Why a US default would lead to the collapse of the crypto market

Bitcoin welcomed the bank collapse in March, moving up 21% to $28,400, as volatile monetary policy and the risk of new bankruptcies boosted interest in the decentralised asset. But in the event of the US defaulting on its national debt, the situation isn't so simple, as there's a strong connection between traditional finance and cryptocurrencies via stablecoins.

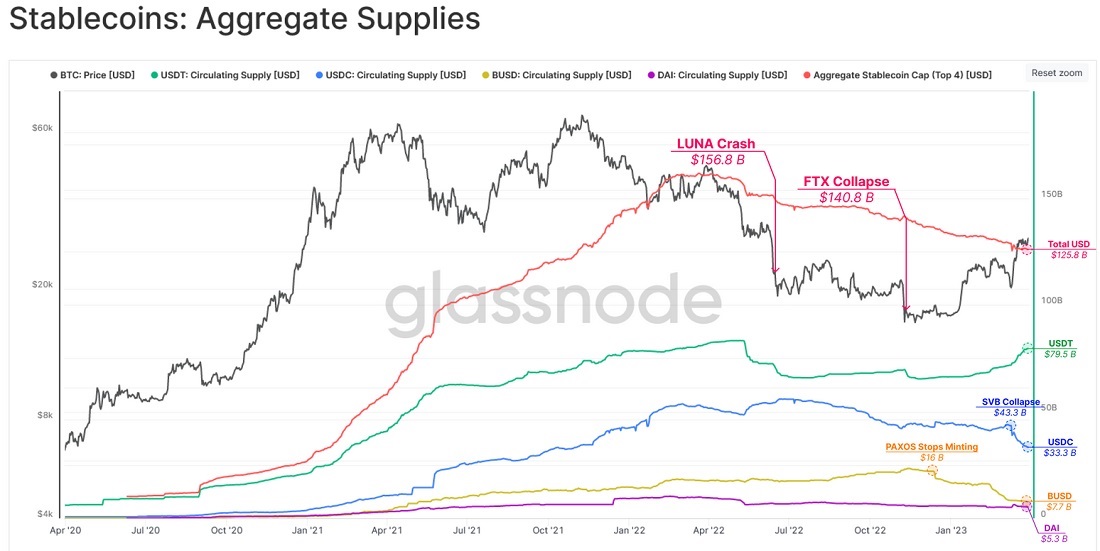

Stablecoins act as conductors, facilitating the payments and valuation of cryptocurrencies. Most crypto exchanges use stablecoins as a base payment currency for financial operations. Despite the loss of credibility and long-term decline of this segment caused by the collapse of the third-largest stablecoin, UST, a year ago, it's still a significant element of the crypto system, with a market capitalisation of $130 billion or 12% of the entire market.

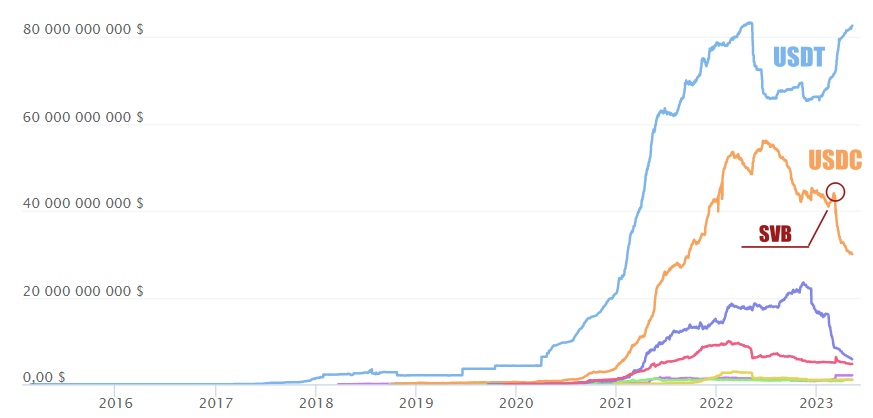

USDT and USDC are the leading stablecoins, each with a share of 64% and 23%, respectively. However, the latter has shown a significant dependence on the banking sector, losing its peg to the dollar amid SVB's bankruptcy and trading at a 10% discount on 11 March. It was a result of blocking SVB's 8% collateral and a risk of losing funds. Since then, USDC has seen its capitalisation cut to $30 billion.

