How to start trading using crypto trading signals

Are you interested in making money with cryptocurrency trading but don't know where to start? Crypto trading signals may be the answer you're looking for. These algorithmic trading tools have become increasingly popular in cryptocurrency trading, helping traders make deals with minimal risk and maximum profit. What are trade signals? Where to get trading signals? How to read trading signals? In this guide, we'll dive deeper into trading signals and explore how they can help simplify the trading process for experienced and novice traders.

What are trade signals in crypto?

Crypto trading signals are notifications that inform you when it's the right time to buy or sell coins. Such signals also give you hints on which coins can be the most lucrative investment at a particular moment. Buying and buying trading signals provide traders with information about potentially profitable deals from analytics.

Trading signals for cryptocurrency result from careful forecasting of market conditions and are essential for making sound judgments. However, obtaining accurate and reliable data can be challenging when making projections on your own. This is when beginner traders rely on expert help and refer to trading signal websites for help. Many of the latter have started to adopt AI trading signals, making it more straightforward for you to learn how to start trading cryptocurrency.

Cryptocurrency trading signals combine insider information about future rate changes for particular coins and cryptocurrency market analysis. They're often forecasts based on analytical work.

The main advantages of using crypto trading signals include:

- Risk reduction. Proper trading signals help protect you from most unsuccessful transactions, reducing the chances of losing money and increasing the chances of earning it.

- Automation. Crypto trading signals help eliminate the routine work that most traders dislike, giving the user plenty of free time. The user just has to follow the direction that the crypto signal sets.

- Doubt elimination. Transactions on the exchange often have an emotional aspect, and traders tend to be guided by emotions, not building complex work schemes. They don't want to do it because of the emotional burden. This approach may only sometimes lead to a win. However, with a clear guide to action created by a team of professionals, all doubts are eliminated because of a clear and logically structured strategy. The user just needs to use it. Moreover, any stressful factors are excluded here.

Crypto trading signals are popular among beginners and experienced traders alike. This type of algorithmic trading helps experienced traders find new strategies. Novice traders can gain the necessary experience and knowledge of crypto trading. Signals entirely automate the trading process and contribute to traders' financial security by stopping losses. This way, market participants can avoid bankruptcy while trading cryptocurrency.

How do trading signals work?

Trading signals are typically generated through an automated technical analysis-based strategy within the provider's servers. Once a profitable opportunity is identified, you receive an email, SMS text, or social media notification with the suggested position parameters. Signals can integrate directly with your trading platform, allowing you to execute trades without leaving your investing software.

After receiving a trading signal, you decide to act on the suggestion. Some traders may find the perceived risk too high or perform their own fundamental or technical analysis, leading them to believe the signal may be unsuccessful.

You can automate your response and use an integrated programme. This reduces the delay between recognising the most accurate trading signals and opening a position, which can increase profits. However, if you choose to automate, you won't be able to reject signals on a case-by-case basis.

You can filter the signals you receive with various variables, such as specifying the assets for which you receive notifications and limiting the timeframes for position openings. Day traders and scalpers may prefer one or five-minute signals, while others may opt for hourly or eight-hour chart notifications.

How to read trading signals?

Reading crypto trading signals may seem complex and require a basic market understanding and technical analysis. However, you can follow these simple steps:

- First, look for the entry price. This is the recommended price to buy or sell a particular cryptocurrency.

- Next, check the stop-loss price. It's the price at which you should exit the trade if the market moves against you. This helps limit your potential losses.

- Then, take a look at the take-profit price. You should exit the trade to take profits at this price. Typically, take-profit prices are higher than the entry price.

- You should also analyse the market sentiment. Most trading signals come with a market analysis explaining the trade's reasoning. Reading and understanding this analysis is important to make informed decisions.

- Consider technical analysis as well. Crypto trading signals often rely on technical analysis, which involves studying charts and patterns to predict market movements. If you need to familiarise yourself with technical analysis, research it further.

- Once you've entered the trade, it's crucial to monitor it closely. Keep an eye on the market and be prepared to exit the trade if the market moves against you.

