Terra (LUNA) Price Prediction 2022-2030

Terra (LUNA) is one of the most actively developing cryptocurrencies that have attracted traders and investors worldwide. It gained public interest in December 2021, reaching an all-time high of $103.03. It astonished the online community more when it significantly crashed after reaching its historically maximum values. This Terra (LUNA) crypto price prediction lets you look closely at LUNA's performance and forecast its future trading opportunities.

What is Terra (LUNA)?

In 2018, the Terra project was first announced as a universal payment system that should make cryptocurrency convenient. Terra's mainnet was launched in 2019.

The main idea of the Terra project is to create a decentralised network for fast settlements linked to stable currencies. When working on the project, developers managed to overcome the key disadvantages of existing stablecoins, like low scalability, centralisation and unstable exchange rates.

The Terra project works on the proof-of-stake (PoS) consensus mechanism. Terra uses a programmable infrastructure to bring self-stabilising stablecoins to the market. The project regulates the number of stablecoins by maintaining their value on the network. This process allows stablecoins to remain pegged to the underlying assets.

LUNA is the native token of Terra's network. It's used for staking, governance voting and maintaining network security. The team of Terra project's developers aims to create a global payment network with low fees and without the barriers imposed by national borders.

LUNA's history

Let's continue our Terra (LUNA) crypto price prediction article with some historical facts about the stablecoin and the Terra project.

Before the crash of Terra's algorithmic stablecoin UST and its native coin in May 2022, the Terra project was a thriving network mainly focused on decentralised finance (DeFi).

Daniel Shin and Do Kwon founded the Terra project in 2018. Kwon is the CEO of Terraform Labs, the entity behind Terra. Previously, he was the founder and CEO of Anyfi (a decentralised wireless mesh networking startup) and a software engineer at Apple and Microsoft. The main objective of Terra's founders was to launch a blockchain focusing on usability and price stability.

Kwon is the face of the Terra project. He used his Twitter profile to express his opinions about the Terra ecosystem on different occasions. Before Terra's launch, Shin founded and led the South Korean eCommerce platform Ticket Monster and a startup incubator Fast Track Asia.

After Terra's crash, many investors filed lawsuits against Terra's founders. On 12 June 2022, Kwon denied claims that he illegally cashed out $2.7 billion in the months leading to Terra's collapse.

Terra Whitepaper

According to Terra's whitepaper, terra.money is declared to be a protocol and an infrastructure for Terra and LUNA coins and third-party decentralised applications. The whitepaper defines Terra as a stablecoin of unlimited supply that is expanded and contracted through different stabilisation schemes. Here are some of them:

- Taxation fees adjust depending on Terra's price. Transaction fees rise if Terra's price falls due to oversupply. Taxes collected from Terra transaction fees end up as rewards.

- Terra (LUNA) is a fixed supply variable token that can be staked to the Stability Reserve stabilisation fund.

- Market shocks are handled with the liquid fiat/crypto reserve, including Terra (LUNA) reserve. The reserve is used to buy Terra back and burn it. Terra (LUNA) reserve is resupplied during oversupply when it collects higher tax rates.

- Extreme undersupply is solved by mining new Terra coins and selling them to exchanges, where received funds are used to reinforce the reserve.

- Market volatility is governed by oracles, collecting data about Terra price relationships and related fiat and cryptocurrencies.

Terra Projects

Before moving to the Terra (LUNA) future price prediction, let's consider several notable projects built on the Terra blockchain.

Anchor Protocol

Anchor is one of the oldest Terra protocols. The Anchor Protocol is a completely decentralised fixed-income platform. It uses staking yields, money markets and incentives on its native token, $ANC. Anchor is the preferred protocol for many because everyone can use it as a savings account with no minimum deposits and no KYC process. You need to create a Terra station wallet and connect it to the platform to start using the Anchor Protocol.

Mirror Protocol

Mirror is a DeFi protocol, allowing anyone worldwide to trade equities 24/7. The project does this by minting synthetic assets. The Mirror Protocol lets you buy trade equities for big projects like Apple, Amazon, Airbnb, Alibaba Group, Facebook, etc.

Loop Finance

Loop Finance is a decentralised exchange platform that has helped 75k+ users do 900k+ transactions with Terra's tokens. This Terra project lets you join its community and earn $LOOPR tokens by creating and rating articles and commenting on them. Users can trade a vast array of tokens. They can also provide liquidity to earn swap fees and LOOP tokens. The platform also mints and trades NFTs with fixed yields in the DeFi NFT Marketplace.

LUNA Benefits

A series of LUNA benefits is worth mentioning in this Terra (LUNA) crypto price prediction article. The ecosystem and the LUNA asset provide traders and investors with multiple advantages.

