Tether (USDT) Price Prediction for 2024, 2025 and 2030

In the summer of 2023, Tether's USDT experienced instability and moved away from its $1 value. The community attributed this to significant selling pressure. Since then, the asset's price has fluctuated around the $1 mark, moving slightly up and down. This has not only increased the public interest but also made users who have assets in the cryptocurrency nervous. The recent USDT price moves have triggered investors' interest in Tether (USDT) crypto price predictions. In this blog post, we also explore USDT's future forecasts.

What is Tether (USDT) crypto?

USDT, also known as Tether, is a cryptocurrency tied to the US dollar's value, offering stability in the volatile cryptocurrency world. Operating on blockchains like Ethereum and Tron, USDT allows seamless transactions across platforms, ensuring transparency and trust through public ledgers and regular audits. This has made it a vital tool for cross-border transactions and financial access in unstable regions. USDT remains a consistent and trusted player as the crypto landscape evolves, bridging the gap between traditional and digital currencies.

Tether (USDT) History

Tether began its journey in 2014 as Realcoin, co-founded by Brock Pierce, Reeve Collins, and Craig Sellars. Originally a coloured coin on the Bitcoin blockchain, Realcoin aimed to bridge traditional fiat and emerging cryptocurrencies with stability.

In November 2014, it rebranded as Tether to emphasise stability in the volatile crypto space, operating as an Omni Layer token on Bitcoin's blockchain. Tether expanded beyond Bitcoin, launching on Ethereum and Litecoin in early 2015 and later on platforms like Algorand, Avalanche, and EOS.

Initially serving traders and exchanges, Tether facilitated swift cross-exchange fund transfers and acted as a buffer against crypto volatility, aiming to maintain 1 USDT equal to $1.

Its popularity surged in 2017 during the crypto market's bullish phase. Traders used Tether as a stable substitute for fiat while benefiting from crypto exposure.

As of July 2024, Tether Holdings, the issuer of the top stablecoin Tether (USDT), reported a record net profit of $4.52 billion for Q1 2024. This profit came from $1 billion in US Treasury holdings and $3.52 billion from gains in Bitcoin and gold. Tether's net equity rose from $7.01 billion in December 2023 to $11.37 billion by March 2024. USDT remains the largest stablecoin, with a market value of over $110 billion, and $12.5 billion worth of USDT was issued in Q1 2024. Tether also holds over $72.5 billion in US Treasuries. Paolo Ardoino is the new CEO, succeeding Jean-Louis van der Velde. Tether is also expanding into the data, finance, power, and education sectors.

USDT Issuance

Throughout 2023, Tether has been actively minting new USDT tokens. In March 2023, Tether minted an impressive 9 billion USDT, following the 3 billion minted in February. Between June 12 and July 12, 2023, another 3.75 billion USDT were issued. November 2023 saw additional significant issuances with 1 billion USDT on the Tron blockchain, another 1 billion on Ethereum, and an earlier issuance of 2 billion on Tron.

Tether explained that the recent USDT minting was intended to "replenish inventory for next period issuance requests and chain swaps," emphasising that these were "authorised but not issued transactions." Despite speculation from the cryptocurrency community linking the aggressive USDT minting to market events like the collapse of Silicon Valley Bank in March 2023, Tether has firmly denied any exposure to these failed banks.

As of Jujy 2024, approximately $113 billion worth of USDT is in circulation across 16 different blockchains, with the majority distributed on Tron (59 billion) and Ethereum (52 billion). Tether has issued over 22 billion USDT so far in 2023, though the exact motivations behind this rapid minting still need to be clarified.

USDT White Paper

According to the white paper, Tether represents the inaugural Bitcoin-linked fiat-pegged cryptocurrencies today. The first tokens were issued on 6 October 2014 on the Bitcoin blockchain. The reserve backing for Tethers maintains a one-to-one ratio, entirely unaffected by market dynamics, pricing fluctuations, or liquidity limitations.

Tether features a straightforward and dependable Proof of Reserves implementation and undergoes routine professional audits. The foundational banking partnerships, adherence to compliance, and legal framework collectively establish a sturdy basis for assuming the roles of reserve asset custodians and Tether issuers.

USDT Benefits

- USDT maintains a stable value, with 1 USDT being equivalent to $1.

- Transactions involving USDT have low costs, especially when transferring between two USDT accounts, free of transaction charges. However, converting USDT to other cryptocurrencies or regular currencies may incur a minor fee.

- USDT is highly adaptable as a currency, seamlessly integrating into exchanges and making it available for trading on various platforms.

- USDT simplifies safeguarding funds for traders and businesses dealing with cryptocurrencies. It enables quick conversion of volatile cryptocurrencies like Bitcoin into a stable cryptocurrency.

Tether (USDT) Price Analysis

At the time of writing this Tether (USDT) price prediction on 4 July 2024, the USDT token price was $0.9992, with a daily trading volume of $72,814,138,798. USDT crypto ranked #3 on CoinMarketCap, with a live market capitalisation of $112,400,123,848, a circulating supply of 82.86 billion USDT, and a total supply of 104 billion USDT.

USDT price statistics (as of 04/07/24)

Current price | $0.9992 |

Market cap | $112,400,123,848 |

Circulating supply | 112 billion USDT |

Total supply | 116 billion USDT |

Daily trading volume | $72,814,138,798 |

All-time high | $1.22 (25/02/15) |

All-time low | $0.5683 (02/03/15) |

Website |

Tether (USDT) price history

Now, let's explore some of the more remarkable moments in Tether's price history. There aren't too many of them, as Tether has managed to stay quite closely tied to the dollar over its relatively extended history in the crypto world.

