Several Revolutionary Uses of Crypto in Developing Countries

In recent years, cryptocurrencies have become a hot topic in the financial world, with more and more people turning to digital assets for a variety of reasons. But it's in developing countries that the cryptocurrency shows particularly great potential. As these countries struggle with issues such as inflation, lack of banking infrastructure and economic instability, cryptocurrency presents a viable alternative to traditional finance. This article explores several uses of crypto in these regions, highlighting how cryptocurrency is transforming lives and economies in developing nations.

Financial inclusion

In developing countries, access to traditional financial services remains limited for a significant portion of the population. Cryptocurrency, with its decentralised and borderless nature, has the potential to bridge this gap and provide financial inclusion.

Access to banking services

A significant portion of the global population remains unbanked, with developing countries representing a large share of this demographic. Traditional banking systems often require extensive documentation, physical infrastructure, and stable economic conditions, factors that are not always available in these regions. Cryptocurrency circumvents these barriers by offering a decentralised and accessible alternative. Through mobile phones and the internet, individuals can create and manage crypto wallets, which enables them to participate in the global economy without having a traditional bank account. This opens up opportunities for saving, borrowing, and investing that were previously inaccessible.

Cross-border remittances

Cross-border remittances play a vital role in the economies of many developing countries, with millions of citizens working abroad and sending money back home to support their families. However, traditional remittance services often charge high fees and take a significant amount of time to process transactions. Crypto assets offer lower transaction fees, faster processing times, and increased transparency. Crypto currency exchanges and crypto ATMs often play an important role in it giving people the ability to convert fiat money to crypto and back.

Microfinance and entrepreneurship

Micropayments are another area where crypto is having a positive impact in developing countries. Many digital content creators, such as artists, writers, and musicians, struggle to monetise their work in regions where traditional payment systems are inefficient or costly. Cryptocurrencies offer a way for these creators to receive small payments directly from their audience without the need for a middleman. Crypto assets' ability to efficiently handle micropayments allows these entrepreneurs to tap into a broader market, including international customers, without incurring prohibitive transaction costs. In essence, crypto assets unlock new opportunities for entrepreneurship in developing countries, which can help even the smallest businesses prosper.

Economic stability

In regions plagued by hyperinflation and economic instability, cryptocurrencies offer an alternative to traditional fiat currencies and can provide stability and security for individuals and businesses.

Inflation and currency devaluation

Inflation and currency devaluation are persistent problems in many developing nations, which erode the value of savings and reduce purchasing power. Cryptocurrencies, particularly those with a fixed supply like Bitcoin, provide an alternative store of value that is not subject to inflationary pressures, unlike traditional fiat currencies. By converting local currency into cryptocurrency, individuals can protect their wealth from local economic instability and inflation.

Furthermore, stablecoins — cryptocurrencies pegged to stable assets such as the US dollar — offer a reliable means of transacting and saving. They combine the relative stability of traditional currencies with the advantages of cryptocurrency, such as ease of transfer and reduced transaction costs. This dual benefit makes stablecoins an attractive option for individuals and businesses seeking to avoid the adverse effects of local currency fluctuations.

A safe haven for savings

Cryptocurrencies provide a safe haven for savings in regions where banking systems are unreliable or inaccessible. Traditional banks in developing countries may be prone to failure, corruption, or lack of liquidity, putting individuals' savings at risk. Cryptocurrencies, stored in secure crypto wallets, offer an alternative means of preserving wealth. The decentralised nature of cryptocurrencies ensures that individuals have control over their assets without reliance on potentially unstable financial institutions.

Crisis management and aid distribution

In times of crisis, such as natural disasters, political unrest, or public health emergencies, cryptocurrencies have the potential to revolutionise crisis management and aid distribution in developing countries. By leveraging blockchain technology, cryptocurrencies can enable efficient and transparent aid distribution in crisis situations. By using blockchain-based platforms, such as BitGive and AidCoin, aid organisations can track the entire process of aid distribution, from fundraising to disbursement, ensuring that funds reach their intended recipients. This transparency improves accountability, helps prevent fraud and corruption, and ensures that aid is used effectively to support those in need.

