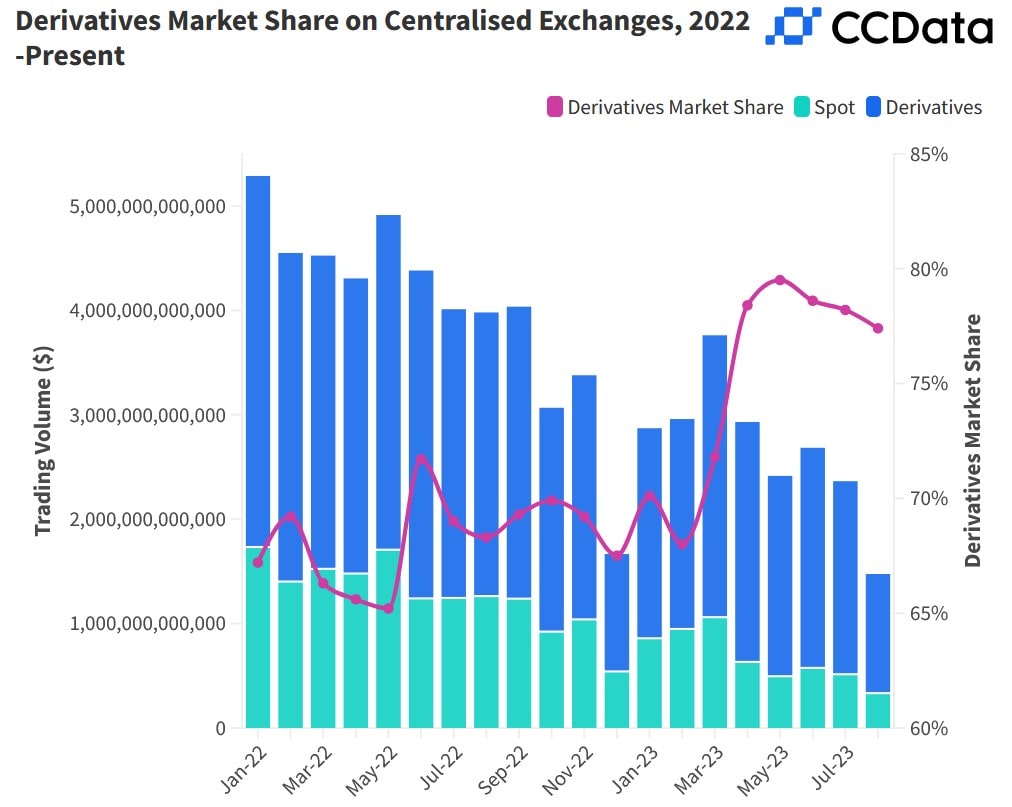

After a sudden sell-off in mid-August, the reasons for which we discussed here, things are quiet again. Despite the significant price drop, trading volumes in the spot market were the lowest since late 2019, reaching $333 billion. Derivatives trading volume was also not significantly affected by the washout of marginal buyers.

