Why does crypto go up and down: what determines crypto price?

The high volatility of cryptocurrencies is one of the main things that attract traders to the crypto market. But why do crypto prices go up and down, and what determines cryptocurrency value? Let's find out.

What is a cryptocurrency?

A cryptocurrency is a type of digital currency based on a decentralised payment system that operates in a fully automatic mode. Cryptocurrency transactions are recorded on the blockchain. Cryptocurrencies are protected by cryptographic methods that make them extremely difficult and costly to hack.

The lack of any internal or external administrator for cryptocurrencies leads to the fact that banks, tax, judicial and other authorities or institutions cannot influence the transactions of any participants in the payment system. Cryptocurrency transactions are carried out directly without the approval and control of a third party and are irreversible. As such, no one can cancel or block a transaction or make a transaction without a private key.

Most cryptocurrencies provide pseudonymity, i.e., all transactions between all addresses are publicly available, but there is no information about the owners of the addresses.

I was very excited about a currency that was not controlled by a central government, that could be a free market currency. That was all the incentive I needed to dedicate my life to it. — Erik Voorhees, Founder and CEO of ShapeShift.

Why does crypto go up and down?

Cryptocurrencies are assets, and, as with any asset, the price of a cryptocurrency is subject to changes. Since cryptocurrencies don't have a governing body that can dictate their price directly, the price of a particular cryptocurrency is determined by the balance of supply and demand in the market. The exception is stablecoins, whose prices are pegged to fiat currencies and fluctuate with them.

What determines cryptocurrency price?

As mentioned above, the balance between supply and demand determines the price of a cryptocurrency. But what influences its supply and demand? The answer is many factors, so we'll list the main ones.

Factors influencing supply include:

- The volume of the cryptocurrency's issuance and its duration. How much of a particular cryptocurrency hits the market every year? Does it have a limited maximum supply (like Bitcoin), or is it unlimited (like Ethereum)? Obviously, the more of a particular cryptocurrency enters the market, the less each coin of that cryptocurrency will be worth.

- Burning coins. When large volumes of coins are burned, their supply is reduced, which has a positive effect on their price.

- Dumps. The sale of large volumes of coins by large holders negatively affects the price.

Factors influencing demand include:

- Cryptocurrency acceptance. The more actively any cryptocurrency is used in real financial transactions, the higher the demand for it is. The proliferation of crypto ATMs and an increase in the number of businesses accepting cryptocurrencies as a payment method have a positive effect on the price of crypto.

- The relevance of a cryptocurrency. If a cryptocurrency is aimed at solving a real problem, this increases the chances of its price growth.

- Technical solutions. The innovative and elegant technical solutions that underlie cryptocurrency increase its competitiveness, and hence the demand for it.

- Marketing. Even the most innovative and relevant cryptocurrency isn't in demand if few people know about it.

- An active community of supporters. As you can see from the example of the Shiba Inu coin, the hype created by the community of supporters can greatly increase the price of a cryptocurrency.

- Listing on exchanges. After being listed on large cryptocurrency exchanges, a cryptocurrency's price usually rises.

- Competition with other cryptocurrency projects. At the moment, over 16,600 different cryptocurrencies are registered on CoinMarketCap. The emergence of new promising projects and positive news from existing ones can win over buyers from other projects.

- Development of a crypto project. An actively developing project tends to attract the attention of investors and traders, and that has a positive effect on the cryptocurrency's price. Conversely, if developers abandon their project, this can cause a severe drop in the price of the corresponding coin.

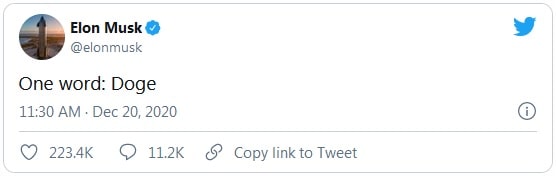

- Mass media and influencers can both fuel hype and create a negative opinion about crypto among those who listen to them. Remember how the price of Dogecoin soared after Elon Musk's tweet.

- Forks. Forks and other technologically important events can also affect a cryptocurrency's price.

- Regulators. Regulatory actions in regards to cryptocurrencies can have an impact on the crypto market, increasing or decreasing demand.

- Macroeconomic events. Economic crises, inflation of fiat currencies and other similar events often influence the entire crypto market.

As you can see, there are quite a few factors that can affect the price of a cryptocurrency.

Why is crypto going up today?

Given the number of factors that can influence the price of a cryptocurrency, it's often difficult to say with certainty which particular factor or factors had a decisive impact on the rise or fall of the price. Moreover, the factors differ not only in the strength of their influence on the supply and demand balance but also in the duration and speed. Some factors may have an immediate impact, while others do so for some time after the event. The influence of some factors is short-lived, while others launch long-term changes.

Of course, there are situations when the reason for the rise or fall in a cryptocurrency's price is quite obvious. However, much more often, it's very difficult or even impossible to answer the question "Why did crypto go up today?" with certainty.

But there is good news, as well. If you're into crypto trading, you don't need to know the answer to this question. One of the main tools of a crypto trader is technical analysis, which is based on the Dow Theory. The first fundamental idea of this theory is that the market price of an asset already incorporates all the needed information. As such, the trader doesn't need to spend time trying to understand what exactly influenced the price. That time would be spent much more productively on analysing the price chart.

Why does the market make cryptos go up and down together?

This phenomenon exists in the crypto market and more traditional markets and is called market correlation. There are certain patterns according to which various assets prices move in relation to each other. Since the crypto market is still quite young, and the market capitalisation of the entire cryptocurrency market is generally small compared to traditional markets, there is one main asset that affects the prices of all other cryptocurrencies. This asset is Bitcoin. Therefore, prominent bullish or bearish sentiment in the Bitcoin market affects both Bitcoin and the entire crypto market.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.