Challenges and limitations

While cryptocurrencies hold immense potential for developing countries, their adoption and integration also present significant challenges.

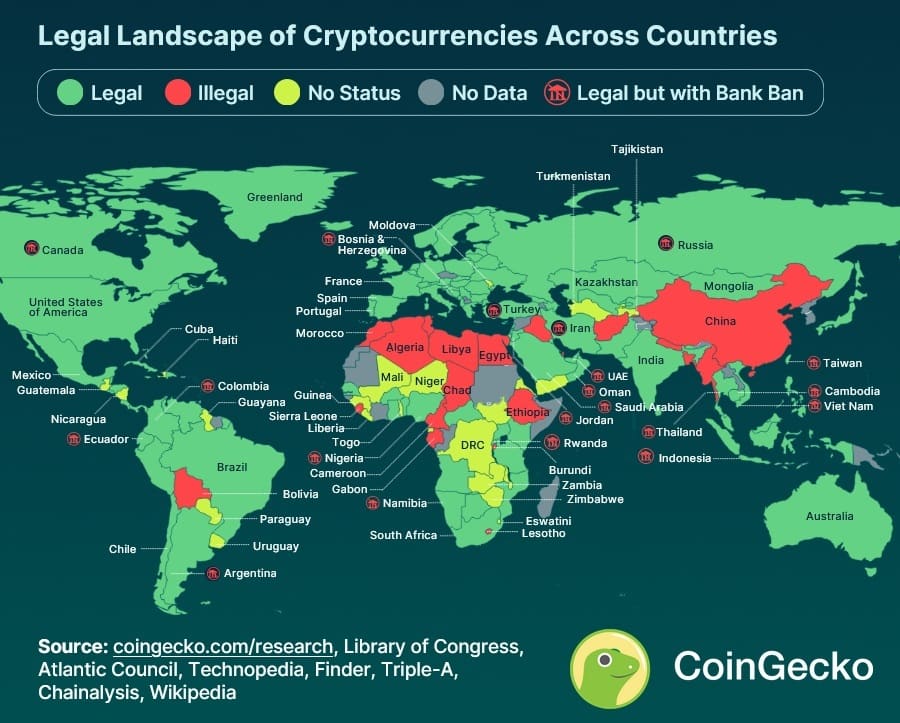

- Regulatory and legal barriers. One of the most significant challenges cryptocurrencies face in developing countries is the regulatory and legal environment. Many governments are still grappling with how to classify and regulate cryptocurrencies. In some cases, there's outright hostility towards cryptocurrencies, with bans or severe restrictions in place. The lack of clear and supportive regulatory frameworks deters investment and innovation.

- Technological infrastructure. Another key challenge cryptocurrency adoption encounters in developing countries is the lack of technological infrastructure. Many developing countries lack the necessary internet connectivity, electricity, and digital devices to support the use of cryptocurrencies. Addressing this issue requires significant investment in technological infrastructure.

- Digital literacy. Digital literacy is fundamental to the successful adoption of cryptocurrencies. In many developing countries, there is limited understanding of how cryptocurrencies work and their potential benefits. This lack of knowledge can lead to misuse, fraud, and resistance to adoption.

Conclusion

The future of cryptocurrencies in developing countries may be bright, with significant potential to drive economic growth, financial inclusion, and social development. If technological infrastructure improves and the regulatory framework becomes more supportive, the adoption of cryptocurrencies will increase.

For developing countries, the integration of cryptocurrencies presents a unique opportunity to leapfrog traditional financial systems and embrace a more inclusive, transparent, and efficient financial future. By addressing the current challenges and leveraging the potential of emerging technologies, these countries can harness the power of cryptocurrencies to foster development and improve the lives of their populations.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.