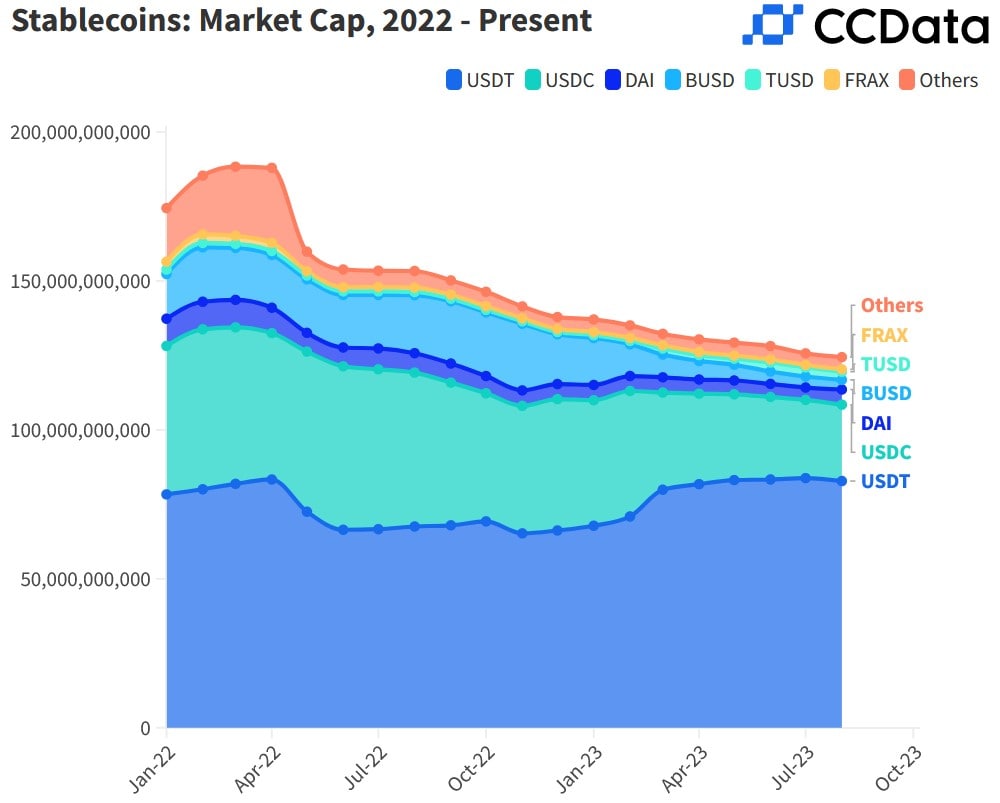

To make matters worse, stablecoin capitalisation has been declining for 17 months straight. Since stablecoins are the bridge between fiat and cryptocurrency assets, this decline indicates a low inflow of new capital.

Analysts from JPMorgan predict that Bitcoin will experience a "limited decline" based on macroeconomic factors, which can be interpreted as consolidation around the achieved level towards $25,000.

This assessment fits well with Fed Chairman Jerome Powell's recent statements at the Jackson Hole symposium regarding the Fed's willingness to raise the key interest rate further and the desire to achieve 2% inflation.

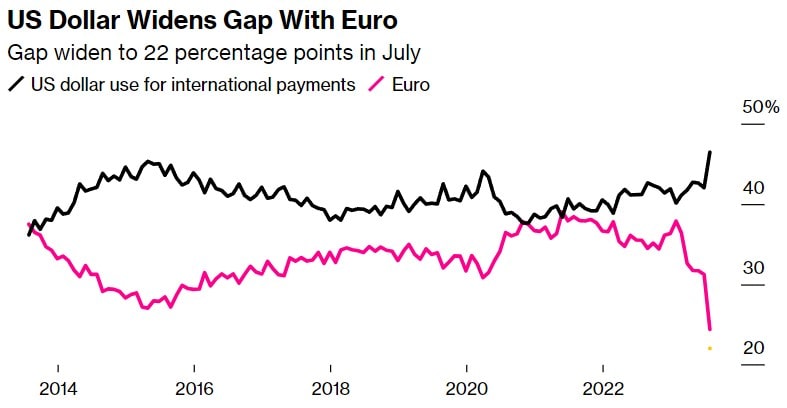

High interest rates lead to capital outflows from risky assets and regional markets in favour of US Treasury bonds. For example, since the beginning of the year, foreign funds' investment outflows from Chinese bonds have exceeded $30 billion. At the same time, the dollar's share of international settlements has risen from 40.1% to 46.5%.

The high Fed Funds rate is having a negative impact on cryptocurrency investment inflows. Since there have been hints of further increases, most forecasts will be for a "limited decline".

However, there are factors that can reverse this interdependence. For example, the long-awaited authorisation to launch spot Bitcoin and Ethereum ETFs will trigger $5 to $10 billion in inflows from institutional investors in the first six months. According to various estimates, this will push Bitcoin up to somewhere between $50,000 and $120,000 in the same time frame.

On top of that, Powell's statements may once again be at odds with reality. Economist Peter Schiff believes the Fed's actions will prove powerless against the United States' skyrocketing budget deficit. The regulator will be forced to raise the inflation target and stop tightening monetary policy.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.