What is an Initial Coin Offering (ICO)?

Currently, there are many options for attracting investment in projects. As technology develops, new ones appear. The emergence and rapid development of blockchain technology and cryptocurrencies brought in a new way of attracting investments: the Initial Coin Offering (ICO). What is an initial coin offering, and how to invest in an initial coin offering? Let's find it out!

For developers of blockchain projects,Initial Coin Offerings are a relatively easy way of raising funds; for investors, it's a profitable (albeit very risky) investment vehicle.

I think there will always be a need of trusted voices in the investment community, but what the ICO markets are showing is that the world has incredible demand for future-looking projects! — Adam Draper, founder and CEO of Boost VC.

ICO meaning in cryptocurrency

What does ICO stand for? An ICO is an Initial Coin Offering, a form of investment attraction that appeared thanks to the development of cryptocurrencies, one which blockchain startups widely use. It involves selling a fixed amount of the project's cryptocurrency tokens to investors. The term traces its origins to the financial term, IPO, an initial public offering of shares. However, unlike IPOs, investors in ICOs don't have some rights that shareholders have. In particular, participating in an ICO doesn't give the investor an ownership stake in the company making the offering.

During the crypto initial coin offering, the project team sells digital tokens to investors for cryptocurrencies (usually Bitcoin or Ethereum) or, in rare cases, for fiat money. Later, these tokens can be used on the project platform as an internal currency or traded on crypto exchanges.

One of the latest fundraising methods, the first ICO, was carried out in 2013 when over $5 million was collected for the Mastercoin project. The most successful example of initial coin offering companiesto date is Ethereum, which raised $18.5 million in 2014 and has since generated millions of dollars in profit for its investors.

What is a white paper?

A white paper is a document that provides a detailed description of the project. Generally, in addition to a general description of the project, it includes a description of its technical aspects, financial model, development roadmap, the development team, and more. The existence of a white paper is a kind of standard for projects conducting an ICO. In some ways, it's a marketing tool to attract potential investors and is designed to convince them of the project's seriousness and potential.

How does an ICO work?

So, how to do an initial coin offering? ICOs are usually carried out as follows:

- Developers come up with an idea for a product that's usually related to blockchain technology.

- The developers announce their project to the public in online publications, social media networks and forums. At this stage, the project usually exists only as an idea. Afterwards, the developers evaluate the level of investors' interest in the project.

- The developers create a public crypto initial coin offering that describes the most important terms of the contract in detail. They also establish a legal entity to make the offer.

- After the offer is posted on the project's website, a marketing campaign gets underway to attract investors.

- The project tokens are sold to investors, most often via the project website. In addition, developers at this stage or a subsequent stage of the crypto initial coin offering try to get their tokens listed on a crypto exchange.

