Crypto day trading for beginners

The development of cryptocurrencies has led to the emergence of new ways to generate income that are available to ordinary people: investing, mining, staking and others. In this article, we'll talk about one of the most profitable ways to make money on cryptocurrency: day trading. We'll cover such topics as "What is crypto day trading?" "How does crypto day trading work?" and how to build an easy crypto day trading strategy. We'll highlight useful tips for crypto day trading for beginners and how to learn crypto day trading.

What is day trading?

The term "day trading" came to the cryptocurrency market from traditional financial markets. Cryptoday trading is speculative trading on the exchange in which a trader buys and sells an asset within the same trading day. In day trading, the duration of holding assets usually ranges from several minutes to several hours.

Initially, day trading was used exclusively by financial companies and professional speculators and carried out by employees of banks and investment firms. However, with the emergence of online trading, this type of activity is becoming more and more popular among retail traders.

Does day trading apply to cryptocurrency?

On traditional exchanges, where the term "day trading" first appeared, there is a trading opening hour and trading closing hour every trading day. The cryptocurrency market has one significant difference: trading on it doesn't stop; it's 24/7. Because of this, there are no "trading days" in the cryptocurrency market. The term "day trading" is used in the crypto market, but it means an individual trader opens and closes a position within one trading day.

Day trading crypto vs stocks

Day trading in the crypto market and day trading in traditional financial markets such as the stock market are very similar in many ways. Because of this, many traders moving to the crypto market from the stock market and vice versa adapt quickly enough.

However, there are a number of notable differences, most of which come from the fact that the crypto market is relatively young.

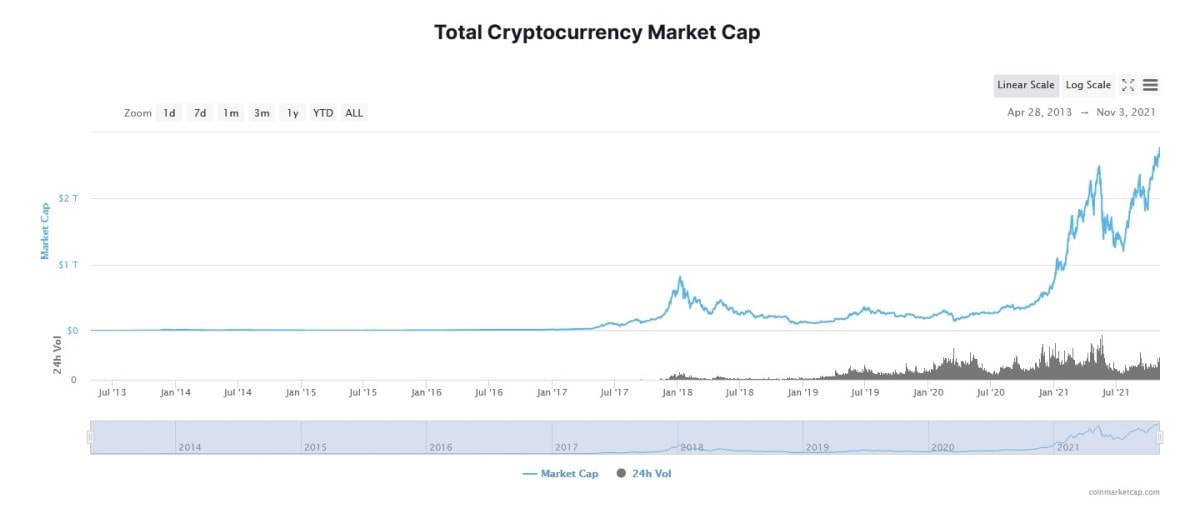

- Volatility. This is one of the main distinguishing features of the crypto market that attracts traders' attention. The tremendous volatility of the crypto market offers traders very high potential profit. This, of course, has a downside: if you make trading mistakes, your losses can also be very high.

- Trading volume. The crypto market has much lower trading volumes than traditional markets. This is one of the main factors behind the high volatility of the crypto market.

- Continuity of trading. Crypto exchanges work 24/7, so you can trade whenever is convenient for you.

- Low entry threshold. You can start trading cryptocurrencies with a fairly small amount of money at your disposal.

- Market assets. Unlike the stock market, where you trade assets that have a certain fundamental value, in the crypto market, you trade cryptocurrencies whose value is made up of the ideas and technologies behind them. For this reason, fundamental analysis of crypto assets is much more difficult and unreliable compared to traditional assets.

- Regulations. Traditional markets are highly regulated, with many laws and regulations governing the behaviour of their participants. The young and rapidly developing crypto market is a bit like the Wild West in this regard, where many of the traditional rules and restrictions don't apply. It's worth noting, though, that regulators around the world are actively working on changing the situation.

