Factors for Ethereum's fall in May

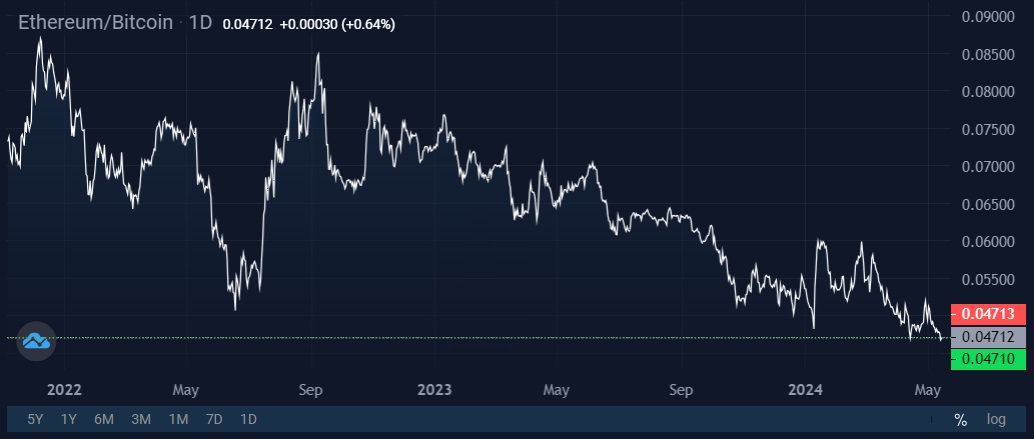

For the third year in a row now, Ethereum has been outpaced by Bitcoin. This year alone, it's dropped by 13% compared to the original cryptocurrency. Two important factors point to this trend strengthening in May.

Shattered hopes

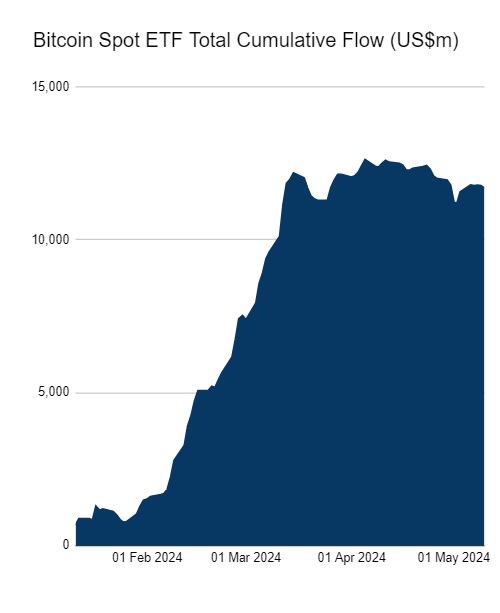

The main catalyst for Bitcoin's rise this year has been the emergence of spot ETFs in the US, which have attracted $11.7 billion in investment in five months of operation.

Ethereum investors are counting on Ethereum experiencing a similar takeoff when the deadline for a decision to be taken on VanEck's application to launch a spot Ethereum ETF approaches on 23 May.

If the SEC wants to refuse it, it will have to find a compelling argument. Otherwise, the very first judicial objection will put the regulator in an awkward position, which is what happened with Grayscale’s application last year.

Since the staking programme is one of the stumbling blocks, Ark Invest and 21Shares recently introduced an amendment to exclude this option for ETF investors. Most experts, however, agree that this won't help.

The SEC was extremely negative towards Ethereum after the cryptocurrency transitioned to the Proof-of-Staking (PoS) algorithm, which SEC Chairman Gary Gensler notified the public about on the same day. In his opinion, the altcoin should be considered a security rather than a commodity like Bitcoin. This places a completely different level of demands on both ETF managers and investors.

One indirect sign that the SEC will reject the application in May is the lack of negotiations with the applicants. Before Bitcoin ETFs launched, the regulator's representatives met with potential managers several times a week for a month and a half.

If the SEC rejects the application, it would serve as grounds for a sell-off of Ethereum since some investors are disappointed in its prospects.

