How to Use AI in Crypto Trading

Artificial Intelligence (AI) has become one of the most important trends of 2023. More and more people are using it for a wide variety of tasks. Of course, the advantages AI offers have not gone unnoticed by crypto traders. In this article, we'll take a look at the use of AI in crypto trading, as well as its benefits and pitfalls to keep in mind.

How can AI be used in Trading?

AI-based tools can provide invaluable assistance in various aspects of cryptocurrency trading by leveraging their ability to analyse large data sets, identify patterns and make data-driven predictions.

- Trading automation. AI-powered algorithms can be designed to execute trades automatically based on predefined criteria, such as price movements, technical indicators, and market sentiment.

- Predictive analytics. Machine learning models can analyse historical data to identify patterns and trends, enabling the prediction of future price movements.

- Sentiment analysis. AI can analyse social media, news articles, and other sources to gauge market sentiment.

- Pattern recognition. AI can automatically identify and analyse technical analysis patterns, such as chart patterns and candlestick formations.

- Educational purposes. AI can assist in providing educational content to help understand various aspects of crypto trading.

- Coding assistance. Those who implement algorithmic trading strategies can use AI to get help with coding.

What are crypto trading bots?

Cryptocurrency trading bots are software programmes that use algorithms to execute trading strategies automatically on behalf of traders in the cryptocurrency markets. These strategies can be based on technical indicators, price patterns, market trends, or a combination of factors. These bots can interact with exchanges, analyse market data, and place buy or sell orders based on predefined criteria. Crypto trading bots are designed to streamline the trading process, reduce human error, and execute trades faster than what is achievable manually.

Trading bots have been around for many years. High-frequency trading (HFT), which cannot be done manually due to the very high speed of making and implementing trading decisions, relies entirely on trading bots. Arbitrage trading also benefits greatly from the speed that bots provide. However, the rapid development of AI technology has made combining trading bots with AI possible, making them much more efficient.

How does an automated AI crypto trading bot work?

AI-powered crypto trading bots typically go through the following steps:

- Data collection. The bot collects real-time market data from cryptocurrency exchanges. This data includes price movements, trade volumes, order book information and other relevant metrics.

- Data pre-processing. The collected data is pre-processed to clean and organise it for analysis. This may involve filtering out irrelevant information, handling missing data, etc.

- Data analysis. The bot analyses the collected data using complex algorithms to identify market trends and patterns and extract valuable information.

- Implementing trading strategies. The bot implements algorithmic trading strategies based on the insights gained from data analysis.

- Decision-making. The crypto trading bot makes trading decisions based on the signals generated by the algorithmic strategies.

- Execution of trades. Once a decision is made, the bot automatically executes trades on the connected crypto exchange by using APIs (Application Programming Interfaces). APIs enable the bot to interact with the exchange.

Pros and cons of using crypto trading bots

Trading bots can be powerful tools, and their use can give significant advantages to a crypto trader. However, it's important to understand the risks of using bots in trading.

Pros of crypto trading bots:

- Automation. Bots can execute trades 24/7, responding to real-time market changes and opportunities. Since the crypto market is constantly active, using bots in crypto trading gives an even greater advantage than using them in traditional markets. Plus, trading bots can manage multiple trading pairs and strategies at the same time.

- Speed. Bots can execute trades at speeds much faster than human traders, taking advantage of fleeting opportunities in the market.

- Algorithmic strategies. Trading bots can implement complex algorithmic strategies based on technical indicators, machine learning models, or a combination of factors, providing a systematic and disciplined approach to trading.

- Emotionless trading. Bots make trades without the influence of emotions, which are one of a trader's main enemies.

- Backtesting. Many trading bots offer backtesting features, allowing traders to test their strategies against historical data.

Cons of crypto trading bots:

- Technical complexity. Setting up and configuring trading bots can be complex and require some technical expertise.

- Technical issues. Bots are susceptible to technical issues, such as software bugs, connectivity problems, or issues with the cryptocurrency exchange's API.

- Dependency on data quality. Bots heavily depend on accurate and up-to-date market data. Inaccurate or delayed data can significantly affect their performance.

- Lack of human judgement. Bots lack the intuitive judgement and adaptability that human traders possess. They may struggle when market conditions change rapidly or unexpected events occur.

Are crypto trading bots profitable?

