One month until $29 billion of Ethereum unlocks

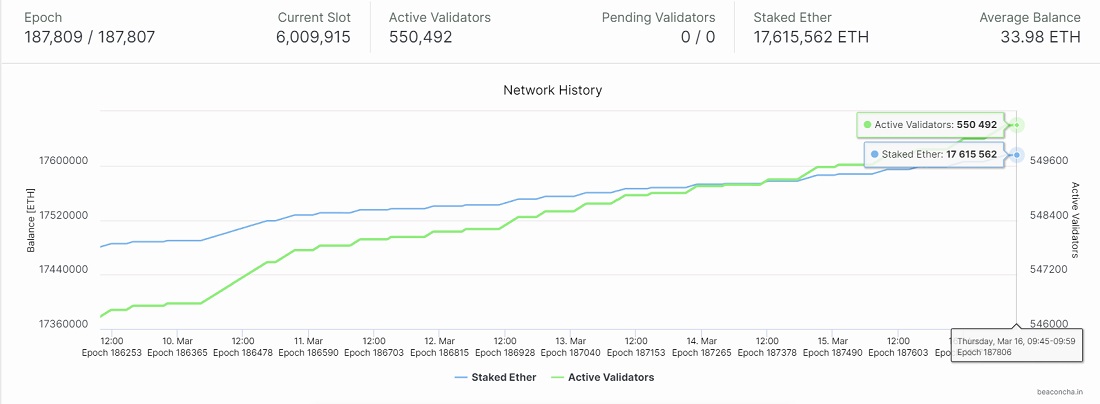

In April, the Ethereum network will undergo the long-awaited Shanghai hardfork, allowing validators and staking investors to withdraw coins. Currently, the deposit contract contains investments for 17.6 million ETH or $29 billion, which exceeds 14% of the total supply.

The final Shapella test took place on the Goerli test network this week. With the exception of some procrastinating validators who didn't update the software, the test was successful. This paves the way for a hardfork to take place on the main network in April.

Since a significant amount will be unlocked and the developers fear a rapid outflow of validators and a drop in the price of ETH, withdrawals will be technically limited to about 2,200 transfers per day. If each validator withdraws an entire block of 32 ETH, the daily outflow would be 70,000 ETH or $116 million.

The hardfork is likely to have a negative impact on the coin's value in the medium term due to the significant outflow associated with US regulators' harsher stance towards Ethereum after its move to PoS. For example, in February, Kraken agreed in a pre-trial settlement with the SEC to stop providing staking services and to pay a $30 million fine.

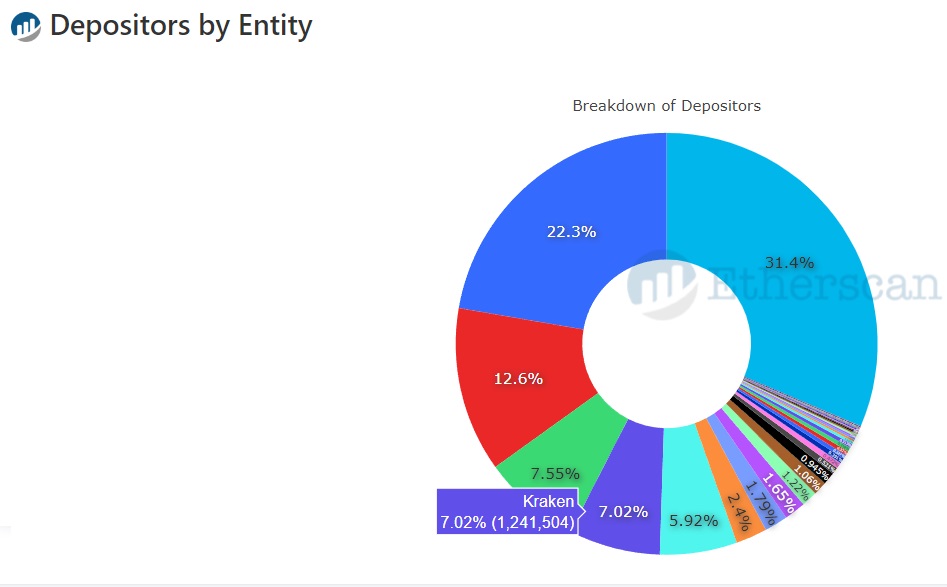

Kraken has a 7% share in the staking, with 1.2 million locked ETH. Immediately following the hardfork, the crypto exchange will join the queue to withdraw the entire amount to return funds to clients. When considering the speed limits for processing its application, more than 17 days would be needed.

It is very likely that Coinbaise will soon be forced to stop offering staking just as Kraken was. Coinbase is currently the second-largest ETH player, possessing a 12.6% share.

In remarks to journalists yesterday, SEC Chairman Gary Gensler confirmed the regulator's intention to get Ethereum recognised as a security. This is all due to the ability to stake coins on a PoS algorithm and investors' expectations to receive passive income.

The New York Attorney General's (NYAG) office is of the same opinion. On 9 March, NYAG filed a suit against the KuCoin crypto exchange after its employees managed to receive ETH on the platform. In the opinion of the AG's office, the exchange must have a license for a professional securities market participant.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.