It's important to note that trading signals are not a guaranteed way to make profits. It's still essential to do your research and make your own decisions. However, crypto trading signals can be helpful for those new to trading or those looking to save time on market analysis.

How to get trading signals?

You can discover crypto signals from various sources and communities, such as Telegram groups and channels, Twitter accounts, TradingView, and cryptocurrency forums. However, it's crucial to remember that not all signal providers are reliable, so conducting your own research is recommended before following any provider. Additionally, it's best to start with small amounts and always manage your risk by setting stop-loss orders.

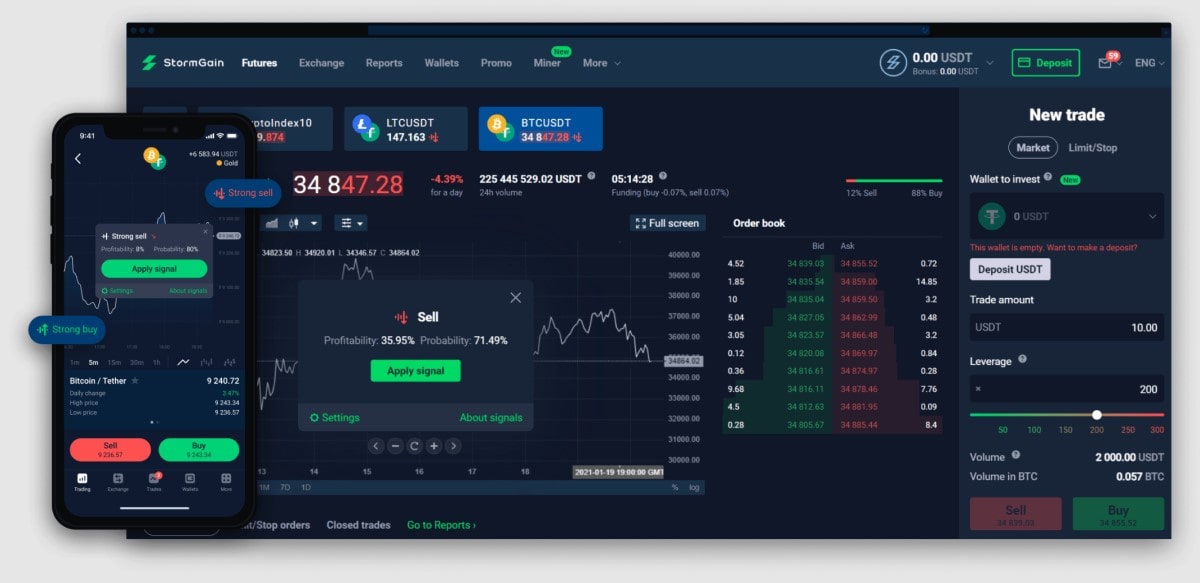

If you're looking for a reliable trading signals website, consider using StormGain's crypto trading signals. These signals are designed to assist you in making cryptocurrency trading decisions based on two primary indicators: profitability and probability.

StormGain offers free crypto day trading signals once you register and comes with built-in risk management instruments. For instance, each signal has default parameters for Stop Loss and Take Profit, which you can use at your discretion. Moreover, options like Increase and Auto-Increase boost your investment amount when the trend is favourable in an open position.

You can make trading decisions, test hypotheses, and plan trades based on data from professional traders with StormGain's Chat GPT trading signals. These easy trading signals simplify keeping up with current trends and trading according to the market.

Furthermore, StormGain's trading signals come with Take Profit and Stop Loss settings to help you manage your risks. They're also accessible on any device, including the extended version on the Telegram channel. The signals automatically adjust based on the asset's current price, making them even more reliable.

Why is trading so hard? Or not?

Trading can be a challenging endeavour due to the many elements involved. However, things will get much easier once you learn how to notice profitable trading signals.

Trading signals include the overwhelming amount of false information available, personal biases, and the need to balance risk and return. Knowing where to focus your attention can be challenging as a new trader.

One of the primary reasons why trading is so hard is the abundance of false information on the internet. It can be challenging to separate worthwhile advice from garbage. To avoid falling victim to false trading advice, testing everything in backtesting software before going live is vital.

