Cryptocurrency Security: A Beginner's Guide

Cryptocurrencies have gained a lot of popularity, and for good reason: they have a lot of advantages. However, these benefits come at a price. Security threats can make interacting with cryptocurrencies risky. Moreover, the responsibility for crypto security lies with the user of cryptocurrencies. This article will explore crypto security, giving you the knowledge you need to protect your digital assets.

What is crypto security?

Cryptocurrency security refers to the set of practices, measures and protocols implemented to safeguard crypto assets and transactions. As cryptocurrencies operate on decentralised and often pseudonymous networks, ensuring the security of these assets becomes a critical concern.

What does a beginner need to learn about crypto security?

When entering the world of cryptocurrencies, learn the following:

- Cryptocurrency basics. Learn the fundamental concepts of cryptocurrencies, including blockchain technology and decentralisation.

- Public and private keys. Grasp the distinction between public and private keys and their respective roles in cryptocurrency transactions. Remember to keep your private key confidential and never share it with anyone.

- Wallet security. Explore the different types of wallets and find the right one for you.

- Strong passwords. Remember to use strong, unique passwords for all cryptocurrency-related accounts.

- Transaction security. Learn how to ensure the integrity and security of crypto transactions.

- Scams and phishing. Be aware of common scams such as phishing attempts, Ponzi schemes and fraudulent ICOs.

- Educational resources. Stay informed about the latest security trends, threats and best practices.

Securing your cryptocurrency wallet

Since cryptocurrencies aren't stored in banks or other centralised institutions, it falls on the owner to take care of the security of the crypto wallet. Choosing a secure wallet and following the rules of safe cryptocurrency holding is crucial for the safety of your digital assets.

What are the types of cryptocurrency wallets?

There are several different types of cryptocurrency wallets, each with different features and designed for different purposes:

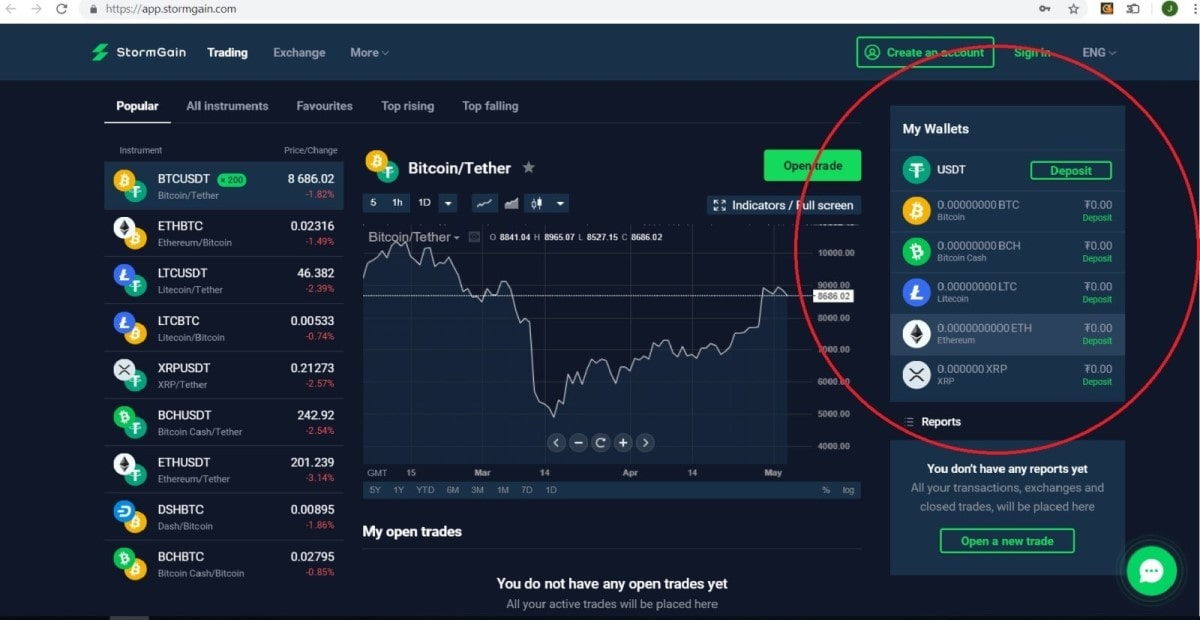

- Web wallets. These are online wallets that users can access through web browsers. Hosted by third-party service providers. Security features: password protection. Some may offer Two-Factor Authentication (2FA). Examples of such wallets are Blockchain.info and wallets that users get when they register accounts on crypto exchanges.

