Why Bitcoin will surpass $100,000 per coin in the next 18 months

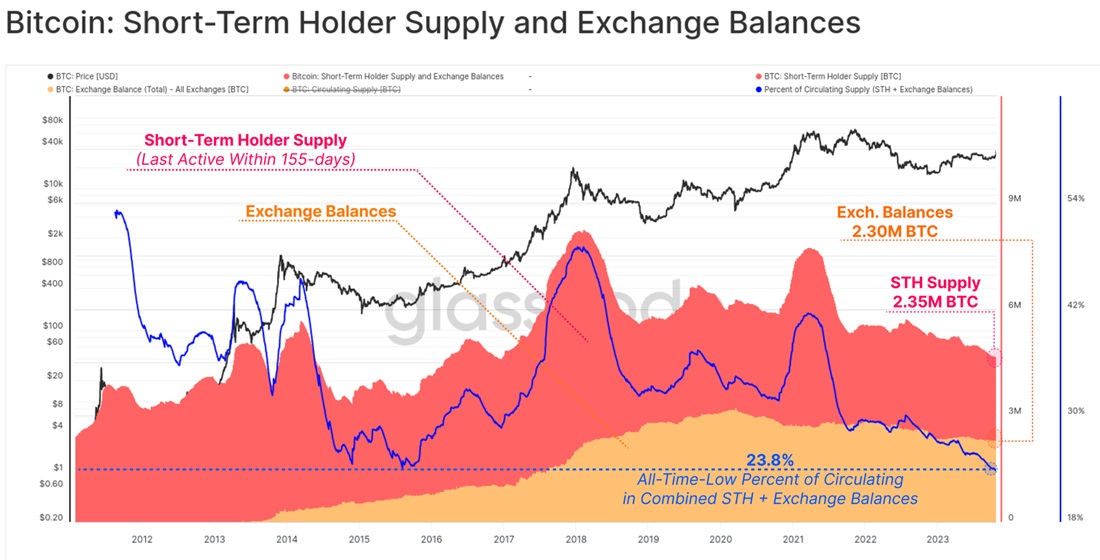

The speed at which hodlers are accumulating Bitcoin is already 2.2 times faster than the speed at which new coins are being issued. Furthermore, the volume of the 'hot' supply that can be released by short-term holders (STH) is shrinking at a rapid pace. This reduces the amount of available coins to an all-time low. The trend will strengthen significantly following the approval of spot ETFs in the US and the halving event in 2024.

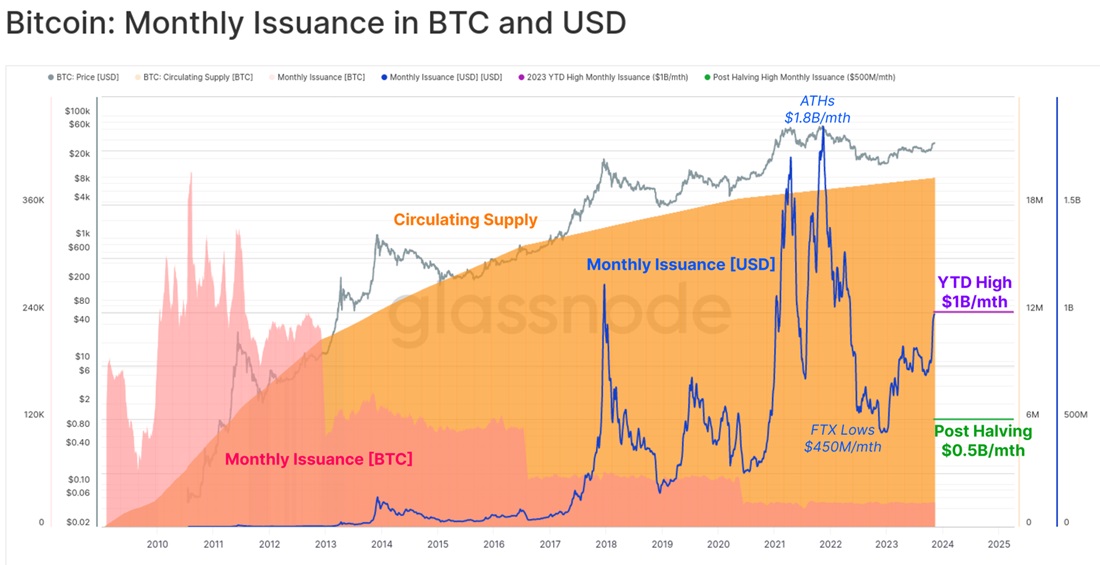

Since mid-2022, miners have been selling nearly all mined coins since mid-2022. At the moment, their pressure on the market is estimated to be $1 billion, and after the halving event, it will decrease to $0.5 billion per month, according to the Glassnode analytical agency.