It is also essential to remain unbiased while trading. Many traders tend to impose their views on the market, leading to poor decision-making. Having a trading strategy that is tested for robustness is critical to success. A trading strategy is a set of rules dictating when to enter and exit a trade and how much to buy or sell short. It should be clearly defined and preferably written in coding language for backtesting.

Risk management and position sizing are also vital aspects of trading. One must balance return and risk and not risk more than 2% in each trade. Persistence is necessary when learning where to get trading signals, as it can take years to master. Additionally, traders must evolve and develop new strategies to remain successful constantly.

Who uses crypto trading signals?

Crypto trading signals are a valuable tool utilised by various individuals involved in the cryptocurrency market. Here are some of the key users of crypto trading signals:

- Individual Traders. Crypto trading signals are widely used by retail traders, including beginners and experienced investors, to make more informed decisions about buying or selling cryptocurrencies. Signals provide insights into potential market trends, which can help traders capitalise on opportunities.

- Day Traders. Day traders engage in short-term trading, buying and selling cryptocurrencies within a single trading day. They use trading signals to identify intraday opportunities and exploit price fluctuations.

- Swing Traders. Swing traders aim to capture price swings over several days to weeks. Trading signals assist them in identifying entry and exit points based on technical or fundamental analysis.

- Hedge Funds and Institutional Investors. Some hedge funds and institutional investors involved in cryptocurrency trading use signals as part of their overall trading strategy. These signals can be generated through algorithmic trading systems or by in-house analysts.

- Algorithmic Traders. Traders who use automated trading algorithms or trading signal bots may incorporate crypto trading signals into their systems. Algorithms can execute trades based on predefined criteria derived from these signals.

- Crypto Exchanges. Certain cryptocurrency exchanges offer trading signals or analysis tools to their users. Traders on these platforms can access signals to make more informed trade decisions.

- Signal Providers. Some individuals and organisations specialise in offering crypto trading signals as a service. These signal providers analyse the market and deliver trading recommendations to subscribers for a fee.

- Investment Advisors. Financial professionals and investment advisors specialising in cryptocurrencies may use trading signals to assist their clients in making investment decisions.

- Long-Term Investors. Investors with a long-term perspective on cryptocurrencies may use signals to identify strategic entry points for accumulating assets or making portfolio adjustments.

- Educational Purposes. Crypto trading signals can also be used for educational purposes. Traders, especially those new to the market, may use signals to understand how trading strategies are formulated and executed.

Users must exercise caution and conduct thorough research on crypto trading signals. Markets can be volatile, and there are risks associated with trading. Additionally, the quality and accuracy of signals can vary, so users should choose reputable sources and consider signals as one part of their overall decision-making process.

Are trading signals worth it?

Determining whether crypto trading signals are worth the investment depends on several factors, such as your level of trading experience and expertise, the reliability of the signal provider, and your risk tolerance. For novice traders, crypto trading signals can be a valuable tool to begin their trading journey. But, it's crucial to conduct thorough research before selecting a trustworthy signal provider.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

Do trading signals work?

Trading signals serve as cues or warnings that indicate the ideal moments to purchase or dispose of a financial asset, taking into account technical analysis. Nonetheless, it is important to note that not all signals are trustworthy or lucrative.

Are trading signals legit?

Trading signals can be legitimate tools for guiding investment decisions, but their reliability varies. It's essential to thoroughly research and assess the source's credibility before choosing the most profitable trading signals. Additionally, consider using signals as a comprehensive trading strategy rather than relying solely on them.

Can I start trading with $100?

Yes, but it ultimately depends on the asset you want to trade and your chosen trading strategy. Based on your particular asset and strategy, some brokerages may require a minimum deposit greater than $100.

Can you start trading with no money?

Yes, you can start trading with no money, but it can be demanding and come with extra hazards. You can take some approaches to begin trading with limited funds. Paper trading is an option. This involves a simulated trading setting where you can purchase and vend securities without employing actual money.

How to start trading with no money

Believe it or not, beginning trading without your capital is possible. Various options are available, such as utilising no-deposit bonuses, demo accounts, proprietary firms, or affiliate programmes. These alternatives can offer you the initial capital or trading opportunities you need without risking losing money.