Investors exchange gold for Bitcoin

The approval of spot Bitcoin ETFs in the US increased the cryptocurrency's reputation and made it much easier for many people to invest in Bitcoin and put it on the same level as gold. In the SEC's accompanying letter to the approval of the ETFs, Chairman Gary Gensler reiterated that the regulator views Bitcoin exclusively as a commodity.

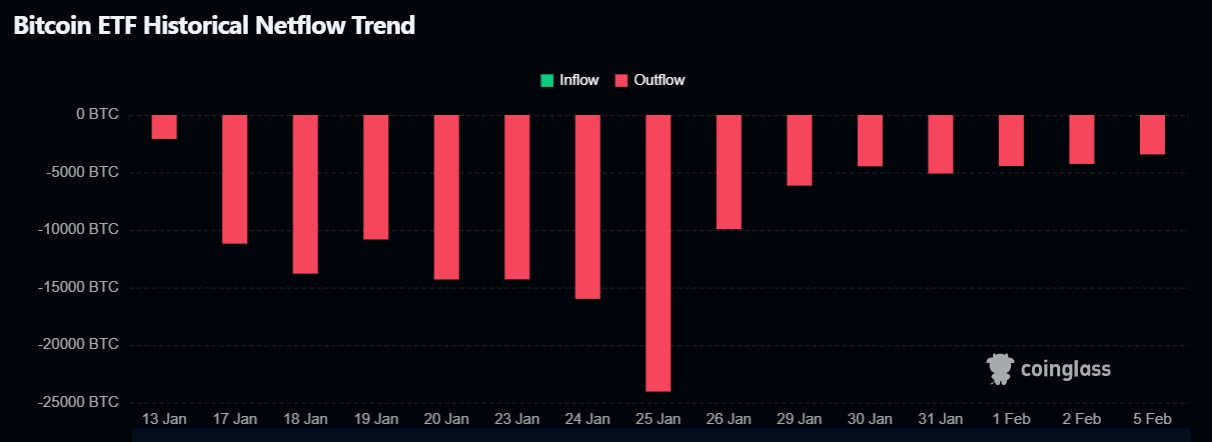

The importance of the event for the crypto market can hardly be overestimated, as it'll cause a significant inflow of capital. In the statistics for January, it's weakly reflected due to the negative impact of Grayscale, which isn't related to the investment attractiveness of Bitcoin (read more on the reasons here). The good news is that this trend is weakening. From a peak of 24,000 BTC (~$1 billion) a day, the outflow has dropped to 3,400 BTC (~$145 million).

