What is the difference between centralised and decentralised cryptocurrency?

Although cryptocurrencies are based on the idea of decentralisation, there are now many centralised digital assets as well. In addition, the degree of decentralisation can vary quite widely. In this article, we'll explore the difference between centralised and decentralised cryptocurrency, including the advantages and disadvantages of each type.

What does it mean to be decentralised?

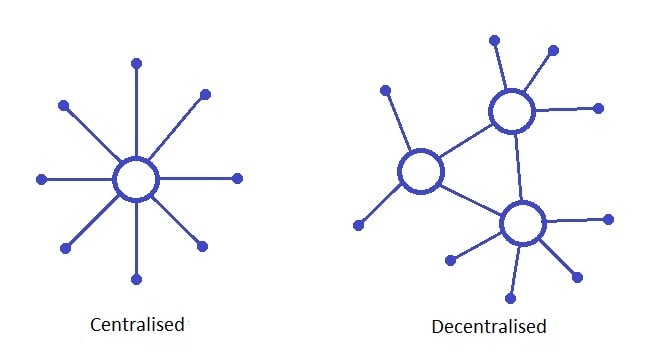

Being decentralised means that a system or network is not controlled by a single central authority or organisation. Instead, it is governed and maintained by a network of individuals or entities. In the context of cryptocurrencies, a decentralised network is one where transactions are recorded on a public ledger and are verified and processed by a network of users rather than by a central organisation or authority.

It's also worth noting that there are two types of decentralisation when it comes to cryptocurrencies:

- Architectural. It depends on the number of physical nodes (computers) in the cryptocurrency's network. The more there are, the more decentralised the network is.

- Political. Depends on the number of individuals or organisations controlling the network nodes. Again, the more there are, the greater the degree of the network's decentralisation is.

What is centralised and decentralised cryptocurrency?

Decentralised and centralised cryptocurrencies are two different types of digital currencies that have distinct features and characteristics.

What are decentralised cryptocurrencies?

One of the key distinguishing features of decentralised cryptocurrencies is the absence of a central authority. Instead, decentralised cryptocurrencies operate on a peer-to-peer network, where transactions are recorded in a decentralised blockchain. This means that users can send and receive funds directly without needing a middleman.

Decentralised cryptocurrencies share a number of common features:

- There is no central server where all information about financial assets transactions resides. This function is performed by blockchain.

- No one can influence the transfer of cryptocurrency from sender to recipient.

- No transactions recorded on the blockchain can be changed.

- Coin issuance is decentralised, with new coins being generated through mining or forging.

- There's no access to the personal information of network users.

- All participants in the network are equal, and each user can gain the ability to verify transactions and generate new blocks.

Examples of decentralised cryptocurrencies include Bitcoin (BTC), Ethereum (ETH) and Monero (XMR).

Advantages of decentralised cryptocurrencies:

- Security. Decentralised cryptocurrencies are highly secure and resistant to hacking or manipulation, as transactions are recorded in a blockchain and verified by a network of users.

- Fault tolerance. Failure of some nodes will not cause the network to stop working.

- Censorship resistance. Decentralised cryptocurrencies do not rely on a central authority, making them resistant to censorship or government interference.

- Anonymity. Decentralised cryptocurrencies offer at least some degree of anonymity, as transactions are not linked to any personal information. Moreover, some cryptocurrencies are specifically designed for anonymous transactions, giving their users a high degree of anonymity.

- Immutability. Records in decentralised cryptocurrency blockchain are extremely difficult to change, ensuring the integrity of transactions.

Disadvantages of decentralised cryptocurrencies:

- Scalability issues. Decentralised cryptocurrencies often struggle with scalability issues as the number of transactions increases.

- Lack of protection and recourse. Decentralised cryptocurrency transactions are irreversible, and there is no third-party intermediary to help in the event of fraud or lost or stolen funds.

- Lack of tech support. Due to the lack of central authority, it's very difficult to organise technical support for users.

What are centralised cryptocurrencies?

Centralised cryptocurrencies are digital currencies controlled by a central authority or organisation. In addition to this, they have several other distinctive features:

- Centralised cryptocurrencies rely on a central server to process and verify transactions.

- Centralised cryptocurrencies are subject to regulations, and users may be required to provide personal information as part of anti-money laundering (AML) and know-your-customer (KYC) procedures.

- Coin issuance is centralised and carried out by a central authority.

- Central authority can block or reverse transactions deemed illegal or undesirable.

