Litecoin (LTC) halving

Cryptocurrency developers have different approaches to solving the question of how to limit the number of coins of a given cryptocurrency. Some, like Ripple, issue a certain fixed amount of coins from the very beginning. Others, like Ethereum, set a certain fixed amount of annual inflation. With the first cryptocurrency, Bitcoin, this issue is resolved using a mechanism called halving. Litecoin, which is kind of Bitcoin's 'little brother', inherited this method from it. So, let's talk about Litecoin halving: its meaning, its effect on price, its cryptocurrency halving dates and history and more.

Reducing the incentive for miners is good for LTC because only serious people will remain in the space. As for the price action, it is difficult, and it depends a lot on the sentiment, but usually this kind of action is positive for the price.- Naeem Aslam, chief market analyst at ThinkMarketsFX.

What is Litecoin halving?

First, let's get Litecoin halving explained. New Litecoins are created when miners add new transactions to blocks. The miner who added the block receives a certain amount of Litecoins as a reward for doing that. This amount consists of a fixed number of new Litecoins and transaction fees included in the block halving. Unlike the Bitcoin network, where new blocks are added approximately every 10 minutes, on the Litecoin network, blocks are added a little faster — once roughly every 2.5 minutes.

After every 840,000 blocks are mined, the block reward is halved. Considering the average block mining rate of 2.5 minutes, this occurs approximately once every 4 years. This event is called Litecoin block reward halving or simply Litecoin halving, and it's pre-programmed in the Litecoin algorithm.

When Litecoin was launched, the block reward was 50 LTC. Now, after two cryptocurrency halvings, the Litecoin block reward was 12.5 LTC.

The purpose behind Litecoin halving

The main purpose of block halving is to control the supply of Litecoin. Unlike traditional fiat currencies, which are issued by central banks in whatever amounts they deem necessary, the supply of Litecoins grows at a constant rate that halves every 4 years. Thanks to block halvings, the maximum amount of Litecoins that can be mined is limited and equals 84,000,000. This prevents inflation, a constant companion of national currencies. The rapid growth in the number of coins at the initial stage of cryptocurrency evolution solved the issue of their initial distribution and incentivised miners to mine this cryptocurrency. Thus, by the time of the first halving, Litecoin already enjoyed a certain level of popularity and adoption.

The gradual reduction in the supply of Litecoin through halvings keeps inflation at bay while simultaneously providing an incentive for miners to continue mining and thus keep the Litecoin network running.

