How to Invest in Bitcoin

In the modern world, rare is the person who's never heard of Bitcoin. Bitcoin laid the foundation and brought the term cryptocurrency into our daily lives. But what do you need to know about Bitcoin investing? Is Bitcoin investment a great opportunity? Is Bitcoin a good investment? What factors should be considered when thinking about Bitcoin investment? What is the best platform to invest in cryptocurrency?

If you ever thought about whether you should invest in Bitcoin, then this article is for you. We'll provide detailed information on the subject to help you develop a proper understanding and take the right decisions. Here are the topics we'll cover in this article:

- What to know before Bitcoin investing

- Bitcoin investment opportunities

- Who invented Bitcoin?

- Is Bitcoin a good investment?

- Is Bitcoin a safe investment?

- Dragons Den Bitcoin investment

- Grayscale Bitcoin Trust

- How much money should I invest in Bitcoin?

- How to invest in Bitcoin in the UK

- Different ways to invest in Bitcoin

- Is it worth investing in Bitcoin?

- Bitcoin investment pros and cons

- Conclusion

What to know about Bitcoin investing

How can we describe Bitcoin (BTC), plain and simple? Bitcoin is a new generation of decentralised digital currency, which is also known as a cryptocurrency. It was created online and only works on the internet. No one controls it. Cryptocurrency is issued as a result of the work of millions of computers around the world, with special software calculating the mathematical algorithms. That's Bitcoin in a nutshell.

How does Bitcoin differ from traditional e-money, such as PayPal, WebMoney, Amazon payments or Google Pay?

With Bitcoin, you can buy anything online as you would with dollars, euros or any other currency. In addition to that, Bitcoin trades widely on stock exchanges (e.g., the Chicago Mercantile Exchange) and cryptocurrency exchanges, such as StormGain. Decentralisation is the primary difference between Bitcoin and other forms of money. No institution in the world controls Bitcoin. It's a plus in terms of independence, but for some, this situation may stir distrust. Specialists say that by controlling the majority of the computing power on the network (over 51% of mining power), an attacker could interfere with the process of recording new blocks by preventing other miners from completing the task. In theory, that would allow the attacker to monopolise the mining of new blocks and gather all rewards.

Bitcoin investment opportunities

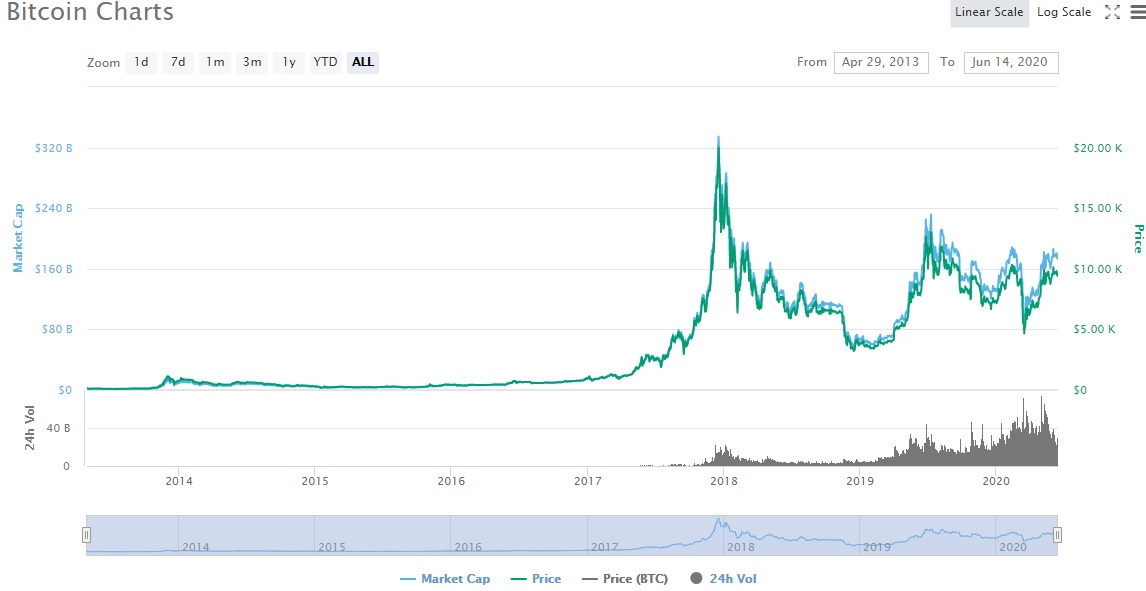

Among the vast array of assets, Bitcoin stands out for its profitability, volatility and innovative approach. That provides plenty of opportunities for traders and 'hodlers', too (people who buy low and hold the coin until it reaches their target). But the timing for jumping into a Bitcoin investment is just as important as the moment to sell. In the long run, we can see a significant increase in Bitcoin value. Here is an example of BTC's exponential growth and decline.