- Software wallets. Applications that can be installed on computers or smartphones. Security features vary by wallet but may include encryption, password protection and 2FA. Examples: Exodus, Electrum, MyEtherWallet.

- Hardware wallets. These are physical devices designed to store private keys offline securely. Security features: immune to online hacking attempts (as they aren't connected to the internet), often come with PIN protection and backup features. Examples: Ledger Nano S, Ledger Nano X, Trezor.

- Paper wallets. Physical documents containing public and private keys printed or written on paper. Often used for long-term storage and as a form of cold storage. Security features: offline storage that is immune to online hacking attempts. Must be created and stored securely to avoid physical damage, theft or loss.

Hot and cold wallets

Hot wallets and cold wallets are two categories of crypto wallets, distinguished by their connection to the internet. Hot wallets are connected to the internet and are designed for frequent and convenient access to cryptocurrencies. They include software and web wallets. Cold wallets are disconnected from the internet most of the time. They're more secure but less convenient for frequent use. Hardware wallets, paper wallets, and some types of offline software wallets are considered cold wallets.

Feature | Hot wallets | Cold wallets |

Connection to internet | Connected to the internet for accessibility | Not connected when not in use |

Security level | Generally considered less secure | Generally considered more secure |

Protection against online threats | More susceptible to phishing, hacking and online attacks | Less exposed to online threats, providing resistance to phishing and hacking |

Usage | Convenient for regular transactions and trading activities | Ideal for securely storing significant amounts for the long term |

Which crypto wallet is most secure?

Determining the "most secure" crypto wallet depends on various factors, including individual preferences, use cases, and the specific security features of different wallets. Hardware crypto wallets are considered the safest, but they aren't always convenient and may not be well suited for some use cases. Consider using a hardware wallet for significant amounts and long-term storage, but for frequent transactions, hot wallets are more suitable. Also, consider spreading your cryptocurrency holdings across different wallets or even different types of wallets. This will minimise the impact if one wallet is compromised.

When choosing a secure wallet for crypto, there are several critical aspects to keep in mind:

- Reputation and track record. Research the reputation and track record of the wallet provider. Opt for wallets with a positive history, strong community trust and a significant user base.

- Reviews and feedback. Seek out reviews and recommendations from reputable sources and the crypto community. Assess both expert opinions and user feedback to gain a comprehensive understanding of the wallet's performance.

- Private key control. Control of private keys is an important aspect of wallet security. Understand the distinction between custodial and non-custodial wallets. Custodial wallets are managed by third-party services, while non-custodial wallets give you full control over your private keys.

- Two-factor authentication and other security features. Look for robust security features, including encryption, PIN protection, biometric authentication (if available) and 2FA.

- Multi-signature support. If applicable to your needs, consider wallets that support multi-signature transactions. Multi-signature wallets require multiple private keys to authorise a transaction, adding an extra layer of security.

- Regular updates. Choose wallets that receive regular updates and security patches. They're essential for addressing potential vulnerabilities and adapting to emerging security threats.

Creating a strong password

Creating a strong password is crucial to protect your accounts and crypto assets. Aim for a password that is at least 12 characters long. Longer passwords are generally more secure. Combine uppercase and lowercase letters, numbers, and symbols in your password.

Avoid using easily guessable information, such as common words or sequences (like "123456" or "password"). Stay away from common keyboard patterns like "qwerty" or "asdfgh". These are easy for attackers to guess. Steer clear of using personal information such as your name, e-mail, or other easily accessible details in your password. Tools like password generators can help create complex and unpredictable passwords.

Backup and recovery

Even with robust security measures in place, unexpected events like device loss or failure can pose a risk. Always back up private keys or seed phrases and keep them in a safe place. Learn the step-by-step process of recovering your wallet using the backup information. This will help you regain access to your wallet.

Best practices for safe transactions

Always double-check the recipient's wallet address and transaction amount before initiating a transaction. Mistakenly sending funds to the wrong address can result in irreversible loss. Refrain from conducting crypto transactions on public Wi-Fi networks. Use a secure and private internet connection.

What are the most common cryptocurrency scams?