First of all, Terra (LUNA) uses a proof-of-stake protocol. It's one of the biggest LUNA benefits because users can stake their tokens for a yearly return of about 6%, which is much higher than traditional financial systems. You'll also be surprised by how fast the transactions are completed. In most cases, it takes no longer than six seconds to complete a transaction with extremely low fees (no more than $0.05).

Terra (LUNA) tokenomics is another LUNA benefit. It's one of the few protocols using the deflationary ecosystem, where tokens are burned to create UST. Such a scheme allows Terra (LUNA) to reduce the supply and increase the coin's value.

Another LUNA benefit is the ability to buy and sell Terra (LUNA) for stablecoins at increased rates when the Terra protocol needs to balance each stablecoin's demand and supply.

Overall, the are multiple advantages to using the Terra ecosystem. The Terra Station mobile app features an intuitive visual interface loaded with handy and easy-to-use features, like staking, swapping, voting and interaction with contracts. The software is available for iOS and Android devices. Coupled with low rates and fast transactions, it offers an enjoyable user experience.

Terra (LUNA) Price Analysis

When writing this price prediction for LUNA (28/09/2022), Terra's (LUNA) price was $2.45, with a 24-hour trading volume of $274,769,748. In the last 24 hours, LUNA lost 7.39% of its price. With the market cap of $311,879,653, Terra (LUNA) ranked #101 on CoinMarketCap. It had a circulating supply of 127,475,474 LUNA coins.

Terra (LUNA) price statistics (as of 28/09/2022)

Tera (LUNA) current price | $2.42 |

Market cap | $308,362,695 |

Circulating supply | 127,475,474.31 LUNA |

Daily trading volume | $275,399,109 |

All-time high | $19.54 (28/05/22) |

All-time low | $1.53 (29/08/22) |

Website |

LUNA's Price History

Let's continue our discussion of the Terra coin price prediction with a glance at the coin's past performance.

Terra (LUNA) was launched at $1.31 in 2019. Following the official release, LUNA was in a downtrend during the first 18 months. The coin kept recording new lows after September 2019. On 18 December 2019, LUNA's price dropped to $0.21. On 18 March 2020, the price crashed to $0.12.

On 19 August 2020, Terra announced LUNA would be listed on the Binance exchange platform. Starting from 28 August 2020, people could stake their LUNA coins. LUNA's price rose from $0.33 to $0.56. However, the trend didn't last long, and LUNA's price dipped again.

When UST launched in September 2021, LUNA's price dropped to $0.32. The coin started in 2021, behaving bullishly. On 9 February 2021, Terra (LUNA) reached $6.44. The price increased over the next six months, hitting $34.96 on 28 August 2021. On 7 September 2021, the coin's price fell to $27.79. During the last year, Terra (LUNA) coin has mostly been in a bearish trend, with minor rises and falls in its price.