Correction start date | Correction end date | Days in correction | Bitcoin high price $ | Bitcoin low price $ | Decline, % | Growth, % |

12/02/2012 | 27/02/2012 | 16 | 7.38 | 3.8 | -49% | *** |

17/08/2012 | 19/08/2012 | 3 | 16.41 | 7.1 | -57% | 421% |

6/03/2013 | 7/03/2013 | 2 | 49.17 | 33 | -33% | 700% |

21/03/2013 | 23/03/2013 | 3 | 76.91 | 50 | -35% | 230% |

10/04/2013 | 12/04/2013 | 3 | 259.34 | 45 | -83% | 518% |

19/11/2013 | 19/11/2013 | 1 | 755 | 378 | -50% | 1,678% |

30/11/2013 | 14/01/2015 | 411 | 1,163 | 152 | -87% | 308% |

10/03/2017 | 25/03/2017 | 16 | 1,350 | 891 | -34% | 888% |

25/05/2017 | 27/05/2017 | 3 | 2,760 | 1,850 | -33% | 310% |

12/06/2017 | 16/07/2017 | 35 | 2,980 | 1,830 | -39% | 161% |

2/09/2017 | 15/09/2017 | 14 | 4,979 | 2,972 | -40% | 272% |

8/11/2017 | 12/11/2017 | 5 | 7,888 | 5,555 | -30% | 265% |

17/12/2017 | 15/12/2018 | 363 | 19,666 | 3,111 | -84% | 354% |

26/06/2019 | 18/12/2019 | 193 | 13,889 | 6,442 | -54% | 446% |

13/02/2020 | 12/03/2020 | 28 | 10,500 | 3,874 | -63% | 163% |

01/06/2020 | *** | *** | 10,433 | *** | *** | *** |

Bitcoin's increases and declines.

Who invented Bitcoin?

Let's look back at the history before discussing the best platform to invest in cryptocurrency and "What are good Bitcoins to invest in?" A developer calling himself Satoshi Nakamoto proposed an electronic payment system based on mathematical calculations. The idea was to exchange coins without centralised control in electronic form, more or less instantaneously and with minimum expenses.

On 31 October 2008, Nakamoto published the article Bitcoin: A Peer-to-Peer Electronic Cash System, which described Bitcoin in full. It is a decentralised e-cash system that does not require trust from third parties. In early 2009, he released the first version of a virtual wallet using Bitcoin and launched the Bitcoin network. To this day, no one has verified Satoshi Nakamoto's identity. Theories on the true entity behind the name range from crypto sphere enthusiasts to such groups as the US National Security Agency.

Is Bitcoin a good investment?

While the dollar has an unlimited supply, Bitcoin's total supply is limited. Only 21 million bitcoins can be issued. Each bitcoin can be divided indefinitely into smaller parts. One satoshi (named after the creator of the cryptocurrency) is 0.00000001 BTC. The fixed total supply with growing demand led to a significant increase in the value of Bitcoin. Investing in Bitcoin cryptocurrency is a great chance to multiply your bank account. It's worth mentioning that the time you invest in Bitcoin is important. The cheaper you buy it, the more profit you make! In one of our articles, we predicted the price of Bitcoin in 2025, 2030 and 2040.

Is Bitcoin a safe investment?

Bitcoin is a very risky asset type. There have been massive surges and drops in price throughout Bitcoin's history. We wouldn't advise investing an amount you can't afford to lose, no matter what the asset is. It's best to diversify investments among a large basket of assets.

Are Bitcoins safe to invest in? As you saw in the table above, there are significant ups and downs in Bitcoin's price. For instance, in the past, Bitcoin fell over 80% over several weeks and even months. That happened multiple times throughout its existence.

Dragons Den Bitcoin investment

Dragons Den is a British reality TV show broadcast in over 30 countries. The show involves entrepreneurs pitching their business ideas to investors. There are rumours that some Bitcoin trading robots have been presented on this show and were invested in. There is no evidence to support these claims. It is, therefore, highly likely that gossip blogs are spreading these unfounded rumours. There was no episode about Bitcoin there. When Peter Jones was asked about his Bitcoin investment and trading robots promoted through their show, he answered as follows:

As you see, many individuals are speculating on investing in cryptocurrency and Bitcoin, in particular. It's recommended that attentive readers do their research and due diligence before taking the next step.