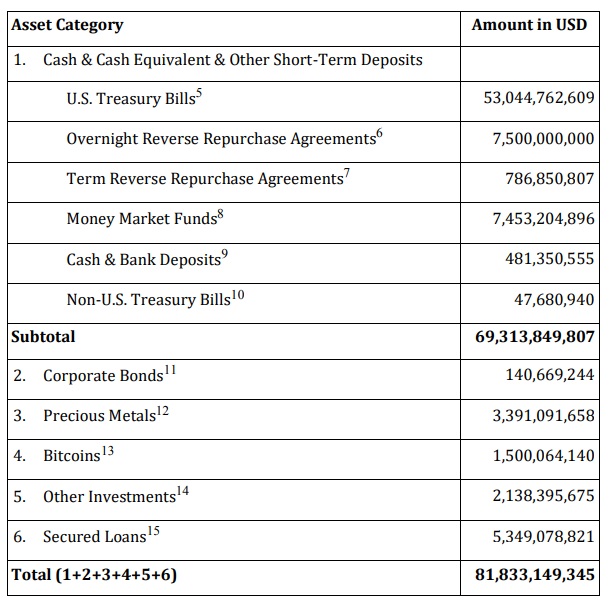

What's more, the primary danger is not just and not so much that assets are held at banks, as it is that US Treasury Bonds make up a large share of what's held in these stablecoins' reserves. If one can depend on the invulnerability of a systemically important bank when choosing a counterparty, things change when it comes to the potential for a default on American debt. In that case, US bonds held in reserves would turn into worthless paper.

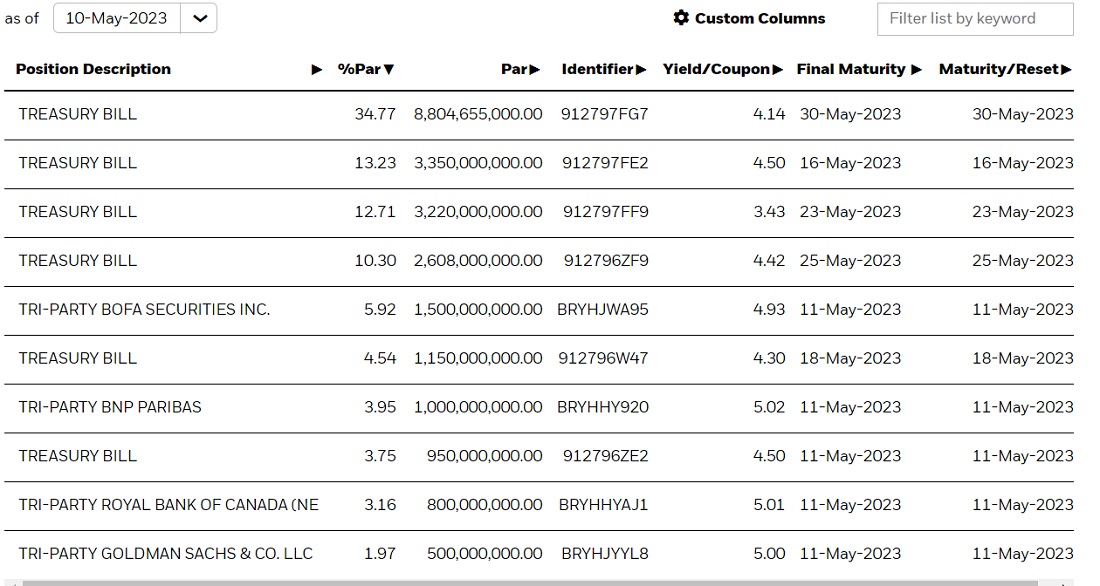

Anticipating the new risks, Circle (USDC's issuer) adjusted its portfolio. Now, the maturity date of the bonds it holds is coming by June, the month that a default could potentially be announced.

Assessing Tether's risks is a lot harder because it's not known exactly which banks hold its reserves and which assets are included in the "corporate bonds" section due to the company's offshore registration and unwillingness to go into details. In terms of bonds, they account for 74%, worth $60.5 billion, while the average expiry date is "less than 90 days".

From this, we can conclude that USDT has a non-zero chance of losing its peg to the dollar if the US defaults on Treasury bonds.

Despite Bitcoin's opposition to the traditional financial system and the collapse of the dollar in the event of a default, the cryptocurrency market could face panic and sell-offs due to the loss of USDT's peg to fiat. It's also worth noting that the likelihood of a default being announced is still low since it would entail systemic risks and hard-to-predict consequences for the US economy.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.