How to day trade crypto

If you're interested in day trading with cryptocurrencyand the topic "How does crypto day trading work?", it's important to understand that day trading isn't easy. Most beginners lose their money when doing it. It's a full-fledged profession that needs to be mastered. Moreover, it's hard and stressful work. But if you're willing to spend time learning and practising, if you're ready for self-discipline and adherence to the rules described below, then the result will be a pleasant surprise for you. That said, let's consider crypto day trading signals and rules for beginners.

Crypto day trading rules

For successful day trading with cryptocurrency, you need to remember and follow these rules:

- Think over your trading strategy and stick to it. We'll tell you more about the top strategies of day trading with cryptoand how to do crypto day trading in one of the upcoming articles.

- Technical analysis is one of the most important tools for a crypto day trader. Learn it, use it and try to improve your technical analysis skills.

- Set clear targets for each trading position. While working with crypto day trading charts, you always have to understand what your opening point and your closing point are and, more importantly, what you'll do if something goes wrong.

- Don't forget about risk management. Use Stop-Loss orders. Split your funds, and don't use them all in one trade. Trade using only the funds you can afford to lose.

- Don't give in to emotions. Emotions are one of the main enemies of a trader.

- Before you start trading any coin, study its historical chart and check if your strategy works on it. Also, consider using crypto day trading predictions, but do not completely rely on them.

- Do not forget about practice while trying to figure out how to learn crypto day trading. Profitable trading requires skills that can only be achieved with practice. Gradually, you'll have more profitable trades and fewer unprofitable ones.

Crypto day trading tips

In addition to the important crypto day trading rules and tips for crypto day trading for beginnersdescribed above, there are many tips to help you improve your trading results. This is not an exhaustive list, and most experienced traders will be able to add something to it.

- Every trade must be deliberate. Trading for the sake of trading is not a good idea.

- Don't be greedy. Fear of missing out on profits isn't your friend. If the price has risen, sell some coins to make profit. If you do that, even if the price goes down later and your Stop-Loss order is triggered, it'll neutralise the loss.

- Don't waste your time on the news. Usually, if an ordinary trader finds out about news that can lead a coin's price to increase, then most likely, this has already happened.

- Ignore the opinions of other traders. When you open a position based on a well-thought-out plan, don't listen to anyone; stick to your strategy.

- Keep a journal of your trades. This will help evaluate and correct the trading strategy, as well as identify the mistakes made.

- Profit is what you convert to fiat money. Until cryptocurrency gains acceptance as a widespread payment instrument, it's best to measure the total value of your portfolio in fiat currencies.

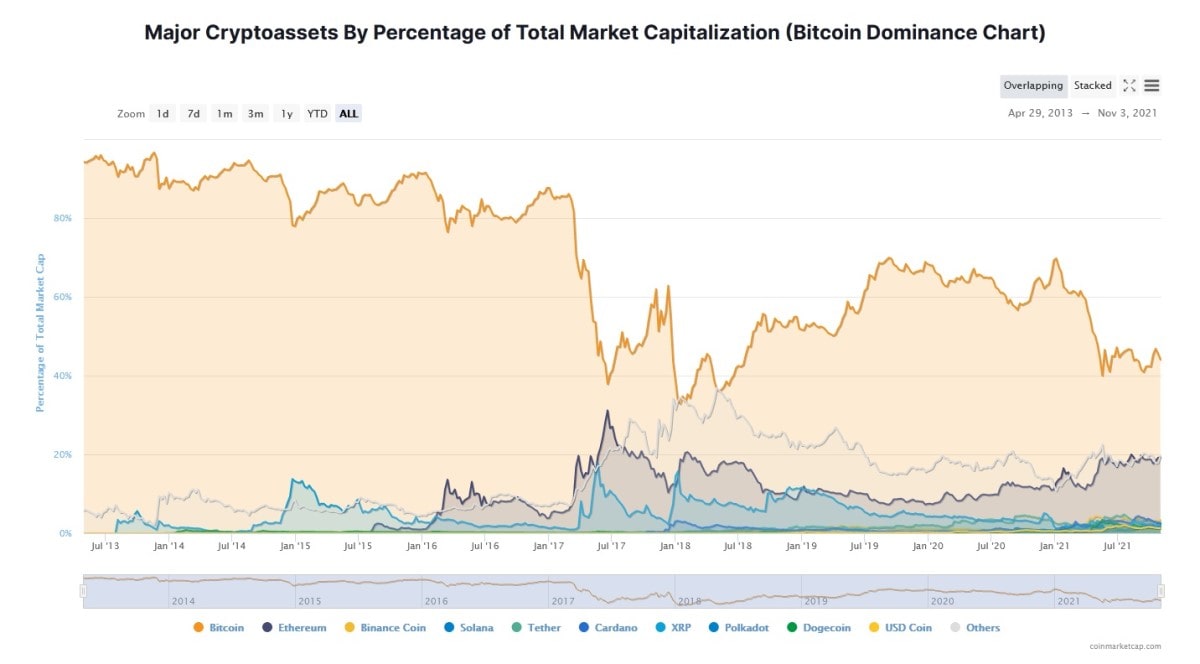

- When trading altcoins, pay attention to Bitcoin's behaviour and crypto day trading signals. Altcoin prices tend to be heavily influenced by Bitcoin price changes. Study how your chosen altcoins react to Bitcoin's fluctuations and monitor them.

