Ethereum validators earn record fees due to the DeFi crisis

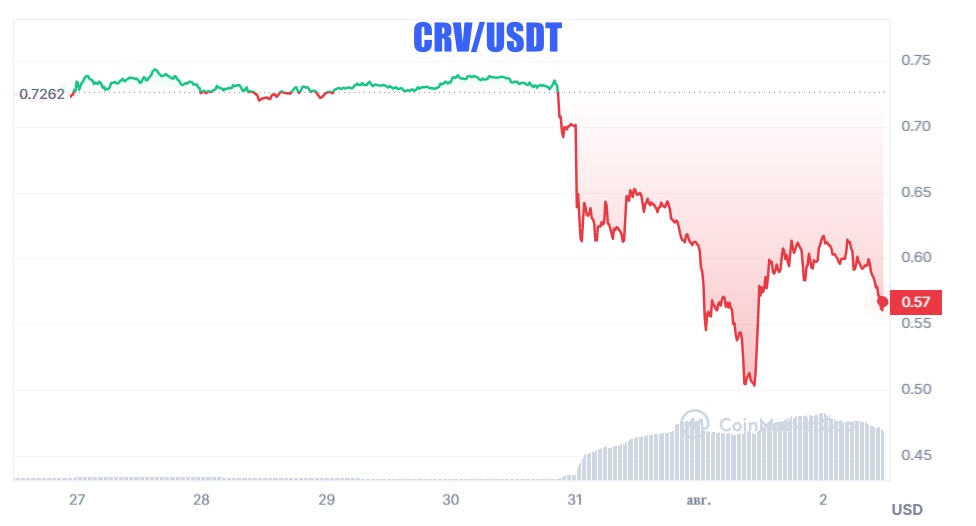

Yesterday, we told you about a new threat facing the cryptocurrency market. Basically, several pools of the Curve Finance (CRV) platform have been compromised, and a drop in CRV's price threatens to set off a chain reaction across the entire DeFi sector.

Over a third of CRV's working supply is pledged to Aave, against which Curve CEO Mikhail Egorov has borrowed $63 million worth of stablecoins to secure. At a price of $0.37 per token, the position will be forcibly liquidated due to insufficient collateral.

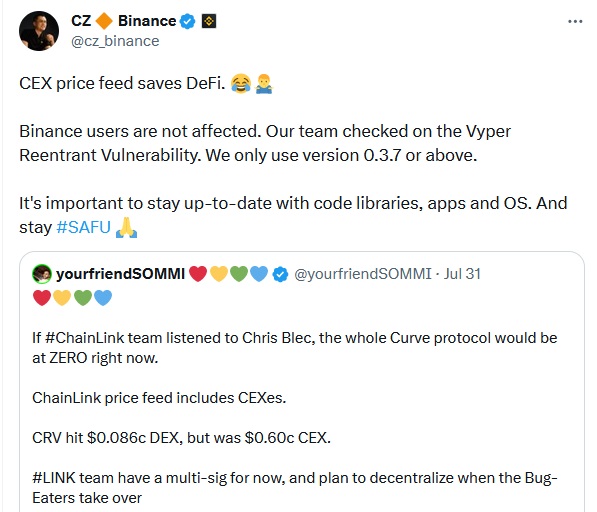

Binance CEO Changpeng Zhao laughed at Curve on Monday as CRV's price — like the entire project — was saved by trading on centralised platforms. On DEX, the price fell to as far as $0.09.

