Crypto wallet types: What's the difference?

So, you've decided to take the cryptocurrency plunge? Great news. Now, all that's left to do is decide how to store all your coins! In case you haven't heard, wallets nowadays aren't just made out of leather and stored in your coat pocket. Following the crypto revolution, a new type of virtual wallet has emerged. They are completely digital, and their purpose is to keep their users' cryptocurrencies both safe and easily accessible when needed.

Different crypto wallet types: Cold vs Hot storage

When it comes to crypto wallet types, there are countless specific solutions on offer, but more or less all fall into two main categories: hot or cold. Let's get different crypto wallet types explained.

Hot storage media are entirely online and include a wide range of individual crypto wallet types. They are generally considered more user-friendly and accessible than their cold alternatives, but this comes with an elevated security risk. Cold wallets, on the other hand, are completely offline and – while a bit tricky to get to grips with – there's no safer way to store large amounts of crypto.

Web/online wallets

This is perhaps the most popular hot storage option, particularly among casual buy-and-hold investors. Typically, this crypto wallet example is hosted on crypto exchanges and is used to hold currency purchased on the exchange in question. Web/online wallets are incredibly convenient and thus make owning cryptocurrency a possibility for a wide range of people of different ages with varying levels of technological literacy. The only downside to online wallets is their relative vulnerability to hacker attacks. Indeed, every year, we see numerous stories of big-name exchanges falling victim to coin thefts.

