Most Decentralised Crypto List

Decentralisation is one of the core principles of the very idea of cryptocurrencies, but the level of decentralisation can vary greatly among different projects. In this article, we'll break down which cryptocurrencies can be considered decentralised and provide a list of the most decentralised crypto coins.

What is decentralisation in cryptocurrency?

Decentralisation in cryptocurrency means that transactions in that cryptocurrency network are not controlled by a single central authority but are recorded and verified by a network of users. This means that no single entity has the ability to manipulate or shut down the network. You can read more about the difference between decentralised and centralised cryptocurrencies in our previous article.

Which coins are decentralised?

By definition, a decentralised cryptocurrency must be susceptible to 51% attacks whether by hashrate, stake, and/or other permissionlessly-acquirable resources. If a crypto can't be 51% attacked, it is permissioned and centralised. — Charlie Lee, creator of Litecoin

Decentralisation is a relative concept, and the level of decentralisation varies from one cryptocurrency to another. There are a number of criteria by which the decentralisation of a cryptocurrency is assessed:

- Decentralised network. The cryptocurrency's network should be decentralised with a large number of nodes that validate transactions and maintain the blockchain. The more nodes the network consists of, the more decentralised it is.

- Decentralised control. Network nodes should be controlled by a large number of different people and/or organisations.

- Decentralised coin issuance. New coins should be generated in a decentralised way by a network of nodes through mining or forging.

- Accessibility. The cryptocurrency can be used by anyone, no matter who they are or what country they are in.

- Transparency. The cryptocurrency's blockchain should be open and transparent, allowing anyone to view transactions.

- Decentralised governance. The cryptocurrency's development and decision-making should be decentralised and open to participation from users rather than being controlled by a central authority.

- Geographical decentralisation. Network nodes should be distributed across different countries. If most nodes are concentrated in one country, there is an increased risk of government interference with the network.

- Decentralised coin ownership. If the majority of a given cryptocurrency's coins are owned by a small number of individuals, there is an increased risk of market manipulation of the coin's price.

- No single point of failure. The network should not have any single point of failure, meaning that if one node or component fails, the network can still function.

Most decentralised cryptocurrencies

The number of different cryptocurrencies has now exceeded 20,000, and all of them have varying degrees of decentralisation. So, which of them are the most decentralised? Let's find out.

The most decentralised coins list

The degree of decentralisation of an individual cryptocurrency is not always easy to assess. Many cryptocurrencies that are widely considered highly decentralised are more centralised than is commonly thought because decentralisation can gradually erode over time as various factors conspire to concentrate power and control within the hands of a few actors. Nevertheless, we have compiled a list of crypto coins considered to be the most decentralised at the moment.

Bitcoin (BTC)

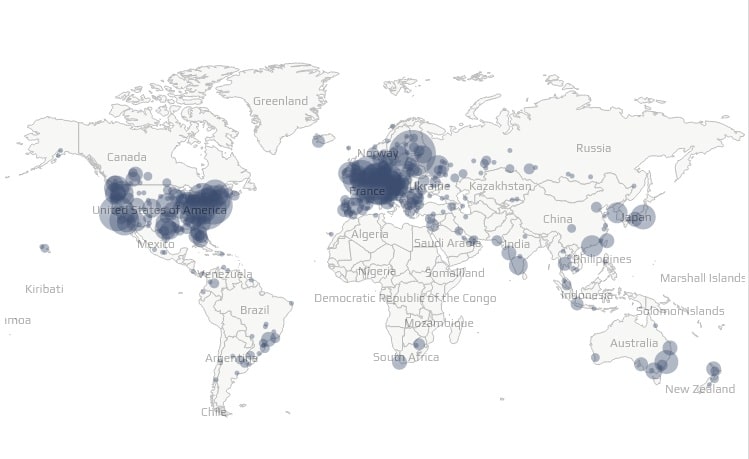

The first and best-known cryptocurrency, Bitcoin, is widely considered one of the most decentralised digital currencies, if not the most decentralised. The Bitcoin network is made up of more than 13,000 nodes spread across the world. Bitcoin is based on the Proof-of-Work consensus mechanism, which requires miners to compete to validate transactions and add new blocks to the blockchain. In theory, anyone can become a Bitcoin miner.

Furthermore, Bitcoin has a decentralised development community with a transparent process for making changes to the protocol. This ensures that decisions are made through consensus and are not subject to the influence of a single individual or group.