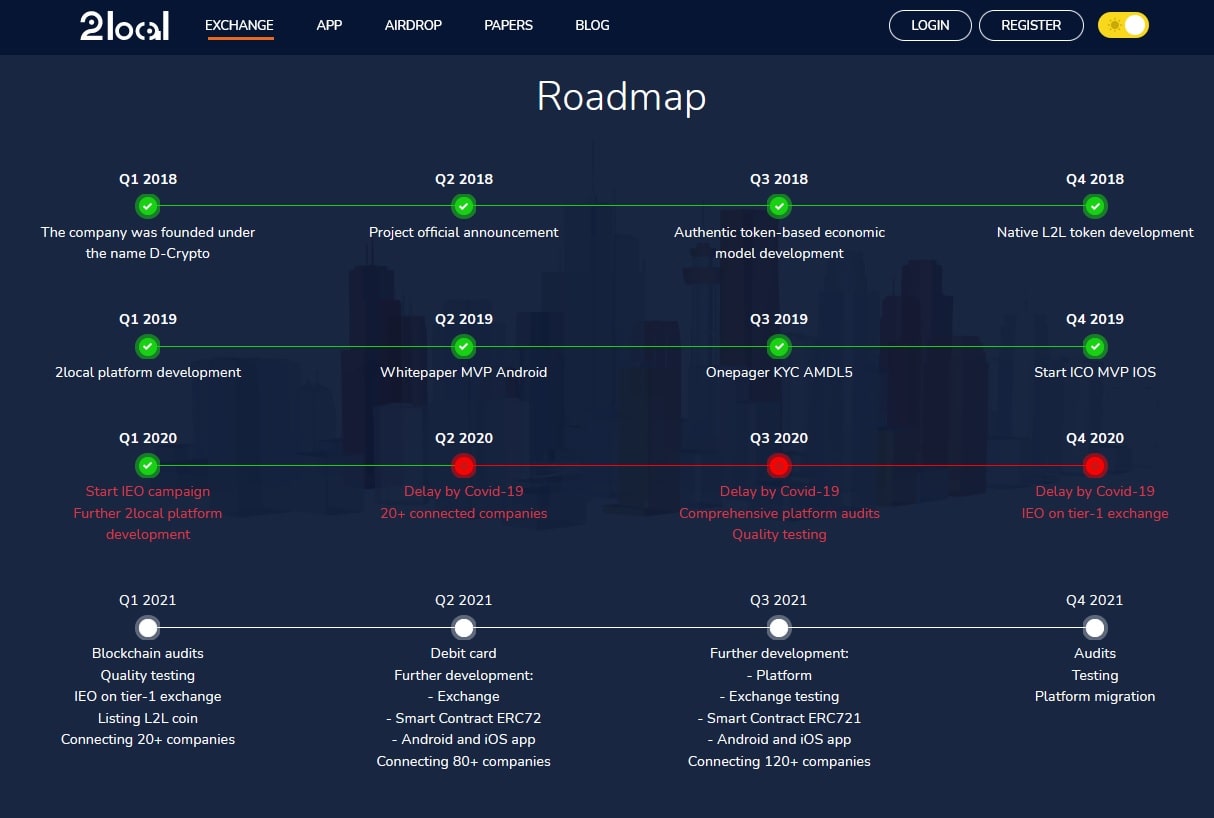

- After attracting the required amount of investment, the project developers work on the project according to the roadmap.

What does pre-ICO mean?

Now that we have found out "What is an ICO in cryptocurrency?", let's move further and discuss the meaning of pre-ICO.

Pre-ICO (also known as pre-sale) is a stage of attracting investment in a project even before the ICO's actual launch. In the pre-ICO period, the token price is at its lowest while the risk for investors is at its highest.

Security token offering vs Utility token offering

Depending on how the function tokens perform, they are divided into two types during the Initial Coin Offering: security tokens or utility tokens.

- Security tokens give their holders the right to receive the underlying assets, dividends and interest. Economically, they function similarly to stocks or bonds. In many countries, regulators perceive the offering of such tokens as a method of circumventing securities laws and treat them accordingly.

- Utility tokens give access to goods and services that the project will provide after its launch. These tokens can also be used to obtain a discount or premium access to the project's goods and services.

Crypto ICO analysis

How to invest in initial coin offering? Investing in ICO is a highly profitable — and highly risky — type of investment. To reduce the risk of losing money, you should first conduct a preliminary analysis of the crypto initial coin offering. When studying the ICO you're interested in, pay close attention to the following:

- Project team. Learn as much as possible about the project's developers, especially the team members' experience, which projects they were previously involved in and in what roles.

- White paper. Carefully study the project's white paper. Projects that do not have this document should be avoided. After reading the white paper, you should understand what prospects the project has, what features it has and which advantages it offers that are different from other projects, among other things. Clear language, precise wording and an attractive, understandable business model are good signs. A project aimed at solving a real problem in the industry will have better prospects.

- Roadmap. A good project roadmap should describe the stages of financing, detailing how the project plans to spend the funds it raises, the timing of each stage, as well as proof of the feasibility and prospects of its selected goals.

- Legal status (including an officially registered legal entity). Make sure the project doesn't have potential legal problems.

- Community and social media. Explore the major forums to see what the average investor thinks about the project. Learn how the media is covering the project.

- Code quality. Most cryptocurrency projects are open-source. If you have programming experience, you can try to analyse the project code yourself. One can get an idea of the developers' skills and how seriously they're taking the project by looking at the code's quality.

- Listing of tokens on the exchange. It's a good sign if a token listing is planned soon, especially on a major crypto exchange.

- Potential ICO participants. It may be helpful to know if any major investors have announced their participation in the ICO.

Still, bear in mind that investing in ICOs is highly risky. Invest only what you can afford to lose.

How to create an Initial Coin Offering

This article doesn't really explore how to start an Initial Coin Offering or how to invest in initial coin offering, which is an extensive topic in its own right. However, if you have an idea for a blockchain project in which an ICO is a suitable fundraising model, you can review the ICO analysis criteria we described here and use them when developing your idea.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

What is an ICO in crypto?

ICOs serve as an unconventional cryptocurrency avenue for businesses seeking capital. Investors engage with ICO trading platforms, exchanging monetary support for unique cryptocurrency "tokens." This method, a form of crowdfunding, involves creating and selling digital tokens dedicated to project development. These distinctive tokens function as currency units, granting investors specific project-related privileges. What sets them apart is their role in funding open-source software projects that often struggle to secure financing through conventional means. Crypto initial coin offerings provide a novel and innovative approach to addressing funding challenges projects face in the dynamic landscape of cryptocurrency and blockchain development.

What are initial coin offering examples?

Some of the most vivid initial coin offering examples include Ethereum, which raised funds through an ICO in 2014 to develop its blockchain platform; Ripple, which conducted an ICO in 2013 to fund the development of its digital payment protocol; and EOS, which raised a substantial amount through its ICO in 2017 to build a decentralised operating system.

Are there regulations governing ICOs?

Yes, there are regulations governing Initial Coin Offerings (ICOs). Various countries have implemented or are developing regulatory frameworks to address the legal and financial aspects of ICOs. These regulations ensure investor protection, prevent fraud and maintain market integrity. Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, issue guidelines and enforce compliance to bring ICOs within established legal boundaries, fostering a more secure and transparent environment for cryptocurrency fundraising.

Are ICO securities offerings?

ICOs potentially fall within the realm of securities offerings, subject to the SEC's oversight for enforcing federal securities laws, contingent upon individual circumstances and details. The classification of crypto initial coins as securities offerings is determined based on specific factual considerations, emphasising the importance of compliance with regulatory frameworks governing financial securities.