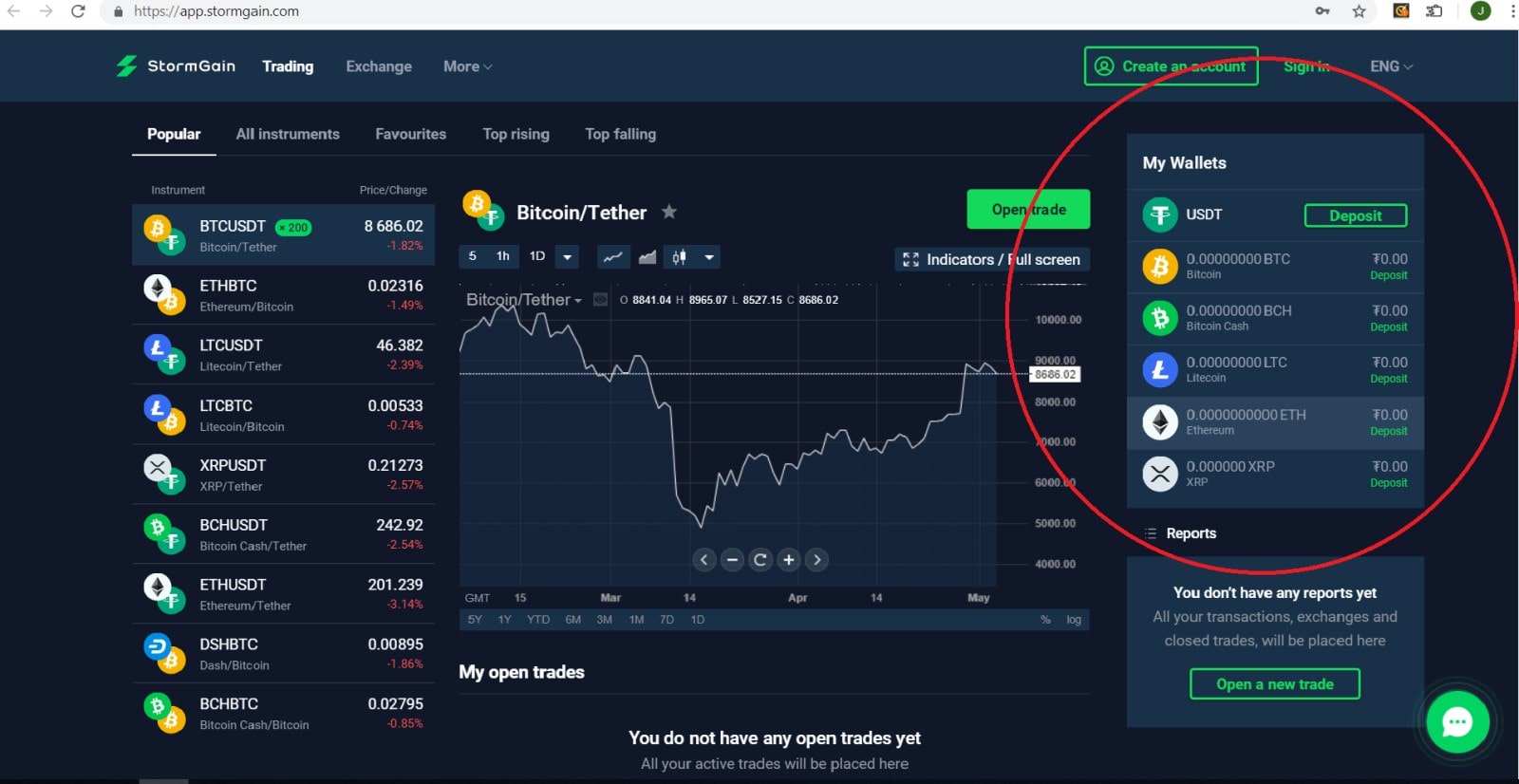

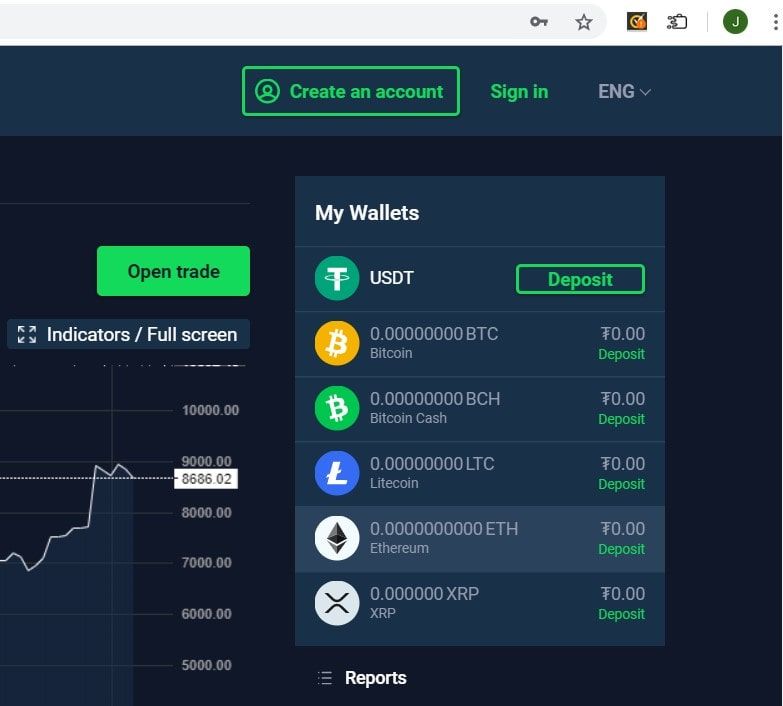

Luckily, StormGain uses online cold storage technology, so you can have all the security advantages of a cold wallet with the ease of access of a hot wallet. With our industry-leading encryption, there's no chance of any would-be coin bandits getting their hands on your crypto. If that wasn't enough, StormGain also uses 2FA to protect your money, even if your account details have been compromised. And that security doesn't come at the cost of convenience. All six of your StormGain wallets are easily accessible directly from the terminal home screen. Just see for yourself:

Mobile wallets

In essence, there is a lot of difference between a standard online wallet and a mobile wallet. Putting aside the fact that mobile wallets are portable and take the form of an application, the technological basis is much the same. That said, some mobile wallets are integrated with trading platforms and, therefore, offer greater functionality. They might, for example, include live charts and one-touch trading capabilities.

StormGain is one such provider that integrates its wallet storage into its trading app, which is available for both iOS and Android. With StormGain, you can hold up to 6 of the biggest cryptocurrencies around using your personal, in-terminal wallets. StormGain supports Bitcoin, Bitcoin Cash, Ethereum, Ripple, Litecoin and Tether, enabling you to keep your entire crypto portfolio all in one place.

Desktop wallets

Desktop wallets are really quite similar to mobile wallets in that they are software-based and stored as a programme file. They, too, offer integration with exchanges and trading platforms while also allowing users to purchase goods and services from vendors who accept crypto payments.