There have been a few exceptions, though. In 2017, for example, it dropped to around $0.91, and in December of the following year, it rose to $1.02. Nevertheless, for the most part, it has either remained at $1 or very nearly so.

A significant deviation occurred in May 2022. This was due to the collapse of the Terra blockchain and the de-pegging of the UST stablecoin. Tether's value dropped to $0.95 during this event before returning to its pegged value.

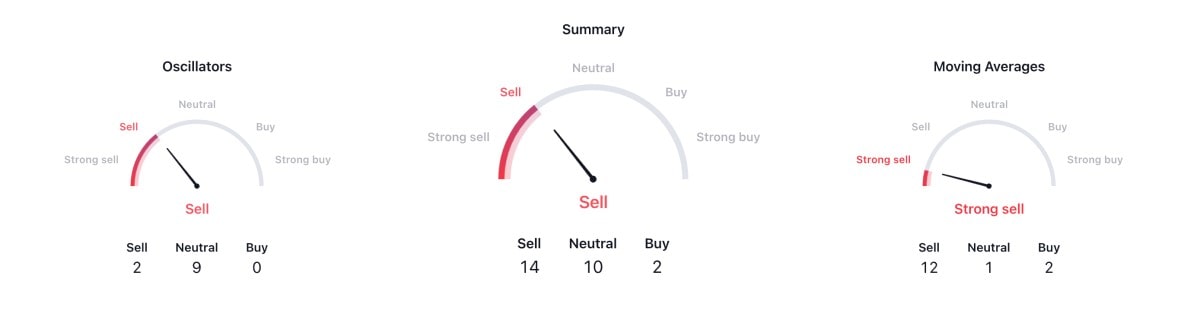

Tether technical analysis

The technical analysis of Tether (USDT) shows a predominantly neutral market sentiment. While some indicators suggest a potential selling pressure in terms of momentum and MACD, the majority of indicators, including RSI, Stochastic Oscillator, CCI, ADX, Awesome Oscillator, Stochastic RSI Fast, Williams Percent Range, and Bull Bear Power, point to a lack of clear directional bias. The Ultimate Oscillator also supports this neutrality.

Tether Price in 2024

In 2024, Tether (USDT) is anticipated to uphold its value at $1.00, driven by its role as a stablecoin.

Still, various resources share their own view on the stablecoin's future price moves. Thus, CryptoPredictions.com forecasts Tether to reach $1.006 by the year's end, with an expected average price of $1.008, representing a 0.82% increase from the current value, and a maximum predicted price of $1.260 by December 2024. BitScreener maintains a bullish sentiment, anticipating Tether's trading range to be between $0.9978 and $1.01 throughout the year.

Is Tether a good investment?

The answer hinges on your investment goals. If you are are looking for a cryptocurrency that maintains its value and can be efficiently traded for other blockchain-based assets, then it might be right for you. However, if your aim is profit generation, USDT might not align with your objectives

Tether (USDT) price prediction for 2024-2050

Many experts and cryptocurrency services have expressed their opinions about the future Tether crypto price. We've compiled a selection of these viewpoints to compare them easily.

WalletInvestor Tether price prediction for 2024, 2025, 2030, 2040 and 2050

As per WalletInvestor's USDT price prediction, the token's value is expected to increase by the end of 2024, reaching around $1.001. Looking ahead to 2025, the forecast for Tether's price is $1.001. By the end of 2028, the cryptocurrency's average value will be about $1.002.

CryptoPredictions Tether crypto price prediction for 2024, 2025 and 2030

According to CryptoPredictions, the price of the USDT cryptocurrency is expected to average $1.006 by the end of 2024. Moving into 2025 and beyond, the projected average price for the USDT cryptocurrency is around $1.006, as well.

CCN Tether price prediction for 2024, 2025 and 2030

According to the Tether crypto price prediction provided by CCN, the Tether price for 2025 or even 2030 would generally result in a value of $1.

PricePrediction USDT price prediction for 2024, 2025 and 2030

According to PricePrediction.net, Tether (USDT) is forecasted to experience a 5% increase, potentially reaching $1.004155. Their projections for subsequent years show gradual growth, with Tether expected to reach $1.000136 in 2024, $1.050143 in 2025, $1.10265 in 2026, $1.157783 in 2027, and $1.340278 by 2030.

Tether (USDT) future forecast in general

The future forecast for Tether (USDT) varies among different sources.

- WalletInvestor predicts a slight increase to around $1.001 by the end of 2024.

- CryptoPredictions shares a $1.006 USDT price prediction for the end of 2024 and an average of about $1.006 from 2025 onwards.

- CCN and other sources foresee a consistent value of $1 for 2025 and beyond.

- PricePrediction's outlook is more optimistic. It forecasts the asset price to grow gradually year-by-year to reach $1.340278 by 2030.

How high can Tether go?

This cryptocurrency is designed to hold a value of around $1 consistently. It undergoes audits and can endure significant demand. Nonetheless, there's always a chance of it facing challenges, so conducting thorough research before getting involved is crucial.

If you're entering the crypto space with hopes of substantial price surges in coins and tokens, Tether might not meet your expectations. If it significantly surpasses $1, that could signal significant issues.

USDT price prediction today

There's a chance that USDT could experience a modest increase in value. This could occur temporarily if a major event in the crypto market prompts investors to swiftly shift a substantial amount of funds to USDT as a secure refuge.

Why is USDT falling today?

Tether's (USDT) price fluctuations can be attributed to changes in the cryptocurrency market, economic news, regulatory announcements, and shifts in investor sentiment. It is essential to understand that USDT is a stablecoin pegged to the value of a specific asset (in this case, the US Dollar) and intended to uphold a consistent value despite external influences.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.