These features can vary depending on the specific centralised cryptocurrency, and not all have these characteristics. For example, some centralised cryptocurrencies may not comply with regulatory requirements.

Examples of centralised cryptocurrencies include Ripple (XRP) and Tether (USDT).

Advantages of centralised cryptocurrencies:

- Faster transactions. Centralised cryptocurrencies may have faster transactions as they rely on a central server to process and verify transactions.

- Stability. Centralised cryptocurrencies can have more stable prices because they are controlled by a central authority. Centralised stablecoins, for example, are currently considered the most reliable ones.

- Integration with existing financial systems. Due to regulatory compliance, centralised cryptocurrencies can be more easily integrated into existing financial systems than decentralised ones.

- Better tech support: Centralised cryptocurrencies may have better technical support.

Disadvantages of centralised cryptocurrencies:

- Security. Centralised cryptocurrencies are less secure than decentralised ones, as they rely on a central server to process and verify transactions. This makes them more vulnerable to hacking.

- Single point of failure. Centralised cryptocurrency servers are generally more reliable than individual decentralised cryptocurrency nodes. But the entire network could be affected if these servers are compromised or go offline.

- Censorship. Centralised cryptocurrencies are much more susceptible to censorship or government interference.

- Lack of anonymity. Centralised cryptocurrencies generally provide a lower level of anonymity than decentralised ones.

- Loss of control. Users of centralised cryptocurrencies typically have much less control over their funds than users of decentralised ones.

- Limited immutability: Centralised cryptocurrencies may not provide the same level of immutability as decentralised ones, as the central authority may have the power to alter the blockchain or reverse transactions.

- Price manipulations. Centralised cryptocurrencies are highly susceptible to price manipulation by a central authority.

Semi-centralised cryptocurrencies

Semi-centralised cryptocurrencies, also known as pseudocentralised cryptocurrencies, are digital currencies with some characteristics of both centralised and decentralised cryptocurrencies. They maintain some level of decentralisation by combining centralised and decentralised elements.

An example of a semi-centralised cryptocurrency is EOS. EOS utilises a Delegated Proof of Stake (DPoS) consensus algorithm, where token holders can vote for block producers (BPs) to validate transactions on the blockchain. While the BPs are centralised entities, the token holders who vote for them are decentralised, making the network semi-centralised.

Semi-centralised cryptocurrencies can balance the benefits of both centralised and decentralised ones, such as improved scalability and ease of use while maintaining a level of security and decentralisation. However, it's important to note that semi-centralised cryptocurrencies may not provide the same level of security and censorship resistance as fully decentralised ones.

In addition, many cryptocurrencies intended to be decentralised turn out to be much more centralised in reality than in theory. For example, a June 2022 study by software security company Trail of Bits found that even cryptocurrencies such as Bitcoin and Ethereum are actually more centralised than commonly thought.

There are several reasons for this, but it's also worth noting that the centralisation of decentralised cryptocurrencies is not a new issue, and the crypto community is continually working to address it. However, it's a complex issue that requires a balance between decentralisation, security, ease of use and scalability.

Government-issued digital currencies

Government-issued digital currencies, also known as central bank digital currencies (CBDCs), are digital versions of fiat currencies issued and backed by central banks. They are designed to operate like traditional currency but in a digital form.

It should be noted that while many central banks are trying to create their tokens based on existing blockchain protocols, the use of blockchain technology in CBDC is optional.

Moreover, compared to cryptocurrencies, CBDCs are unlikely to have problems with adoption, as governments are quite capable of creating the infrastructure for the everyday use of CBDCs and enforcing their use.

No central bank has implemented CBDCs yet, and it is not yet known when or how this implementation will start and how aggressively governments will impose their use.

Potential dangers of government-issued digital currencies

CBDCs are highly controversial because of the serious potential dangers associated with them:

- Loss of privacy. Government-issued digital currencies will almost certainly not provide the same level of anonymity as decentralised cryptocurrencies. This could lead to increased surveillance and government control over citizens' financial transactions.

- Censorship. CBDCs are controlled by a central authority, meaning that transactions can be censored or blocked if deemed illegal or undesirable. This could lead to limitations on freedoms and the ability to transact freely.

- Increased government control. Government-issued digital currencies can be used as a tool for governments to exert more control over the economy and citizens' financial transactions. This could lead to increased government intervention in the economy, the possibility of government-mandated spending, the expiration date on money, denial of access to funds due to behaviour or attitudes deemed undesirable, etc.

- Increased financial inequality. CBDCs could reinforce existing financial inequalities by putting more power in officials' hands.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.