Less than a week until Ethereum staking ends

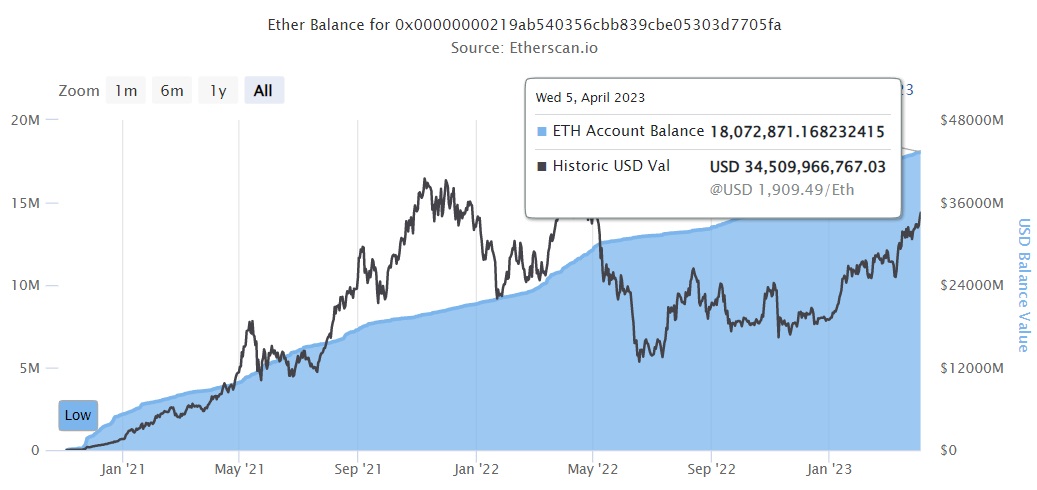

On 12 April, the Ethereum network will undergo the long-awaited Shanghai hardfork, allowing validators to withdraw coins that have been frozen in staking. Currently, they amount to 18 million ETH worth $34 billion, or 15% of ETH's total supply.

To reduce potential pressure on prices and not overload the network, those wishing to withdraw funds will have to queue up. The maximum daily outflow is limited to 2,200 transactions. If each validator withdraws a block of 32 ETH, 70,000 coins worth $132.5 million will be withdrawn from the network every day.

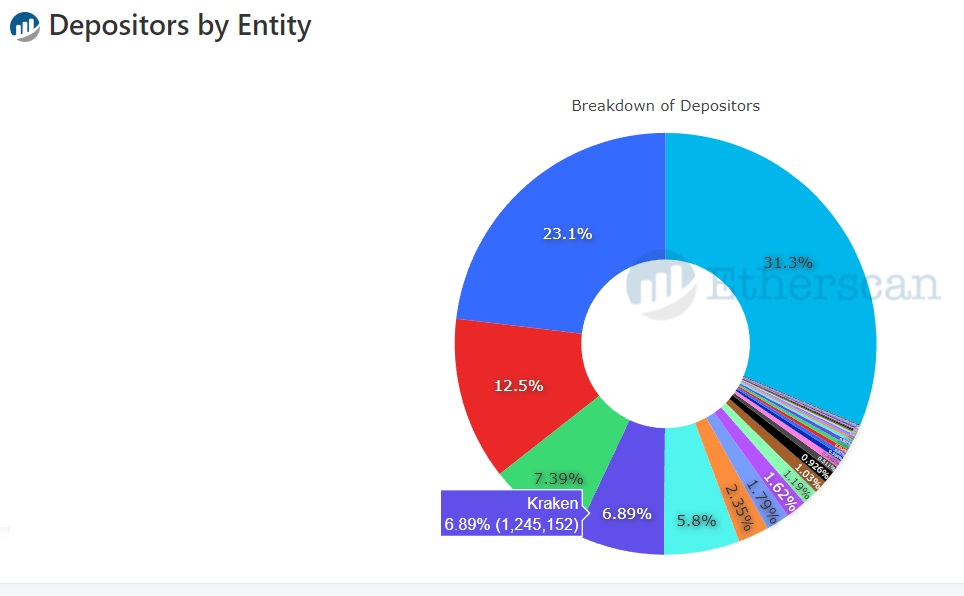

Because of pressure from US regulators, the number of those willing to exit staking will be significant. For example, in a pre-trial settlement, cryptocurrency exchange Kraken agreed to accept a ban on providing staking and to pay a $30 million fine. Its customers now hold a 6.9% share of the total validator pool with 1.2 million staked ETH. It'll take Kraken 17 days just to process the applications.

Coinbase, a cryptocurrency exchange whose market share is almost twice that of Kraken, received a similar pre-enforcement action from the SEC. It may also soon give in to the regulator.

The SEC is seeking to ban staking and to get Ethereum recognised as a security. If it's approved in court, cryptocurrency exchanges must obtain a broker's licence and keep stricter records of both clients and all transactions to deal with the cryptocurrency.

But even in the absence of a precedent, regulatory pressure is growing. For example, on 9 March, the New York Attorney General's Office (NYAG) sued KuCoin, accusing the crypto exchange of conducting illegal financial transactions. In that case, prosecutors managed to buy ETH without the operator holding a professional securities market participant license.

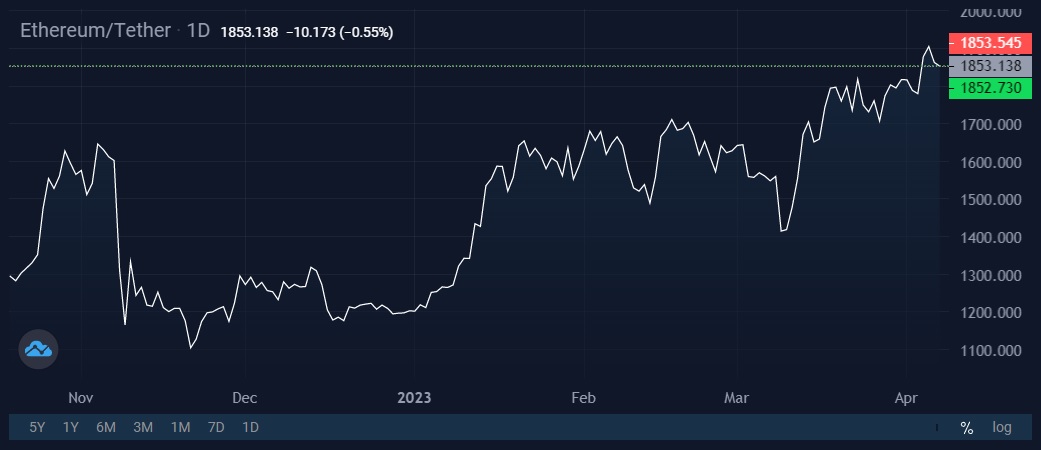

Tougher regulatory treatment of Ethereum isn't just pushing US market participants away from staking. It's also reducing the asset's overall attractiveness as an investment option for them.

A hardfork is an important milestone for the network, and the ability to move coins freely increases interest in staking by cautious investors not ready to stake coins for an indefinite period of time. The colliding contradictions will likely lead to significant ETH volatility over the next two months.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.