The impact of LTC halving on miners

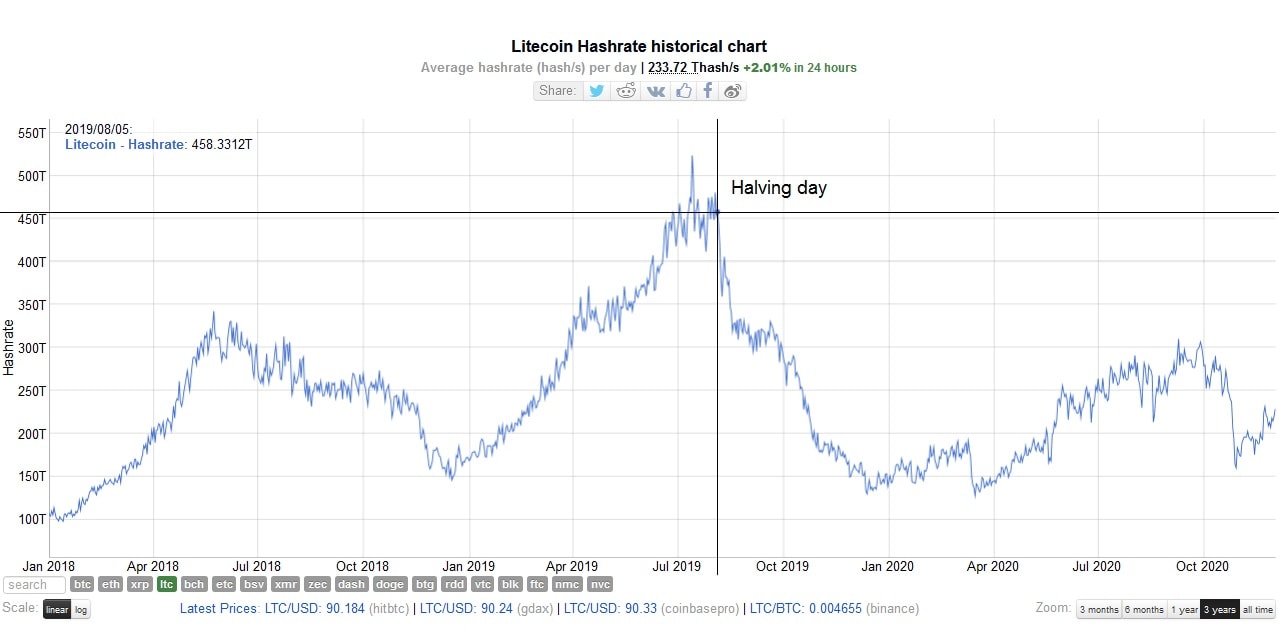

As you might guess, a decrease in block reward will inevitably affect miners' income. If the first halving had almost no effect on the Litecoin hashrate, causing only a short-term decrease of 15%, the second one caused a severe drop in the hashrate. This means that after the second block halving event, miners began to massively switch to mining other cryptocurrencies until the difficulty of Litecoin mining decreased to more acceptable values.

When is the next Litecoin halving?

The next LTC halvinghappenedon 2 August 2023. During that cryptocurrency halving event, the block reward dropped to 6.25 LTC. A visual countdown to the next Litecoin halving can be found on some websites, such as www.litecoinblockhalf.com.

Litecoin halving price history

Litecoin halvings occur and will occur approximately every 4 years until the block reward is less than the smallest possible fraction of Litecoin, 1/100-millionth. As with Bitcoin, this will happen after the 33rd halving. To date, only three halvings have occurred. Let's take a closer look at past crypto halving dates and LTC's price behaviour around these dates.

Pre-halving period

Litecoin was created by Charlie Lee, a former Google employee. According to Lee, Litecoin was not intended to compete with Bitcoin but was designed to be used in smaller transactions. The Litecoin network was launched on 13 October 2011. In November 2013, the value of Litecoin experienced significant growth, and as a result, its market cap exceeded $1 billion. However, after that, its price steadily declined until May 2015.

Pre-halving period

Date | 13 October 2011 |

Block number | 0 |

Block reward, LTC | 50 |

LTC created per day | 28,800 |

LTC price at the start | N/A |

LTC price 100 days later | N/A |

LTC price 1 year later | N/A |

Litecoin halving 2015

Litecoin's first halving took place on 25 August 2015. Even before the event, starting from the end of May, the price was on an upward path. But, after reaching its peak on 10 July, it began to fall right up to the halving itself. After the halving event, the fall stopped. However, Litecoin did not experience any real significant growth until May 2017, when the entire crypto market experienced a sharp rise. In addition, in May 2017, the Litecoin network activated the SegWit protocol, which probably had a positive impact on its price. On 18 December 2017, Litecoin reached its all-time high price of $357.

First LTC halving

Date | 25 August 2015 |

Block number | 840,000 |

Block reward, LTC | 25 |

LTC created per day | 14,400 |

LTC price at the start | $3.05 |

LTC price 100 days later | $3.35 |

LTC price 1 year later | $3.85 |

Litecoin halving 2016-2018

There were no LTC block halvings during these dates.

Litecoin halving 2019

The second Litecoin halving occurred on 5 August 2019. The half-year bullish trend turned bearish at $146.95 on 22 June 2019. While many people expected the cryptocurrency halving to have a positive impact on the price, that did not happen. After the halving, the price continued to fall.

Second LTC halving

Date | 5 August 2019 |

Block number | 1,680,000 |

Block reward, LTC | 12.5 |

LTC created per day | 7200 |

LTC price at the start | $93.03 |

LTC price 100 days later | $61.50 |

LTC price 1 year later | $57.63 |

Litecoin halving 2020

There was no LTC block halving in 2020.

