The Ethereum Casper protocol explained

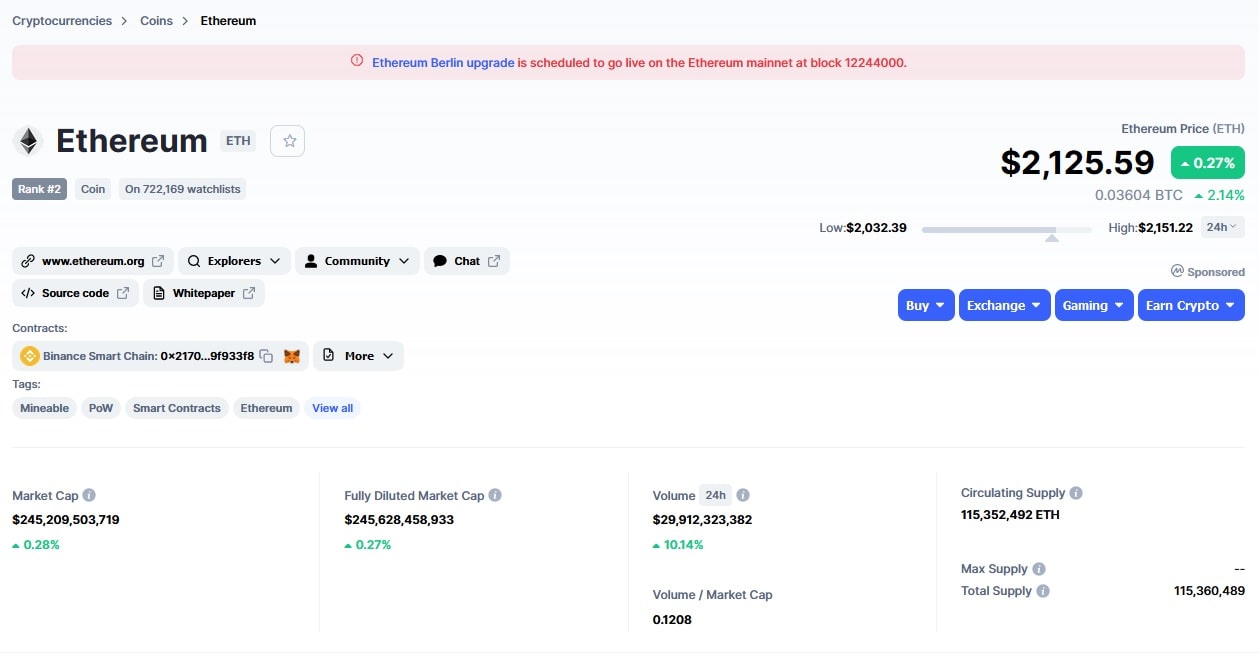

Ethereum, the platform behind the second-most-popular cryptocurrency in the world, was created in 2015. Even before the decentralised app development platform launched, its creator, Vitalik Buterin, intended to use the proof-of-stake consensus algorithm in it. His plan failed at the time, resulting in the platform launching on a proof-of-work consensus algorithm. However, the developers of Ethereum didn't give up their intention to switch the platform to proof-of-stake. They've worked on it ever since, which is why a PoS protocol named Casper is being designed for Ethereum. In this article, we'll explain what the Casper update for Ethereum is, how it works, what problems it aims to solve and when the Ethereum Casper release is expected.

What is the Ethereum Casper protocol?

Casper is a variant of the PoS protocol designed for use on the Ethereum network. The process of gradually implementing this protocol is currently underway. After the Ethereum network finally switches to using the Casper protocol, Ethereum mining will be a thing of the past, entirely replaced by staking.

Why is the Casper protocol needed?

The decision to endeavour on such a long and complex process as the Ethereum network's transition to the proof-of-stake algorithm wasn't made without good reason. The proof-of-work algorithm that has been used since launching the network has many disadvantages. At the same time, the standard version of the proof-of-stake algorithm also has several problems that the Ethereum developers want to solve before finally transitioning to it.

One of the reasons why we're doing a proof-of-stake is because we want to greatly reduce the issuance. — Vitalik Buterin

Problems with the PoW algorithm

Even though proof-of-work is a popular algorithm successfully used in many cryptocurrencies, it's still a relatively old technology (by crypto industry standards) with many drawbacks. This has resulted in regular criticism of the algorithm.

The Ethereum network transition to proof-of-stake aims to solve the following main problems inherent in the proof-of-work algorithm:

