Bitcoin halving: what, when, and how can the price be affected?

There's an event in the world of cryptocurrencies that happens every few years and is of great importance for the entire crypto industry. This event doesn't come unexpected but has severe and lasting consequences nonetheless. Meet Bitcoin halving.

The fact that new coins are produced means the money supply increases by a planned amount, but this does not necessarily result in inflation. If the supply of money increases at the same rate that the number of people using it increases, prices remain stable. If it does not increase as fast as demand, there will be deflation, and early holders of money will see its value increase. – Satoshi Nakamoto, creator of Bitcoin.

What is a Bitcoin halving?

New Bitcoins are created on the Bitcoin blockchain as a reward for keeping it running by verifying transactions and adding them to blocks. This process is called mining. The miner who was the first to find a solution to a complex mathematical problem adds transactions to the block and receives a reward that includes a certain fixed amount of newly created Bitcoins, plus fees for transactions included in the block. A new block is added approximately every 10 minutes. Thus, the existing amount of Bitcoins increases by a certain amount every 10 minutes.

Bitcoin halving is an event pre-programmed by the Bitcoin algorithm that cuts the number of new Bitcoins in the mentioned above block reward in half. When Bitcoin was first launched, the block reward was 50 BTC. Given that the halving event has occurred three times since then, the current block reward is 6.25 BTC.

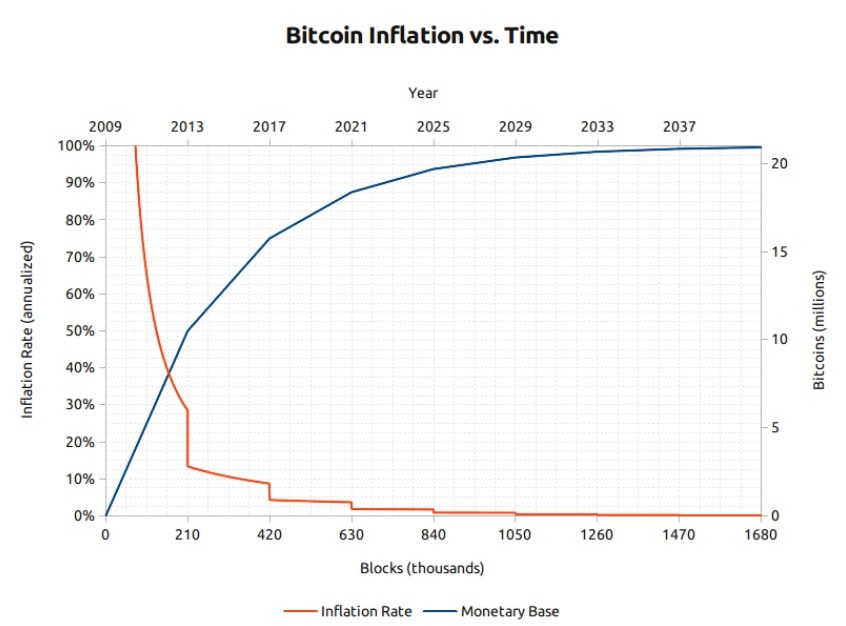

Thus, halving is a slow and predictable process of decreasing the number of newly created Bitcoins that will continue until the influx of new coins into the Bitcoin network is reduced to zero.

When is Bitcoin halving?

Bitcoin halving is an event that is programmed to happen at a certain frequency. And although its exact time can't be predicted in advance, the closer it is, the more accurate the forecast of the date is.

How often is Bitcoin halved?

Bitcoin halvings are triggered not by date but by the length of the Bitcoin blockchain. The Bitcoin algorithm is designed so that a Bitcoin halving event occurs after every 210,000 blocks mined. Considering that one block's addition occurs approximately every 10 minutes, halvings happen roughly every 4 years.

Bitcoin halving 2020

The last Bitcoin halving by the current date took place on 11 May 2020, causing the block reward to fall from 12.5 to 6.25 Bitcoins.

When will Bitcoin halve?

The next halving is expected to happen around May 2024. Once this happens, the block reward will be 3.125 BTC. And then again, after about 4 years, the block reward will decrease by half. This will repeat until, after the next halving, the block reward falls below 1 satoshi, the minimum possible Bitcoin share, equal to 0.00000001 BTC. Once this happens, all 21 million Bitcoins will be mined, and the only reward for mining and thus keeping the Bitcoin network up and running will be the transaction fees. But this won't happen soon, according to current estimates; this final halving will occur around 2140. However, it is worth noting that more than 98% of the maximum possible amount of Bitcoins will be mined by 2030.

Bitcoin halving dates

Halving | Date | Block number | Block reward, BTC | BTC created per day |

Launch | 3 January 2009 | 0 | 50 | 7,200 |

1 | 28 November 2012 | 210,000 | 25 | 3,600 |

2 | 9 July 2016 | 420,000 | 12.5 | 1,800 |

3 | 11 May 2020 | 630,000 | 6.25 | 900 |

4 | Around 2024 | 840,000 | 3.125 | 450 |

5 | Around 2028 | 1,050,000 | 1.5625 | 225 |

- | - | - | - | - |

33 | Around 2140 | 6,930,000 | 0 | 0 |

Register and start mining free

Bitcoin halving countdown

If you want to watch a real-time countdown to the next Bitcoin halving, there are many websites on the internet where you can see it. Some of the most well-known Bitcoin halving countdown clocks can be found at Bitcoinblockhalf.com, which is entirely dedicated to the halving event. The famous coinmarketcap.com has its built-in countdown clock. Another countdown can be found on the "Bitcoin clock" page at buyBitcoinworldwide.com. And on the bitconsensus.com site, there are even two countdowns — one based on the average block generation time, and the second is based on the current one.