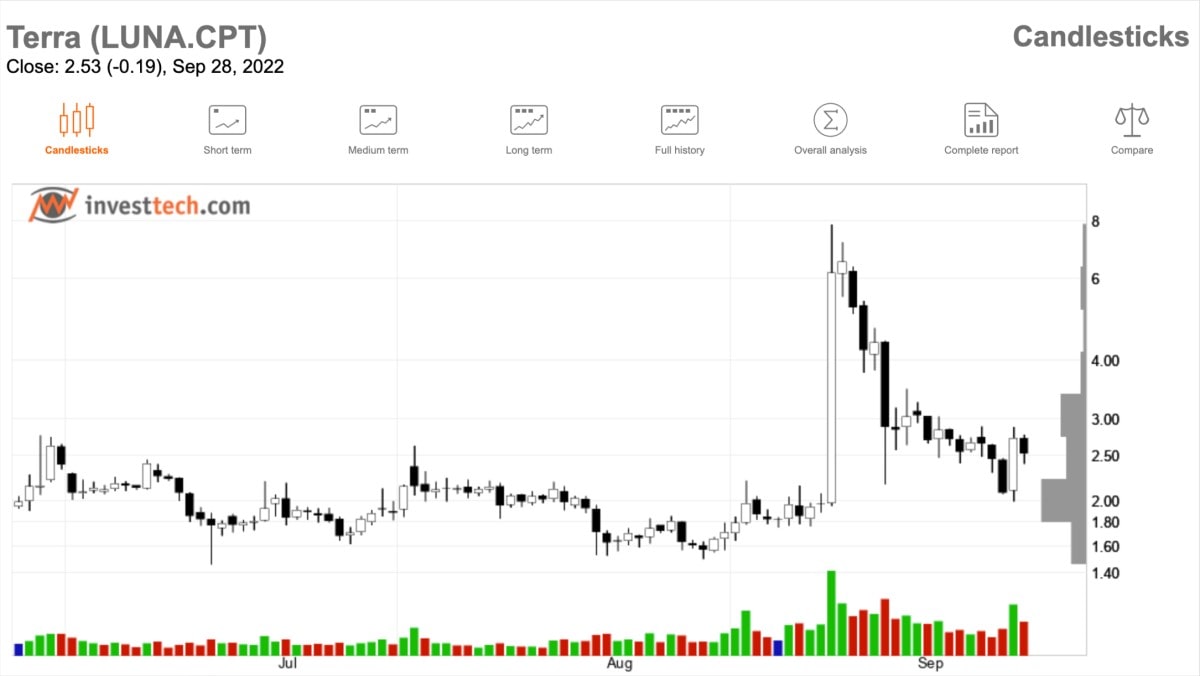

LUNA technical analysis

Terra (LUNA) is within an approximate horizontal trend channel in the medium-long term, which indicates further development in the same direction. The currency is testing support at point 2.00. This could give a positive reaction, but a downward breakthrough of point 2.00 means a negative signal. Volume has previously been high at price tops and low at price bottoms. Volume balance is also positive, strengthening the currency and indicating an increased chance of a breakup. The currency is overall assessed as technically positive for the medium-long term.

Is Terra coin a good investment?

Terra (LUNA) is expected to show an upward trend in the future. Opinions about the coin's future differ. Analysts from WalletInvestor and TradingBeasts share optimistic price predictions of LUNA, assuming the cryptocurrency may be a good investment idea. However, the crypto market is always unpredictable. You never know which way the crypto coins' trends will go. We recommend you take a look at all Terra (LUNA) crypto price predictions before buying or selling crypto assets.

Terra price prediction 2022-2030

Many traders and analysts consider the Terra (LUNA) project very promising and predict the coin could show significant growth in the upcoming years. However, no one knows for sure how LUNA will perform. Many factors can affect LUNA's future performance.

Terra (LUNA) could attract more attention from investors in the future. If this Terra coin prediction comes true, the asset's price will rise. The Terra community may attract more users by cooperating with other projects and startups. Some analytics predict that LUNA's price might be around $1,800 by 2030.

WalletInvestor LUNA price prediction for 2022, 2025 and 2030

According to WalletInvestor's Terra (LUNA) crypto price prediction, the stablecoin is expected to trade at an average price of over $52 by the end of 2022. LUNA price prediction for 2025 forecasts the assets' price would rise to an average price of about $159. In 2030, Terra (LUNA) is expected to reach an average price of $160.227 per asset.

DigitalCoinPrice LUNA price prediction for 2022, 2025 and 2030

DigitalCoinPrice's Terra (LUNA) prediction is bullish over the long term. According to its Terra coin price prediction, the asset is expected to trade at an average of $2.49 in 2022, $10.11 in 2025 and $35.42 in 2030.

CoinCodex LUNA price prediction for 2022, 2025 and 2030

According to CoinCodex's short-term LUNA coin price prediction, the value of Terra is predicted to rise by 17.55% and reach $ 2.99 by 3 October 2022. According to their technical indicators, the current sentiment is Neutral, while the Fear & Greed Index shows 20 (Extreme Fear). Based on CoinCodex's Terra (LUNA) prediction for 2025, the asset will reach the price of $23.61.

LongForecast LUNA price prediction for 2022, 2025 and 2030

Long Forecast's Terra price prediction for 2022 is bearish. The analysts forecast the asset would close the year at $1.07. According to Long Forecast's Terra price prediction for 2025, LUNA would fall below the dollar mark to $0.96 by the end of 2025.

Terra's future forecast in general

Some of the Terra (LUNA) crypto price predictions sound extremely bullish, considering the crash the cryptocurrency has recently experienced. The future of Terra is highly dependent on the overall performance of the crypto industry. The average price of Terra (LUNA) might go to $3.13 by the end of 2022. If we estimate the five-year plan, the coin's value can reach the $14.92 mark.

How high can LUNA coin go?

Despite the recent crash, many analysts share positive LUNA coin price predictions for 2022 and beyond. WalletInvestor's analysts think Terra (LUNA) will gradually rise and hit $160.227 per asset by 2030. DigitalCoinPrice analysts also suggest that this uptrend will be gradual but do not expect LUNA to surpass $35.42 in 2030.

LUNA price prediction today

Terra's value is expected to continue to expand, as shortage tends to encourage price rises.

When discussing price predictions for cryptocurrencies, we'd like to warn you that analyst and algorithm-based LUNA future price predictions can be wrong. Always do your research before you decide to trade or invest in crypto assets.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.