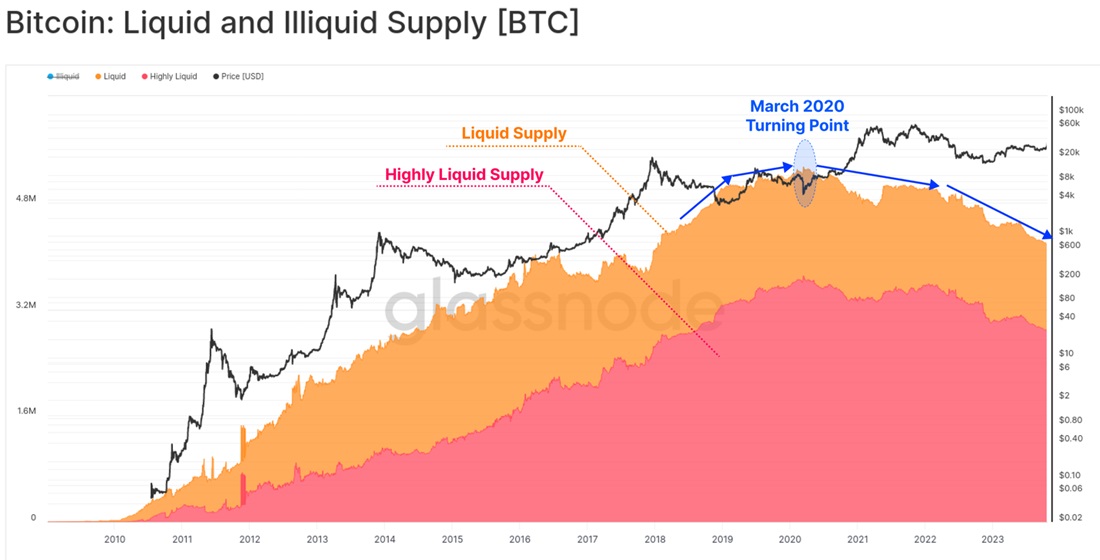

As for the liquid and highly liquid supply (hot wallets, crypto exchange accounts, short-term holders' addresses), they have been actively reduced since March 2020. This is due to the flow of coins to long-term holders who have not parted with their coins for more than six months, and 57.1% of coins from the circulating supply remain haven't moved at all for more than two years.

Currently, STH and crypto exchanges account for 2.3 million BTC, which collectively accounts for a modest 23.8% of the circulating supply. When coupled with the growing volume of coins with no movement, this leads to a historically low level of available supply.

These conditions are a good Bitcoin growth booster.

