Why Solana will benefit from MiCA implementation

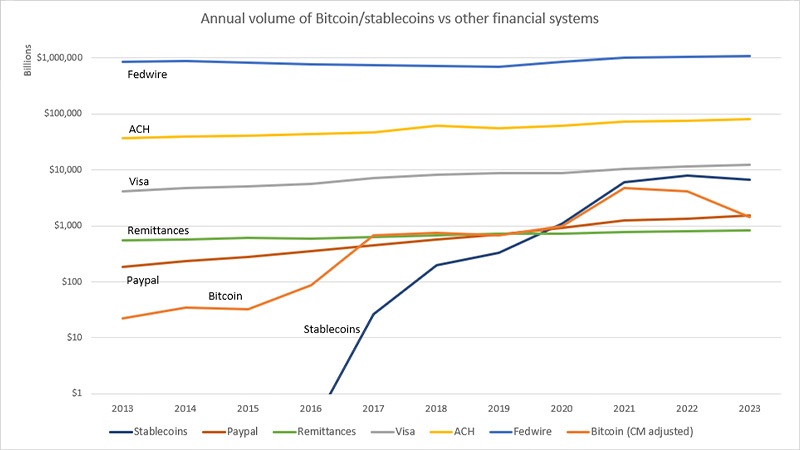

At the end of June, the MiCA bill came into force, regulating the crypto industry in the EU. One of the key areas it concerns involves stable coins and high requirements for issuers. In particular, the circulation of algorithmic coins is completely excluded, and the reserves of all others must be held in accredited banks and 100% be secured by fiat or government bonds.

Tether does not meet key requirements as:

- the company is incorporated offshore (in the British Virgin Islands);

- USDT is secured with a hodgepodge of fiat, government bonds, tokenized gold, Bitcoin and IOUs;

- information about correspondent banks is hidden from the public.

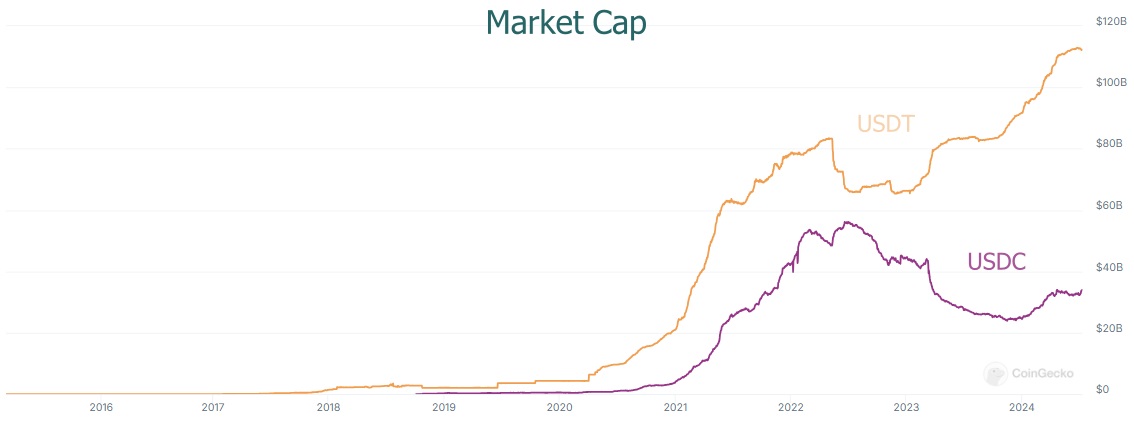

Now USDT is at the peak of growth with a capitalization of $113 billion. However, the introduction of MiCA and the imminent appearance of a similar regulatory act in the United States will lead to a reshuffle of forces in the market. Leading crypto exchanges in the eurozone, including Binance, Kraken and OKX, have already limited the turnover of this coin.

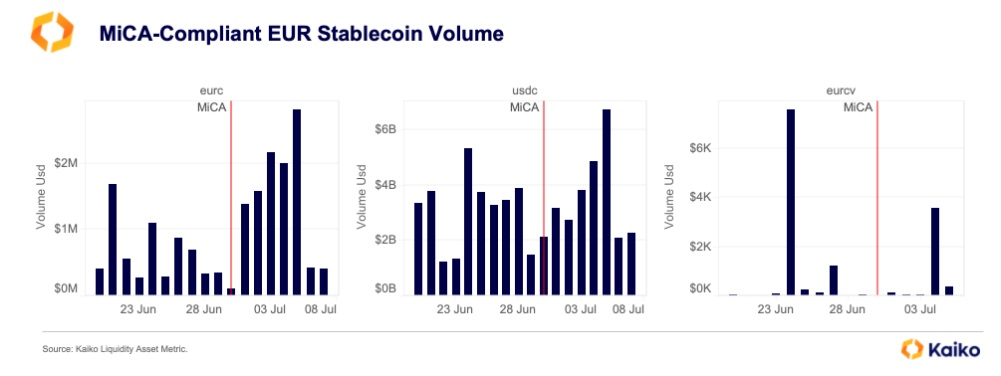

Circle, on the other hand, was given the green light to become the first European licensed issuer. This immediately affected the turnover of USDC and EURC.

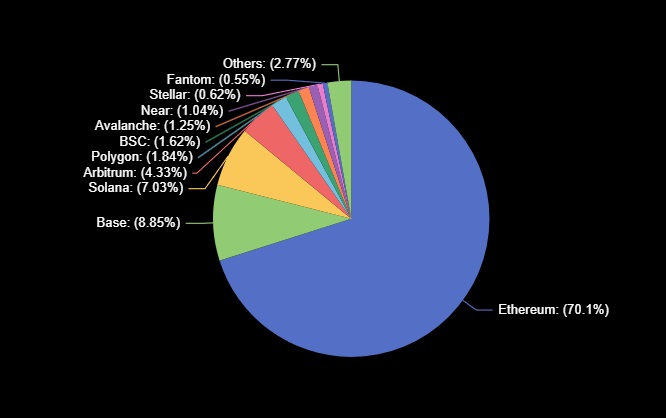

Among the blockchains conducting operations with USDC, Ethereum ranks first. But the network is losing ground due to low transaction processing speed and extremely high fees compared to its competitors.

Base is limited in growth for a number of reasons, such as being the second-tier blockchain on Ethereum released by Coinbase. But Solana has a high chance of eventually becoming the leading network for USDC processing. In particular, the potential is highlighted by the cooperation between Solana and VISA in the USDC interbank exchange pilot project. The payment giant appreciated the speed and cost of transactions.

If Solana lives up to expectations, SOL will rush to new heights: investment company VanEck with AUM of $102 billion in a bullish scenario predicts the coin to grow to $3211 by 2030.

But in order for this to happen, developers will need to learn how to deal with periodic failures and a high number of unsuccessful transactions. Perhaps the problems can be solved by introducing a new client-validator Firedancer, which enters the final stage of testing on July 10. The team announced the Bug Bounty program, promising to pay up to $1 million for any bugs found.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.