Bitcoin After Halving 2024: What's Next?

With the countdown to the Bitcoin halving event of 2024 underway, the cryptocurrency community eagerly awaits the implications of this milestone. With the halving date drawing near, let's assess the implications of this event and explore its potential impact on Bitcoin's future trajectory and price.

Gold is a great way to preserve wealth, but it is hard to move around. You do need some kind of alternative, and Bitcoin fits the bill. I'm not surprised to see that happening. — James Rickards, investment banker.

What is Bitcoin halving?

Bitcoin halving is an event programmed into the Bitcoin protocol that occurs after every 210,000 blocks mined, which is approximately every four years. During a halving event, the reward that Bitcoin miners receive for validating transactions and adding them to the blockchain is cut in half. This reduction in block rewards serves as a mechanism to control the supply of new bitcoins entering circulation, ultimately contributing to the predetermined limit of 21 million bitcoins.

The process of halving is integral to Bitcoin's deflationary monetary policy, designed to mimic the scarcity characteristic of precious metals like gold. By reducing the rate at which new bitcoins are minted, halving events play a crucial role in managing inflation.

What is Bitcoin halving countdown?

The Bitcoin halving countdown refers to the time remaining until the next scheduled halving event in the Bitcoin network. Various online platforms and websites provide real-time countdown timers, displaying the exact time and date when the next halving is expected to occur. These countdowns are based on the predetermined block height at which the halving will take place, as defined by the Bitcoin protocol.

The Bitcoin halving countdown is closely monitored by the cryptocurrency community due to its potential impact on market dynamics and investor sentiment. As the countdown progresses and the halving event draws nearer, speculation and anticipation often intensify, leading to increased activity in the Bitcoin market.

When is the next Bitcoin halving?

The next halving is due to take place around 20 April 2024. This will be the fourth BTC halving. It will result in a reduction of the block reward to 3.125 BTC per block.

How the halving could impact Bitcoin's price

The halving event can potentially impact Bitcoin's price through several mechanisms.

- Supply reduction. The most immediate impact of halving on the BTC price is a decrease in the rate at which new bitcoins are created. However, it's worth noting that this effect decreases with each subsequent halving.

- Market sentiment. Halving events generate significant media attention and speculation within the cryptocurrency community and beyond. Positive sentiment surrounding the halving may attract new investors and traders who anticipate potential price appreciation. This increased demand could further fuel upward price movements.

- Historical precedence. Previous halving events in Bitcoin's history have been associated with significant price rallies in the months and years following the event. While past performance is not indicative of future results, historical patterns may influence market participants' expectations and behaviour, contributing to price movements around the time of the halving.

Previous Bitcoin halvings and their effect on the BTC price

So far, there have been three Bitcoin halving events, and a fourth is expected soon.

Bitcoin halving dates

Halving | Date | BTC price 30 days before halving | BTC price at halving | BTC price 30 days after halving | BTC price 1 year after halving |

First | 28 November 2012 | $10.60 | $12.35 | $13.42 | $1101.47 |

Second | 9 July 2016 | $575.52 | $652.65 | $592.57 | $2502.82 |

Third | 11 May 2020 | $6888.70 | $8571.67 | $9893.44 | $56759.91 |

The first halving (2012)

The first Bitcoin halving took place on 28 November 2012, reducing the block reward from 50 to 25 bitcoins.

In the months leading up to the halving, speculation and anticipation heightened, with many investors anticipating a bullish trend. Before halving, Bitcoin's price experienced relatively low levels of volatility and trading activity. Following the halving, Bitcoin's price began to steadily rise over the subsequent months, eventually reaching new all-time highs.

The first halving marked the beginning of a significant bull run for Bitcoin, with the price eventually surpassing $1,000 in late 2013.

The second halving (2016)

The second Bitcoin halving occurred on 9 July 2016, reducing the block reward from 25 to 12.5 bitcoins.

Similar to the first halving, anticipation and speculation surrounding the event intensified in the months leading up to the halving date. Post-halving, the price declined for about a month, but then the bull run began, during which Bitcoin's price surged to nearly $20,000 in late 2017.