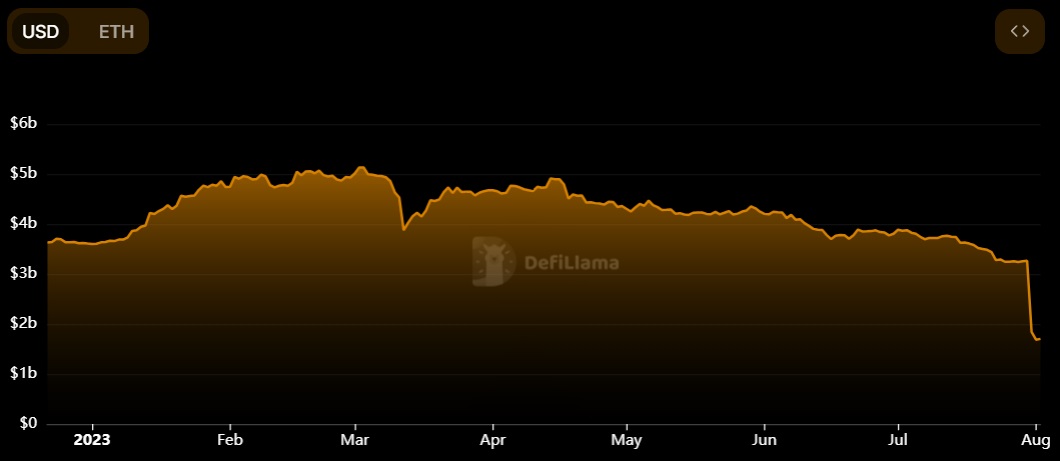

But Curve users weren't laughing. In the past three days, they've withdrawn half of the total value locked (TVL) in the platform.

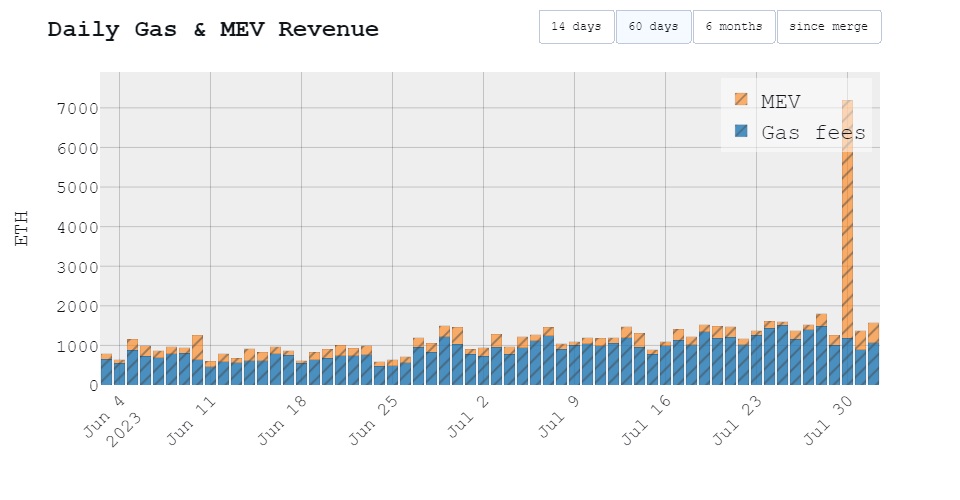

The mass exodus of users has led to a dramatic increase in the reward offered to Ethereum validators. The network is notoriously slow, and the higher a transfer fee a user assigns, the faster their transaction will be included in the block.

Most validators use the MEV-Boost bot to maximise profits by searching for transactions in the mempool with the highest reward. On 30 July, the MEV reward reached a record of 6,006 ETH or $11 million.

The price of Ethereum, on the other hand, was negatively affected by the situation.

This is due to the risk of not only Curve collapsing but also spreading the infection to other projects, most notably to Aave. To stabilise the situation, Curve founder Michael Egorov sold some assets and reduced the loan amount from $63 million to $54 million.

Curve has also rushed to the aid of a number of crypto investors, including Justin Sun (Tron). Egorov sold 39 million CRVs for a total of $16 million in over-the-counter auctions. The average selling price was $0.40, and the discount was 25% of the market rate.

The amount received in the auction will mitigate the risk of compulsory liquidation in Aave, but it doesn't completely remove it. In addition to spooked retail investors, hackers, who still hold over 7 million coins, could also impact CRV's price.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.