1inch Network (1INCH) price prediction 2022-2030

Despite the growing popularity of decentralised crypto exchanges (DEX), they are still inferior to centralised ones in terms of trading volumes and, as a result, in terms of liquidity. A project aimed at solving this problem is the 1inch Network. In this article, we'll tell you about the project and its native token 1INCH and explore its future price predictions.

What is 1inch Network (1INCH)?

The 1inch Network platform is an aggregator of decentralised exchanges that facilitates their use and is capable of splitting a single trade transaction across multiple DEXes. It allows users to trade on DEXes with minimal price slippage and time delays, as well as earn money by providing liquidity for specific trading pairs.

We aim to unite traders and liquidity providers, facilitating transactions that are profitable for both sides. The core functionality of 1inch is to aggregate data from various decentralised exchanges and to combine the best prices from all bids with the necessary liquidity. — Sergej Kunz, CEO and co-founder of 1inch Network.

The history of 1inch Network

1inch Network was founded in May 2019 at the ETHGlobal hackathon by Russian programmers Sergej Kunz and Anton Bukov. In August 2020, the platform was officially launched, with its initial funding round raising $2.8 million.

In December 2020, the second round of funding came to an end, which resulted in $12 million. During the same period, 1inch Network's native token 1INCH was issued. A total of 1.5 billion tokens were issued, but only 6% of them were unlocked. The rest will be gradually put into circulation and be fully unlocked by 30 December 2024.

In February 2021, 1INCH tokens were also released on Binance Smart Chain. In June 2021, the limit order protocol was launched, and in December 2021, the third round of funding closed after raising $175 million.

1inch Network's features

The 1inch Network platform gives its users access to many decentralised crypto exchanges from one interface. The platform combines three protocols:

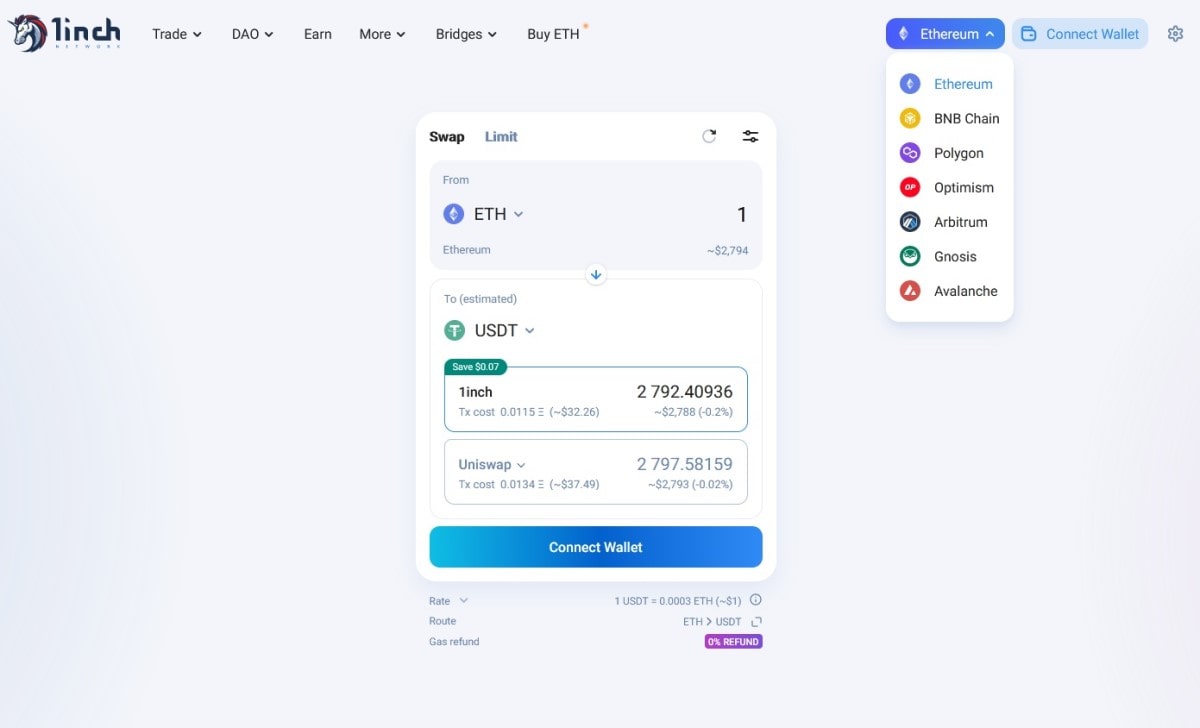

- Aggregation protocol. It searches for the best price among multiple DEXes and transfers an order to the corresponding exchange using a smart contract. If there isn't enough liquidity, the platform splits the order into several smaller ones and redirects them to several exchanges. As a result, the trader gets fast order execution with minimal slippage.

