The Cost of Bitcoin Exceeded $30,000. Should I Buy Bitcoin?

The first half of 2023 was quite positive for Bitcoin. Its price, around $16,600 at the start of the year, recently surpassed the $31,000 mark. But will this growth continue further? In this article, we'll look at the reasons behind Bitcoin's price rise and provide information to help you determine whether now is a good time to buy Bitcoin.

Good time to invest in Bitcoin?

Determining the right time to invest in BTC or any other asset is a complex and subjective decision that depends on various factors, including financial goals, risk tolerance, and understanding of the market. While we can provide some insights, it's important to conduct your own research before making any investment decisions.

Why has the BTC price dropped?

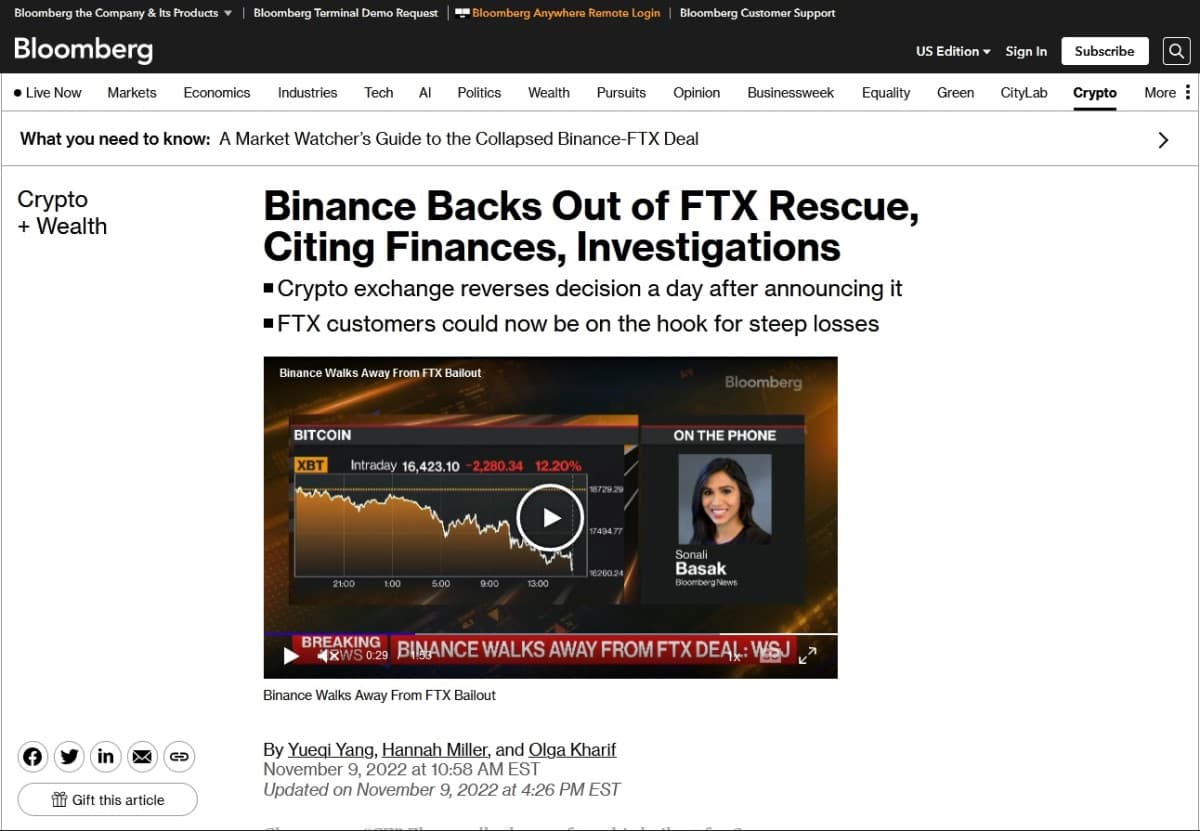

The price of Bitcoin can change for numerous reasons. And more often than not, it's difficult to say with certainty which factors have had the greatest impact on the price change. Several factors caused Bitcoin's price to drop throughout 2022. After 2021, central banks raised interest rates to fight inflation caused by the influx of money into the economy due to the pandemic stimulus. This naturally caused a shift of investments from riskier assets (including cryptocurrencies) to less risky ones. The collapse of Terra's major blockchain ecosystem in May 2022 also dealt a severe blow to the cryptocurrency market. Finally, the bankruptcy of the world's second-largest crypto exchange FTX caused another cryptocurrency price crash in November 2022.