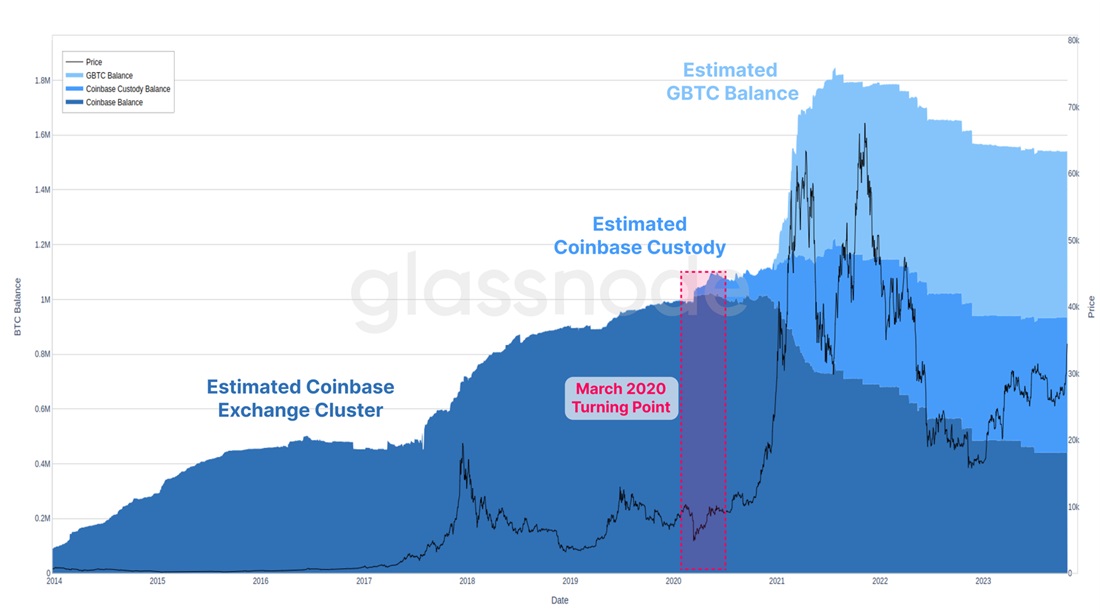

But there's a supply shock waiting ahead due to the emergence of spot ETFs in the US and the Bitcoin halving event expected to take place in April 2024. To have a rough idea of ETF's impact, one can look at the accumulation volumes by the GBTC trust fund and Coinbase's storage service for institutional investors (both options have downsides against the expected ETFs). These decisions and the reduction of the Fed's key rate to zero were the main drivers behind Bitcoin's price growth in 2020-2021.

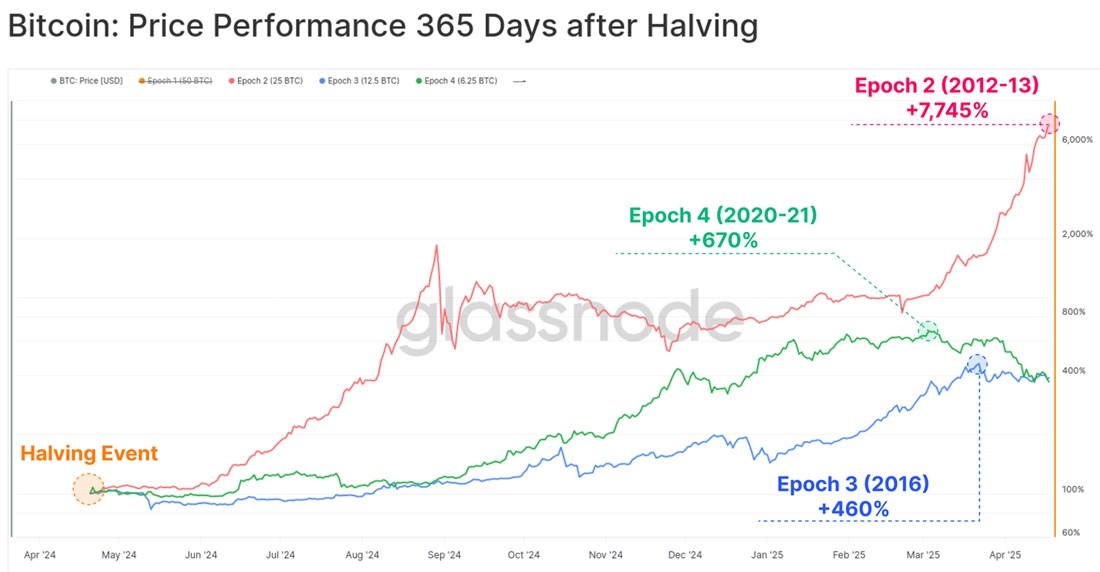

The inflow of institutional capital will coincide with the decline of new coins from 81,000 to 40,500 per quarter. If we just look at the halving by itself, such events have historically led to Bitcoin's price rising 460%-7745% in the first 12 months after the halving.

The overlapping of two such powerful factors and the high accumulation mood shown by most market participants can take Bitcoin past the $100,000 threshold in the next 18 months.

The Federal Reserve may be the fuel to the fire if it tightens its monetary policy, which would cause a recession and a decline of capital inflow into risky assets. However, the majority of economists agree that the regulator will loosen its grip in the near future.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.