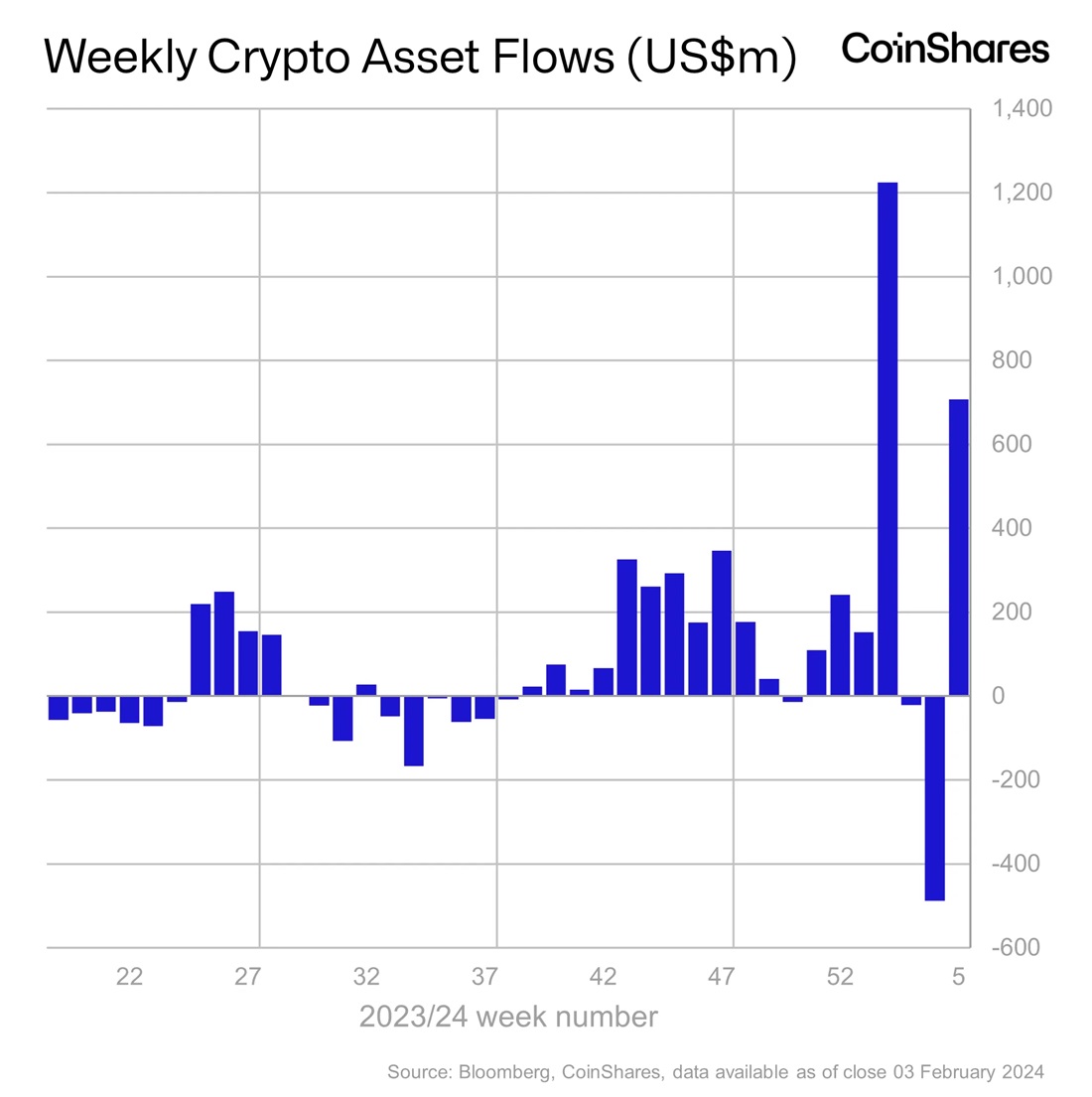

As interest in the remaining nine spot ETFs didn't change much, last week marked a return to growth in net inflows, reaching $708 million.