Why has the BTC price gone up?

The recovery of the crypto market in general and the Bitcoin price in particular, which began in 2023, is most often attributed to the following factors:

- Slowing inflation in the US and the Federal Reserve lowering interest rates are helping people feel more relaxed and willing to invest in risky assets again.

- The cyclic nature of cryptocurrency price changes suggests that after a long price decline, there is a significant price increase, and now more and more investors are coming to the conclusion that a new period of growth has begun.

- The banking crisis in the US is making many investors doubt the safety of the traditional financial system, and they are starting to see Bitcoin as a hedge.

- The growth of mass adoption of cryptocurrencies among ordinary users. Awareness of cryptocurrencies is growing, and cryptocurrency platforms and exchanges are becoming more accessible and user-friendly, attracting new clients. In addition, the real-world applications of cryptocurrency are increasing, including the options to pay for goods and services. All this increases the demand for cryptocurrency.

How high are the risks of BTC's price falling?

The risks of price falling are inherent in any investment, especially in the cryptocurrency market, which is known for its volatility. Therefore, when considering your investment strategy, it's important to always consider risk management. There are different strategies for dealing with falling prices, such as using stop-loss orders or dollar cost averaging.

What's next: BTC analysis

The Bitcoin price is now in an uptrend and recently reached a local high of $31,500. Many indicators, including Moving Averages and MACD, indicate that a local correction is highly probable. However, the correction is unlikely to break the uptrend. In addition, a symmetrical triangle is currently formed on the chart, and the price should break out of it in the coming days. A downward breakout of the triangle is more likely, but an upward breakout still cannot be ruled out.

Reasons to buy BTC now

Although investing in Bitcoin no longer brings the huge profits it did several years ago, it's still an attractive asset for investors, even though it's risky. There are several reasons why Bitcoin could prove to be a good investment right now.

- Relatively low price. Although Bitcoin's price has risen noticeably over the past six months, it's still more than two times lower than its all-time high.

- Potential for long-term growth. Bitcoin has seen significant growth since its inception, and many investors believe it still has room to grow and believe in its long-term potential.

- Diversification. Bitcoin is often viewed as a diversification tool within an investment portfolio. Adding Bitcoin to a diversified portfolio of traditional assets may potentially provide an additional layer of diversification.

- Store of value and inflation hedge. Bitcoin's decentralised nature and limited supply have led many to view it as a potential store of value and a hedge against inflation. In times of economic uncertainty or when fiat currencies are affected by high inflation, some investors turn to Bitcoin to preserve purchasing power.

- Means of payment and remittances. As Bitcoin's acceptance grows, it's becoming more and more convenient to use as a fast and reliable means of payment and remittance.

What you need to know before buying Bitcoin

Before you buy Bitcoin or any other cryptocurrency, it is wise to educate yourself and consider a few important factors. Here are some important points to know:

- Research and understand Bitcoin. Take the time to understand what Bitcoin is and how it works. Learn about blockchain and the potential use cases of cryptocurrencies. Familiarise yourself with the risks and benefits associated with Bitcoin.

- Risk assessment. Bitcoin is known for its price volatility, and investing in cryptocurrencies carries inherent risks. Assess your risk tolerance and evaluate whether you can afford to invest in a highly volatile asset class.

- Market analysis. Stay informed about the state of the cryptocurrency market.

- Security measures. Understand the importance of security when it comes to owning crypto. Educate yourself about practices for securing your digital assets, such as setting up a secure wallet. Be cautious of potential phishing attempts and scams targeting cryptocurrency users.

- Investment strategy and portfolio allocation. Determine your investment strategy and Bitcoin's role in your overall investment portfolio.

- Exchange selection. Choose a reputable cryptocurrency exchange to buy Bitcoin. Research different exchanges comparing factors such as security measures, fees, liquidity, and user experience.

- Wallet selection. Decide on the type of wallet you will use to store your Bitcoin. Research different wallet options and choose one that aligns with your needs.

- Regulatory considerations. Stay informed about the regulatory landscape surrounding cryptocurrencies in your country.

Whether or not to buy Bitcoin now is a personal decision that depends on your individual circumstances and investment goals. In any case, it's advisable to do your own research and only invest what you can afford to lose.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.