Liquid staking pushing Ethereum

The Proof-of-Stake (PoS) algorithm has provided Ethereum holders with a passive income opportunity. The growing interest in staking has been slowed by the 32 ETH ($60,000) limit required to deploy one's own node. Many experts have criticised the owning limit, but liquidity pool platforms have come to users' rescue.

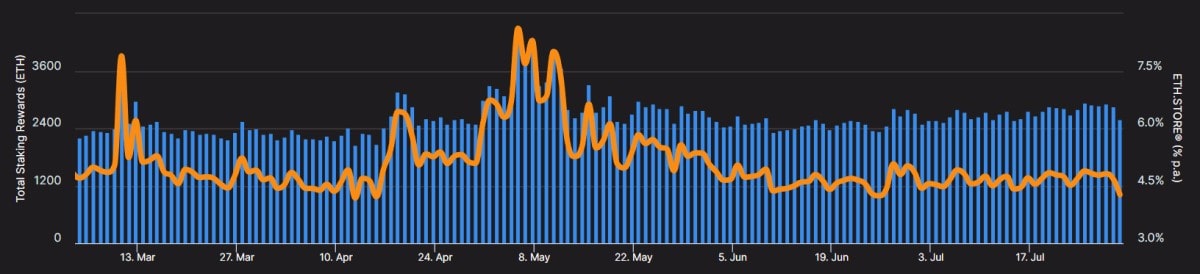

First, liquidity pools provide almost the same amount of profit as staking does. This amounts to a 4.3% annual return, but because of the growing network load, it may even reach higher numbers, as was the case in May.

Second, when staking ETH, platforms issue their tokens in return, which are called liquid staking derivatives or LSDs. These 'coupons' can be exchanged for ETH at any time or be traded or used in third-party staking programmes. This allows seasoned users to get the most profits when compared to regular ETH staking.

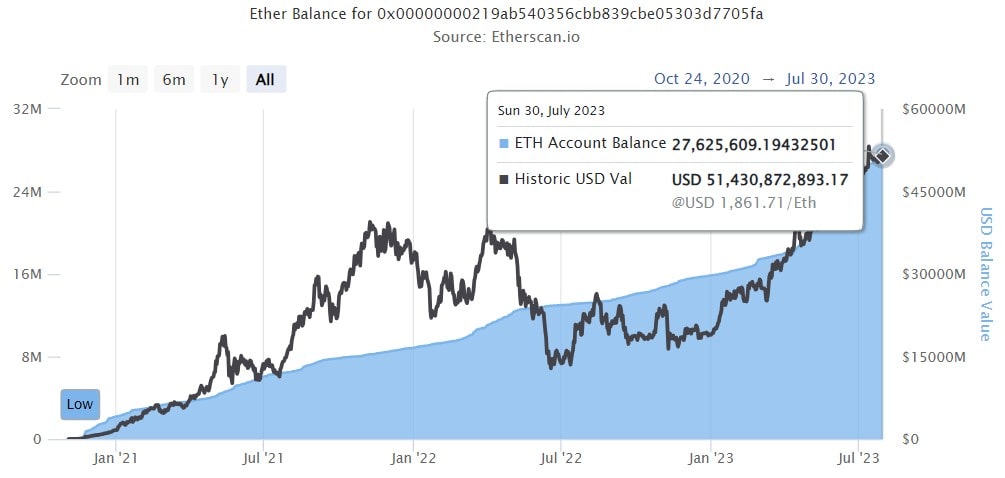

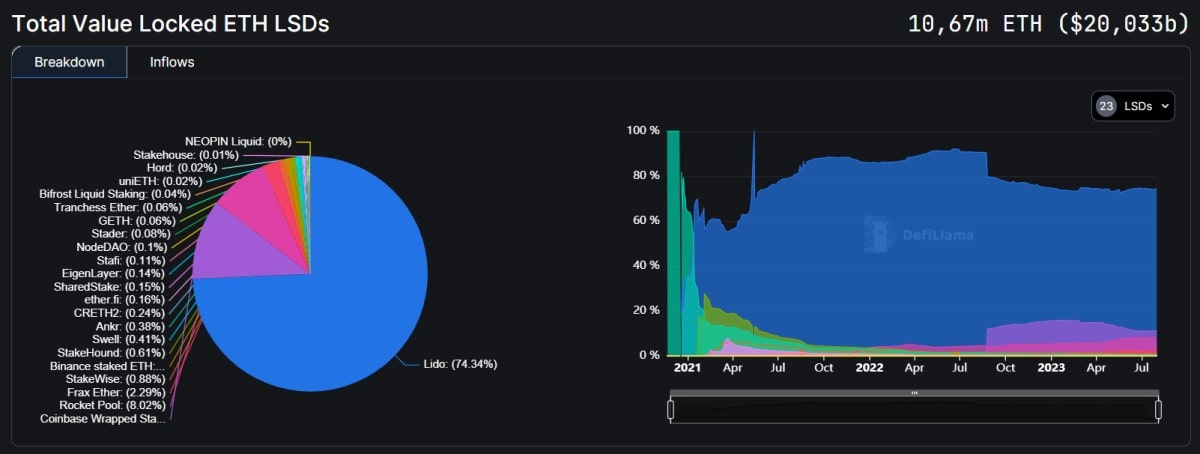

As of now, the staked amount is 27.6 million ETH, which is currently worth $51.4 billion, with 10.7 million ETH or 30% accounting for LSD.

Most analysts are of the opinion that LSD will soon exceed the share of funds directly participating in staking. On the one hand, this is a positive trend that illustrates the resumption of interest in the DeFi sector after the collapse of a series of projects in 2022. Without Ethereum staking pools, it would be difficult to attract investors with such a higher barrier to entry.

On the other hand, projects' interdependence is once again rising, which could lead to a chain reaction if one of them crashes. The risks are especially acute due to the dominance of Lido Finance, which holds a 74% share of the LSD market.

Last year, the STETH 'coupon' from Lido was already trading at a significant discount to ETH, which was caused by users' massive sell-off.

Right now, the market is rising, and the crisis is fading into the background. However, similar situations could occur again in the future. Investors aiming to maximise their profit should bear these risks in mind.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.