Inflation

Ethereum became deflationary after the London hard fork and the inclusion of a mechanism to burn part of the reward. In other words, the number of coins destroyed began to exceed the number of new ones issued. All other things equal, this would be a reason for the price of any asset to go up. The effect intensified after the transition to PoS.

However, the staking craze and low network activity led to the undesirable result of inflation taking place again. In the past month, this indicator has stood at 0.4%.

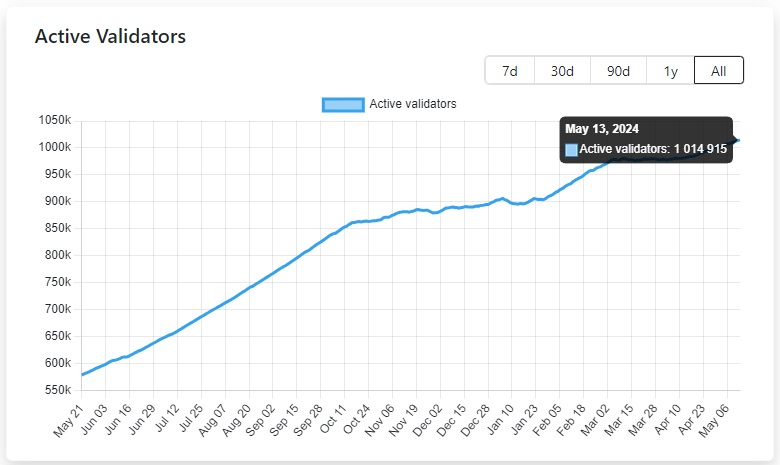

The number of active validators (who must be paid a reward) is now over 1 million, which is more than enough to ensure the network's security and functionality. A further influx will only cause congestion due to the growth of technical messages.

The algorithm for reducing profitability based on the number of validators turned out not to be flexible enough, which is why developers are considering the option of forcing a reduction in the reward.

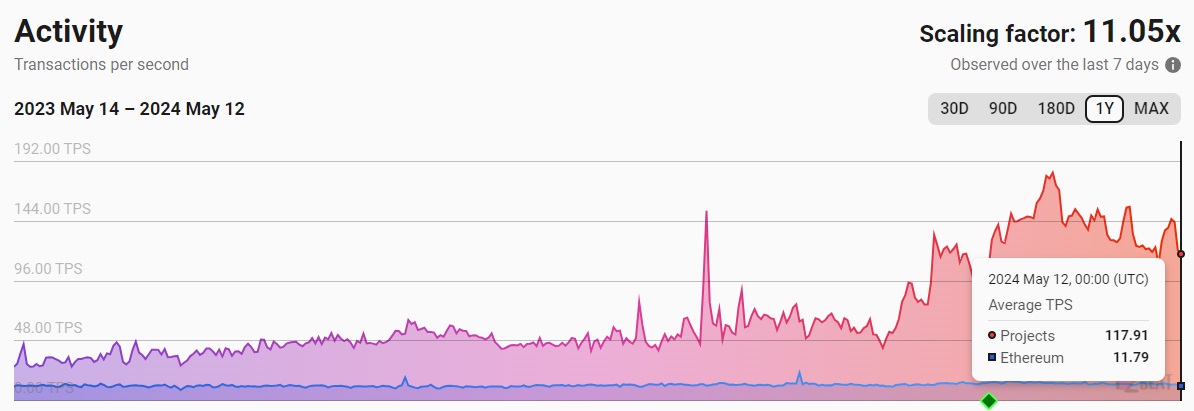

At the same time, network activity, which led to increased coin burning, fell due to a shift in interest to L2 and L3 networks. Simply put, users began to spend more time in Base or Arbitrum, from which transactions in Ethereum are received in a compressed form.

Since the mentioned trends are gaining momentum, it's likely that inflation in Ethereum is here to stay for a long time. It will have a long-term negative effect on the cryptocurrency's value, and coupled with the SEC’s refusal, it will lead to Ethereum pulling further apart from Bitcoin.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.