When used appropriately, trading bots can be powerful tools, but they are not a one-size-fits-all solution. While bots can offer efficiency and automation, they are tools that should be used cautiously. Markets can be unpredictable, and even well-designed bots may experience periods of losses. Moreover, market conditions change quickly, and a trading bot's past performance is by no means a guarantee of future results. Traders should thoroughly understand the bot's strategy, set proper risk management rules, and regularly monitor the bot's performance.

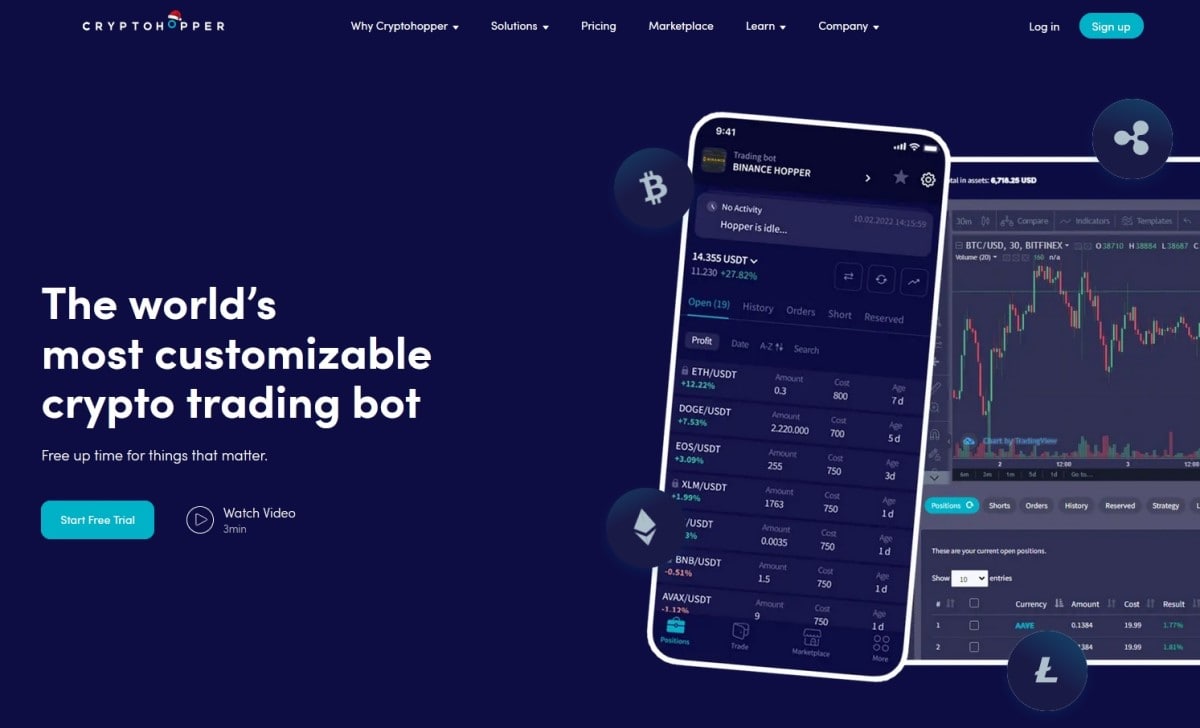

Best AI crypto trading bots

Choosing the best AI bot for crypto trading requires careful consideration of various factors. When choosing a bot, conduct thorough research on different AI trading bots. Look for reviews and feedback from other users. Forums, social media groups, and dedicated online communities can provide valuable insights into the performance and reliability of specific bots.

Choose a trading bot with clear and transparent documentation about its features, strategies, and performance. Make sure the trading bot is compatible with the crypto exchanges you plan to use. Consider the user interface and user experience of the trading bot.

Look for a trading bot that lets you customise trading strategies. The ability to configure parameters, indicators, and risk management settings will enable you to tailor the bot to your specific trading style and goals.

Prioritise security features. The bot should have robust security measures to protect your trading accounts and API keys.

If possible, assess the bot's historical performance. Past performance is not indicative of future results, but it can provide some insights.

And remember: the crypto market is dynamic, and the best trading bot for one person may not be the best for another. Choose a bot that aligns with your trading preferences, risk tolerance, and technical proficiency. Additionally, start with caution, test the bot with small amounts, and gradually scale up as you gain confidence in its performance.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.