When comparing these two crypto wallet types, some argue that desktop wallets are more secure than their mobile counterparts – a claim that does have some truth to it. However, while there are many more attacks on mobile systems, on account of their widespread use, desktop wallets are only as well-protected as the machines they're installed on. If you don't have a strong firewall and good anti-malware set-up, you're just as vulnerable as any other hot wallet user.

Hardware wallet

This is probably the most popular cold storage type of cryptocurrency wallets. Hardware wallets come in various shapes and sizes, but their users usually look for small, portable devices that are, of course, durable. The two biggest brands on the market are Ledger and Trezor, with both these brands featuring in most top hardware wallet rankings. The image below shows just how compact these devices have become in recent years:

The biggest benefit of thistype of crypto wallet is its security. Since they only connect to the internet via the manufacturer's web portal, there are no back doors for hackers to exploit. As touched upon earlier, hardware wallets are favoured by those with significant crypto holdings, who stand to lose serious money if their accounts are hacked. While they do offer greater protection, it's also worth noting that you must set up a recovery seed password that you must also keep safe. Otherwise, you will not be able to recover your coins in the event that your wallet is lost, damaged or stolen.

Paper wallet

This kind of storage was very popular in the early days of Bitcoin, but it is now generally considered to be technologically obsolete and risky. Firstly, it's important to make the point that no cryptocurrency can be stored on paper. When people refer to paper wallets, what they really mean is the act of generating a wallet address and then printing (or writing) one's private keys as a QR code on a piece of paper (see image below for an example).

Provided you generate the paper wallet offline and then delete your internet history afterwards, it should be totally invulnerable to hacker attacks. This is clearly a huge advantage, and it really was the safest way to store crypto before encryption technology managed to catch up. The massive downside of paper wallets, compared to more modern cold storage methods, is the risk of damage or loss, rendering your coins totally irretrievable.

Public and private keys

All blockchain-based cryptocurrencies work with both public and private keys. As the name suggests, your public keys are not secure and do not contain any information that would allow the user to spend your coins. The rights to use your cryptocurrency are instead controlled by your private key. This two-key authentication technique is part of a wider cryptographic field known as Public Key Cryptography (PKC) or Asymmetric Encryption.

Put into practice for cryptocurrency transaction authentication, the result is a one-way mathematical function: a problem that is very easy to solve in one direction but which is virtually impossible to reverse. And since the key pair is linked mathematically, whatever you encrypt with a public key can only be deciphered by its corresponding private key.

Say Person A wants to send private information to Person B: he/she will encrypt the data with Person B's public key. Since nobody has access to the corresponding private key other than Person B, there's no way for anyone else to intercept and read the information in the message. The principle is exactly the same for cryptocurrency transfers. The sender uses the recipient's public key to encrypt the transfer, so only the receiver has the key to decrypt the communication.

Multi-currency wallets

As you might have guessed, multi-currency wallets are the type of crypto wallets that allow the storage of multiple different cryptocurrencies. They are useful because they enable users to keep all of their various coins in one place for easy access, which is of particular benefit at a time when most crypto investors/users have more than one coin in their portfolios. There is a wide range of both hot and cold crypto wallet types available, including Android and iOS-optimised apps and hardware USB stick-type wallets.

The most popular type of multi-currency wallet is the hot variety, with many users understandably opting for mobile solutions. One of the biggest names in this sector is Coinomi, and while they do offer great functionality and performance, there's one major drawback. You can't buy, exchange or trade coins directly in their app. StormGain, on the other hand, supports the storage of up to 6 different cryptocurrencies while also facilitating the purchase, exchange and active trading of all these coins and more.

Multisignature wallets

Multisignature (or multisig) wallets essentially refer to wallets with two private keys, each held by a different person or group of people. A good way to think about it is like a bank safety deposit box with two locks and two separate keys. Therefore, if the box's owners wish to open it, then they both need to present their individual keys simultaneously. This makes it impossible for either user to access the contents without the express consent of the other.