- Limit order protocol. While limit orders are the norm on centralised exchanges, they're still rare on DEXes. Moreover, in addition to the usual limit orders, this protocol makes it possible to set trailing stop orders that increase the stop price when the market price rises.

- Liquidity protocol. It allows users to earn interest on their assets by providing liquidity to liquidity pools.

The project is managed by a decentralised autonomous organisation (DAO). The native 1INCH token is the governance token in the 1inch Network ecosystem. Token holders can vote to change key protocol parameters in the DAO model and participate in network governance. 1INCH is an "instant governance" token, which means that the governance protocol starts making changes according to the number of votes as early as 24 hours after the vote. In addition to governance, the 1INCH token also performs utility functions in the liquidity protocol.

1INCH is a multichain token, available on Ethereum and on Binance Smart Chain.

1inch Network (1INCH) price analysis

As of 29 July 2022, the 1INCH token ranked 80th among cryptocurrencies by market capitalisation at $404,558,558.

1INCH price statistics (as of 29/06/22)

1INCH current price | $0.7403 |

Market cap | $404,558,558 |

Circulating supply | 546,513,977.71 1INCH |

Max supply | N/A |

Daily trading volume | $196,329,870 |

All-time high | $7.87 (08/05/21) |

All-time low | $0.5178 (18/06/22) |

Website |

1INCH's price history

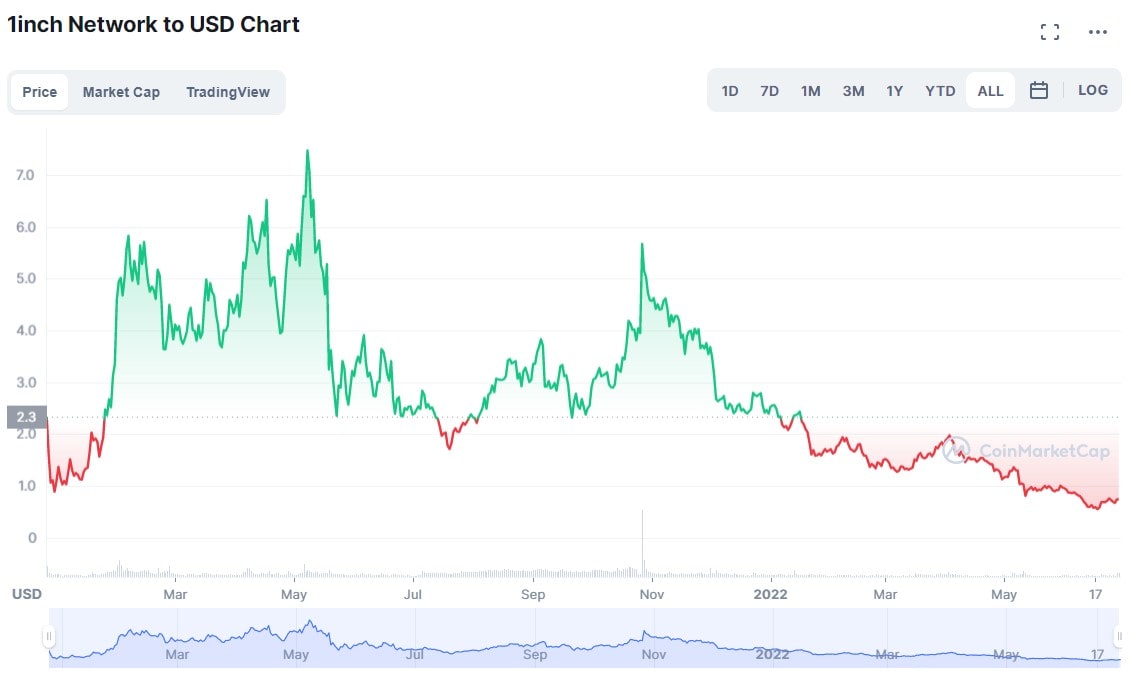

In the first days after the release of the token on the crypto market, its price fell and reached an all-time low on 29 December 2020. After that, in early 2021, the price began to rise and, despite high volatility, consistently reached new all-time highs on 5 February, 8 April, 17 April, and finally on 8 May, when it rose to its current all-time high. That was followed by a landslide price drop that continued until 20 June. The subsequent recovery of the price failed to update the historical maximum. After 27 October, the bearish trend returned and has continued till now.