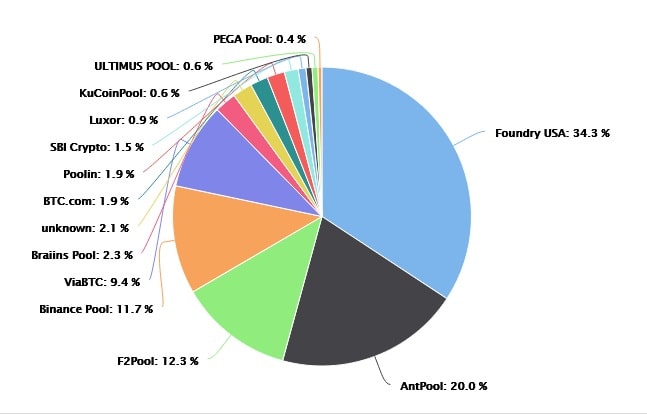

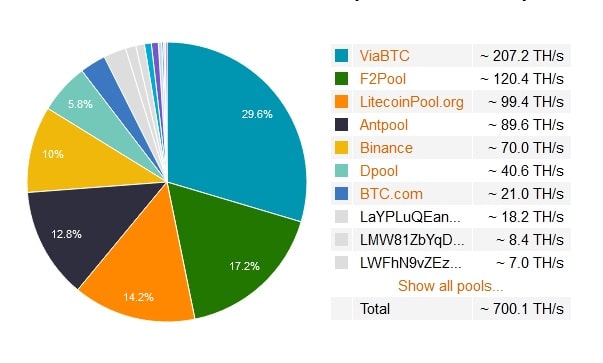

However, the intense competition among Bitcoin miners means that it's only worthwhile to mine it on special, rather expensive equipment, which increases the entry threshold into mining and reduces decentralisation. In addition, to receive consistent mining rewards, individual miners join together to form mining pools. This has led to the four largest mining pools now controlling more than 75% of Bitcoin's hashing power.

Ethereum (ETH)

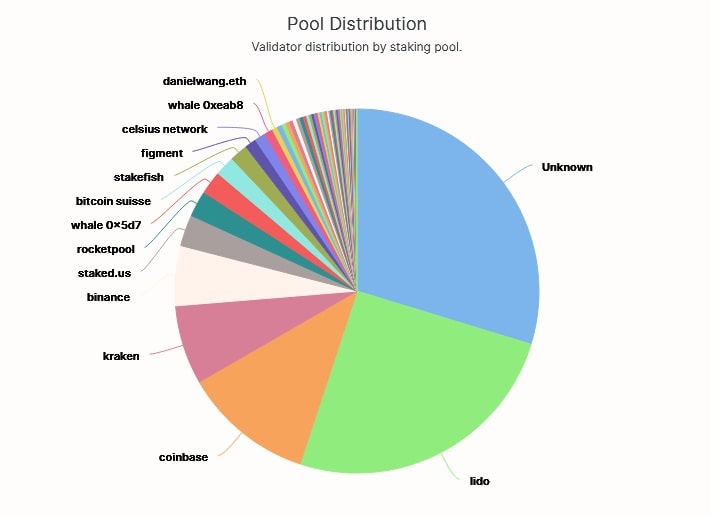

The second most-popular cryptocurrency also has a fairly high degree of decentralisation. Its network consists of more than 10,000 nodes. However, more than half of them are located in one country, the US. Validators are distributed more evenly between pools than in the case of Bitcoin.

Ethereum's biggest weakness in terms of decentralisation is the centralised leadership represented by Vitalik Buterin, who has enormous influence over the network's development.

Monero (XMR)

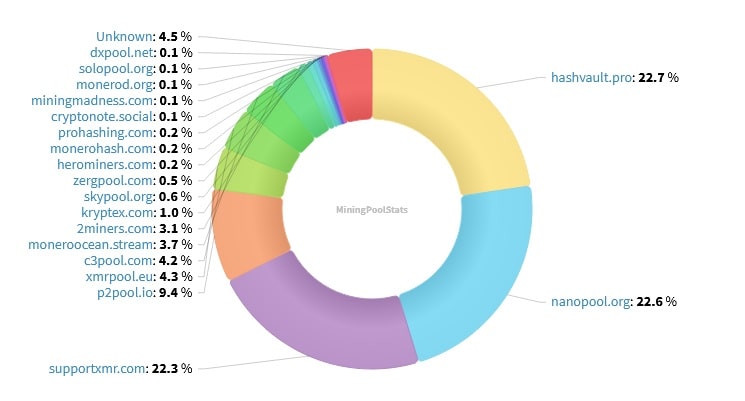

One of the oldest and most popular anonymous cryptocurrencies, Monero also retains a high degree of decentralisation. Its network consists of more than 2,000 nodes located in dozens of countries around the world. Unlike Bitcoin, Monero does not require expensive equipment to mine, which lowers the entry threshold and increases decentralisation. However, Monero miners still have to join mining pools. And, as with Bitcoin, the four largest pools control more than 85% of the network's hashing power. Moreover, the Monero development community is more centralised than those of Bitcoin or Ethereum.

Litecoin (LTC)

One of the oldest cryptocurrencies, Litecoin launched in 2011. The Litecoin network currently has more than 1,000 nodes. As with other Proof-of-Work cryptocurrencies, a threat to Litecoin's decentralisation is the centralisation of mining pools. In addition, as with Ethereum, Litecoin's decentralisation is weakened by the fact that it has a strong leader, Charlie Lee.

Decentralised stablecoins list

Stablecoins are digital assets whose price is pegged to the price of an underlying asset, usually fiat currency. Given the importance of stablecoins to the cryptocurrency industry, it is not surprising that, in addition to centralised stablecoins, an alternative in the form of decentralised ones has emerged.

The most popular decentralised stablecoins (as of 30/01/23)

Stablecoin | Market cap | Type |

Dai (DAI) | $5,836,614,347 | Overcollateralised |

USDD (USDD) | $719,740,077 | Overcollateralised |

Fei USD (FEI) | $419,564,181 | Algorithmic |

Frax (FRAX) | $1,021,583,834 | Fractional-algorithmic |

sUSD (SUSD) | $54,476,571 | Overcollateralised |

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.