The third halving (2020)

The third Bitcoin halving took place on 11 May 2020, reducing the block reward from 12.5 to 6.25 bitcoins.

Two months before halving, the crypto market crash occurred due to the Covid-19 pandemic. However, the price managed to recover during the remaining time before the halving. Following the halving, the price moved sideways for a while, but a new bull run began in October 2020, with Bitcoin reaching $69,000 in November 2021.

Predictions for Bitcoin halving 2024

Any predictions regarding the price of cryptocurrencies should be taken with a grain of salt. The same goes for the Bitcoin halving and predictions of what will happen after it in 2024 and beyond. Having said that, it's still possible to make some assumptions about how events may unfold after the fourth halving.

Bitcoin halving 2024 price prediction

Historical analysis of previous Bitcoin halvings reveals recurring patterns and trends that shed light on the potential impact of these events on Bitcoin's price and market dynamics. Although past performance doesn't indicate future results, we can use these patterns as a basis for making predictions about the possible future price of Bitcoin. However, it's important to recognise that market dynamics are complex and are influenced by multiple factors, so predictions based solely on historical data should be approached with caution.

In case the established pattern is repeated, the Bitcoin price is likely to move sideways or even correct for some time after the halving. After that, the bull run will continue and peak approximately by the winter of 2025 at around $150,000-$160,000. The retracement caused by the subsequent bearish trend may bring the price to the levels of $50,000-$65,000.

Will altcoins go up after the Bitcoin halving?

Altcoin prices tend to be highly dependent on the dynamics of Bitcoin's price. If the bull run continues after the halving, altcoins are also expected to go up.

Halving and Bitcoin mining

The reduction in block rewards can have profound implications for miner economics. Since block rewards constitute a significant portion of miners' revenue, the halving event can lead to a decrease in miners' profitability, especially for those operating less efficient mining operations. Miners must adapt to the reduced rewards by optimising their operations, upgrading hardware, or adjusting operational expenses to remain profitable post-halving.

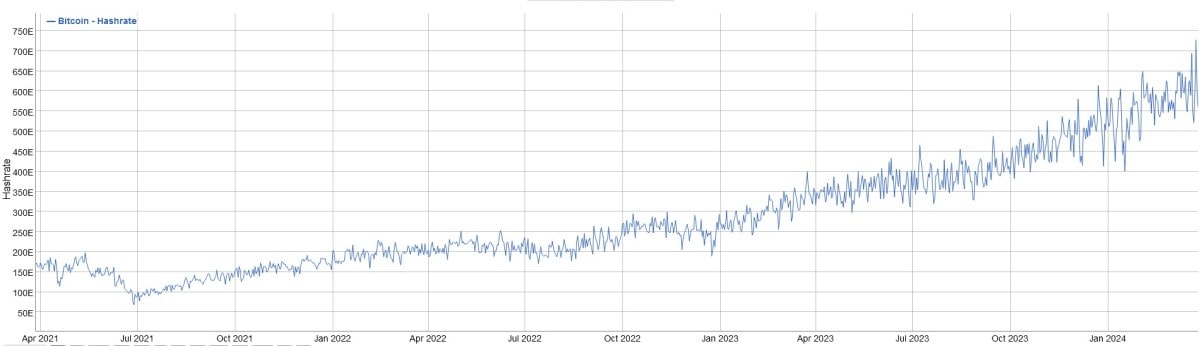

Following a halving event, some miners may choose to exit the network due to decreased profitability. As a result, the network hashrate may decline, leading to longer block times. However, Bitcoin's difficulty adjustment mechanism ensures that the network automatically recalibrates to maintain a target block time of approximately 10 minutes, thereby stabilising the mining ecosystem.

The halving event can lead to shifts in the mining landscape, with some miners ceasing operations while others may continue or increase their mining activities. Miners with access to low-cost electricity and efficient mining hardware are better positioned to weather the post-halving challenges and remain profitable. Consequently, the halving may contribute to centralisation pressures within the mining ecosystem, favouring larger, more established mining operations over smaller participants. However, Bitcoin's growing adoption drives up the price, mitigating the effects of halving and increasing the profitability of mining operations. And Bitcoin's scarcity achieved through the halving mechanism helps with that.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.