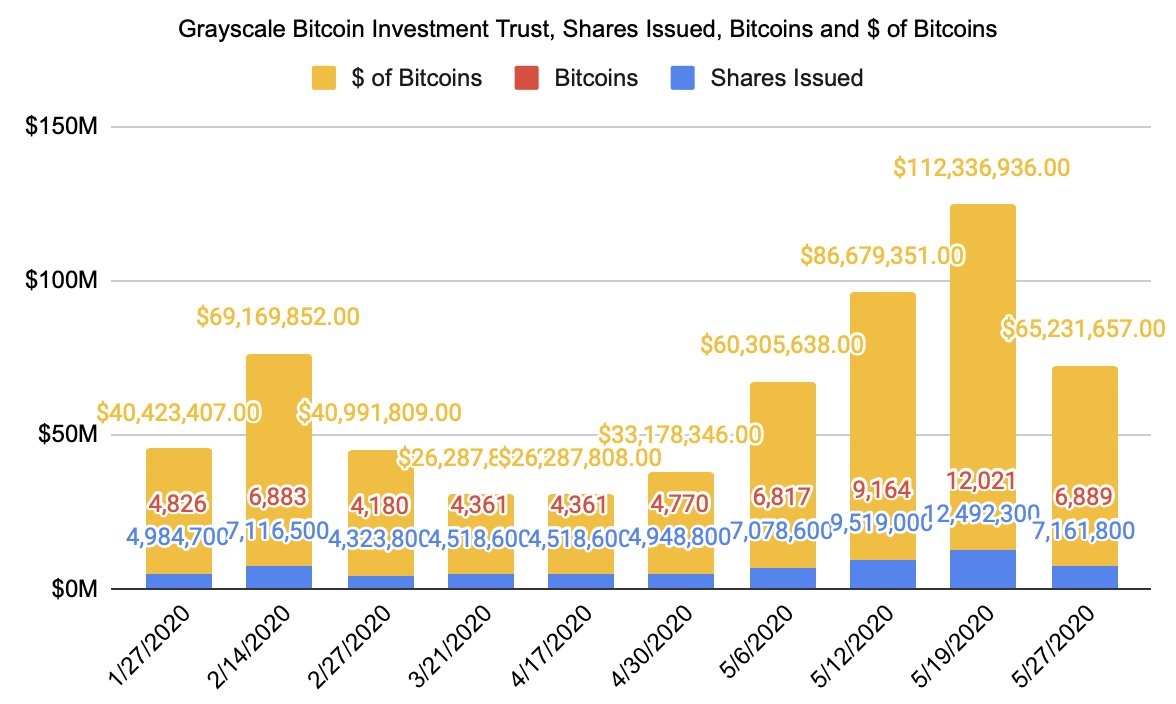

Grayscale Bitcoin Trust

On the other hand, we have clear evidence that big hedge funds are interested in Bitcoin. For example, Grayscale Bitcoin Trust is expanding its presence in cryptocurrencies and Bitcoin. Grayscale is one of the biggest companies investing in cryptocurrency and Bitcoin, in particular. Here are the metrics from their official site.

How much money should I invest in Bitcoin?

Every investor should decide for themselves how much to invest in Bitcoin. Investments and risks go hand in hand when you invest in stocks or cryptocurrencies. The higher your Bitcoin investment is, the greater your returns, and vice versa. We recommend studying up first and building a profitable trading strategy. There's no harm in using a demo account with virtual money to learn how trading works and see what your results would be. You can get an understanding of the risks involved in real trading and always stick to your risk management system.

Different ways to invest in Bitcoin

Investors who decide to invest in Bitcoin are, first and foremost, interested in how to do it better. These are the main ways to invest in cryptocurrency and Bitcoin, specifically:

- Buying Bitcoins with a bank card

- Buying Bitcoins for cash (hand-to-hand or via a cash machine)

- Bank wire transfer

- Invest in Bitcoin through mining

How to invest in Bitcoin in the UK

Many platforms in the UK make investing in Bitcoin a possibility. For example, you can fund your account via bank transfer or credit card. You can learn how to buy Bitcoin in our blog article.

Is it worth investing in Bitcoin?

Bitcoin is the first of its kind. BTC's limited supply makes it unique when compared to current fiat currencies with an unlimited supply. And Bitcoin is only 11 years old! In our view, yes, it's worth investing in Bitcoin.

Bitcoin investment pros and cons

Before deciding "Should I invest my Bitcoins?" and "What is the best crypto investment platform?", it's always good to learn about the following pros of Bitcoin investment:

Decentralisation. There is no central committee governing the Bitcoin network. It's distributed to all participants, and each computer mining Bitcoins is an equal member in this system. That means that no central authority can dictate the rules to Bitcoin owners. And even if part of the network goes offline, the system will continue to work.

Easy to use. When opening a company bank account, you have to go through the seven circles of Hell. In the end, you may be refused without explanation. With Bitcoin, forget about those problems. When investing in cryptocurrency, it only takes five minutes to create a Bitcoin wallet and immediately start using it. No questions, no commission. After that, all that's left to do is fund your wallet. Read our article to learn more about how to buy Bitcoin with a credit card.