Crypto trading tools

Currently, there are many tools to help traders. We won't delve into this topic in this article. Instead, we'll only list the ones that are useful for crypto day trading for beginners.

- Crypto trading hardware. To start out, you'll just need a personal computer or even a smartphone. Internet access is, of course, required.

- Crypto exchange. It's quite difficult to trade cryptocurrency without it. Currently, there are many cryptocurrency exchanges, both centralised and decentralised.

- Crypto charts for technical analysis. Although reputable crypto exchanges usually offer their users built-in technical analysis tools, many traders prefer to use specialised platforms for this purpose. Currently, the most popular charting and technical analysis platform is TradingView.

The best cryptocurrency for day trading

In general, a good coin for day trading is one that you personally understand and for which you have a suitable strategy. If you're looking at a coin's crypto day trading charts and don't understand what you can possibly expect from its price, then it's better to look for another coin. But if you see that backtesting your strategy on the price chart of this coin gives good results, then this is a good sign.

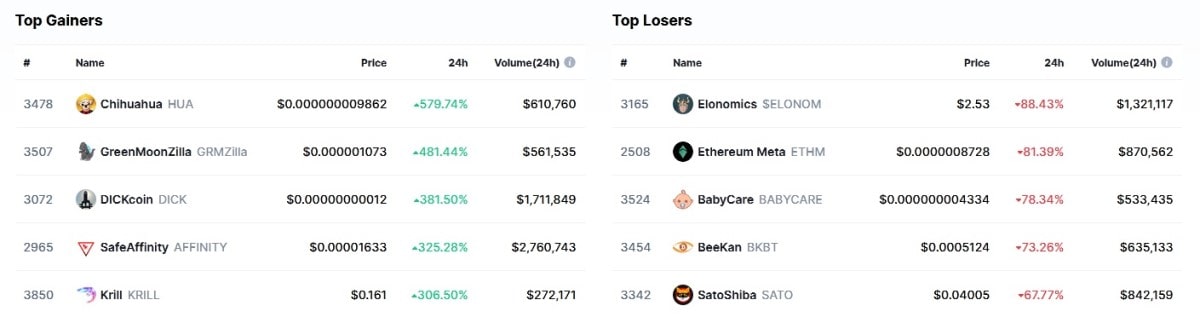

In addition, it's better to choose liquid cryptocurrencies with a large market capitalisation. This is especially true for novice traders. New cryptocurrencies with low market caps have higher volatility and carry more risks for traders than popular and established ones. An additional problem with new cryptocurrencies is that, due to the small amount of historical data, it's difficult to conduct technical analysis for such coins.

How to start day trading crypto with $100

There is a widespread misconception that you need to have a decent initial sum to start day trading with cryptocurrencies. In fact, learning crypto day trading for beginners is pretty risky. Without the necessary knowledge and trading experience, the loss of funds is highly probable. That's why it makes sense to invest any significant funds in crypto day trading only after you gain experience and show stable profitability of your trading.

If you decide to dip your toe into crypto day trading, it's better to adhere to the following sequence of actions:

- Learn the basics of technical analysis.

- Try so-called 'paper trading'. This term refers to simulated trading in a demo environment that allows you to practise trading without risking real money. After you start getting somewhere, you can move on to real trading.

- Register on a crypto exchange and transfer a certain amount of your cryptocurrency there. If you don't have cryptocurrency yet, you can buy it with a debit or credit card either directly on the exchange or through a third-party exchanger.

- Start trading small amounts. As you gain experience and confidence in your abilities, move on to larger trades.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

Is crypto day trading profitable?

Crypto day trading can be profitable, but it's important to note that it's not easy. Many beginners lose money initially, and success requires time, effort, and discipline. However, traders can achieve profitability with the right knowledge, skills, and strategy.

How to read crypto charts for day trading?

Reading crypto day trading charts involves understanding technical analysis. Technical analysis tools help traders analyse price movements and identify potential trading opportunities. Platforms like TradingView offer comprehensive charting and technical analysis features that can be useful for day traders.

What is the difference between day trading crypto vs stocks?

While day trading in crypto and stocks shares similarities, there are notable differences. One significant difference is the level of volatility; the crypto market tends to have higher volatility than traditional stock markets. Crypto markets operate 24/7, offering continuous trading opportunities, whereas stock markets have specific trading hours.

How to pick crypto for day trading?

When selecting cryptocurrencies for day trading, it is essential to choose coins that you understand and have a suitable strategy for. Liquidity and market capitalisation are also important factors to consider, as trading in more liquid and established cryptocurrencies can reduce risks for novice traders. Conducting technical analysis on historical price data, reading crypto day trading signals, and checking out crypto day trading predictions can help identify coins with potential for day trading.