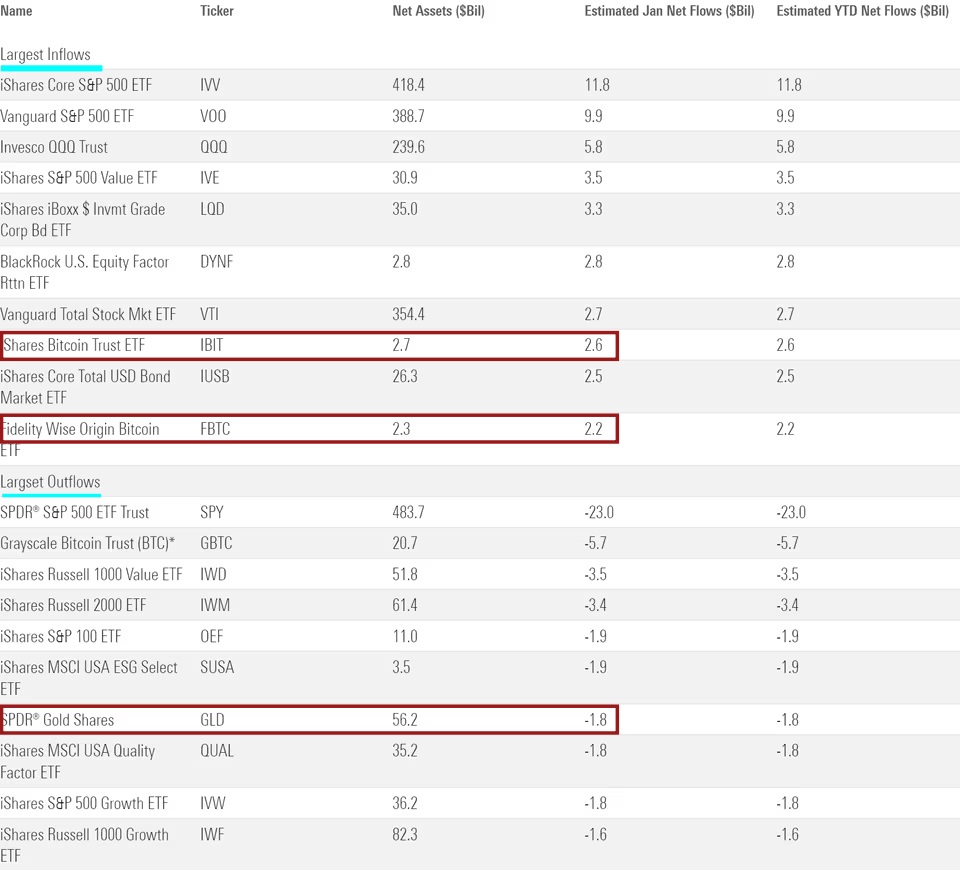

Moreover, funds from BlackRock and Fidelity were among the top 10 fastest-growing ETFs in the US in January. In contrast, the gold ETF from SSGA, which has the largest private gold holdings, showed a significant outflow of $1.8 billion.

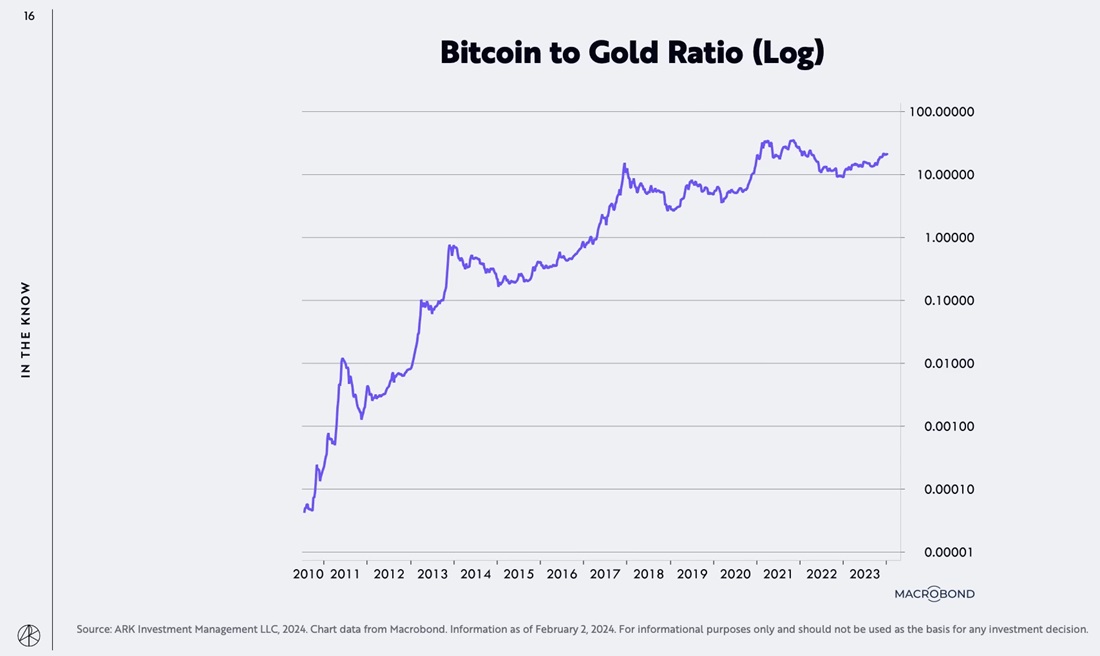

The trend of Bitcoin replacing gold as an investor preference has been noted by many analyst companies since 2021, including Bank of America and JPMorgan. This trend started to fully manifest after the launch of spot ETFs.

For the long-term valuation of gold and cryptocurrency, Cathie Wood of Ark Invest suggests relying on the ratio of Bitcoin's value expressed in ounces of gold. The logarithmic chart speaks for itself.

A new boost in crypto growth may provoke a repeat of last March's banking crisis when a full-scale crash could only be prevented by the direct intervention of the government and the Fed (read more in our article). Bitcoin then gained 50%, rising to $30,000 within a month.

In addition to the banking crisis, the US faces a national debt problem that is costing a lot to service. Even Federal Reserve Chairman Jerome Powell, who usually ignores politics, recently criticised the government:

The US federal government's on an unsustainable fiscal path... The debt is growing faster than the economy.

For centuries, gold was a safe haven, but Bitcoin will eventually replace it as a more convenient and safer (in certain aspects) instrument.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.