The same exact principle applies to multisignature cryptocurrency wallets, the only difference being that multisig wallets are not limited to just two owners. At their most basic level, people use multisignature wallets as a way of creating an additional layer of security to protect their funds. They are also an excellent way of managing joint crypto accounts with multiple stakeholders, given that, unlike traditional joint accounts at a bank, there are no physical controls to prevent individual holders from draining their wallets.

Choose your wallet on StormGain

Which type of wallet in crypto is best for trading?

Now, if you've got a small crypto fortune and just want to make sure nobody can get their hands on it but you, you'd probably be best served by a hardware wallet. However, if, like most people, you've not managed to attain millionaire status just yet, you're probably going to be interested in trading your cryptocurrencies actively. And for this, you really can't beat a secure hot wallet that's fully integrated into your trading platform or terminal.

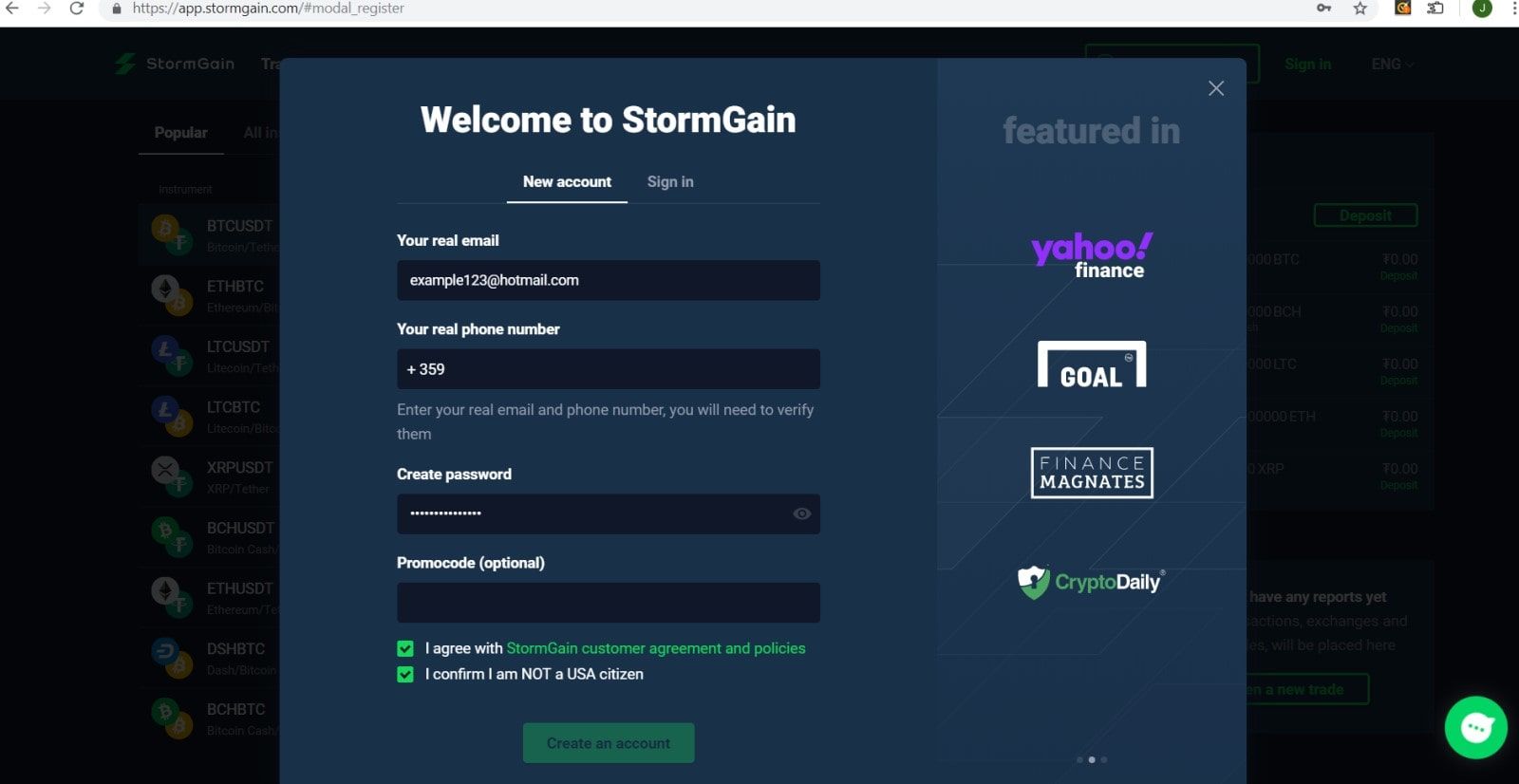

While there are indeed many different crypto wallet types out there in this day and age, none of them can offer the same level of functionality and ease of use as StormGain. As soon as you register your StormGain account, you are automatically provided with wallets in six of the most popular cryptocurrencies in circulation (Bitcoin, Bitcoin Cash, Ethereum, Ripple, Litecoin and USDT Tether). Out of these, you can then trade up to 23 different crypto pairs on the open market. Best of all, your coins are almost as safe as in a hardware wallet because the private keys are kept safe on StormGain's cold storage servers.

What are the benefits of the StormGain wallet?

Apart from being fully integrated with the trading terminal for simple and effective management, StormGain's wallets are also protected by state-of-the-art encryption – all at no extra cost to you. In fact, StormGain will even pay you 15% on all your crypto deposits up to a $50,000 USD equivalent. Guaranteed. As far as we know, there aren't any banks offering that sort of return on deposits!

With StormGain's wallets, you can sleep easy knowing your money will always be available at any time of the day or night. Furthermore, you can manage your wallet on any device you like for ultimate convenience on the go. Another noteworthy addition is StormGain's super-fast registration procedure, which allows you to purchase, store and trade cryptocurrency in just 5 seconds. As you can see in the image below, the amount of information required to set up an account is minimal:

Final thoughts

The enigmatic Satoshi Nakamoto once famously wrote: ‘If you don't believe it or don't get it, I don't have the time to try to convince you, sorry'. Well, as you've probably realised, we're a little more patient and keen to educate. Hopefully, you found this guide helpful and are now sufficiently well-versed on all the different crypto wallet types available. Ultimately, your own personal needs and requirements will guide you towards the type of wallet you will choose to store your crypto in, but it's good to know all of your options before making a final decision.