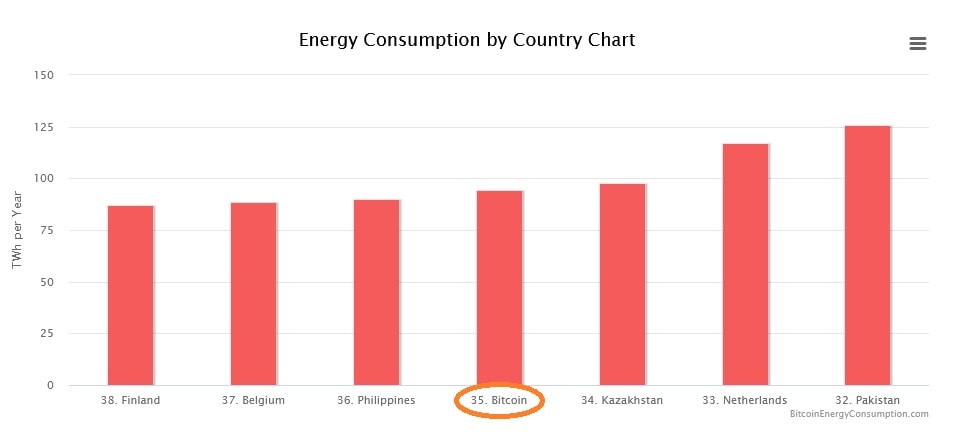

- Energy inefficiency. Block mining cryptocurrencies with PoW algorithms consume a lot of electricity. Bitcoin is a particularly illustrative example of this. Bitcoin mining already consumes more electricity for its network to function than some entire countries. To make matters worse, these increasing amounts of electricity are actually wasted, providing nothing but the Bitcoin network's functioning. Cryptocurrencies using the PoS algorithm are free of this disadvantage.

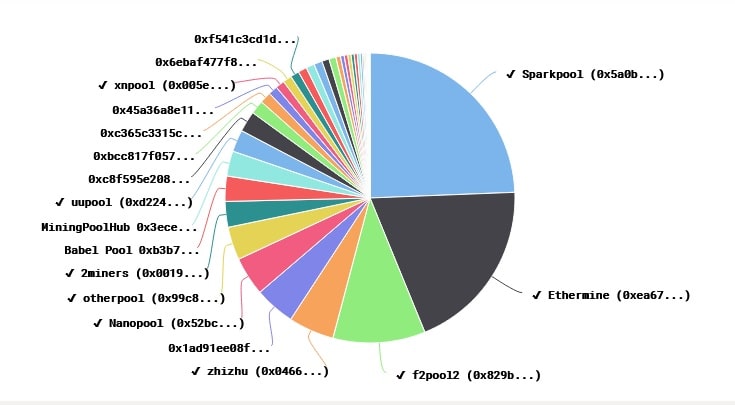

- The high costs of mining equipment and electricity required to mine PoW cryptocurrencies led to a situation in which mining is only profitable for wealthy people or companies. As such, control over the network is increasingly transferring to owners of large mining facilities. This phenomenon contradicts the very idea of decentralisation underlying cryptocurrencies.

- The probability of a 51% attack. If attackers can accumulate 51% of the hashrate of a PoW-based cryptocurrency, they'll have enough power to cancel or change transactions. Ethereum may be a very popular cryptocurrency with a very high hashrate that makes such an attack extremely unlikely, but an attack can't be completely ruled out. That's especially true given the increase in mining centralisation mentioned above. At the time of writing, the three largest Ethereum mining pools control 54.11% of its hashrate.

Additionally, Proof of Stake is more censorship-resistant. GPU mining and ASIC mining are both very easy to detect: they require huge amounts of electricity consumption, expensive hardware purchases and large warehouses. PoS staking, on the other hand, can be done on an unassuming laptop and even over a VPN. — Vitalik Buterin

Problems with the PoS algorithm

Although proof-of-stake is a newer consensus algorithm, it has several disadvantages of its own. Ethereum's developers tried to take these drawbacks into account and fix them when designing Casper.

- One of the significant drawbacks of the PoS algorithm is the so-called 'Nothing at stake' problem. It lies in the fact that block validators can simultaneously support several competing block versions, including fraudulent ones, to increase earnings. In this case, they risk nothing and receive a reward no matter what. In the Casper protocol, this problem is solved by introducing a penalty for maintaining a short blockchain branch. The validators stake a certain amount of their Ethereum before starting to validate the blocks. A validator who has placed bets on several different block versions at the same time loses his money.

- Another potential PoS problem is a 'long-range attack'. Attackers in control of old private keys can use them to create a competing version of the blockchain. If there are enough keys under its control, a group of attackers can try to completely rewrite the history of transactions over a long period and make a fork of the Ethereum blockchain. Casper offers a solution to this problem: as soon as two-thirds of the validator pool votes for a block, the nodes finalise the block and precludes reorganisation. A long-range attack is only possible when the nodes are turned off.

How Casper protocol works

Casper is an economic consensus protocol based on a security deposit. This means that the nodes — so-called 'validators' — must place a deposit to serve the consensus by producing blocks. The ability to directly control such deposits built into the protocol is the main way to influence the amount of reward received by validators. In particular, if the validator produces something that Casper considers invalid, its deposit will be cancelled along with the validator's right to continue participating in the consensus process.

The use of security deposits eliminates the 'Nothing at stake' problem in which the violator risks nothing when misbehaving. There is a stake, and there is an objective method of assessing behaviour. The validators will lose this stake if they behave inappropriately.

It's hugely important that the validator's signature is economically significant at every point in time as long as the validator places a deposit. This means that clients can only rely on the signatures of validators known to have a deposit placed at the moment. When clients download and check the state of consensus, their verification includes only validators with a deposit at the time of verification.

Casper on Ethereum release date

The ultimate goal of the Casper protocol's implementation is to update the Ethereum network to Version 2.0, also called Serenity. The new version should be faster, more efficient and more scalable. The transition has several phases that have been postponed many times, although the process hasn't stopped. The first phase of the transition to Ethereum 2.0 officially began on 1 December 2020 with the launch of the Beacon Chain, the new coordination blockchain for ETH 2.0. Still, the process remains far from complete; it's difficult to name even an approximate date for the final transition to Ethereum 2.0.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.