Anonymity. Bitcoin is completely anonymous and, at the same time, fully transparent. An infinite number of Bitcoin addresses can be created without a name, address or any other information. However…

Transparency. Bitcoin stores the history of all transactions that have ever taken place. This is called a sequential blockchain, and blockchain knows all. So, if you have a publicly used Bitcoin address, anyone can see how many Bitcoins you have in your account. No one will know that the address belongs to you if you don't report it. Those who want complete anonymity use a new Bitcoin address for each transaction.

Low commission. Your bank can easily deduct $50 for international wire transfers and charge extra. But that's not the case with Bitcoin, and this is another reason to invest in cryptocurrency. Investing in cryptocurrency, you can send tremendous amounts of money while paying as low as $10 per $1,000,000 transferred!

Despite Bitcoin's many advantages, investing in it comes with some cons, too. Every investor should pay close attention to these risks. The main ones are the lack of equivalent values of cryptocurrency, the uncertainty of regulatory authorities, hacker attacks and anonymity. Here are the cons.

The value of Bitcoin. The opponents of the first cryptocurrency use this argument. Everyone knows the value of gold and fiat money, but opponents say that the value of Bitcoin isn't backed by anything. It can be argued that Bitcoin is at least backed by the resources spent to produce and run the network. However, the value of cryptocurrency rests on demand. The more demand there is, the higher the value is. The real value of investing in cryptocurrency is the result of speculative transactions and the hype around the currency itself. If large investors suddenly decide to sell their bitcoins, panic would ensue in the market, which would lead to a dramatic collapse in prices. Bitcoin's collapse in 2018 is associated with this phenomenon.

Absence of regulatory norms. Financial regulatory institutions in different countries are very wary of cryptocurrency. In the United States, the Securities and Exchange Commission still cannot decide what kind of asset to consider Bitcoin. There are strict restrictions on the activities of cryptocurrency exchanges and companies. It is still unknown when Bitcoin will be recognised as a universal medium of exchange.

Attacks by hackers. Fraudsters became active in the cryptocurrency field almost immediately after its inception. Nearly every year, trading platforms get hacked, with thieves stealing hundreds of millions of dollars. Investors are left unprotected, unable to get their money back. Only in recent years have law enforcement agencies begun to investigate such cybercrime successfully.

Conclusion

In summary, investing in cryptocurrency and trading cryptocurrency is the newest market, one that requires some specialised knowledge. Today, cryptocurrencies are one of the fastest-growing classes of investment assets, guaranteeing unseen prospects and threats for the development of the entire global financial system. There are many ways to invest in cryptocurrency, and the possibilities to choose thebest platform to invest in cryptocurrency are advancing. Many governments are slowly changing their negative attitude towards cryptocurrency. Having analysed the dynamics of Bitcoin's value and its market capitalisation, we can predict that Bitcoin will continue to grow.

Investing in Bitcoin is a risky business, but it can be profitable at the same time. If you have funds available, start investing in Bitcoin with StormGain (one of the best platforms to invest in cryptocurrency) now to begin your journey to earning a respectable income.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

Are Bitcoins safe to invest in?

If you want to invest in cryptocurrency and Bitcoin, in particular, you should be aware that such a decision comes with a substantial amount of volatility and risk. Before making any investments, it is crucial to deeply understand the nature of Bitcoins, develop a strategy for your crypto assets, and consider seeking appropriate financial guidance. It is important to remember only to invest an amount that you can afford to lose.

What are good Bitcoins to invest in?

Identifying new bitcoins to invest in requires thorough research and consideration of various factors. When investing in cryptocurrency, it's essential to analyse the project's technology, team, and community support. Keep an eye on market trends and emerging opportunities, and consider using a reputable crypto investment platform to execute trades securely. Diversifying your portfolio with well-established cryptocurrencies, often referred to as thebest crypto to invest in, alongside potential new and promising projects, can be a prudent strategy.

What are the risks of investing in Bitcoin?

Due to Bitcoin's extreme price fluctuations and security vulnerabilities, it is crucial to carefully evaluate your motivations before exchanging any currency for BTC. Cryptocurrency is a highly speculative investment. Investors should only put in money they are ready to lose, as the risk/reward characteristics of Bitcoin investing differ significantly from traditional stocks or bonds.

Is investing in BTC worth it?

Investing in cryptocurrency and Bitcoin is a risky endeavour due to its high volatility. It is advised only to consider investing in Bitcoin if you have a high tolerance for risk, are financially stable, and can afford potential losses.

How can I invest in Bitcoin?

Investing in Bitcoin can be done through major cryptocurrency exchanges or by purchasing shares in a company heavily involved in Bitcoin, like a Bitcoin mining company.