While there truly is a world of possibilities when it comes to choosing a wallet for your crypto portfolio, there aren't many solutions that can offer everything StormGain can. With the perfect balance between security, convenience and functionality, StormGain is head and shoulders above its closest competitors. Create an account today to start making a guaranteed return of at least 15% per year. It really couldn't be easier, and – with the current market volatility – there truly have never been more opportunities to make a profit.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

What are the different types of crypto wallets?

There are two main crypto wallet types: hot and cold. A hot wallet is connected to the internet or a device with internet connectivity, while a cold wallet is not connected. Additionally, there are three subcategories of wallets: software, hardware, and paper. These types of cryptocurrency wallets can be classified as either hot or cold wallets.

What is the difference between a crypto wallet and exchange?

Crypto wallets are designed to store, receive, and send cryptocurrencies, whereas exchanges serve as platforms where users can purchase, sell, and exchange cryptocurrencies. It's worth noting that centralised exchanges also provide storage options for cryptocurrencies, although the custodian (the exchange) holds the private keys.

What is the difference between a crypto wallet and a fiat wallet?

Crypto wallets and fiat wallets are two different crypto wallet types. While fiat wallets focus on facilitating deposit and withdrawal transactions, maintaining transaction records, and integrating with debit or credit cards, crypto wallets offer unique wallet addresses, private keys, transaction history, and robust security measures.

Does it matter which type of crypto wallet you have?

Cold storage wallets are considered more secure than hot storage wallets for storing cryptocurrency. For long-term storage of a significant amount of coins or tokens, it is advisable to use a cold wallet.

Why use different crypto wallet types?

Using different crypto wallet types is advisable for various reasons. It enhances the security of your coins and assets. To ensure safety, it is recommended to store significant amounts of cryptocurrency offline. On the other hand, smaller amounts that are used frequently can be stored online in smaller and more secure denominations.

What is the safest type of crypto wallet?

The safest types of cryptocurrency wallets can be categorised into two main groups: hot wallets and cold wallets. Hot wallets, which are connected to the internet, are more prone to hacking and, therefore, less secure. On the other hand, cold wallets are offline and provide enhanced security.