1inch Network technical analysis

At the moment, the token's price is in a descending channel. In June 2022, 1inch created a new all-time low at $0.51 and has yet to return to the channel support, indicating that we may still see another all-time low formed in the coming days or weeks. The moving averages are also strongly bearish, and the MACD is showing signs of uncertainty.

The nearest resistance levels are at $0.72 and $1.18, while the nearest support level is the newly formed all-time low at $0.51. The most likely scenario at the moment is a price drop to the nearest support level.

1inch Network (1INCH) price prediction 2022

The token price behaviour in 2022 will primarily depend on the general state of the crypto market. If the price continues to fall and breaks the all-time low, it's impossible to predict how low it can fall. If the price breaks through the upper border of the descending channel, this may mean the return of the bullish trend.

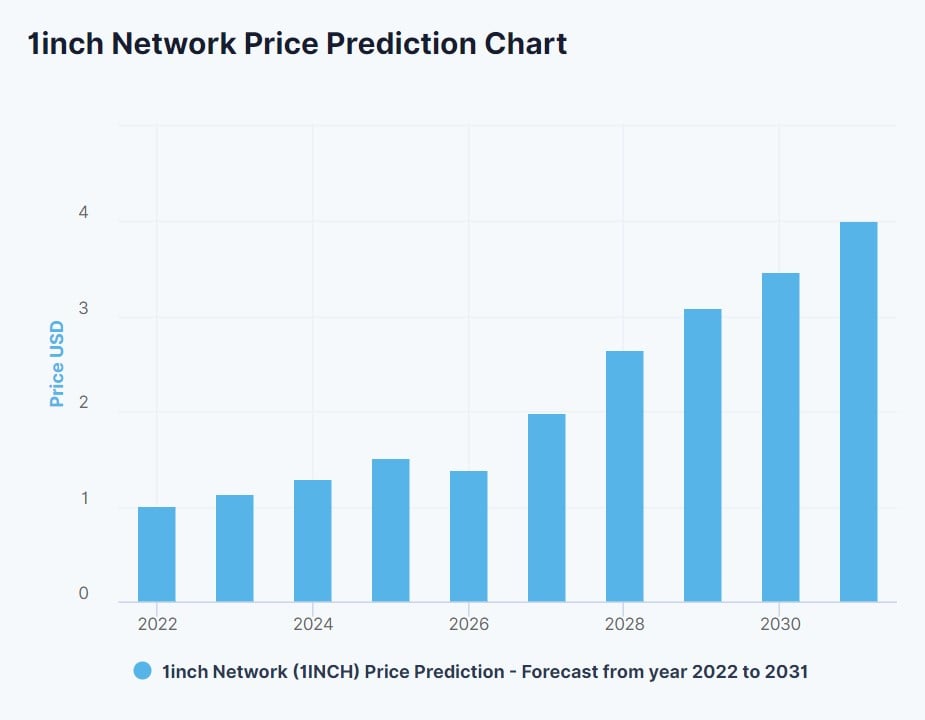

1inch Network(1INCH) price prediction for 2022, 2023, 2025 and 2030

Now let's take a look at the 1INCH crypto future price predictions made by popular forecasting services.

Trading Beasts' 1INCH price prediction for 2022, 2023, 2025 and 2030

Trading Beasts predict an increase in the token price in the coming years. They believe the token will be worth $1.13 at the end of 2023, $1.67 at the end of 2024 and $2.07 at the end of 2025.