Cryptocurrency scams have unfortunately become common due to the growing popularity of crypto assets. To protect yourself and your investments, you must be aware of these scams and learn how to recognise them.

Fake wallets

Scammers create malware posing as cryptocurrency wallets that steal private keys. To prevent this, only download wallets from official sources, check reviews and ensure the wallet provider has a reliable reputation.

Phishing scams

Phishing is one of the most popular schemes among scammers. To get your money or data, they create fake websites or e-mails that mimic legitimate cryptocurrency platforms to trick users into entering their private keys, passwords, or other sensitive information.

Always double-check website URLs, use bookmarks to access websites, and be wary of unsolicited e-mails asking for personal information.

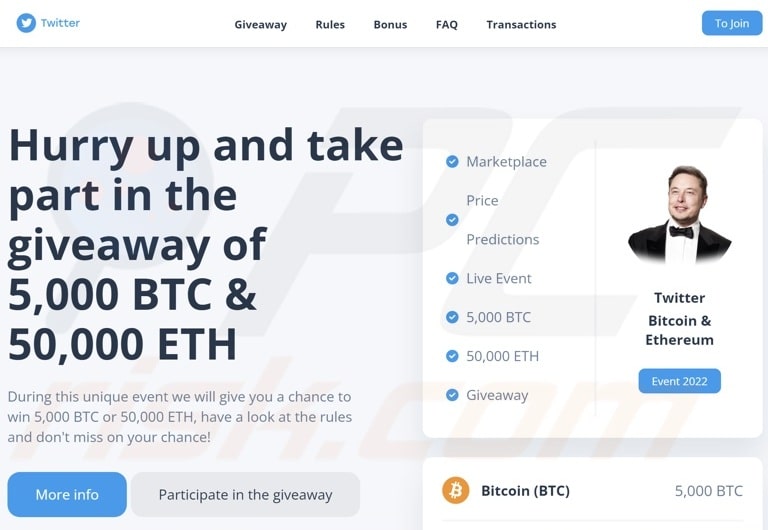

Giveaway scams

Scammers create fake giveaways on social media platforms, promising to send more significant amounts of cryptocurrency if users send an initial payment. In the process, criminals often impersonate influential people, projects or companies to trick users into sending cryptocurrency. So be sceptical of giveaways, especially those requiring upfront payments.

Frauds promising romance

Scammers find a victim on Tinder or other dating platforms. After a long romantic correspondence, scammers ask to transfer cryptocurrency for some purpose. Or the conversation turns to investment topics, and the criminals recommend some "promising" project, which turns out to be fraudulent.

Ponzi schemes

It's a fraudulent investment scheme where returns are paid to earlier investors using capital from newer investors rather than from profit. Exercise scepticism towards investment opportunities that promise high, guaranteed returns and conduct thorough research on the legitimacy of investment platforms.

Tech support and remote access scams

Scammers pose as tech support agents or cryptocurrency service providers, convincing users to grant remote access to their computers, leading to theft of funds. To prevent this, never give remote access to unknown individuals or companies. Use official customer support channels for assistance.

What are the red flags of cryptocurrency scams?

Cryptocurrency scams are numerous, and new ones are constantly popping up. Recognising the red flags of crypto scams is vital to protect yourself against potential fraud and financial loss. Here are some common warning signs associated with cryptocurrency scams:

- Guaranteed high returns. Be sceptical of investment opportunities that sound too good to be true. High returns usually come with high risk.

- Pressure to act quickly. Legitimate investments allow you time to research and make informed decisions. Avoid rushing into any investment.

- Unsolicited offers and cold calls. Be cautious of offers that come out of the blue. Scammers often use unsolicited communication to target individuals.

- Anonymous teams or lack of information. Research the project thoroughly. Legitimate projects have transparent teams, clear goals, and detailed information available.

- Fake reviews. Be cautious of platforms that rely heavily on unverifiable positive feedback. Look for reviews from reputable sources.

- No physical address or contact information. Legitimate businesses have clear contact information. Verify the legitimacy of the project by checking its physical presence.

How secure are cryptocurrencies?

Cryptocurrencies, while designed with security in mind, aren't immune to risks and vulnerabilities. Users must adopt best practices, stay informed about potential risks, and actively secure their assets to mitigate vulnerabilities in the ever-evolving landscape of crypto assets.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.