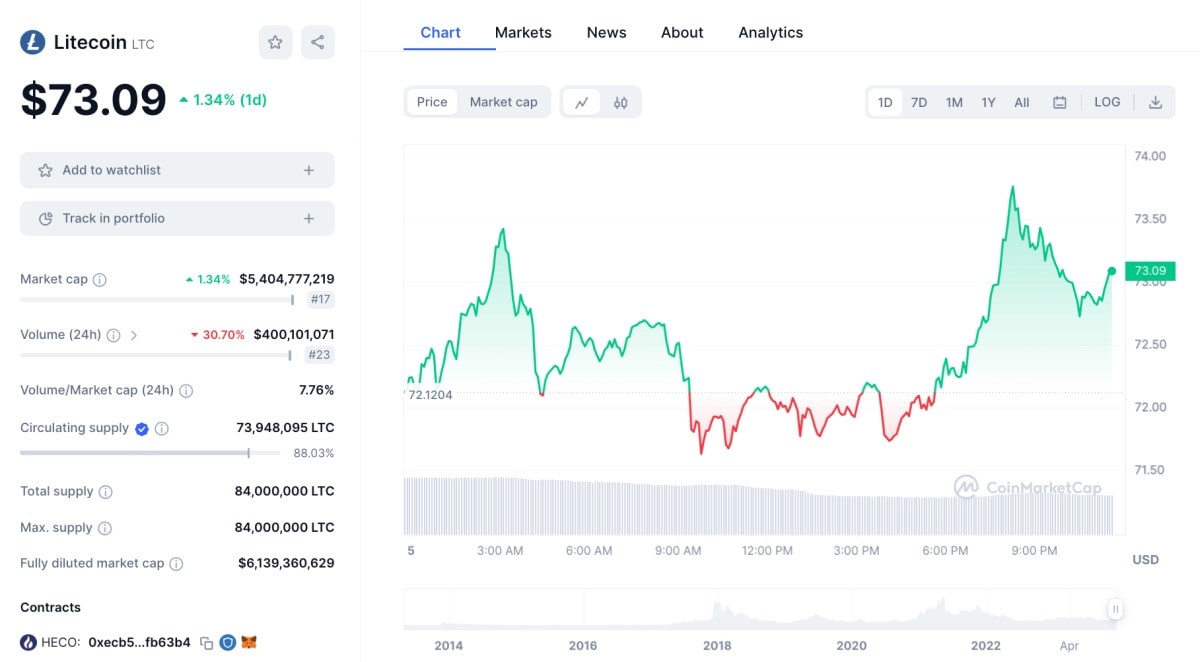

Litecoin halving 2023

The last halving event for Litecoin happened on 2 August 2023. This cryptocurrency halving event resulted in a reduction of the block validation reward to 6.25 LTC. As of now, the price of LTC stands at approximately $70.

Historically, previous halving crypto dates have caused a temporary increase in LTC's price, followed by a stabilisation period. The current block-halving event could follow a similar pattern, with a potential rally in price followed by a settling down. However, it is essential to note that last halving events do not guarantee the same outcome for the current situation.

The next halving event is set for 2027, causing mining rewards to decrease from 3.125 LTC to 1.5625 LTC per block. This occurrence is anticipated to generate scarcity, potentially influencing the price and market sentiment of the cryptocurrency.

Looking ahead to 2024, there is expected to be a positive start to the year due to a stable global economic and political outlook. This could contribute to a rally in LTC's price, possibly exceeding $300 at the beginning of 2024 before settling around $250. Additionally, another rally may be towards the end of the year, pushing the price towards $400. On average, experts predict that the price of Litecoin in 2024 will be around $350.

It is worth noting that Litecoin's block-halving process is similar to that of Bitcoin and other cryptocurrencies. However, each cryptocurrency has its unique block time and cryptocurrency halving schedule, contributing to different supply dynamics and potential market responses.

Litecoin price prediction after halving

Many people might ask, "Will Litecoin halving increase its price?" The honest answer is nobody knows for sure. The effect of Litecoin's halving on its price is a highly debatable issue. The main stances on this issue are:

- Halving affects the price, but only in the long run.

- Halvings are already factored into the price long before the event itself.

- Halving doesn't really have a significant impact on Litecoin's price. The price is determined by supply and demand, which, in turn, are influenced by many different factors. Since by the time of the next halving, 87.5% of all Litecoins have already been mined, a slight drop in the supply of new Litecoins cannot have a noticeable effect on their price.

Thus, the only thing that can be said for sure is that LTC's halving is unlikely to have a noticeable impact on its price in the short term.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

What are the dates of the last and next Litecoin halving?

The last Litecoin halving occurred on 2 August 2023. This event led to a decrease in the block validation reward to 6.25 LTC. Currently, the price of LTC is approximately $90. The next halving event is scheduled for 2027, which will reduce mining rewards from 3.125 LTC to 1.5625 LTC per block.

Will the price of Litecoin increase after the halving?

Regarding the Litecoin coin halving dates, the last LTC mining halving event occurred in August 2023. Litecoin's price is projected to reach its highest point of $217.76 by the conclusion of 2025. If there is a significant surge, the price may reach as high as $528.57 by the end of 2030.

What happens when Litecoin halves?

The block reward for Litecoin is divided every 4 years, reducing the production rate of Litecoin. This mining halving process is pre-programmed in Litecoin's code. Following the last halving in 2023, the block reward will be 6.25 LTC.

How did the Litecoin halving in 2023 affect the price of LTC?

The price of LTC was affected by the Litecoin halving in 2023. The cryptocurrency halving event occurred on 2 August 2023 and reduced the block validation reward to 6.25 LTC. In early December 2023, the price of LTC was around $70.

What's the difference between BTC halving and LTC halving?

Bitcoin and Litecoin are two popular cryptocurrencies. Bitcoin, the original cryptocurrency, holds a higher market cap than Litecoin. Both cryptocurrencies use the proof-of-work consensus mechanism, but Litecoin can produce a greater number of coins. While both currencies were designed as payment methods, they have also become popular for speculation and investment purposes.