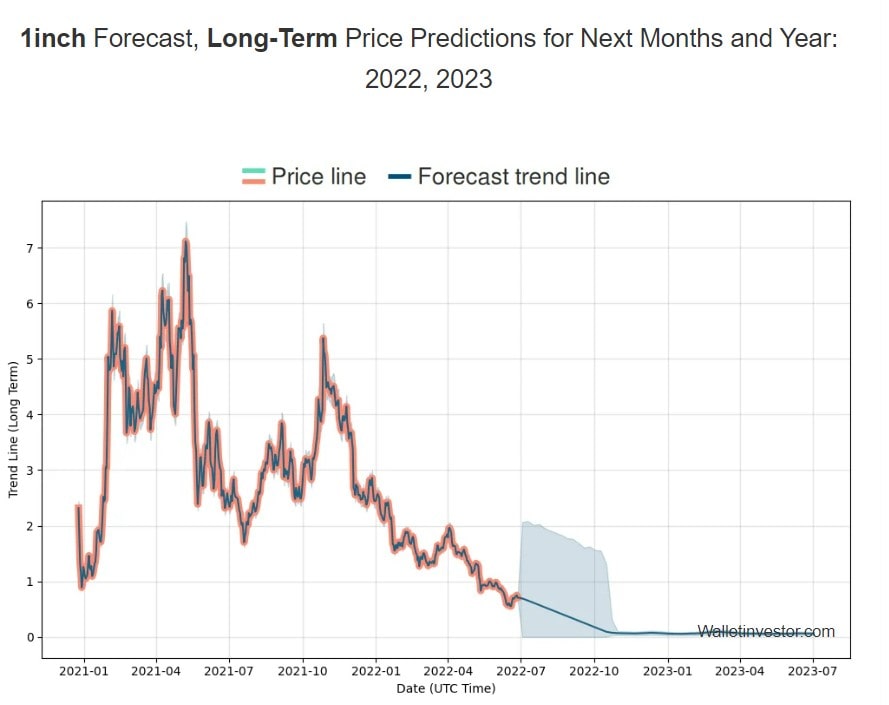

Wallet Investor's 1INCH price prediction for 2022, 2023, 2025 and 2030

Wallet Investor doesn't agree with the Trading Beasts' prediction and believes that the price of 1INCH will decline by over 90% in the next year. According to their forecasts, the price will be $0.062 in one year. In subsequent years, the price will partially recover and fluctuate between $0.15-$0.25.

DigitalCoinPrice's 1INCH price prediction for 2022, 2023, 2025 and 2030

According to DigitalCoinPrice calculations, the token price, despite fluctuations, will grow and reach $1.00 at the end of 2022, $1.13 at the end of 2023, $1.51 at the end of 2025 and $3.46 at the end of 2030.

PickACrypto's 1INCH price prediction for 2022, 2023, 2025 and 2030

PickACrypto thinks that the token price has a good chance of visiting the $5.00-$10.00 mark in 2022. For 2023-2025 their opinion is that the price will most likely grow and will be in the range of $15-$40.

Gov Capital's 1INCH price prediction for 2022, 2023, 2025 and 2030

Gov Capital's forecasts are often among the most optimistic when compared to other renowned forecasting services. This is also true in the case of 1INCH. According to their calculations, the token will be worth $5.40 in a year.

Price Prediction's 1INCH price prediction for 2022, 2023, 2025 and 2030

Price Prediction is also very optimistic about the prospects for 1INCH. They believe the average trading price of the token will be $3.98 in 2022, $6.00 in 2023, $13.57 in 2025 and $82.87 in 2030.

CryptoPredictions'1INCH price prediction for 2022, 2023, 2025 and 2030

CryptoPredictions' 1INCH price forecast is quite similar to the Trading Beasts' prediction. According to them, the token price will be $2.054 at the end of 2022, $2.955 at the end of 2023 and $4.227 at the end of 2025.

1inch Network (1INCH) overall future value predictions

Given the growing popularity of decentralised crypto exchanges, the popularity of DEX aggregators will grow, as well. Moreover, the advantage of 1inch Network over its competitors is that it doesn't just choose the best price but distributes orders between different exchanges, thus solving the liquidity problem and optimising trading.

Having said that, it should be noted that the future of the 1inch Network, like other DEX aggregators, depends on the popularity of the DEXes. If it falls for any reason, they will also experience an outflow of users. In addition, the 1INCH token, according to the developers themselves, is not intended to be an investment asset. The volume of tokens in circulation is constantly growing due to the unlocking of frozen tokens. Besides, the maximum number of tokens is theoretically unlimited. Thus, the price can remain low even despite the growing popularity of the platform.

How high can 1inch Network go?

With a favourable situation in the crypto market in general and in the DeFi sector in particular, the token price is quite capable of exceeding $3.00 again. An even more optimistic forecast shows the price is likely to repeat or even break the all-time high.

1inch Network(1INCH) price prediction today

In the near future, the price is most likely to fall further to set a new all-time low in the coming weeks.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.