How many days until Bitcoin halving?

At the time of writing, the estimated time until the next halving is 1316 days (based on the average block generation time) or 1201 days if you base the prediction on current block generation time. According to hybrid calculation methods, this time is 1219 days.

The discrepancy in the estimates is that due to the constant growth of the total hashing power of miners, the real average time to create a block is about 9 minutes 20 seconds instead of the presumed 10 minutes.

Why is Bitcoin halving important?

The main reason why this is done is to keep inflation under control. – Vitalik Buterin, creator of Ethereum.

Bitcoin isn't like traditional fiat money. Their respective central banks issue the national currencies we are all familiar with. The central banks can issue national currencies in any amounts and without any prior notice based on their monetary politics, which, in turn, are based on human decisions. This state of affairs provokes inflation and uncertainty.

However, this isn't the case with Bitcoin. The amount of Bitcoins in circulation increases at a stable and predictable rate, and it'll never exceed 21 million. "But why halve this rate every 4 years?" you may ask.

This is quite an elegant solution that allows the Bitcoin blockchain to solve several issues at the same time. In the beginning, when Bitcoin was little known, the high block reward incentivised people to join the Bitcoin network and keep it running, and solved the issue of initial coin distribution. But with the expansion of the network and the growth of Bitcoin adoption, the need to reduce inflation and simultaneously prevent the rapid depletion of Bitcoin available for the mining came to the fore.

If there were no halvings and the block reward would remain equal to 50 BTC, the entire available volume of Bitcoins would have been mined already in 2016, when Bitcoin was becoming a widely known thing. In this case, the vast majority of Bitcoins would belong to a small number of early adopters and Bitcoin would never have gained its current popularity.

But if there were no limitation of the maximum number of Bitcoins, the supply of Bitcoin would quickly exceed the demand, and it would have a meagre value, which would also be bad for its popularity.

A smaller but fixed block reward like 20 or 10 BTC wouldn't be the best option. In this case, the initial distribution of coins would be much slower, and early miners would have less incentive to join the network.

Thus, the pre-programmed halving in the Bitcoin algorithm was the right solution for the world's first cryptocurrency. It allowed Bitcoin to both quickly gain popularity and to maintain interest in it until now and probably for many years to come.

Bitcoin halving effect on the price

Looking at previous halvings and their impact on the Bitcoin price, you can notice specific patterns, but this doesn't mean that they'll necessarily be observed in the future too.

- The halving in 2012 was the first one, and nobody knew what effect it would have on price. First, the event didn't seem to affect the price significantly. But within a year, the price experienced a sharp rise.

- The crypto community highly anticipated the second halving that happened in 2016. And again, the initial effect wasn't significant. The real bull run occurred 18 months later. Some claimed this price surge was a delayed effect of halving, but we can't be sure of this due to lack of real evidence.

- The third halving took place on 11 May 2020. So far we haven't seen any noticeable effects, but many believe that in the coming months the price will surge again, as with previous halvings. Time will tell.

Register and mine Bitcoin for free

What happens when the block reward gets really small?

This is a complicated question, and it's difficult to predict how things will turn out in many years. But many claim that this could be a severe problem for the Bitcoin network. Miners, being essential for the functioning of the Bitcoin network, have to get paid. Mining equipment and large amounts of electric power required for mining aren't cheap. After the size of the block reward fixed part becomes insignificant, transaction fees will become the primary source of income for miners. And this, in turn, means that these fees will have to grow significantly to serve as sufficient incentive for miners. A sharp rise in fees will lead to a severe drop in the popularity of Bitcoin, especially given the fact that it has many competitors.

But at the same time, don't forget that Bitcoin is a whole ecosystem consisting of a large number of participants and is in constant development. This suggests that when block rewards decline becomes a severe problem for the network, its members will probably find a solution.

Bitcoin Halving 2024

The Bitcoin network is preparing for a halving event in mid-2024. It is predicted that the Bitcoin halving will occur around that time. Based on past trends, miners may accumulate more Bitcoin in anticipation of a significant price increase after the halving. During a halving event, the number of new Bitcoins created per block is cut in half, reducing the supply of new coins entering the market. Currently, miners receive 6.5 BTC per block, but after the next halving, this reward will be reduced to 3.25 BTC. This means that approximately 450 BTC will be created each day.

Looking back at previous halvings, the price of Bitcoin hit its lowest point around 517 to 547 days before the halving. This aligns with the recent market bottom for BTC on 19 November. Based on this pattern, Bitcoin's price tends to increase as the halving event draws near.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

How do I trade Bitcoin during halving?

One option to trade Bitcoin during the halving is to use derivatives like contracts for difference (CFDs). This allows you to speculate on price movements without actually owning the coins. Another option is to buy Bitcoin directly through an exchange. If you choose this route, you'll need to create an exchange account and take measures to secure your cryptocurrency tokens in a wallet. Remember that any profits you make will be subject to regular taxation.

Can I make money from Bitcoin halving?

Money from the BTC halving can be earned by speculating on Bitcoin's price changes. Contracts for difference are a popular method for speculating Bitcoin's price movements, allowing you to take both long and short positions. However, it is essential to acknowledge that all forms of trading carry risk. While there will be profit opportunities, you should only invest what you can afford to lose. With IG, you can access guaranteed stops, which will close your trade at the specific level you set, ensuring you know the exact amount you risk with each trade. A small premium is required if a guaranteed stop is triggered.

Is the 2024 Bitcoin halving priced In?

Given that the upcoming supply of Bitcoin is known to the public, all future halving events are already factored into the price. However, according to a divisive cryptocurrency expert's model, we are currently in a new bull market, and it is expected that Bitcoin's price will significantly increase after the 2024 halving.